Author: Xiaoying Andy

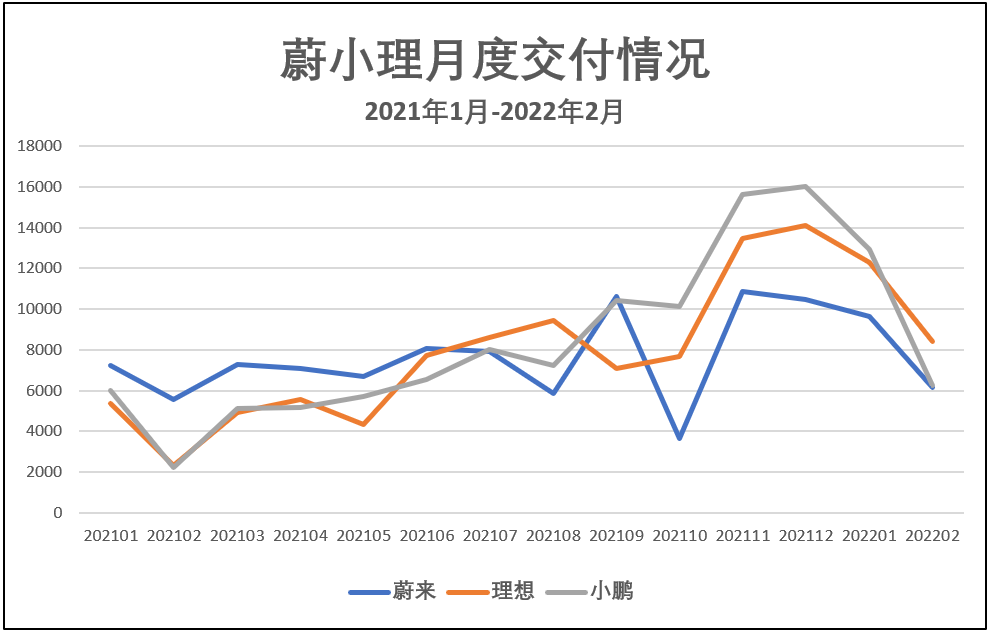

From October 2021 to February this year, NIO’s sales have been behind Xpeng and Li Auto.

Author: Xiaoying Andy

New forces in China’s auto industry used to look up to “NIO, Xpeng, and Li Auto”, but now “NIO, Xpeng, and Li Auto” are looking up to NIO.

That was before. In 2021, NIO lost its position as the best-selling new energy vehicle maker in China.

In 2022, for NIO CEO William Li, a major task may be to regain the top spot, including both sales and overall competitiveness.

On the morning of March 25th, Beijing time, NIO released its 2021 financial report and held a conference call.

At the conference call, Li set the tone for NIO’s development: “2021 is a year of accumulating energy, and 2022 will be a year of full acceleration“.

The Top New Energy Vehicle Maker

The auto market has always been a competition in sales.

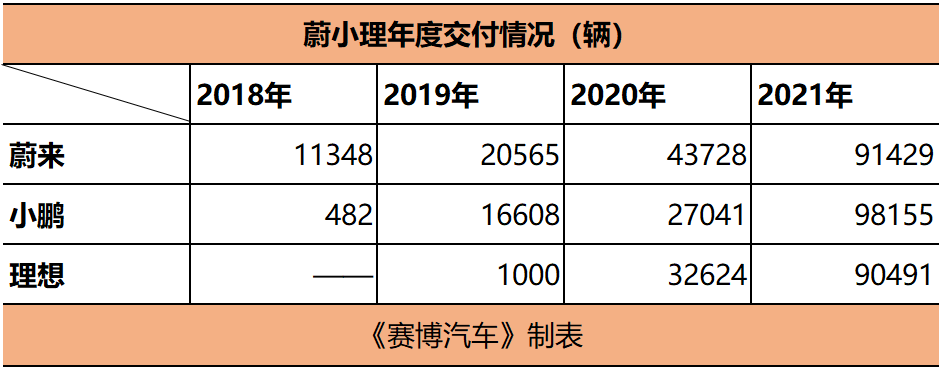

Compared to the three new energy vehicle makers, NIO, Xpeng, and Li Auto, NIO was once the leader. It was the first to deliver and the first to sell over 10,000 vehicles. Since the delivery in 2018, it has always “suppressed” Xpeng and Li.

In 2021, NIO lost this absolute advantage. All three automakers achieved an annual delivery volume of approximately 90,000 vehicles, and NIO’s sales advantage has been leveled down, and the first position has been taken by Xpeng.

If we look at the monthly sales data, from October 2021 to February this year, NIO’s sales have been behind Xpeng and Li Auto.

Perhaps Li also felt a bit embarrassed about the delivery results, and that’s why he said at the financial report meeting that 2021 was a year for NIO to accumulate energy.

So, what kind of energy did NIO accumulate in 2021?

In 2021, NIO’s annual delivery volume exceeded 91,429 vehicles, more than doubling compared to 2020. This sales performance cannot be considered poor. However, there is no harm in comparison. The other two competitors both achieved delivery volumes 2-3 times higher than the same period last year.

In 2021, new energy vehicles exploded in the market, but NIO did not enjoy much of the dividend with better sales performance mainly due to two reasons: NIO did not introduce new products in 2021, and the autonomous driving accident that happened in August 2021.

NIO needs to make up for these shortcomings in 2022.# NIO will launch three new products based on NT 2.0 in 2022: ET7, ET5 and ES7.

- ET7 will be delivered at the end of March,

- ET5 is planned to start delivery in September,

- ES7 is planned to be released in the second quarter.

NT2.0 is a new platform developed by NIO, which is heavily invested in and has the core advantage of supporting autonomous driving. ET7 is the first model to land on this platform. With the delivery of this product, NIO’s autonomous driving capability is expected to achieve qualitative improvement.

Li Bin mentioned in a conference call that ET7’s full-stack autonomous driving was developed by NIO’s own team. After delivery, ET7 will first enable assisted driving, and NAD services will be gradually launched in some regions subsequently.

In order to welcome the three new cars, NIO is also actively building production capacity.

Li Bin introduced that the production line upgrade of JAC-NIO advanced manufacturing base (the first factory) in Hefei is in stage progress, and the expected total production capacity of the whole assembly line will reach 60JPH (Jobs Per Hour, 60 beats per hour, about 250,000 units/year) mid-year. The second production base located in Hefei Xinqiao Intelligent Automobile Industry Park has a planned production capacity of 60JPH and is scheduled to be put into operation in the third quarter of this year. On March 16th, the first ET5 trial production car has been off the production line at the trial production center.

In parallel with capacity building, the sales network and charging and swapping service system are also advancing.

NIO is still actively investing in charging and swapping and sales service network, with 46 NIO Centers and 341 NIO Spaces covering 155 cities around the world. At the same time, there are 60 service centers and 179 authorized service centers in 146 cities in China.

In 2022, NIO plans to add no less than 100 sales service outlets and more than 50 NIO service centers throughout the year.

In terms of charging and swapping network, NIO has built 866 battery swap stations covering 190 cities in China, with users completing more than 7.6 million battery swaps. At the same time, NIO has deployed more than 711 supercharging stations and 3,786 destination chargers across the country.

In 2022, NIO plans to build 30 new destination charging routes, and a cumulative total of more than 1,300 battery swap stations, 6,000 supercharging piles and 10,000 destination charging piles will be built in the Chinese market.

Multiple Challenges Affecting Sales

Although it seems that NIO has made sufficient preparations, competitors seem to be speeding up.# The Product Strategies of NIO and Its Competitors

NIO’s product strategy is clear, which is to directly compare with BBA and seize the market share of BBA. Specifically, the NIO ET7 competes against BMW 5 Series and Audi A6, while the ES7 competes against BMW X5.

Li Bin believes that the demand for these two sub-markets is growing fast. Taking the large five-seat SUV market where the ES7 is located as an example, the market space exceeds 200,000 vehicles. NIO hopes to replace luxury cars to some extent with its excellent electric car products.

However, BBA is also evolving. Take BMW, for example, which has a very clear and stable electrification strategy. According to the information publicly released by BMW, BMW’s electrification is divided into three stages, and it has now entered the second stage, producing products with different driving technologies on an intelligent platform, including fuel, plug-in hybrid, and electric versions.

This will to some extent block the attack of NIO and other new carmakers.

In addition, XPeng and Li Auto have also laid out their product lines in the 400,000 yuan SUV market, releasing the XPeng G9 and Li Auto L9, directly impacting the market share of NIO ES8 and ES7. NIO is competing downwards with XPeng P5 by launching the ET5.

As the product lines of NIO, XPeng, and Li Auto become clearer, it can be seen that the competition among the new car makers is becoming more and more intense.

The three companies each have their own advantages. NIO has its service system, XPeng has its intelligence, and Li Auto has its high cost-effectiveness. It will be difficult for NIO to break through and return to the top position.

Furthermore, NIO’s own product line also has a certain cannibalization problem. Although the ET7 and ET5 are two models launched nearly a year apart, from the appearance and interior design perspective, the latter looks more like a miniature version of the former. What the ET7 has, the ET5 also has.

As a result, NIO owners who have already placed an order for or are considering the ET7 turned around and placed an order for the ET5 instead upon its release.

Perhaps Li Bin is also aware of this problem. In order to have some room for delivery in the future, Li Bin stated that the ET7 is produced in the first factory, facing complex production line upgrades and improvements, and is expected to ramp up slowly, hoping to reach normal production capacity in the third quarter.

Another factor affecting NIO’s sales is the supply chain problem.From the second half of 2021, the prices of battery materials have been on the rise, forcing most car makers to increase their car prices. NIO has not yet increased its car prices due to the separation of the electric vehicle and battery. This may be considered an advantage for NIO in the short term.

However, there are still bottlenecks in the battery production capacity and chip shortage. Many car makers face challenges such as receiving orders but being unable to fulfil them.

According to Li Bin, NIO has had in-depth communication with CATL in 2021, and from the perspective of power batteries, risks are relatively small and demand can be met. However, there are still significant challenges with chips. More than 1000 chips, which account for about 10% of the total, are needed in a NIO vehicle, and they face unstable supply.

Overall, the production capacity of both vehicles and batteries will be relatively controllable in the second half of 2022 and beyond, but the fluctuation of chip supply may still have some impact on sales.

Currently, NIO’s entire product line has not yet increased in price, but Li Bin says that the annual product improvement plan is expected to be implemented this year, mainly around upgrading intelligent hardware for ES8, ES6, and EC6. This, combined with the appropriate price strategy, will depend on market conditions.

In 2021, NIO’s total revenue for the year was RMB 36.14 billion, an increase of 122.3% compared to the previous year. Gross profit was RMB 6.82 billion, an increase of 264.1% compared to the previous year with a gross margin of 18.9%, up from the previous year’s 11.5%.

Automobile sales for the year were RMB 33.2 billion, an increase of 118.5% year-on-year, with an auto gross margin of 20.1%, up from 12.7% the previous year.

Net loss for the year was RMB 4.02 billion, a decrease of 24.3% compared to the previous year.

As of the end of 2021, NIO had a cash reserve of RMB 55.4 billion.

Judging from various indicators, NIO’s financial situation is still relatively healthy. Losses mainly come from research and development investment and charging and sales network deployment.

In 2021, NIO’s R&D expenditure was RMB 4.6 billion, an increase of 84.6% compared to the previous year.

Li Bin said that 2021 was a significant year for NIO’s R&D investment. This year, research and development investment will continue to increase and is expected to double, simultaneously expanding R&D to 9,000 personnel, which will mainly invest in global market vehicle adaptation, next-generation model development, and forward-looking technologies such as autonomous driving. He believes that continuous investment in autonomous driving is essential to improving the company’s competitiveness and enhancing profitability.

Meanwhile, Li Bin said that NIO’s charging and battery swapping station layout is forward-looking. In theory, one battery-swapping station can serve 1000 vehicle owners, but the usage rate of the current battery-swapping station is far from saturated.

This means that NIO has invested heavily in the early stage, and the investment pressure will be reduced to some extent in the later stage.Therefore, NIO hopes that with its rich product lines, self-driving technology, and battery swapping services, it can achieve overall profitability throughout the year 2024.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.