Insurance, the biggest expense for most car owners (excluding those who like modifications), comes in two options: cost-effective or worry-free. As a seasoned driver with over a decade of insurance purchasing experience, I believe in the worry-free philosophy, which doesn’t equate to wasting money. Rather, it means relying on dependable insurance providers, choosing trusted channels, and paying a reasonable price.

Of course, purchasing habits differ among individuals, and my suggestions are based on my personal experience. Therefore, my advice for buying car insurance for new and old cars may not be applicable to everyone.

5 Insurance Companies That Partner With Ideal Automotive

Under the traditional 4S dealership model, new car buyers are generally required to purchase insurance from the dealership in the first year. However, since I purchased the Ideal ONE in early 2020, the policy at Ideal’s delivery center allows car owners to purchase insurance from wherever they choose.

Occasionally, some car owners inquire why a particular insurance company in their city is not available for Ideal ONE insurance. The answer is rooted in Ideal Automotive’s partnership with insurance channels.

Currently, five insurance giants, including PICC, Ping An, CPIC, An Xin, and China Life, are the official insurance channels of Ideal Automotive. This partnership is based on a headquarter-to-headquarter approach and intended to ensure the quality of customer service, the efficiency of insurance claims, and the amount of compensation.

Because of this headquarters-to-headquarters approach, these five insurance companies have internal divisions for accepting Ideal ONE insurance orders, which are typically managed by its headquarters.

Thus, if you’re purchasing insurance for your new car in the first year and have a preference for Ideal Automotive’s five official insurance partners, you may purchase your policy directly from the Ideal delivery center. Alternatively, you may opt to purchase insurance from a different company altogether.

What Are the Advantages of Ideal’s Official Insurance Partners?

When purchasing insurance, customers generally care about two things: price and service quality. It’s true that some mid-sized and moderately-priced insurance companies offer very affordable insurance quotes. However, in terms of service quality, larger insurance companies generally stand out (let’s not consider individual examples, but rather see things from a broader perspective).

Therefore, my suggestion is that if you are an experienced driver and have absolute confidence in your safe driving abilities, then selecting a smaller insurance company with high-value coverage is perfectly acceptable because you’ll save a considerable amount on premiums without making claims every year. However, if you haven’t done so for several consecutive years, my advice would be to consider an established insurer.## How are the differences in renewal prices generated?

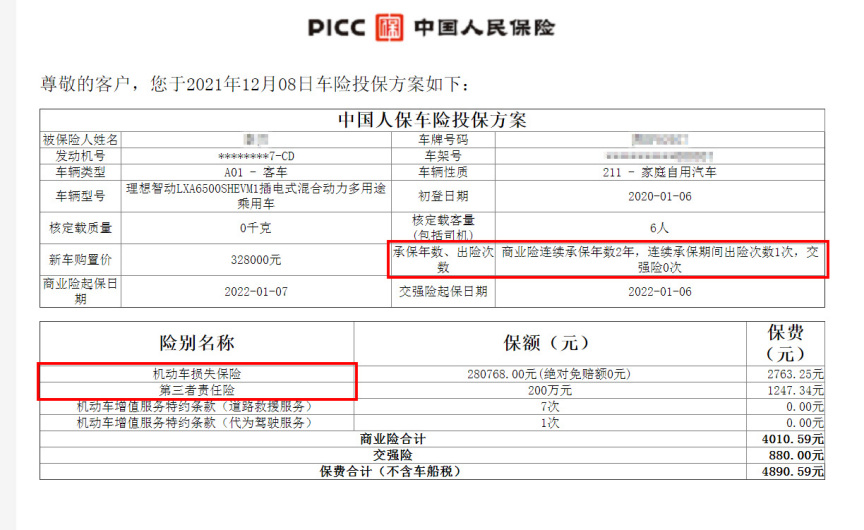

When it comes to the second or third year of vehicle ownership, it’s time to renew your insurance. At this time, car owners in the community begin to exchange how much they are paying for their renewal. Some pay over 4,000 Yuan, some over 5,000 Yuan, and some over 6,000 Yuan. What causes this difference? Apart from the different quotes provided by insurance companies, it mainly depends on three factors: insurance categories, accident history, and the year of insurance.

1. Insurance Categories

Before 2020, insurance brokers would offer a series of insurance categories such as glass insurance, theft insurance, and no-deductible insurance. After the 2020 insurance reform, these categories have been merged into the vehicle damage insurance. Therefore, the main types of commercial vehicle insurance now are vehicle damage insurance and third-party liability insurance. The vehicle damage insurance is calculated annually by each insurance company according to your vehicle type, and most variation in premiums is found in the third-party liability insurance.

2. Insurance Year

As we all know, the first year of insurance for a new car is the most expensive. If there is no accident during the first year, the premium will be reduced in the following year. I have seen an Ideal ONE car owner who did not have any accident claim for two consecutive years, and the renewal cost in the third year was below 4,000 Yuan. Good driving habits can indeed save money.

3. Accident History

The accident history is the most important factor affecting premium. If an accident occurs during the year, the premium will be increased the following year. As an owner of an Ideal ONE, I went through this myself. I had one accident in 2020, and my premium for 2021 was seven to eight hundred Yuan more expensive than my local friends who did not have an accident, and it impacted not only the second year but also the third year of 2022, for which I had to pay 4,800 Yuan for my renewal, which was still six to seven hundred Yuan more expensive than my friends.

Here I’d like to share a valuable experience with you. The premium discount is calculated based on a three-year cycle. Each year’s premium calculation will take into account the claims list of accidents that occurred in the past three years. For every additional accident within the past three years, hundreds of yuan need to be paid for the premium of the next cycle. Only by being accident-free for three consecutive years can your premium return to the most favorable level.

Therefore, here is a suggestion for you: if it is a minor accident like a single-sided scratch under 1000 yuan, do not claim the insurance. Fix the car yourself, or otherwise, the extra premium paid in the future may exceed the repair costs.

In fact, there are many factors that affect the premium, such as the differences in premiums due to different provinces and cities, the vehicle’s violations and the individual credit history, as well as the policy differences between different cities, ranging from 1000 to 2000 yuan according to the China Insurance Regulatory Commission.

Regarding the price, there is another factor, which is the new energy vehicle-exclusive insurance that was implemented at the end of last year. It has added external power grid fault loss insurance, self-use charging pile loss insurance, and liability insurance, which has caused an increase in the premium of many pure electric vehicle models. After observing for nearly three months, the change in Ideal ONE’s premium is relatively small, with only about a 5% fluctuation compared to pure electric vehicle models.

Above is my experience and insights on purchasing insurance. In summary, one sentence is, no matter which insurance company you choose, the safer driving habits you have, the more money and worry you will save. I hope it can be helpful to you.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.