Bike profit margin 20.1\%, net loss RMB 40.169 billion

During the earnings call on March 25, 2022, although NIO remained in a loss position in 2021, NIO founder and CEO William Li revealed NIO’s next big moves:

-

The ET7, based on NIO’s NT2.0 platform, is in the ramp-up phase and will start deliveries on March 28th;

-

Construction and equipment installation of the second production base in the Hefei Xinqiao Intelligent Automotive Industry Park has been completed. The second production base is scheduled to start production in the third quarter of this year, with the first model being the ET5;

-

The ES7, a mid-to-large-size high-end 5-seat SUV, will be launched in the second quarter of this year and deliveries will begin in the third quarter;

-

The new brand for the mass market is progressing smoothly, with the core team built and the first batch of products entering the key R&D phase.

-

The product and service system construction in Germany, the Netherlands, Sweden, and Denmark is progressing well;

-

The ES8 has won the favor of Norwegian users, with monthly deliveries ranking in the top two in Norway’s 6- and 7-seat passenger car market since the beginning of this year.

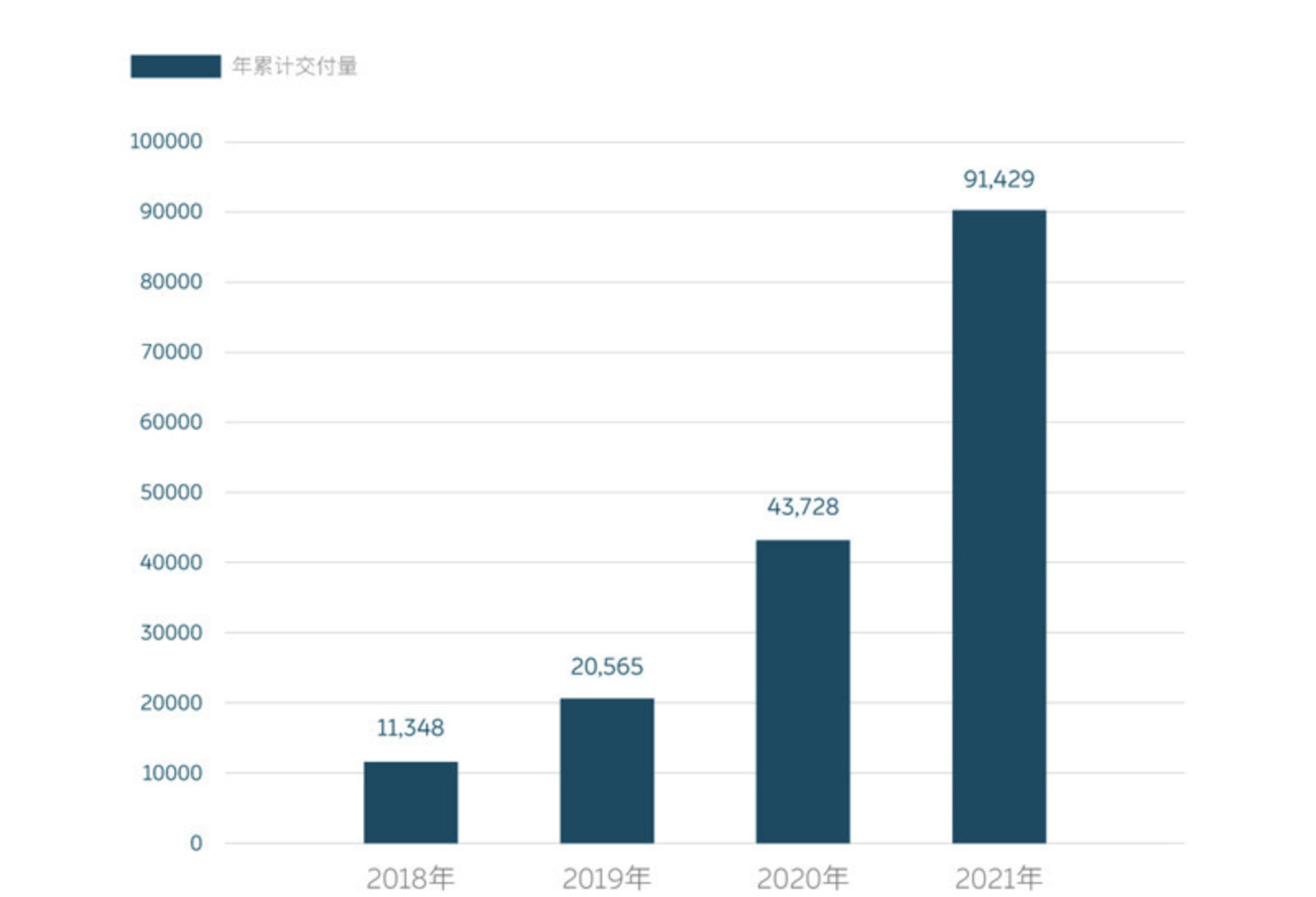

In January and December 2021, the ET7 and ET5 were the highlights of NIO Day. In 2021, with the rise of raw materials prices, chip shortages, and the surge in the penetration rate of new energy vehicles, NIO achieved a bike profit margin of 20.1\%, full-year vehicle deliveries, full-year gross profit of RMB 6.822 billion, and full-year R&D expenses of RMB 4.5919 billion, relying on the “866 Three Musketeers” of ES8, ES6, and EC6. NIO has set a target of delivering 25,000-26,000 new vehicles in Q1 2022, which is about to end.

2022 is a big year for NIO’s new NT2.0 platform products: ET7, ET5, and ES7.

Holding RMB 55.4 billion cash flow, expected to achieve profitability in 2024

From NIO’s 2021 Q4 earnings report and full-year financial data, NIO has achieved a healthy and positive closed loop of “production-sales-R&D-development” in terms of delivery data, production capacity, and service system construction:

-

91,429 new vehicles were delivered throughout the year, nearly twice that of 2020;

-

15,783 new vehicles were delivered in the first two months of 2022;- The upgrading of production lines in the JAC NIO Advanced Manufacturing Base is being phased in, and it is expected that the production capacity of the entire production line will be increased to 60 JPH (Jobs Per Hour) by mid-year.

-

In 2022, NIO will deploy an additional 30 power plans to destination charging routes. More than 1,300 battery swap stations, 6,000 supercharging piles, and 10,000 destination charging piles will be accumulated in the Chinese market.

-

NIO plans to add no less than 100 sales outlets in the whole year, and more than 50 NIO service centers and authorized service centers will be added as well.

Perhaps having already planned for the sharp increase in demand for new energy vehicles in 2021, if NIO’s new factory in 2022 is run at full capacity, it can achieve the expected target of producing 20,000 new cars per month. With the determination to increase efficiency and reduce costs revealed in the NIO conference call, it remains uncertain if NIO will be able to respond to market demand and achieve an annual output of 300,000 vehicles. The arrangement of ET5 and ET7 being produced on the same line may also significantly shorten the waiting time for ET5 owners while maintaining the pace of delivering ET7.

NIO’s second production base will also debut simultaneously with the ES7 in the third quarter of 2022. The planned production capacity of the second production base is 60 JPH, and the first mass-produced model is ET5. This is also an important factory for NIO, being the first to have an annual production capacity of one million vehicles.

Tesla announced in its 2021 Q4 financial report that its Model 3 and Model Y achieved a gross profit margin of over 20\% – the “life and death line” widely believed to determine whether car makers can survive and develop through a closed-loop production and sales system. NIO’s gross profit margin per vehicle maintained at 20\% or above for two consecutive quarters in 2021, indicating that NIO has the “blood-making function” to maintain healthy production, research and development, and operations through product revenues, even without the background of delivering new models in the market.

-

NIO’s automotive sales revenue in Q4 2021 was RMB 9.2154 billion, a year-on-year increase of 49.3\%.

-

The total revenue in Q4 2021 was RMB 9.9007 billion, a year-on-year increase of 49.1\%. The gross profit was RMB 1.6995 billion, a year-on-year increase of RMB 0.5576 billion and a quarter-on-quarter increase of RMB 0.1777 billion.- NIO’s annual car sales revenue in 2021 was RMB 33.139 billion, a year-on-year increase of 118.5%, with a car sales gross margin of 20.1%, up from 12.7% in 2020.

-

NIO’s total revenue in 2021 was RMB 33.1697 billion, a year-on-year increase of 122.3%; gross profit was RMB 6.8214 billion, an increase of RMB 19.8785 billion from 2020.

-

NIO’s full-year gross margin was 18.9%, up from 11.5% in the previous year.

NIO believes that two factors have played a key role in improving car gross margins:

-

The use of the 75 kWh ternary lithium battery pack since Q4 2021 has improved vehicle costs and supply efficiency.

-

The growth in total vehicle sales has brought economies of scale and spread costs.

The speculative rise in raw material prices, and the continuing tightness of the automotive chip supply

In 2021, the penetration rate of China’s new energy vehicle market increased from 5.9% to 18.6%, and the surging demand within a year let upstream suppliers see a window of profit. Li Bin said during a conference call that NIO’s holdings of onboard chips and battery pack inventories are sufficient to support production delivery in 2022.

Li Bin believes that NIO’s current product line will not consider price adjustments in the near future, and even the hardworking “866” triad will be able to enjoy the upgrade of intelligent cockpit hardware in 2022. However, prices for the 2022 ES8, ES6, and EC6 models, equipped with the updated 8155 vehicle processor chip and 5G communication module, will be adjusted.

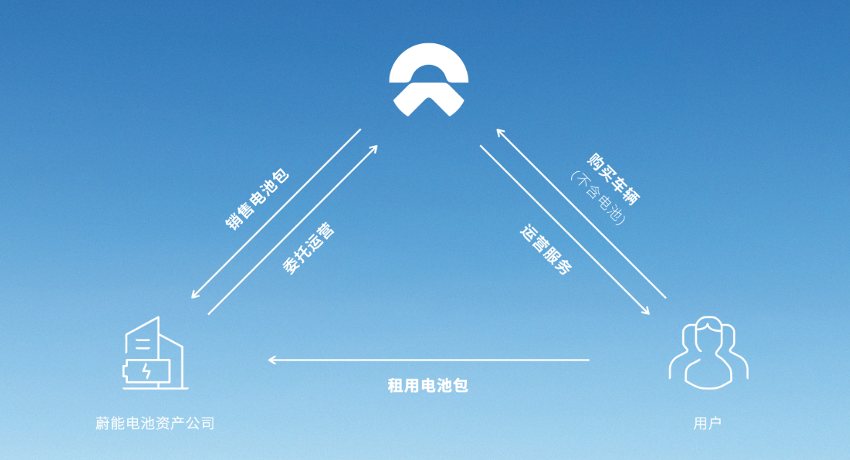

NIO’s commitment to battery-swapping means that it needs to maintain a large reserve of battery packs for an extended period of time, to maintain NIO’s battery-swapping product service and replenish the shortfall of battery packs that have been taken out of the system due to shortened lifespan. Against the backdrop of high battery costs this year, NIO’s established battery-swapping business and the BaaS battery leasing business together act as a sponge to absorb and digest the cost increase of battery raw materials.

For customers, even if NIO raises the price of battery use out of necessity, the additional price, due to the characteristic of paying for battery use in installments, will not be immediately deducted from their wallets. The fact that NIO has characterized the price hike in 2022 as “speculative” gives users time to buffer the increase every month when they pay their rent in anticipation for the price to fall back.

New brands moving downmarket, new markets expanding outward

Li Bin said that NIO’s new brand aimed at the broader market has completed team building and the R&D of the first batch of products has entered a critical stage.NIO’s Q2 financial report has released news about its overseas layout and market expansion, which can enhance investor confidence. With Li Bin’s positioning of NIO’s brand towards the public market and a price plan of $5,000 to $15,000, a new brand will certainly have a price range that overlaps with current products such as Tesla’s Model 3, Model Y, and XPeng P7. NIO will make the new brand an entry ticket for its service system, achieve healthy brand revenue through more profit-making processes in the service system, and differentiate it from the NIO brand.

Exploring new overseas markets and launching new brands is the driving force behind NIO’s core battery technology and standard NAD assisted driving hardware. At the same time, the expansion of new factories, production line reforms, and ET7 production climbing will bring NIO scale effects and bring cost savings and shortened delivery cycles. Higher vehicle delivery will bring more users, and NIO’s proud service system will become a moat to ensure revenue and even bring in cash flow.

For listed companies, investors often value long-term business performance rather than profit and loss. No investor can refuse a company with a single-car profit margin comparable to Tesla, higher-priced mainstream models than Model 3 and Model Y, worldwide market layout, and additional revenue from service systems.

China’s top three EV companies- NIO, XPeng, and Li Auto- have all surpassed the survival threshold, and their vision has also expanded to overseas markets. The volatility of the supply chain in 2022 is enough to make many companies that have not passed the “self-generation” threshold and have not yet “survived.” feel pressured- the new energy market may be difficult to accommodate challengers starting from scratch.

Q&A Session

-

Q1: How is NIO coping with the pressure of rising commodity prices and supply chain?

-

A1: The newly launched 75-degree ternary lithium battery pack’s cost is slightly lower, which is very helpful for vehicle gross profit. Currently, NIO does not plan to share the pressure of raw material price increases by raising prices. Instead, we will try to offset the increased cost through efficiency optimization as much as possible. NIO hopes to achieve a single-car gross profit margin target of 18% to 20% in 2022.

-

Q2: What is the relationship between NIO’s product line and traditional luxury fuel vehicles?

-

A2: NIO believes that the sub-market demand for mid-to-large-sized SUVs above RMB 400,000 is growing rapidly in China. Regarding the competition with fuel competitors, NIO has great confidence in the performance of its products in this sub-market. Currently, NIO estimates that the market capacity is about 200,000 vehicles and will continue to grow in the future, and NIO’s product competitiveness still has advantages.

-

Q3: How is NIO coping with the shortage of vehicle chips, especially for driving assistance chips?

-

A3: The chip’s price issue is mainly due to unstable supply. NIO’s use of high-end chips reduces the pressure. We have long-term strategic partnerships with vendors such as Qualcomm and Nvidia. In the future, for the Qualcomm 8155 chip for the intelligent cockpit, we will also provide upgrade services for existing car owners.

-

Q4: What is NIO’s production capacity plan for new cars?- A4: Currently, ET7 is still in the phase of increasing production capacity, and the co-linear production plan of ET5 and ET7 will also facilitate the delivery of ET5 in the future.

-

Q5: How does NIO view the rise in battery raw materials?

-

A5: We believe that the current rise in upstream raw materials is speculative, and the gap between actual supply and demand is not that big. Currently, relevant authorities such as the Ministry of Industry and Information Technology are actively participating in market regulation. We call on everyone to consider the long-term interests of the industry and try to avoid speculative price hikes.

-

Q6: What is NIO’s research and development plan?

-

A6: NIO will double its investment in research and development and is expected to have a research and development team of 9,000 people by the end of the year, and achieve overall profitability by 2024.

-

Q7: How is the usage of NIO’s charging and battery swapping stations?

-

A7: There are about 30,000 battery swapping orders per day, and some battery swapping stations can handle over 100 orders per day, while others only handle 10-20 orders. A battery swapping station can serve approximately 1,000 users.

-

Q8: What about the NAD and smart cockpit of NIO’s new cars?

-

A8: The auxiliary driving function will be available when ET7 is delivered this year, and the NAD subscription service will be launched in the fourth quarter of 2022. NIO is actively exploring the interconnection between vehicles and terminals, and there are many areas for innovation in AR and VR.

-

Q9: How will NIO achieve more sales in 2022?

-

A9: The product’s price coverage range is limited, and in the future, we will mainly cover the price range of $5,000 to $15,000, but we will not go too low and need to ensure a certain gross margin.

Finally, everyone is welcome to download the Garage App to learn about the latest news in new energy, and if you want more immediate communication, you can click here to join our community.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.