Jia Haonan from the Co-pilot Temple

Reference for Smart Cars | WeChat Official Account AI4Auto

A sharp observation:

“80% of China’s gasoline car brands will cease operation and transformation within the next 3-5 years.”

A promised goal:

“Fully unmanned driving will be achieved by 2026, and “fully automated charging” will be available next year”.

There is also an official judgment on the important trend of the industry:

“Functional cars are transitioning to smart cars…”

All of these are fresh statements from the 8th China Electric Vehicle Hundred-person Forum.

Why is it important?

It is the top-tier tripartite think tank in China’s new energy vehicle industry, covering heavyweight players from the policy side, industry sector, and academic circle.

Industry trends, new products, and technological routes… the forefront of China’s smart car development can all be seen here.

This year’s hot topics, whether it is the rise in lithium battery prices, supply chain tensions, the battle between fuel and pure electric vehicles, or whether extended-range vehicles count as new energy…

We have sorted and summarized the smart electric vehicle topics that you care about~

Is the Automobile Industry 3.0, Changing Its Main Character to Smart?

Let’s focus on the words of vehicle manufacturers that are directly related to us ordinary users.

Quickly grab a notebook and take note, so we can supervise them whether they can live up to their promises.

As for the issue of intelligence, of course, XPeng Motors (XPENG) is the company that needs to pay the most attention.

He XPeng said that with the advent of unmanned driving, cars will change significantly. For example, whether the five-star installation collision is still necessary. Because when all cars are fully unmanned, traffic lights will change and cars will change. This is a huge opportunity for transformation.

XPENG may transition to unmanned driving in 2026. Before that, He XPeng believes that it is the transition stage from initial intelligence to higher-level intelligence.

The first step planned by XPENG during this stage is to equip multiple car models with XPILOT 4.0 next year, with a 508TOPS ECU computing power, an 8 million-pixel binocular camera and a highly integrated domain controller.

XPILOT 4.0 can even automatically plan driving at night to park in the charging station and charge, and then automatically drive back when it completes charging.The Jidu Automobile, which also emphasizes intelligence and proposes the concept of car robots, has also clarified its understanding of automatic driving.

Jidu CEO Xia Yiping believes that the era of energy-driven fuel or electric has passed, and Automotive Industry 3.0 should be the main stage of intellectualization.

“freedom of movement, natural exchange, and self-growth” are the basic concepts that automotive products should have, and behind them requires a set of complex software and algorithms, as well as hardware that meets the corresponding computational requirements.

And software security is the most critical in this era.

Based on the accumulation of Baidu Apollo’s road test data of tens of millions of kilometers and zero accidents, Jidu has already achieved the integration of automatic driving in high-speed and urban domains at the end of last year.

Jidu’s first car will be released at the upcoming Beijing Auto Show and delivered in 2023.

Jidu and XPeng focus their attention on artificial intelligence, but more automakers are still paying attention to the needs and pain points of electric vehicles today.

For example, Range-extended Electric Vehicle (EVR), is it a new energy vehicle? Can it enjoy preferential policies?

According to the “Automobile Industry Investment Management Regulations” published by the National Development and Reform Commission, EVR and EV (pure electric type) are classified as electric vehicles.

Therefore, Sailesi, backed by Huawei, called for all electric cars to enjoy the preferential policy of not paying consumption tax.

Furthermore, Ideal Car CEO Li Xiang explained the reasonableness and necessity of range-extended electric vehicles from the perspectives of user and policy demands.

Firstly, at the user level, pure electric vehicles have limited endurance, sparse energy supply networks, and slow charging speeds, which cannot meet the needs of mid-to-long distance travel.

Especially during the holiday travel peak periods, the pure electric vehicle experience is poor for family trips.

Therefore, “0-mile anxiety + family car use” has become the two biggest guiding principles of Ideal Automotive.

In addition, Ideal closely follows the policy advocacy of “pure electric drive” and tries to increase the pure electric endurance mileage of cars to meet the needs of most city car uses.

Most of those who purchase the Ideal car have family car demands, and most have private charging piles, which enables Ideal car owners to use pure electric travel in most scenarios.

Therefore, Li Xiang said that fuel consumption cannot represent whether it is low-carbon and environmentally friendly. Based on the actual situation of Ideal users, more than 70% of them use pure electric travel, and the car-end emissions are 65% lower than those of traditional fuel cars, and even large SUVs.Regarding intelligentization and automotive safety, Li Xiang suggested that AEB should be a standard configuration for vehicles, and received official acknowledgment and agreement.

On the topic of extended-range electric vehicles, regardless of whether or not it is considered a new form of energy, Wang Chuanfu, chairman of BYD, agrees with it. In his speech, he mentioned that regardless of extended-range electric vehicles or plug-in hybrids, the ultimate goal is for users to use more electricity and less oil. BYD insists on implementing a “pure electric + hybrid” strategy.

BYD believes that current stage’s pure electric vehicles primarily address the need for additional purchases, whereas plug-in hybrids fulfill the needs of more families purchasing or replacing vehicles. In terms of phasing out fuel vehicles and transitioning, plug-in hybrids offer a gentler and more stable approach.

Wang Chuanfu’s speech on the topic of batteries is not yet over; however, let’s continue looking at the perspective of car companies. The most remarkable point of view comes from Zhuhuarong, chairman of Changan Automobile, one of the three independent automakers in China. Last year, Changan had excellent sales results, ranking at the forefront among independent brands, and exceeding that of joint ventures.

However, Zhuhuarong talked about contingency planning, stating that China’s competition within the new energy market will become increasingly fierce, and that within the next 3-5 years, 80% of China’s fuel vehicle brands will have closed or restructured. He listed out actual data, mentioning that in 2021, there are 85 fuel vehicle brands in China, of which 34 have monthly sales of less than one thousand units, and 9 have already vanished.

Traditional auto companies must accelerate “survival,” which is also the fundamental motive for Changan’s series of moves last year. Similarly, established car manufacturers such as Volvo and BMW announced their policies during the forum. Volvo aims to complete its complete electrification transformation by 2030, while maximizing its use of sustainable materials in production and operations. BMW, on the other hand, promises to reduce its single-vehicle carbon footprint by 40% by 2030 compared to 2019.

On the domestic fortification of energy storage batteries, the top two major players, CATL and BYD, have different views. Contemporary Amperex Technology Co. Ltd. vowed to produce heat-free extended-range power batteries with a range of 1,000 kilometers by 2023 during the forum. However, BYD, the second-largest battery supplier, cooled down the industry leaders by expressing different opinions.##王传福:Focus on Safety and Reliability of Battery Technology

According to Wang Chuanfu, nowadays, an electric vehicle can easily achieve a range of 500-600 kilometers, making it no different from filling up a tank with gasoline. Therefore, in the future, the focus of battery technology will no longer be on improving range, but on safety and reliability.

In addition, China cannot afford to be neck-deep in oil in the era of gasoline-powered vehicles, only to be suffocated by metal cobalt and metal nickel in the era of electric vehicles. Lithium iron phosphate does not contain rare metals and is more in line with social resource carrying capacity.

So, BYD’s insistence on lithium iron phosphate is the “orthodox” choice for power batteries.

In fact, Wang Chuanfu’s view is not wrong. BYD almost single-handedly “revived” lithium iron phosphate batteries, which were revalued by the industry last year.

Ningde times is also accelerating the layout of lithium iron phosphate battery production capacity.

As for new technologies, Ningde Times also revealed its upcoming third-generation CTP technology, internally referred to as “Kirin Battery.” Under the same chemical system and equivalent battery pack size, the battery pack of Kirin Battery can increase its capacity by 13% compared to the 4680 system.

Did Musk’s trump card get outstripped before its debut?

Industry’s Important Wind Vane: Intelligent Cars Replacing Functional Cars

Finally, let’s take a look at the important statements from officials, academia, and the industry.

Their views usually represent the direction of future development of intelligent electric vehicles.

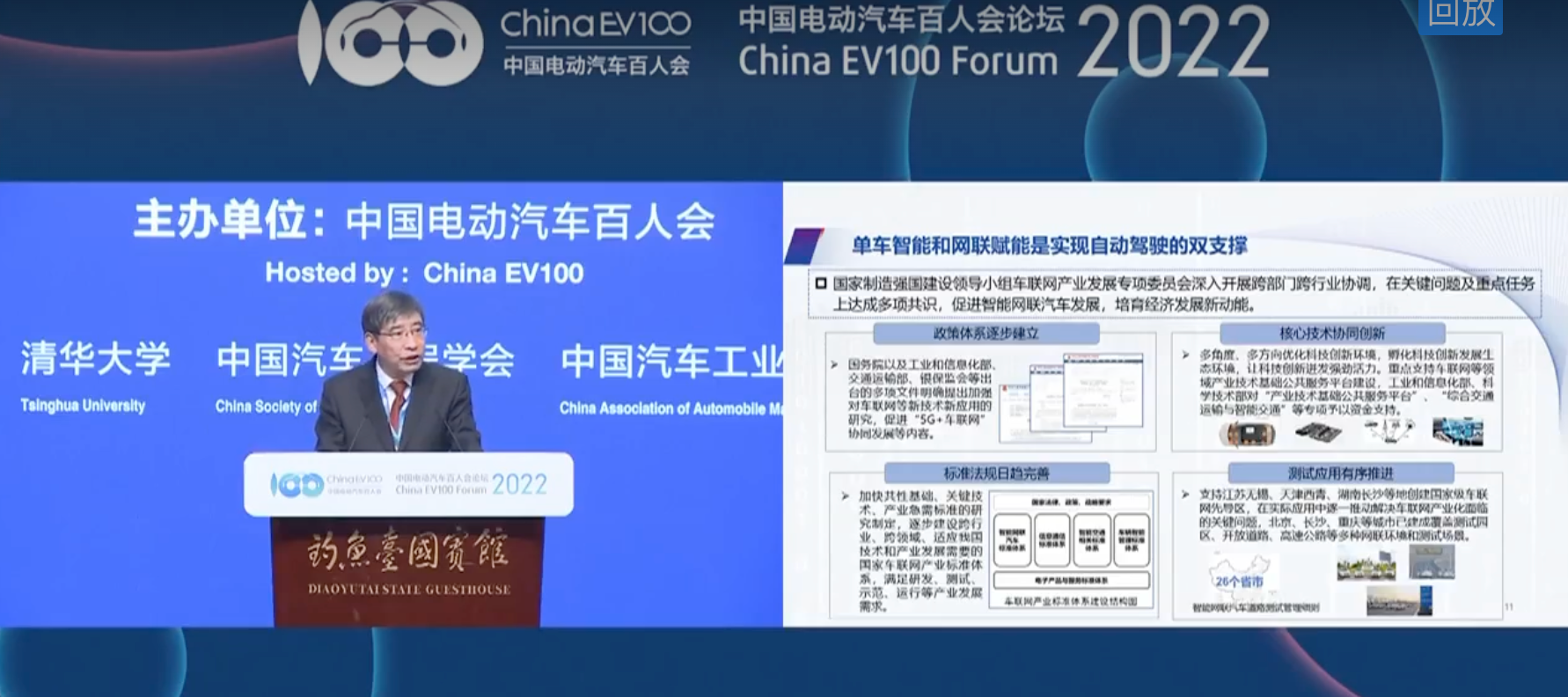

Firstly, the official first proposed the concept of distinguishing between intelligent cars and functional cars.

Miao Wei, Vice Chairman of the Economic Committee of the National Committee of the CPPCC, made it clear that “functional cars are being converted into intelligent cars“:

If new energy vehicles can be compared to the first half, and intelligent connected vehicles can be compared to the second half, China’s automotive industry has made great achievements in the first half, but the outcome still depends on the second half.

Moreover, the key to winning the second half of the game, intelligent connected vehicles, the Ministry of Housing and Urban-Rural Development also expressed its willingness to deepen the pilot integration of smart city infrastructure and intelligent connected vehicles.

In addition, the National Development and Reform Commission has made it clear that in the future, it will explore new models such as vehicle-electricity separation, combination of charging and exchanging, and flexible battery configuration.

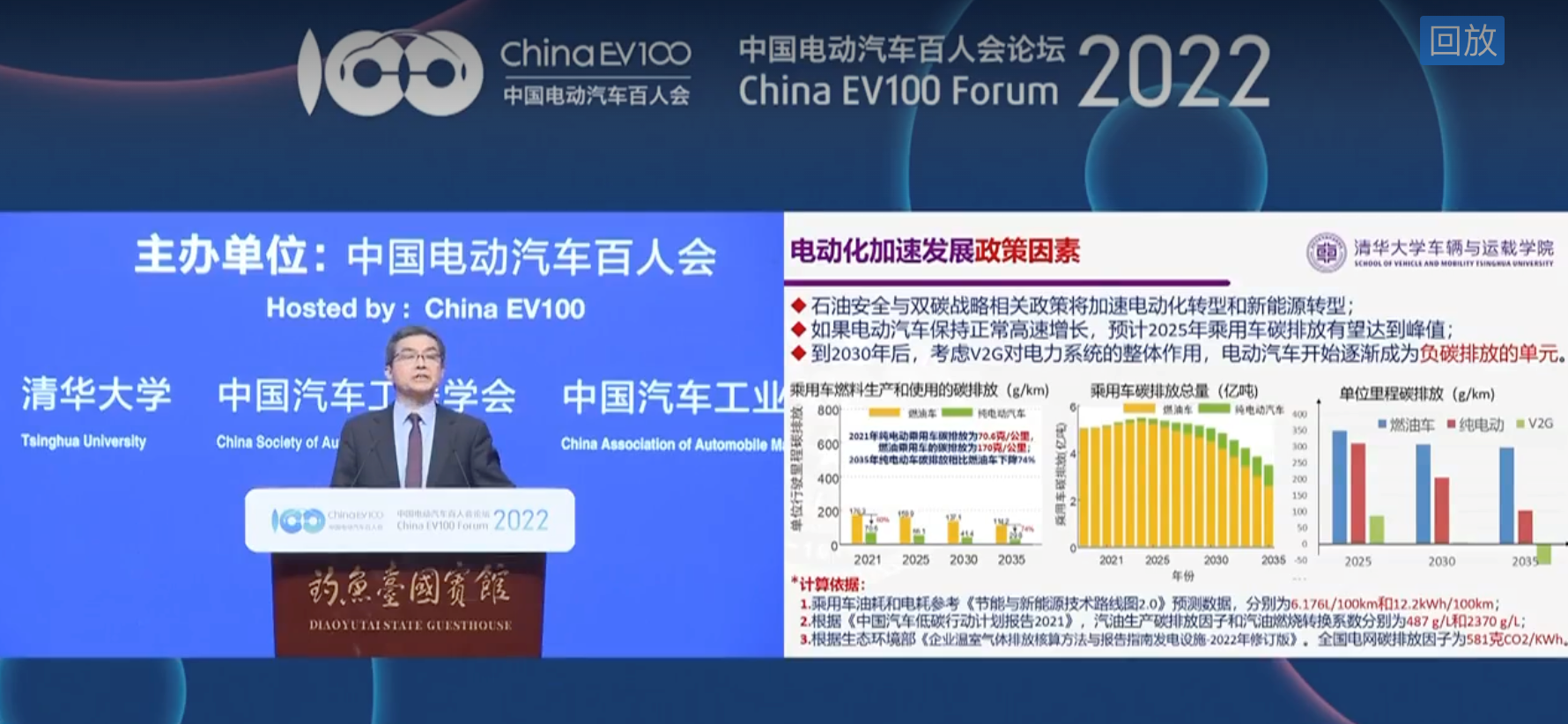

Also, with regards to the development of the entire electric vehicle industry, Ouyang Minggao, Vice Chairman of the Hundred People’s Association, stated that 2022 would be the peak of gasoline cars, and the industry would continue to decline thereafter. The overall trend from 2021-2030 for new energy vehicles is rapid growth, but cyclic fluctuations cannot be ruled out.

As a result, although some companies have surfaced in the electric vehicle market, the future is still uncertain. It is best to get in on the action now, as there is still enormous potential and opportunities.# Major Focus of NEV Supply Chain in China

One of the hottest topics this year is the NEV supply chain, with a particular focus on upstream materials such as chips and battery components in the Hundred-People Forum.

Ouyang Minggao predicts that the supply and demand of lithium resources may return to normal in 2-3 years.

Regarding chips, the shortage of supply has already become the norm, and many car companies have established relevant teams to ensure supply.

On the other hand, there is a wave of “Chinese chip self-replacement” surging.

Since last year, many domestic chip companies have launched vehicle MCU and autonomous driving chips. In this Hundred-People Forum, there are even more new announcements.

Heizhima’s 7nm process A2000 autonomous driving chip will be released this year, and it is said to outperform Nvidia Orin.

Hanguangji will also release two autonomous driving chips in the middle of this year. SD5223 is aimed at the L2+ market, with a maximum computing power of over 16 TOPS, covering entry-level models from 50,000 to 100,000 RMB. SD5226 is aimed at the L4 market, supports on-board training products, uses a 7nm process, and has AI computing power exceeding 400 TOPS.

As the player with the fastest progress in domestic vehicle-borne AI chips, Horizon goes one step further and proposes a new mode that supports the automaker to develop their own chips.

Combined with the open-source real-time operating system of Horizon’s Journey 5 chip, TogetherOS, it can meet the real-time performance and functional safety requirements of high-level autonomous driving, support rich upper-layer application software, and provide flexible and open development tools. It can develop solutions for vehicle applications such as autonomous driving, intelligent interaction, intelligent connected vehicles, and intelligent vehicle control.

Simply put, Horizon’s chips are not bound to software, highly open, and will also help automakers develop their own autonomous driving systems.

This is in stark contrast to the “imported” AI chip binding scheme adopted by car companies in the past.

These are the main highlights of this NEV Hundred-People Forum, covering topics such as cars, autonomous driving, batteries, chips, and policies.

Which topics are you most interested in?

- The End –

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.