“Chip shortage, battery price hike, and charging difficulty” become hot topics and actual challenges for China and global new energy vehicle industry in 2022.

On March 26th, Ouyang Minggao, the vice chairman of the China Electric Vehicle Hundred People Association and a academician of the Chinese Academy of Sciences, delivered a speech at the Hundred People Forum on a series of critical industry issues including the sales forecast of new energy vehicles, the rise of battery prices and production capacity, the evolution of battery technology roadmap and target standards, and the ideal charging system construction.

He predicted:

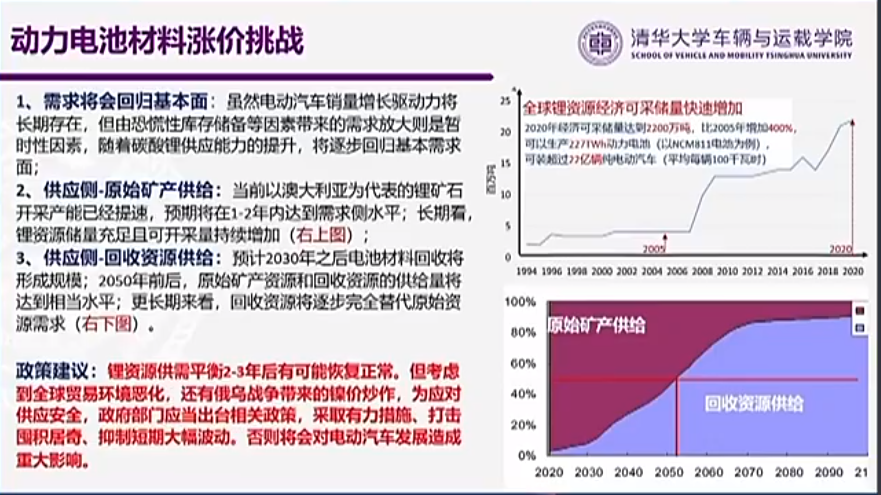

- In two to three years, raw materials such as lithium carbonate may restore complete supply and demand balance.

- By 2025, China’s power battery capacity may reach 3,000 GWh, while battery shipments are expected to reach 1,200 GWh in 2025. Production capacity will be significantly surplus.

- Around 2050, the supply of primary mineral resources and recycled resources will reach a significant level.

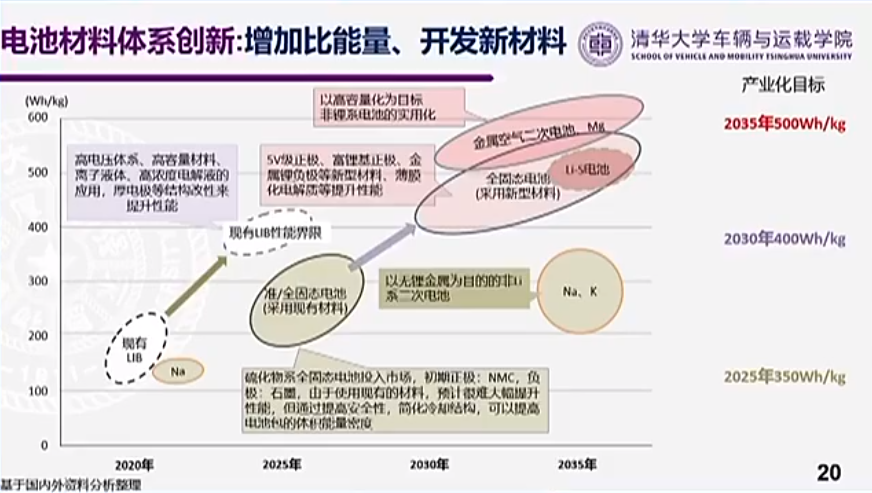

- Regarding the evolution of power battery technology, the industrialization target for battery energy density in 2025 is 350 watt-hours per kilogram, and the target for 2030 is 400 watt-hours per kilogram. The target for 2035 is 500 watt-hours per kilogram.

- The target for cycle life is 10,000 times, and both lithium iron phosphate and ternary batteries are expected to achieve it.

- The Chaoji charging standard that supports high-power fast charging is expected to be approved in the third quarter.

- As the number of electric vehicles increases, the amount and power of electricity that can participate in grid peak and frequency regulation are considerable.

- The total carbon emissions of passenger cars are expected to reach their peak before 2030. The sales of new energy vehicles are expected to be roughly equal to that of fuel vehicles around 2030.

The battery material is expected to restore supply and demand balance in two to three years.

Ouyang Minggao also believes that the reason for the increase in battery material prices this year is partly due to the growth in demand for complete vehicles and the expectation of higher battery prices, leading companies to expand capacity and increase reserves.

On the other hand, the delayed supply is also due to the release cycle of the typical lithium carbonate production capacity of 3-5 years and the longer lithium extraction cycle of brine, coupled with the impact of the epidemic on production and transportation.

From the supply side, the economically recoverable reserves of global lithium resources increased by 400% from 2005 to 2010, and now the global recoverable reserves are 22 million tons, which can produce 22.7 billion vehicles (using NCM811 batteries as an example, they can produce 227TWh of power batteries, calculated by a battery of 100kWh per car). And new exploration amounts and recoverable reserves are continuing to increase.From the demand side, the demand amplification caused by panic inventory is temporary and will gradually return to the basic demand side with the improvement of the supply capacity of lithium carbonate. It is expected that it may restore complete supply-demand balance in two to three years.

Overcapacity in Battery Production is Expected in 2025

Based on industry investment information, China’s battery production capacity may reach 1.5 billion kWh (1500 GWh) in 2023, and 3 billion kWh (3000 GWh) in 2025. The expected battery shipments will reach 1200 GWh in 2025.

Seventy to eighty percent of batteries will be used in the domestic market, and there will be 20 to 30 percent export to overseas markets.

Overcapacity in battery production is expected in 2025.

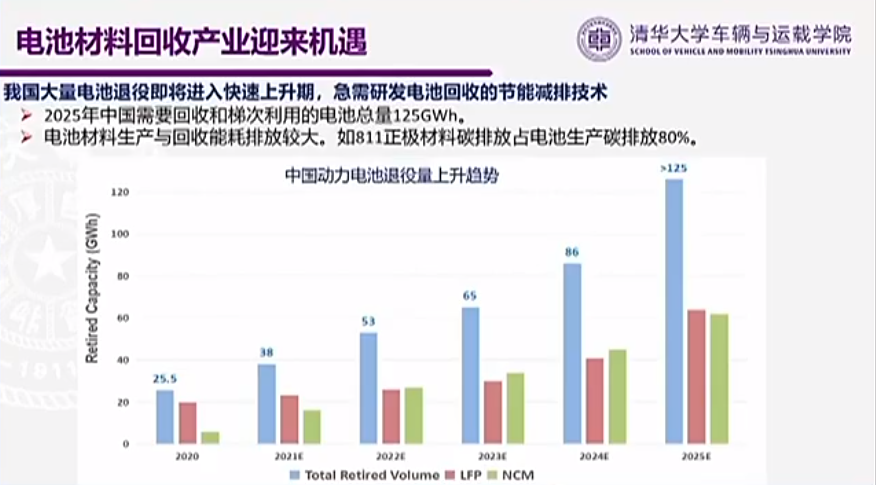

Battery Material Recycling Expected to Form a Scale after 2030

It is estimated that there will be 125 million kWh of recycled battery material in 2025, and recycling will form a scale after 2030; before and after 2050, the supply of primary mineral resources and recycled resources will reach a relatively balanced level.

In the longer term, recycled resources will gradually replace the demand for primary resources.

From Liquid System to All-Solid-State Battery from 2025 to 2035

In terms of the evolution of power battery technology, Ouyang Minggao also made predictions.

By 2025, the industrialization goal of battery energy density is 350 watt-hours / kilogram (currently less than 300 watt-hours / kilogram). This stage is still a liquid electrolyte system, mainly including conventional lithium-ion battery materials, solid-liquid hybrid materials, and liquid battery material systems such as sodium-ion and future potassium-ion.

The goal for 2030 is to reach a density of 400 watt-hours / kilogram and achieve full industrialization in all aspects. This stage is the transition from liquid to solid, including liquid high voltage, thick electrode, and less electrolyte; positive high nickel, such as Ni95, negative silicon-carbon; as well as quasi-solid-state battery systems.

2030 should be a key node for the transition to all-solid-state batteries. In 2030, he estimates that the proportion of domestic all-solid-state batteries will not exceed 1%.The goal for 2035 is to achieve 500 Wh/kg for industrialization, including all-solid-state batteries, lithium-sulfur batteries, and high-capacity lithium-manganese-based materials, and the voltage window will be increased to 5 volts.

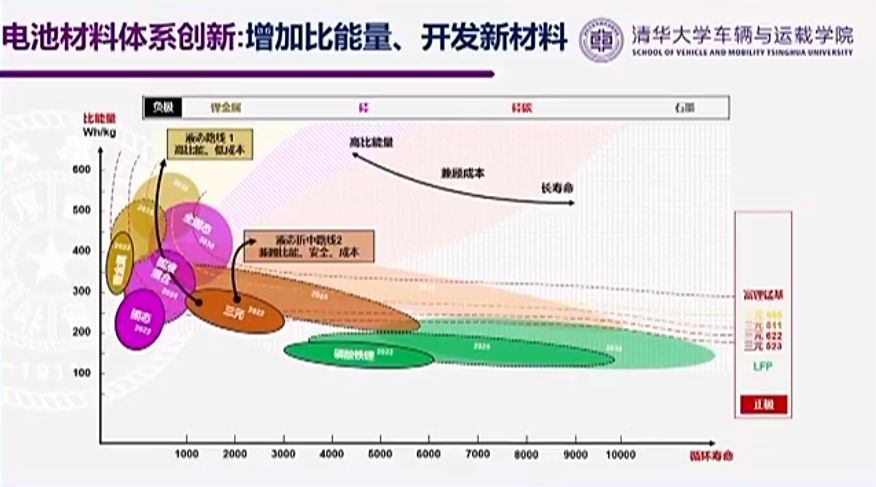

Battery life target: 10,000 cycles

Based on the consideration of large-scale energy storage, the requirement for battery life will also become longer, with a goal of 10,000 cycles.

Ouyang Minggao uses specific energy and battery life as two axes to show the diversified technology routes in the future:

High specific energy and low cost liquid technology path – from high nickel ternary to rich lithium-manganese-based positive electrode system and from high proportion silicon carbon to lithium metal negative electrode system, with a specific energy target of 500 Wh/kg but low battery life.

Liquid compromise path – balance the specific energy, safety, cost, and battery life by adopting high-nickel positive electrode system, with no decrease in battery life but a 50% increase in specific energy, or a more than 3-fold increase in battery life without decreasing the specific energy, approaching 10,000 cycles.

High safety liquid path based on iron-lithium – with the lowest cost and an expected battery life of over 10,000 cycles. Recent studies have shown that liquid ternary systems can also achieve 10,000 cycles.

Chaoji charging standard is expected to be approved in the third quarter

To break through the difficulties of charging, first of all, innovative charging standards should lead. Chaoji is a set of direct current charging solution technology schemes with independent intellectual property rights, which was first created and led in China. It takes into account the past (can directly match the existing GB system), the future (350 kW high-power fast charging, small-power charging direct current and vehicle-to-grid interaction (V2G)), and leads the world (synchronized with IEC international standards, promoting Chinese enterprises to go global and promoting the unity of international interface standards).

The first phase of the Chaoji demonstration project has been completed: In 2019, high-power charging demonstration projects were built and put into operation successively in 8 cities including Beijing.

The second phase of the Chaoji demonstration project is expected to be put into operation this year: Chaoji charging stations are being built on the Beijing-Shanghai expressway, and are expected to be operational in the second quarter of 2022.

The Chaoji national standard is under development, including GB/T 20234.4 (connection components), GB/T 27930 (communication protocols), and GB/T 18487.1 (charging systems). The second solicitation for opinions has been conducted for GB/T 18487.1 and 27930, and the first solicitation for opinions has been conducted for GB/T 20234.4. It is expected to be approved for submission in the third quarter of this year.The upgrade of this charging standard will bring huge opportunities for the development of fast charging and complementary charging and orderly slow charging and vehicle-network interaction.

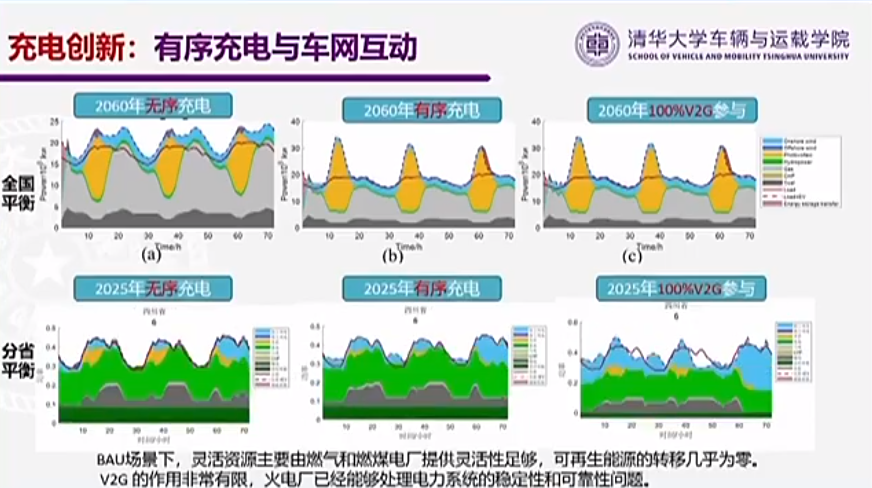

Broad Prospects for Orderly Charging

With the increasing number of electric vehicles, the huge demand for charging will inevitably lead to the supply capacity of the power grid. The solution is to have orderly charging.

Ouyang Minggao introduced that orderly charging and vehicle-network interaction technology includes one-way orderly charging V1G, vehicle-network energy bidirectional flow V2G, and V2X for everything connected in the vehicle network.

V1G is one-way orderly charging, such as charging during low electricity times at night. V2G is a vehicle that can supply and charge in reverse, providing power to the local area network and the power grid. V2X includes vehicle-to-vehicle supply, building power supply, emergency power supply, and home backup power supply, etc.

According to the China Energy-saving and New Energy Vehicles Route Map, by 2040, there will be 300 million new energy vehicles in stock. The scale of vehicle-borne power is equivalent to the total daily power consumption in China in 2020 (calculated based on 65 kW/vehicle, with a battery storage capacity of 20 billion kWh).

However, considering the travel demand, the average electricity used by passenger cars that can participate in the power grid scheduling flexibly per day is 10 billion kWh.

More meaningful is the power regulation potential of the vehicles. If the bidirectional charging pile is calculated based on a power of 15 kW, according to the probability distribution of daily travel, the ability of the 300 million new energy vehicles to support the power grid is about 3 billion kW, even higher than the national installed capacity of 2.38 billion kW.

Just orderly charging can transform the use of electricity for new energy vehicles from unordered to ordered, greatly reducing the load on the power grid.

By 2030, the number of electric vehicles in stock will reach 80 million to 100 million. Ouyang Minggao predicts that after 2030, with the popularization and development of V2G, its capacity will exceed the electrochemical battery storage capacity of the power grid. In the future power system, electric vehicles will work together with energy storage power stations to bear the important responsibility of stabilizing the power grid, and are expected to become the main body of distributed energy storage.

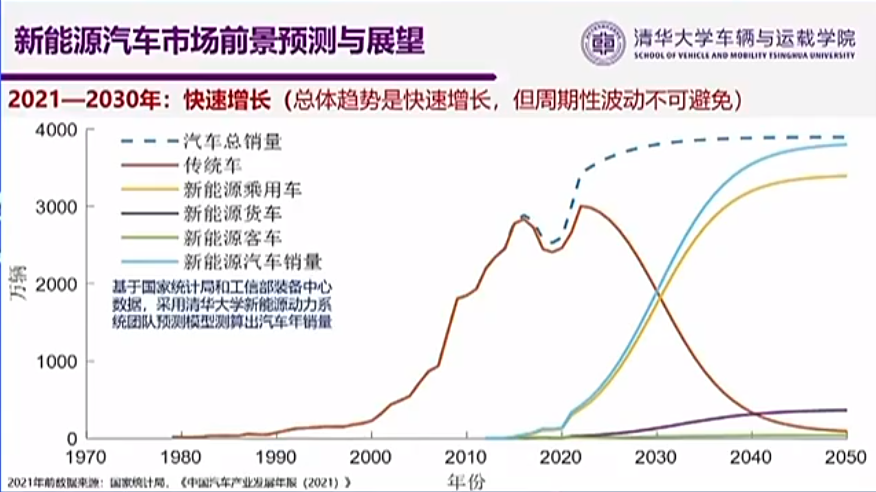

By 2030, New Energy and Fuel Vehicle Sales Will Be Balanced

In 2021, China’s new energy vehicle industry has achieved a transition from a growth period to an explosive growth period, which is five years earlier than the previous forecast. The role of electric vehicles in China’s achievement of the “dual-carbon” target has become increasingly prominent.

Firstly, electric vehicles will ensure that the carbon peak in the automotive industry is achieved before 2030. According to calculations from Ouyang Minggao, in 2021, the carbon emissions per kilometer for electric vehicles is approximately 70 grams, which is only 40% of the 170 grams per kilometer emitted by fuel vehicles.

Firstly, electric vehicles will ensure that the carbon peak in the automotive industry is achieved before 2030. According to calculations from Ouyang Minggao, in 2021, the carbon emissions per kilometer for electric vehicles is approximately 70 grams, which is only 40% of the 170 grams per kilometer emitted by fuel vehicles.

Based on this and the trend of vehicle development, the total carbon emissions of passenger cars are expected to reach its peak before 2030, with a peak of less than 600 million tons.

Secondly, from 2030-2035, electric cars will begin to achieve negative carbon emissions.

With the Vehicle-to-Grid (V2G) technology, electric vehicles can serve as energy devices to store zero-carbon new energies such as wind and solar power, suppress carbon emissions from thermal power plants, and bring about a reduction effect, which is significant.

The negative carbon effect of new energy vehicles will receive a series of policy support benefits.

The forecast results from the team of Ouyang Minggao show that the peak sales of fuel vehicles will occur in 2022-2023, and then fuel vehicle sales will continue to decline. By 2030, the sales of new energy vehicles will be roughly equal to fuel vehicles, accounting for half of the total vehicle sales, which is roughly consistent with the goals of China’s energy-saving and new energy vehicle technical roadmap.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.