Wanbo 发自 Co-pilot Temple

Intelligent Car Refers | WeChat Account AI4Auto

BAIC BluePark, has released its report card for the year 2021.

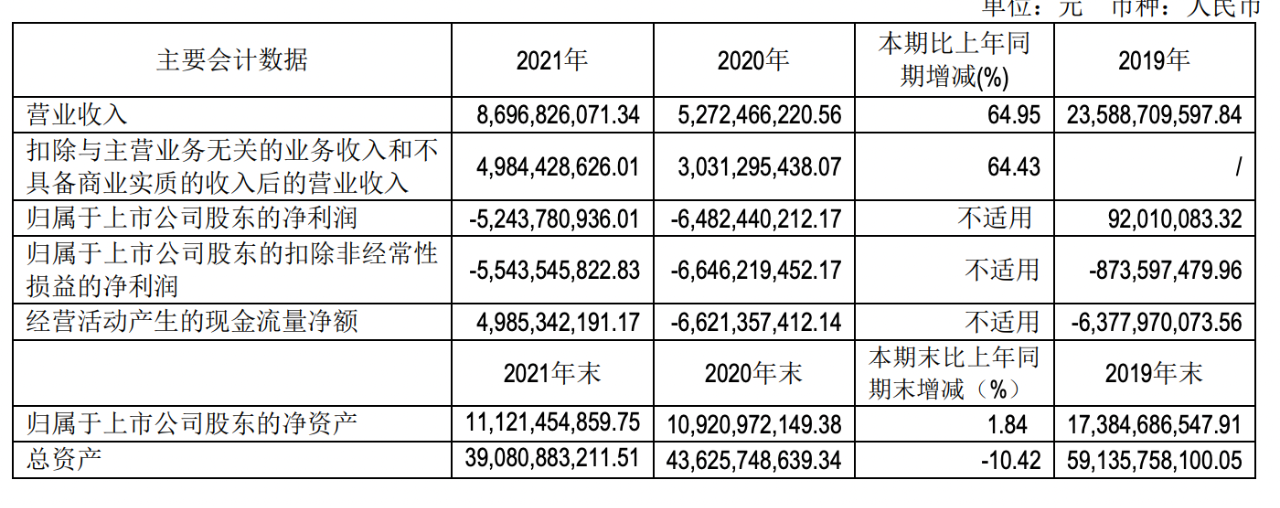

The revenue was 8.7 billion RMB, an increase of 64% from the previous year, while the net loss was reduced by 19% to 5.24 billion RMB.

Judging by these results, it seems that after partnering with Baidu and Huawei last year, the former leader in the new energy vehicle market found a way to move forward.

But can it really rely on these two straws to turn the tide after falling from grace?

How Did BAIC BluePark Perform in 2021?

Growth was the main theme of BAIC BluePark’s latest financial report.

The financial report shows that the revenue of BAIC BluePark was 8.697 billion RMB in 2021, an increase of 64.95% from the previous year. By business segment, the revenue from new energy vehicle sales was 5.12 billion RMB, an increase of 69% from the previous year.

The gross profit margin was -32.16%, an increase of 23.5 percentage points from last year, while the gross profit margin of complete vehicles was -32.73%, an increase of 27.34 percentage points from the previous year.

In terms of expenses, the sales expenses were 1.67 billion RMB, an increase of 65.83% from the previous year, which increased almost in sync with revenue. The R&D investment was 1.21 billion RMB, an increase of 24.14% from the previous year, taking up 21% of the revenue, which was slightly lower than the average level of R&D investment in the industry.

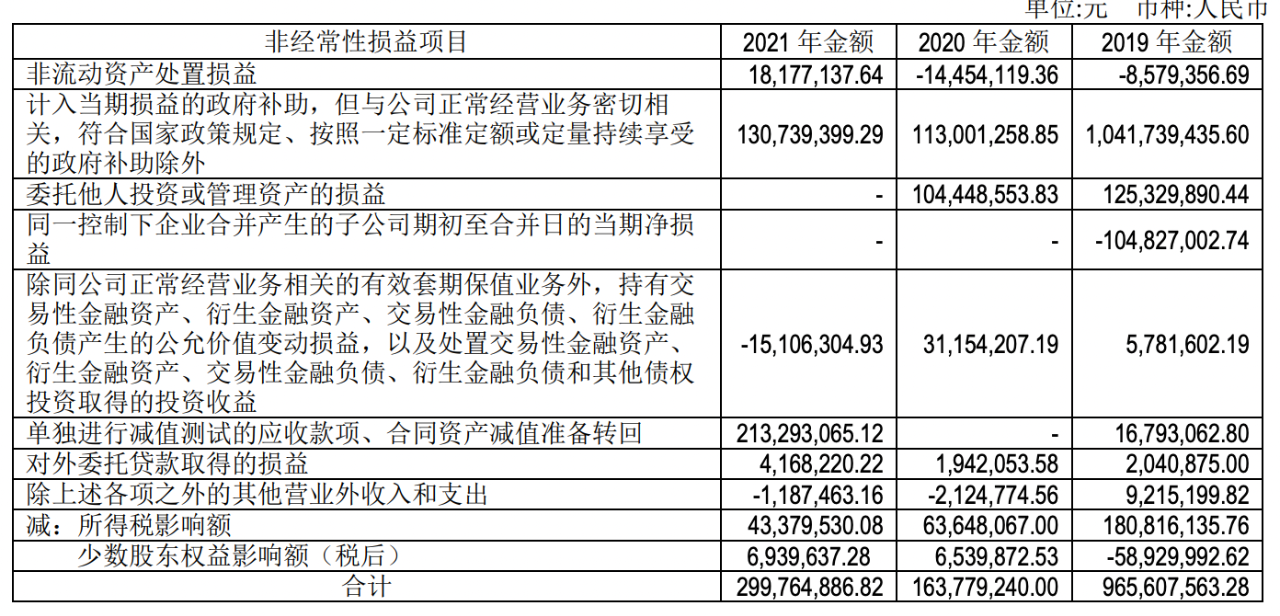

In terms of profit, the net loss attributable to shareholders of the parent company was 5.244 billion RMB, a decrease of 19% from the previous year.

Overall, BAIC BluePark has shown signs of recovery and has turned its declining trend around from 2020.

However, from another perspective, the composition of BAIC BluePark’s revenue is not optimistic.

According to the financial report, after deducting revenue from business unrelated to its main business and revenue that lacks commercial substance, the operating revenue of BAIC BluePark was 4.98 billion RMB.

In other words, nearly 40% of the revenue of BAIC BluePark has little to do with car sales. This part of the revenue is mainly from the government’s new energy policy subsidies, tax subsidies, and other non-operating revenue.

Baidu and Huawei Can’t Save BAIC BluePark

BAIC BluePark used to be the king of China’s new energy vehicle market, even BYD could only look up to it. However, in 2020, due to the pandemic and the exposure of the fact that BAIC BluePark relied heavily on the B-side market and new energy vehicle subsidies, it fell from grace.

At the same time, there was a concentrated outbreak of product quality problems at BAIC BluePark.These issues were also noticed by BAIC Group. As early as 2016, BAIC Blue Valley relied on its subsidiary Black Fox to enter the high-end intelligent pure electric vehicle market.

In order to ensure product quality, BAIC cooperated with Magna to produce the Black Fox. After four years of development, the Black Fox was finally launched. However, the intelligent vehicle market had already changed since then. Emerging auto makers such as Tesla, LiXiang, and XPeng had already made their mark, while traditional car manufacturers had put their own products on the market.

The Black Fox’s release did not create much of a stir. But BAIC Blue Valley did not give up. Before the 2021 Shanghai Auto Show, the Black Fox brand’s Alpha S, an intelligent pure electric vehicle, equipped with Huawei Hi full-stack intelligent automotive solutions, went viral on the Internet.

In June, the Apollo autonomous vehicle from Baidu and Black Fox teamed up to create a RoboTaxi for an affordable cost of 480,000 RMB, which caused a stir online. In July, a video of Black Fox’s car colliding with BYD’s Han on Dongche Di went viral on the internet, which led to increased visibility for Black Fox.

Combining passenger vehicles and RoboTaxis, Black Fox has become a force to be reckoned with. But despite the buzz, the company’s financial reports showed only 520 million RMB in direct sales revenue in 2020, accounting for just 6% of the total revenue. This means that Black Fox still struggles with sales volume, and according to sales volume data, in 2021, the cumulative number of Black Fox vehicles with insurance was only 4,827, which is less than 500 per month on average.

In contrast, other traditional car manufacturers have successfully launched their own high-end sub-brands. For example, LI announced the delivery of nearly 6,000 cars three months after officially launching in October 2020, and by February 2021, this number had exceeded 12,000.

Partnering with Huawei for intelligent technology and collaborating with Baidu for RoboTaxi has certainly earned BAIC Blue Valley the spotlight. However, at the end of the day, market recognition and user approval will still be the deciding factors, as buzz is fleeting.If the sales cannot have a qualitative improvement, according to the iteration speed of the intelligent car track, there is not much time left for BAIC New Energy.

Financial report express train:

http://static.sse.com.cn/disclosure/listedinfo/announcement/c/new/2022-03-26/6007332022032625_eDjxOVjz.pdf

— Done —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.