In November 2021, the foreign skateboard chassis company Rivian officially went public, while in December, the domestic company Youpao Technology also released the Youpao UP super chassis. For a time, skateboard chassis became a hot topic of discussion in the autonomous driving industry.

People are discussing whether the market for skateboard chassis really exists and which customers will adopt them. This article will elaborate on skateboard chassis from four aspects, including what skateboard chassis is, the advantages and challenges of skateboard chassis, the competitive landscape and business models of skateboard chassis, and the direction of future scenario landing.

What is a Skateboard Chassis?

Definition of Skateboard Chassis

Skateboard chassis is a modular system that integrates the steering, braking, powertrain, suspension, and other systems originally on an electric vehicle onto the chassis of the vehicle. It can change the corresponding module according to the requirements of different vehicle models, shorten the development cycle, and realize the decoupling development of the upper and lower parts of the vehicle body. The reason why it is called a skateboard chassis is mainly because of its similar shape to a skateboard.

Skateboard chassis should be understood as a concept of platformization. The platformization production mode has appeared in the era of fuel and electric vehicles. However, the skateboard chassis is a new platformization production mode under the intelligent vehicle era. By changing the traditional mode of the supply chain and the production mode of the whole vehicle, the skateboard chassis will reshape the research and development and manufacturing process of future vehicle chassis.

Bai Junbo, the CTO of Ecarx, said: “Platformization mode is not a new concept in the automotive industry. Its main feature is the universalization of parts. It is mainly manifested in the universalization of systems, subsystems, parts, interfaces, etc. in different vehicle models, which is visible. At the same time, there is a strong degree of universalization in some invisible parts, including design and development processes, manufacturing production modes, etc.”

Development and Evolution

Throughout the development history of the entire automobile industry, there have been platformization development models in different development periods.

Bai Junbo introduced: “With the development of electrification and intelligence, the requirements of the automotive industry for automotive platformization have been upgraded. Platformization can be divided into three eras, including the fuel vehicle era, the electric vehicle era, and the intelligent vehicle era. Among them, the fuel vehicle era is platformization 1.0, with the universality of ‘mechanical parts’ as the core; The electric vehicle era is platformization 2.0, with the universality of ‘mechanical parts + electrical components’ as the core; The intelligent vehicle era is platformization 3.0, mainly based on ‘hardware universalization + software platform + standard interface.'”

Now, let’s take a look at how the automotive industry achieved platformization in the three different eras.

(1) Fuel vehicle era## In the era of fossil fuel vehicles

In the era of fossil fuel vehicles, the OEMs have independent R&D and design capabilities for the chassis and body. To minimize supply chain costs, each level of vehicle has its own common parts manufacturing platform. For example, A-class or B-class vehicles have their own set of platforms, and some parts between different platforms can be shared.

Regarding the common parts, Bo Junbo shared, “The common parts include the front cabin firewall, steering system, some chassis parts, tires, some white body parts, fixed driving and passenger seating positions, instrument clusters, central armrests, seats, and air conditioning systems.”

In the era of electric vehicles

In the era of electric vehicles, the concept of platformization is similar to that of fossil fuel vehicles, except that components such as engines and transmissions are replaced by the current three-electric system. Therefore, compared with the era of fossil fuel vehicles, there are some common electrical parts in this phase of platformization.

In the era of intelligent vehicles

In the era of intelligent vehicles, the status of software services gradually increases, leading to a development mode of “hardware common + software platform + standard interface.”

On the one hand, the development of the entire vehicle is driven by hardware. Making hardware modular, integrated, and standardized enhances the universality of parts. On the other hand, standardizing hardware interfaces can integrate parts from different suppliers. As hardware technology becomes increasingly similar, the importance of hardware is decreasing, and the technical focus of vehicle development will shift from hardware to software platforms for chassis development.

As the skateboard chassis possesses the above two characteristics, it belongs to a new platform product in the era of intelligent vehicles. Often, we can also regard the skateboard chassis as a “large part.”

Common Misunderstandings about Skateboard Chassis

(1) Difference from traditional unibody

Many professionals in the industry equate the skateboard chassis with the unibody, but the author believes that this view has a certain misunderstanding of the skateboard chassis.

Unibody vehicles have been around since the fossil fuel vehicle era and are primarily used in SUVs or off-road models. The entire chassis is a beam structure, and the body is suspended on the frame and connected through elastic elements.

Compared with the unibody, the advantages of non-unibody vehicles are: first, high stiffness. With the beam structure, the overall rigidity of the vehicle is higher, which makes the body and frame less prone to deformation in the event of a collision and safer. Second, easy to modify. The body is installed above the chassis, which makes it easy to modify for various special vehicles according to actual needs, such as forest fire trucks, ambulances, or recreational vehicles.The disadvantages of unibody construction are also quite obvious: first, they are heavy. Two thick beams plus the weight of the car’s outer shell make the weight of the whole car larger compared to the body-on-frame construction, which reduces acceleration capability and increases fuel consumption. Second, the handling is poor. The larger engine and transmission system of a fuel-powered car can only be placed above the entire frame, causing the vehicle’s center of gravity to move upward, which is unfavorable for handling. Third, the cost is high. Because independent frames and bodies use more steel, production costs are high.

The reason why skateboard platforms are equated with unibody construction is mainly due to some similarities: first, they are separated from top to bottom in the manufacturing process. Second, both platforms have a rigid structure. The skateboard platform is reinforced on both sides of the beam to protect the battery pack. Third, both platforms integrate power systems, suspensions, brakes, and steering modules.

The differences between the two mainly lie in two points: first, skateboard platforms are mainly low-floor structures with a lower center of gravity and stronger stability. Second, the internal combustion engine of a fuel-powered car is replaced by smaller and lighter batteries, motors, and electronic controls, while the entire electric system is integrated in the center of the platform.

Considering the above content, the skateboard platform is only similar to the unibody construction in terms of the connection between the upper and lower bodies, but the latter lacks the important characteristics of the skateboard platform, such as decoupling development of hardware and software and standard interfaces, so unibody construction is not a necessary condition for skateboard platforms.

Secondly, some traditional car companies on the market have successively launched their own new electric vehicle platforms, such as Volkswagen’s MEB, Hyundai’s E-GMP, and Toyota’s e-TNGA. Many industry insiders believe that the development mode of these electric vehicle platforms is already very close to that of skateboard platforms, but the author is also considering the specific similarities and differences between the two.

First of all, the similarity between the two lies mainly in: first, in terms of structure, to protect the battery pack, they are equipped with the same side beams to enhance safety; second, in terms of integration, because they do not have an engine and a transmission system, the platform is highly integrated; third, in terms of modularity, both use modular components and assemblies to simplify the production process and reduce manufacturing costs.

Secondly, in terms of differences: first, although this type of electric vehicle platform is also a platform architecture, it is still a body-on-frame construction and cannot truly achieve separation between the upper and lower bodies, and still belongs to an integrated development mode; second, based on the characteristics of modularity, standardization, and universality, the development cycle of vehicle models is relatively shortened, but the development cycle of skateboard platforms will be shorter.

It can be seen that the biggest difference between the two lies in the difference in development mode, so does the platform development mode of the smart car era have to be a split type?For my question, Bai Junbo explained: “First of all, the skateboard chassis is a detachable form of platformization 3.0 in the era of intelligent vehicles, but it is not necessary to develop a detachable method for platformization 3.0. Secondly, to achieve the era of intelligent vehicles 3.0, a truly domain-controlled structure must be in place, and different companies and products also have different domain control decomposition methods. Taking Tesla as an example, its domain control architecture is based on physical space distribution, and Tesla’s commonality rate of parts has reached about 70%, although it has not adopted a detachable development method, it still has important characteristics of platformization 3.0.”

In this regard, the development model of Tesla or other electric vehicle platforms belongs to a model of intelligence 3.0, but unlike the detachable development of the skateboard chassis, it belongs to a unified development.

Development Opportunities

(1) Under the trend of electrification, the entire vehicle’s supply chain system is broken

After the form of the terminal product changes, it will affect the upstream parts supply chain system and also affect the product R&D and design process.

On the one hand, as the architecture of a fuel vehicle is completely different from that of an electric vehicle, a fuel vehicle has an engine and a gearbox, while the main components of an electric vehicle are batteries, motors, and controllers. Under the trend of oil-to-electricity conversion, the pattern of parts required by a vehicle is disrupted, leading to changes in the design of parts on the chassis, such as the volume and structure of parts, and the installation location.

On the other hand, when the host manufacturer originally designed a fuel vehicle, it was mainly a unified body, and the development and design had an already matured set of processes. This design process had a high degree of complexity and low fault tolerance, and was not conducive to the rapid iteration of products. For some new entrants, developing the chassis for an electric vehicle requires setting up a new team and continuously investing a large amount of capital and time, which is not conducive to rapidly breaking through.

Under the influence of these two factors, as a highly integrated and standardized product, the skateboard chassis does indeed have some market opportunities.

(2) The importance of hardware optimization is decreasing

The convergence of electric vehicle technology at the hardware level is increasingly low, leading to limited added brand value.

An engineer in a start-up chassis company mentioned that “there is not much room for optimization and innovation of electric vehicle hardware technology currently, and the gap is getting smaller.”

In the context of hardware convergence, car companies have focused on differentiation competition in software and user operation.

The original chassis development process has changed, and new car-making forces such as Weichi are defining products by starting from user demand through internet thinking, mainly driven by user demand to product design.PIX Moving partner Zhu Xiaosong told Jiuzhang ZhiJia: “Looking back at the history of oil-to-electric transformation, the reason why traditional car manufacturers have declined is because they still use the logic of manufacturing cars to build cars. It wasn’t until Tesla and several domestic new forces emerged that the definition of products by original equipment manufacturers (OEMs) changed, and the focus shifted to the user based on user needs”.

(3) The Definition of OEMs has Changed

The definition of OEMs has changed. Different types of companies are entering the intelligent vehicle era, and some new entrants have less focus on hardware, and more attention is being paid to the user experience on the back-end. If the skateboard chassis can achieve low cost and short development cycle advantages, they will also be willing to adopt it. For example, Didi’s “DaVinci” plan is currently a strategy of cooperating with OEMs, but once the advantages of the skateboard chassis are demonstrated, the car-making mode of adopting the skateboard chassis may also become a possibility, because it will be more flexible than OEMs in terms of product definition.

Bo Junbo explained: “Taking the skateboard chassis company REE as an example, it has reshaped the division of labor in the automotive industry by inserting a new ecological chain between upstream Tier 1 and downstream OEMs. REE believes that downstream customers are no longer just OEMs. Future players entering the auto industry may undergo structural changes, including brand merchants, logistics companies, fleets, technology companies, business holders, or real estate holders, and traditional OEMs rank relatively lower, which means that the appearance of skateboard chassis will change downstream ecology.”

After the definition of OEMs has changed, the entire ecological chain and division of labor have also changed. Originally, the automotive industry was dominated by OEMs, but now different types of companies are joining the intelligent car team. They are more concerned about the end-user experience and iterative software algorithms, and the hardware side will be outsourced to third-party companies.

Advantages and Challenges of Skateboard Chassis

Advantages

(1) Independent R&D of Upper and Lower Body

The greatest advantage of split-body development is that OEMs or segmented scenario customers can focus on the design of the upper-body vehicle. Compared with the development difficulty of an integrated body, this split-body approach will be much easier.

For passenger cars, firstly, relying on full-line control and high integration, a chassis can be adapted to multiple upper-body styles; secondly, facing the personalized needs of C-end users, the standardized development mode of skateboard chassis can be applied to realize the differentiation of upper body; thirdly, the skateboard chassis of passenger cars adopts a low-floor structure, which can release the space of the upper body to some extent.

For commercial vehicles, skateboard chassis are mainly used in low-speed scenarios of unmanned vehicles, and the vehicle speed will not exceed 20 kilometers per hour. Therefore, the requirements for the chassis are mainly for versatility and durability, and the differentiation is mainly concentrated on the upper-body part.Changsha Wanke Technology General Manager Peng Xu said, “The skateboard chassis is more of a power platform, and it is important to make corresponding functional changes to the upper part. The upper part mainly includes specific operating systems, automatic driving computing platforms, and related sensors, while the chassis only needs communication and power interfaces. From the perspective of the modification logic of commercial chassis, unmanned environmental sanitation vehicles are equipped with sanitation systems such as road sweepers, cleaning vehicles, and garbage transfer vehicles on top of the skateboard chassis’s main beam.”

(2) Decoupling of software and hardware

When consumers purchase electric vehicles, their focus is on autonomous driving and intelligent cabin interaction experiences, and the chassis is not their primary concern. In this case, the main factory can focus on the interaction experience of terminal users, polishing of distribution channels, etc. by using a third-party chassis.

Bai Junbo also mentioned that “the speed of intelligent development is getting faster and faster, resulting in a rapid increase in the application of vehicle functions. If decoupling of software and hardware cannot be achieved, any adjustments or additions to new functions would be a considerable challenge for hardware.”

(3) Shortening the development cycle of new models

In traditional processes, it may take about three years for a new car to go from the conceptual stage to product and production maturity. However, the skateboard chassis can speed up the product iteration speed due to the modularization of various functions, such as Canoo, which has announced that a new car can be developed based on its skateboard chassis in 18-24 months.

Bai Junbo also mentioned that, taking the braking system as an example, in the low-speed vehicle field, when we need to replace a braking component, the coupling of the skateboard chassis leads to related interfaces being plug-and-play instead of having to perform extensive calibration, testing, and other work. From this perspective, the skateboard chassis can indeed help shorten the development cycle of the entire vehicle.

Challenges

Technical challenges

(1) Line control technology is a key technology, but line-controlled steering technology is not yet mature

Line control technology is one of the most critical technologies for the skateboard chassis, especially line control braking (EHB/EMB) and line-controlled steering (SBW). As mentioned above, one of the advantages of the skateboard chassis is the upper and lower separate development, which requires the application of line control technology to accomplish human-machine decoupling driving experience.

How mature is line control braking and line-controlled steering technology? A skateboard chassis engineer from a Tier 1 head product company said to Jiuzhang Intelligent Driving, “Judging from the Tier 1 products, line control braking (EHB) is currently relatively mature, but line-controlled steering technology has not yet been mass-produced.”

Currently, line-controlled steering technology only stays at EPS and has not completely removed the mechanical connection. The steering signal still comes from the driver’s operation, which cannot truly achieve the decoupling of driver operation and vehicle control. SBW removes the connection between the steering wheel and the gear entirely, and the steering signal comes from algorithms, which is more in line with the development direction of autonomous driving technology, but the technology is not yet mature.Currently, most of the skateboard decks on the market are applied to semi-closed and low-speed scenarios, which have low requirements for redundant safety. Therefore, EPS is “acceptable” for these scenarios. However, in high-speed environments, especially in the passenger car field, advanced autonomous driving in the future will inevitably be directly controlled by algorithms, and SBW is an unavoidable technological path.

(2) Low applicability of hub motors

Many insiders believe that hub motors can be used on skateboard decks, but the author believes that hub motors are unlikely to be applied to skateboard decks in the short term. The main reasons are: firstly, the technology is not yet mature; secondly, the industrial maturity is not enough, and there are fewer hub motor suppliers to choose from, and the cost is higher; thirdly, it increases the spring mass and affects the vehicle’s handling performance.

For commercial vehicles, hub motors will be applied to some special scenarios of vehicle decks, such as unmanned freight transportation. However, most low-speed commercial vehicles do not use hub motors, mainly because of their high cost and low practicality, which is contrary to the concept of most low-speed unmanned driving.

For passenger cars, the probability of large-scale application is even smaller. For most target audiences (middle and low-end models), hub motors are not practical, and the replacement cost is very high. They will become a burden unless high-end models are used as a selling point to attract consumers.

Hub motors will be a direction for the future development of electric vehicles, but under the premise that the safety and stability of products have not been verified reliably, the large-scale promotion in the passenger car field will inevitably slow down.

Challenges in engineering under CTC trends

Many insiders unanimously believe that CTC batteries are the technical direction of future power batteries, and many skateboard deck companies have also planned the layout of CTC batteries in the future. What is a CTC battery? Why is it suitable for skateboard decks?

The CTC battery directly arranges the battery cells on the deck, eliminating the concept of battery packs. On the one hand, the skateboard deck has an independent structure and strength, so the load borne by the battery cells will be smaller, reducing the effect of the battery pack. On the other hand, the direct integration of battery cells in the deck design can both install more battery cells to improve the vehicle’s cruising range and reduce the cost of the battery pack.

The purpose of CTC batteries is highly integrated and modular, pursuing an integrated design that simplifies the overall assembly process and reduces costs. This is very close to the concept of skateboard decks, and the improvement of energy density it brings will also become a selling point of skateboard decks.

However, the disadvantages of CTC batteries are also very prominent. The battery cells are directly assembled into battery packs, and each battery cell is sealed by gel and wrapped in multiple layers of protective materials. This will cause a single battery cell to be unable to be repaired or replaced. Once the battery has a problem, the battery cells need to be taken out from the opening of the deck design, the sealing gel needs to be removed, and the difficulty of repair is very high, even requiring the deck to be returned to the factory for repair.#### Challenges in the Supply Chain

Most skateboard chassis players are startups whose supply chain system has not yet been fully developed, and their control over the supply chain of core parts is not high.

On the one hand, there are not many optional core parts suppliers. From the domestic market perspective, some domestic suppliers have achieved mass production of electromagnetic brake (EHB/EMB), while the technology of steer-by-wire (SBW) is still controlled by international giants, but the maturity of SBW technology is still premature.

On the other hand, the original supply system has become very mature and solid. As a new product form, it is difficult for skateboard chassis to break through the original supply chain system. When the skateboard chassis has not yet had sales in the early stage, the supply chain price does not have the advantage.

Competition Pattern and Business Model of Skateboard Chassis

Upstream: parts suppliers, such as three-electricity, wire control system, BMS, tires, etc.

Midstream: skateboard chassis R & D and manufacturing enterprises, such as skateboard chassis R & D enterprises, skateboard chassis solution providers, Tier 1, etc.

Downstream: use and service, such as different segmented scenario users (sanitation, terminal distribution, mining, etc.), travel service enterprises, logistics enterprises, passenger car OEMs, etc.

Player Types

For potential skateboard chassis players, based on the layout of relevant companies in the current market, the author divides the player types into three categories, mainly including Tier 1, scenario-side enterprises, and skateboard chassis start-ups.

(1) Tier 1 (Bosch, CATL, etc.)

Advantages: Have certain bargaining power over supply chain prices and internal space design structure for certain core parts of skateboard chassis, such as battery and wire control technology.

Challenges: With the maturity of technology, the number of optional parts suppliers in the market will increase. For example, in wire control technology, domestic suppliers are also gradually expanding their business.

(2) Scenario-side Enterprises (Yawan Intelligence Driving, Xingshen Intelligence, Westing Technology, etc.)

Advantages: On the one hand, these companies have strong development capabilities in automatic driving functions; on the other hand, they have a deep understanding of scenarios and certain operational data, so they can produce skateboard chassis products that meet their own needs.

Challenges: Unless they are well-funded leading companies, the early development costs will be high and will affect the continuous iteration of the product. In addition, how to adapt to different upper-body functions will also be a research and development challenge.

Peng Xu, the general manager of Yawan Technology in Changsha, said: “Yawan’s advantage is deep cultivation in the sanitation scenario, with independent operation of sanitation projects. They have a deep understanding of scenarios and can produce skateboard chassis products that meet their own needs based on their existing operational data. The biggest challenge is integration, such as brake steering, battery, motor and other parts. Simple stacking is relatively easy, but adapting to unmanned driving and unmanned sanitation operations requires certain technical content.”He continued to add, “The reason why we choose to develop our own skateboard chassis is twofold. Firstly, it’s because of the price advantage. Secondly, the interface of externally sourced vehicles is not open to the public. In the sanitation industry, external traditional chassis cannot allow customers to control the engine and steering with their own upper controller, let alone access the chassis information, due to the principle of commercial confidentiality.”

Chassis Start-up Companies (PIX Moving, Yika Smart Car, Yourui Technology, Rivian, Canoo, REE, etc.)

Advantages: Can provide a highly universal chassis that can cover a certain range of vehicle conditions, and can reduce the development cycle of vehicle models for OEMs or scene customers, speeding up product iteration.

Challenges: Firstly, it is necessary to discover sub-markets with fast volume growth. Secondly, the cost of the supply chain will be relatively high if no volume is generated in the early stage.

Main Models

(1) Three types of commercial models

主要模式

Self-use as the main focus: represented by companies like Rivian, which produce their own skateboard chassis while also selling their own branded vehicles.

Providing skateboard chassis solutions: represented by companies such as PIX Moving, Yika Smart Car, REE, etc., whose products are mainly focused on commercial vehicles.

Providing skateboard or whole vehicle solutions: represented by companies like Yourui Technology, which outputs complete vehicle solutions through third-party factories, or provides only skateboard chassis solutions.

In terms of profit models, currently, the sale of the complete hardware set of the skateboard chassis is the main focus. In the future, some companies may also provide software services while providing hardware upgrade services and accessories.

(2) Research and development model

The focus of skateboard chassis development is on the integration and tuning of the chassis, and can be regarded as the outsourcing of chassis design, development, and production.

Most skateboard chassis companies do not directly manufacture cars, instead focusing more on modular integration and calibration technology of the chassis, as well as the ability to iterate products quickly.

Many skateboard chassis companies also have their own software algorithm teams, although the scale is not large. More of these teams focus on improving the value of the vehicles for their own customers. On the one hand, some of the customers themselves are start-up companies with weak research and development capabilities. If the skateboard chassis has certain algorithmic functions, it will become a major selling point of the product. On the other hand, for some major customers, their understanding of the scene and their algorithm iteration are bound to be stronger than those of skateboard chassis companies.

(3) Production

For low-speed commercial vehicle skateboard chassis, self-built production lines are the mainstay. The technical barriers to chassis development are relatively low, and the construction of production lines does not require strict regulatory qualifications. Self-built industries are conducive to diluting the cost of skateboard chassis in later stages of scale. The leading skateboard chassis companies in China, such as PIX Moving and Yika Smart Car, have already built their own production lines.Translate the Chinese text in Markdown into English Markdown, and professionally retain the HTML tags within the Markdown. Only output corrections and improvements, do not provide explanations.

The skateboard chassis for passenger cars requires a qualification for car manufacturing. Unless, like Rivian, a company makes and sells their own cars, external cooperation is mainly used in the early stages with no large-scale production.

An Inventory of Typical Domestic and Foreign Companies

(1) Foreign companies

(2) Domestic companies

Customer Types

The main customers for the skateboard chassis can be divided into three categories: scenario providers, self-driving solution providers, and some manufacturers. The difficulty order for implementing these scenarios is also the same.

(1) Scenario Providers

The scenario provider customers have a relatively thorough understanding of specific scenarios and are mainly focused on low-speed scenarios such as sanitation and last-mile delivery.

These customers are the most likely to use the skateboard chassis. Their primary feature is that low-speed vehicles have relatively low technical requirements for key components such as line control technology, the three electric systems, etc., and their attention is mainly focused on the operation of the scenario. They are more concerned with commonality and durability rather than comfort and driving space inside the vehicle.

Bo Junbo also mentioned that, taking unmanned last-mile delivery as an example, this is a case of AI+business scenarios, including real-time delivery, last-mile delivery, and others. The skateboard chassis plays a role as a mobile platform. The vehicle models’ purpose is mainly to serve commercial vehicles, so these enterprises’ most significant demands are cost and stability, and the primary differences are in the upper body unit.

The two main further reasons for buying skateboard chassis from scenario providers are:

First, to reduce the development cost of the vehicle model. The volume of each sub-scenario is relatively small, and if one were to create a model and a chassis themselves, the initial investment cost would be very high, and the fault tolerance rate would also be very low. When there is no large-scale production yet, developing a unique model oneself is not necessarily the best way, which can even increase the enterprise’s operating costs.

Second, to increase the flexibility for vehicle modification. Purchasing whole vehicles externally is not conducive to automated modification and cannot develop custom development. Some vehicle interfaces of certain scenarios are not open to customers.

(2) Self-driving Solution Providers

Self-driving solution providers mainly include Robotaxi, Robobus, Robotruck, and other enterprises.

On the one hand, the significant advantage of these enterprises is their ability to develop advanced autonomous driving features, but their engineering capabilities are relatively weak. The skateboard chassis can help them quickly launch new models.

PIX Moving’s partner Zhu Xiaosong mentioned as an example, PIXRobobus took less than a year from 0 to 1 in development cycles, which would take at least two to three years using traditional development methods.(3)Some OEMs

Some OEMs refer to those who have been focusing on the traditional fuel vehicle market but have been slow to catch up in the process of electrification. They urgently need the assistance of third-party skateboard chassis to catch up with the “last bus” of electrification.

If a new set of vehicle R&D system is established, the investment of time and capital will be very significant, and it may even affect its product iteration speed. In the case of weak brand and channel power, using skateboard chassis may be a good choice for quickly completing the know-how process, quickly opening up the market, and establishing brand awareness.

Challenges and Trends in Future Scenarios

Suitable Landing Scenarios in the Future

In the short term, the priority is still low-speed commercial vehicles. First, as the solution for unmanned driving becomes more and more mature, the demand for automatic driving in low-speed scenarios will also increase; second, this type of scenario does not have particularly high technical requirements for the chassis, and the promotion of skateboard chassis is relatively strong.

Cao Yuteng has also publicly mentioned the outbreak period of commercial vehicles. He said: “In the field of commercial vehicles, there may be an outbreak in the next 3-5 years.”

In the medium term, some solution providers for autonomous driving will have a higher demand in some commercial vehicle fields, such as long-haul logistics and Robotaxi. The starting point of the outbreak is when high-level autonomous driving is relatively mature. After the development in the low-speed car field and related core technologies become mature, the overall cost of skateboard chassis will reach a level that can be widely promoted.

In the long term, some OEMs may choose skateboard chassis, but the outbreak of passenger cars will be relatively late, and will be restricted by various conditions such as regulations, technology maturity, and customer acceptance.

Challenges in Commercialization

(1)The Application Bandwidth of a Single Skateboard Chassis is Limited

A highly standardized skateboard chassis, no matter how the hardware is fine-tuned, cannot cover the needs of all vehicle models.

Regarding commercial vehicles, the performance requirements of the chassis are also different according to the needs of different scenarios. On the one hand, for self-driving cars in open scenarios, their hardware requirements will be higher than those in closed or semi-closed scenarios and they will need to face various complex open road conditions; on the other hand, self-driving cars with different working functions may also have different requirements for load-bearing capacity, power, etc.

Peng Xu, General Manager of Changsha Yuwan Technology, said: “Most of the skateboard chassis in China are used in related logistics fields, while Yuwan mainly focuses on the environmental sanitation vehicle area. Currently, most skateboard chassis in China are used in logistics-related fields, but they are not suitable for environmental sanitation vehicles because the load-bearing capacity of skateboard chassis for unmanned logistics vehicles is low, and the overall structure does not meet the requirements of environmental sanitation vehicles.”He continued to add, “The biggest technological barrier for unmanned sanitation vehicles is that the manufacturing process refers to vehicle-level standards, such as the standards of medium and high-speed commercial vehicles in some line control technologies. Although it is a low-speed vehicle (about 3-5 kilometers per hour), because it is put on open roads, the vehicle needs to increase a certain degree of redundancy.”

The same is true for passenger cars. The bandwidth of the skateboard chassis cannot cover all models, and in terms of performance, it cannot be “just right.”

On the one hand, a skateboard chassis cannot cover all levels of vehicle models. Perhaps within the range of adjustable wheelbases, it can cover about three levels of sedans, and even SUVs, but some models cannot be covered, such as sports cars. Because the hardware space of the skateboard chassis is very limited, the performance requirements for sports cars must be different from those of household cars. The endgame in the passenger car field is inevitably a customized development platform, which is a combination of multiple standardized products and customizable hardware modules. Taking REE as an example, it has announced five sizes of chassis that can be adapted to different vehicle needs.

Many skateboard chassis companies are also developing developer platforms. For example, PIX’s independently developed AMM is a “calculated design” model, users only need to drag the slider and enter boundary data to customize different skateboard chassis.”

On the other hand, the standardization of skateboard chassis will inevitably have a certain design range and safety performance boundary. Taking a household sedan as an example, no matter how the exterior of the car body is designed, the A-pillar, B-pillar, and C-pillar outside the car body will have a fixed range of installation points. Otherwise, the passive safety performance of the vehicle will lose a certain guarantee beyond this range. And the interior seats of the car cannot change too much no matter how they are installed. After all, the central control screen, air conditioning system, trunk, etc. will also occupy a part of the space.

(2) Landing issues in the passenger car scene

In the short term, it is difficult to break the original supply chain in the passenger car field, and the chassis is still the most core technology of the main factory.

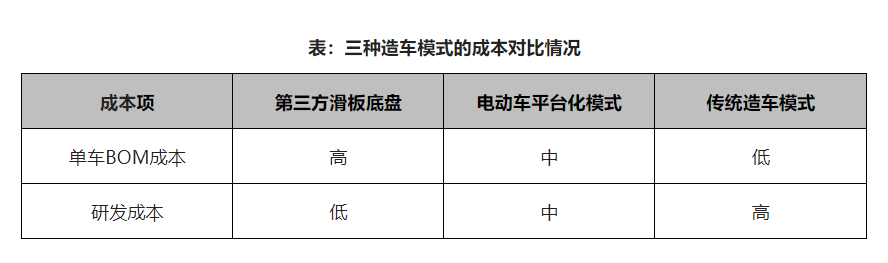

From the perspective of supply chain security, the chassis gathers most of the core hardware of electric vehicles. If it is outsourced, the main factory may only have two departments of software and upper car body design. Even some skateboard chassis companies can provide a complete set of vehicle solutions. What should the original chassis department personnel do? Should they all be laid off? In addition, once the third-party chassis company does not supply skateboard chassis, who will the main factory buy in the future? This will make the position of the main factory very passive in the future.From the perspective of supply chain costs, the current top host manufacturers have significant supply chain cost advantages, and using skateboard decks will increase BOM costs in the absence of supply chain advantages for skateboard deck companies. Similar to the logic of popular mobile phones and Teslas, host manufacturers including the new players are also mainly promoting explosive products. In this context, the disadvantage of high BOM costs for skateboard deck bicycles is very obvious when the sales volume has not reached a high level yet (the figure below shows the cost comparison of three car-making modes).

For the host manufacturers, the cost of the entire vehicle includes BOM costs and R&D costs, which are generally distributed to the cost of each bicycle. As sales volume gradually increases, R&D costs decrease and become mainly the BOM cost of each bicycle. What is the critical point at which the specific sales volume needs to reach in order to reach the three car-making modes? Under what conditions can the adoption of skateboard decks maximize the benefits?

A skateboard deck company expert responded to these questions by saying, “The production of skateboard decks is mainly done using a customized production method. However, it is generally believed that the higher the degree of customized production, the lower the total cost of each bicycle, which is incorrect. In fact, the higher the degree of customized production earlier on, the lower the degree of customized production will be later on.”

He continued, “In general, when the sales of vehicles reach more than 1,000 units per year, the cost of traditional production processes will be lower than the cost of customized production processes.”

This means that when the annual sales volume is less than 1,000 units, the total cost of a bicycle using a third-party skateboard deck will be lower than that of the traditional car-making mode. However, when the sales volume exceeds this critical threshold, the cost of the traditional car-making mode will quickly decrease as the R&D costs are quickly amortized with the further increase in sales volume, and at this point, the third-party skateboard deck loses its competitiveness in cost.

From the perspective of applicable customer groups, the willingness of host manufacturers above the waist to adopt skateboard decks is not high. Some of the top host manufacturers have already achieved integrated and modular chassis, but what they lack is not chassis technology, but core components of the future chassis, such as full-line control technology.

Some industry insiders also believe that tech giants such as Huawei, Xiaomi, and Apple may be potential users of skateboard decks. However, these companies have very strong capital and R&D capabilities, and self-developing chassis is not difficult. Considering the cost disadvantage of skateboard decks in large sales volumes, they are unlikely to outsource chassis to third-party companies.(3)Trends of commercial vehicle application scenarios

For low-speed application scenarios, the market volume of each subdivision track is not large, but it is crucial to pinpoint the market demand at the early stage. The author believes that a good subdivision track must have the following three characteristics to be the best market entry point for skateboard chassis: First, the track has a strong self-generating ability with outstanding profit mode; secondly, the same skateboard chassis can be reused for different upper bodies, and the iteration of upper body design will not have too much impact on the hardware of the lower body of skateboard chassis; thirdly, the market space must be large enough to amortize the overall cost of the skateboard chassis.

PIX Moving co-founder and COO Yuteng Cao previously publicly stated: “We first start from the market entry of unmanned specialized vehicles since it is the easiest area for commercial landing of high-level automatic driving. We consider three factors: firstly, whether it can truly create value for our customers and solve practical problems; secondly, whether customers can better reuse our existing products and technologies; thirdly, whether it has the possibility of mass production.”

Furthermore, customers of subdivision scenarios may also produce skateboard chassis on their own, but only companies with certain capital strength can afford such production cost, and it is only feasible for the star products of their own companies, as the cost of mold opening easily exceeds tens of millions. However, most customers of subdivision scenarios are start-up companies that lack the determination to invest capital and cannot develop skateboard chassis on their own.

For medium and high-speed scenarios, such as trunk logistics, 70%-80% of the cost is invested in the chassis, and the cost of current trunk logistics vehicles is already at a minimum. Unless there are obvious cost advantages for skateboard chassis, or other differentiating advantages in terms of software and hardware performance, the attractiveness of using skateboard chassis is not significant.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.