Special Contributor | Zhu Yulong

Editor | Qiu Kaijun

In early 2022, the rise in the price of power batteries and subsidy cuts has led to many vehicle manufacturers increasing their product prices.

In March, vehicle manufacturers began a round of intensive price increases. The logic behind this is that power battery products have seen another wave of price increases.

What impact will the series of price increases have on sales?

Let’s explore how electric vehicle sales in 2022 and the future prospects of new energy vehicles under the complete withdrawal of subsidies in 2023 are affected by this growth dilemma.

Here is the conclusion:

-

The impact of the price increase will be reflected from Q2, with Q2 sales likely remaining the same as Q1. Q3 will gradually increase, and Q4 will see a surge, with total sales of about 4.5 million new energy passenger vehicles for the year.

-

The proportion of A00 will decrease slightly, and the proportion of PHEV will further increase.

-

In 2023, with battery costs not decreasing and subsidies continuing to decline, it will be difficult to maintain stable growth.

Upstream raw materials: The rise in the cost of power batteries

For pure electric vehicles, the cost of power batteries is the largest part of the vehicle cost, accounting for about 40% of the total cost.

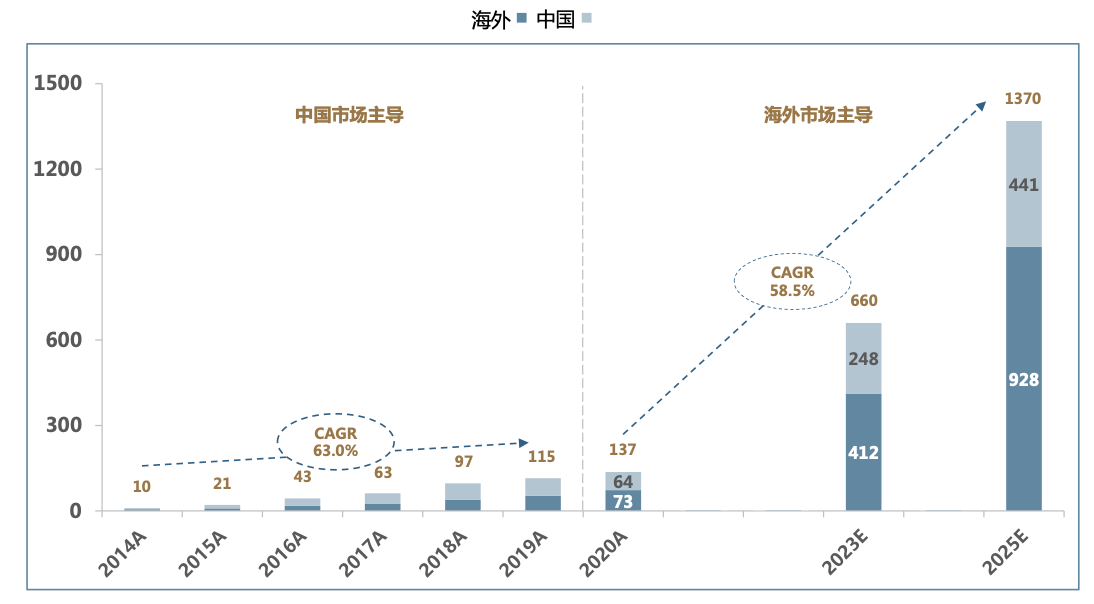

In the past, the decrease in the cost of power batteries has been the key driver of the penetration rate of electric vehicles in China and globally. Technological progress, economies of scale, and material cost control are the main ways to reduce the cost of power battery systems.

Thanks to technological progress and economies of scale, the cost of power batteries is still rapidly decreasing, effectively supporting China’s new energy vehicles to transition from the policy stage to the market stage, in spite of subsidy cuts.

In 2021, with joint efforts from the upstream and downstream industries of the power battery industry chain, the power battery system has reached a low price:

In 2021, the price of the ternary battery system was about 775 yuan / kWh (excluding tax), a decrease of 38% compared to the beginning of 2019. The price of the lithium iron phosphate battery system was about 625 yuan / kWh (excluding tax), a decrease of 46% compared to the beginning of 2019.

In 2022, as China’s power battery scale reached a new high in February, it completely pushed up the price of upstream resources. On the one hand, Europe and the United States emphasized the route of electric vehicle transformation, and on the other hand, they also emphasized the security of the local supply chain. Power battery companies at home and abroad are also expanding production in synchronization.

As we described in detail in our “Supply Chain Expansion and Upgrading” presentation at Electric Vehicle Observer, the production expansion plan on paper has indeed reached a very considerable figure, which has led to the early locking of upstream raw material production.

In the original cost structure, the four major materials account for nearly 50% of the cost of power batteries, with positive electrode materials having the highest proportion. Various power battery companies have controlled costs by enhancing technology and compressing their own labor and manufacturing costs, but with the rise of materials such as lithium, copper, and aluminum, this price is difficult to control.

A 1 GWh LFP battery requires 2,000-2,500 tons of positive electrode materials, and approximately 0.25 ton of lithium carbonate is needed for one ton of LFP material. Microscopically estimated, a 60 kWh LFP battery requires 30kg of lithium carbonate per vehicle.

Currently, the price of lithium carbonate in China remains high, causing LFP prices to be high as well, keeping pace with the previous ternary prices, even though the latter is also soaring. Battery companies layout upstream resources by buying mines, investing in equity, signing long-term contracts, etc., to control the quantity and price of upstream raw materials, which to some extent offsets the risk of fluctuating prices of mineral resources such as lithium, cobalt, and nickel. However, if demand does not decrease in the short term, battery prices will remain high.

How should we estimate demand in 2022?

Within the analysis conducted by the NE Research Institute, there is one page of particular value. From the bigger picture, under the 625 CNY/kWh cost in 2021, the marginal contribution rate of a 100,000 RMB electric vehicle is negative, while in 2022, it will face subsidy reductions (for the 300 km model), point deductions (from more than 2000 down to about 300), and a 30-50% increase in battery costs (the low base of the battery price means a higher percentage surge).“`

From this round of price increases, the internet-based approach of companies previously subsidizing consumers has been broken.

New players (including Tesla), new companies, and some urgently transforming companies are currently benefiting consumers in multiple aspects, allowing consumers to experience high cost-effectiveness in terms of the consumption experience and actively improving users’ use experience in the customer-use phase, promoting positive word-of-mouth.

However, when costs rise rapidly, this big logic changes. New power leader – Tesla needs to transfer its costs and bear them for consumers in the global market, while in China, XPeng and BYD have started to choose price increases.

In other words, the overall sales pattern in 2022 may weaken from the price increase tide starting in April, and move downstream. The current monthly data is as follows:

- January: 315,600

- February: 238,900

- First three weeks of March: 290,000, expected to be 385,000 in March

Therefore, Q1 sales were 939,000, more than doubled from 435,000 in 2021 Q1, and it is a very good start. However, the situation in Q2 may be divided into two levels:

1) Currently, the original goals of NIO, XPeng and Li Auto are all to increase from the 100,000-level to the 200,000-level, and the sales impact above 200,000 will not be significant;

2) The impact of 100,000-200,000 is the greatest, because the price is in a sensitive range. According to the data that every kWh of 60kWh increases by 2.5 cents, the cost of a single car increases by 15,000 yuan. Therefore, the prices are not in place, and I believe the manufacturers in this range will be very conflicted and are basically priced at around 180,000 yuan;

3) Under 100,000, the design of the model subsidized by the original 35 kWh has become impossible to achieve. Only Wuling Hongguang, Ben Ben and QQ ice cream, with a capacity of 8-10kWh, can survive. However, from my understanding, the cost of the original low-end battery cell has significantly increased, and it is not profitable even if the battery cell has increased by 50%. Therefore, this is only the first price increase, and as the volume reaches a certain level, they may directly stop taking orders (it will not be a loss if it meets compliance requirements).

Therefore, my personal understanding is that from the perspective of Q2, Q3 and Q4 in 2022, Q2 may remain at around 900,000 to 1 million, Q3 gradually increases to 1.2 million to 1.3 million, and Q4 surges to 1.5 million, so the total number of new energy passenger vehicles will be around 4.5 million for the whole year.

“`Compared to 2021, the proportion of A00 will decrease slightly, while the proportion of PHEV will continue to increase.

Currently, the insurance data for the first two months of PHEVs is only 132,000 vehicles. As car companies increase their sales efforts, this proportion will gradually rise to 100,000 vehicles per month (74,000 vehicles in January and 58,000 vehicles in February). Therefore, it is highly probable that it will exceed 1.2 million this year and reach around 1.5 million.

In contrast, 2023 will be a real test.

If we estimate based on 4.5 million vehicles, the growth this year is good. However, it will be difficult to maintain stable growth in 2023 if battery costs do not decrease and subsidies continue to decline. After all, the penetration rate is already very high at this time, and the dual credit policy has completely failed. All new energy vehicles will have to rely on market-oriented means, which depends on consumers’ enthusiasm for this category.

In summary, due to the insufficient consideration of key materials in the promotion of electric vehicles, material shortages have reappeared, and the high prices of raw materials have impeded the accelerated penetration of electric vehicles. Therefore, I believe that in 2022, we need sufficient strategic patience to wait for balance once again. This is not a problem that can be solved simply by developing lithium resources.

References:

-

The Hundred People’s Association’s “Innovation Drives Prosperity for New Generation Batteries.”

-

NE Research Institute’s “2021 Market Review and 2022 Outlook.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.