Author: Zhu Yulong

After entering 2020, the semiconductor industry has become the most important issue in the industrial and economic development strategies of countries around the world. Currently, various industries are concerned about being strangled by this industry chain, which is also the key to carrying core technologies in the future, because the current supply problem will have an impact on the future automotive industry.

Recently, I have been researching Japan’s semiconductor industry. The previous article “Renesas Electronics and Japan’s Automotive Semiconductor Industry” has mentioned that Japanese automakers and the industry will also strengthen their investment in semiconductors in the next step.

Last year, the Japanese Ministry of Economy, Trade and Industry launched the “Semiconductor and Digital Industry Strategy”, highlighting that solving semiconductor-related problems requires government intervention and cannot rely solely on private forces (investments by companies and capital).

Multiple meetings have been held now, including the 1st (March 24, 2021), 2nd (April 27, 2021), 3rd (May 19, 2021) and 4th meetings (November 15, 2021), among which the part related to the automotive industry can be carefully studied.

Trend of Automotive Semiconductors

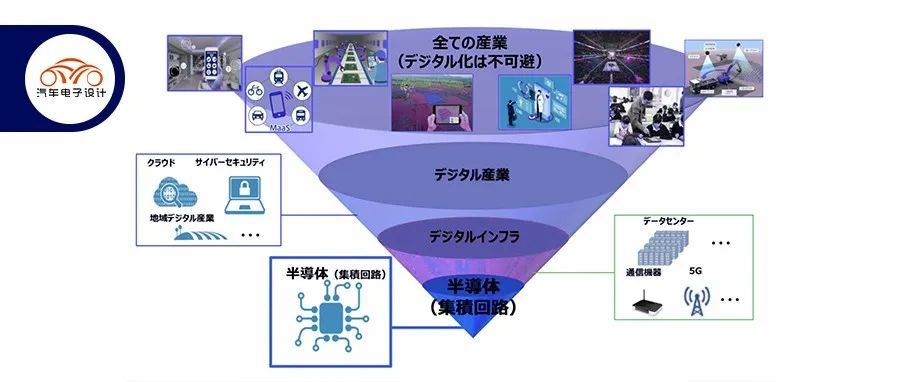

With the advancement of social digitalization, semiconductor chips have become the lifeline of the automotive industry, the Internet of Things, data centers, and metaverse, and are related to economic security.

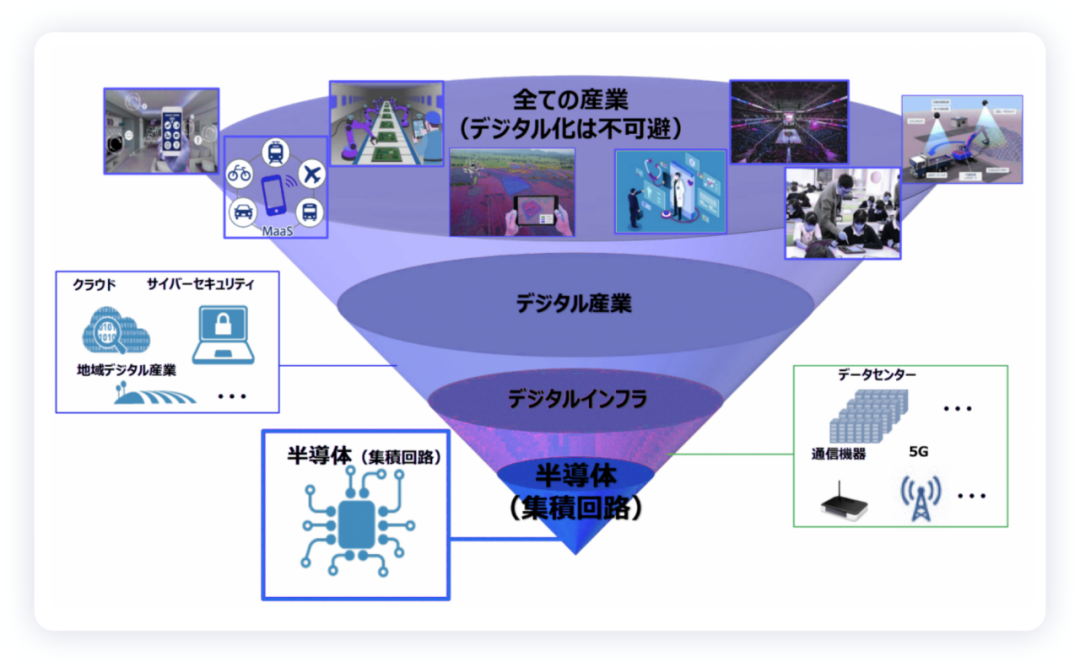

One of the main factors for the low economic growth during Japan’s “Lost 30 Years” was “failed digital transformation”. Semiconductor chips are expected to be the main market in Japan’s electric vehicle and autonomous driving fields. The Japanese Ministry of Economy, Trade and Industry believes that Japan’s chip industry will not compete with the United States, China, South Korea, and China Taiwan in the main battlefield of consumer electronics (computers and mobile phones), but need to target the fields of automobile, data center, and IoT edge to reverse its only 10% market share.

In the digital revolution, the market share of the United States, China Taiwan, and South Korea in the fields of logic/storage and other chip sectors continues to grow, and Japan has the last opportunity for growth in the fields of automotive and factory automation – reducing power loss of silicon carbide and traditional low-power consumption automotive semiconductor chips.

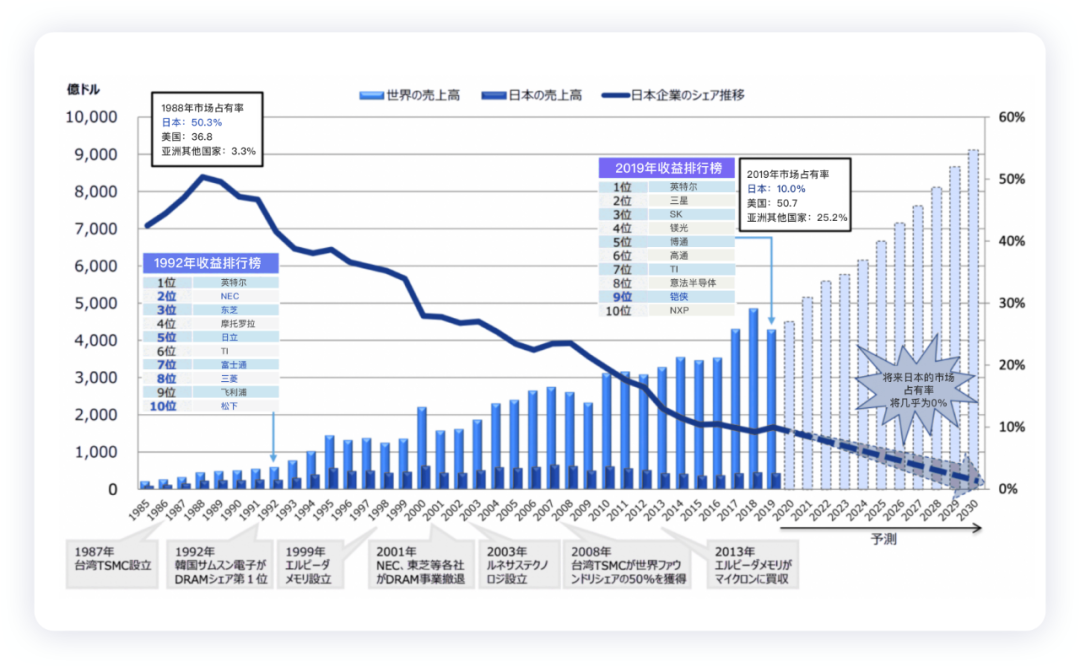

In the field of automotive semiconductors, the demand for the upper layer related to automated driving perception and information processing and the lower layer related to the power consumption of electric vehicles is increasing.- Upper layer: The sensors used for functional safety, AI systems, and high-performance/low-power processing chips that are required to process information are centered around computational power. The SoC system-level chip/sensor is primarily used for this purpose, as well as AI systems, processing power, and low-power chips.

- Lower layer: The reduction of energy loss for power semiconductors is crucial, and the focus is on low-computational power chips and power semiconductors (MCUs/power semiconductors) to achieve this.

The demand for semiconductor chips required for electric vehicles and autonomous driving, which will become widespread between 2022 and 2030, must be firmly grasped.

Looking at it from another perspective, if Japan does not grasp both of these fields, the competitiveness of automotive products in the current Japanese economy would be in trouble.

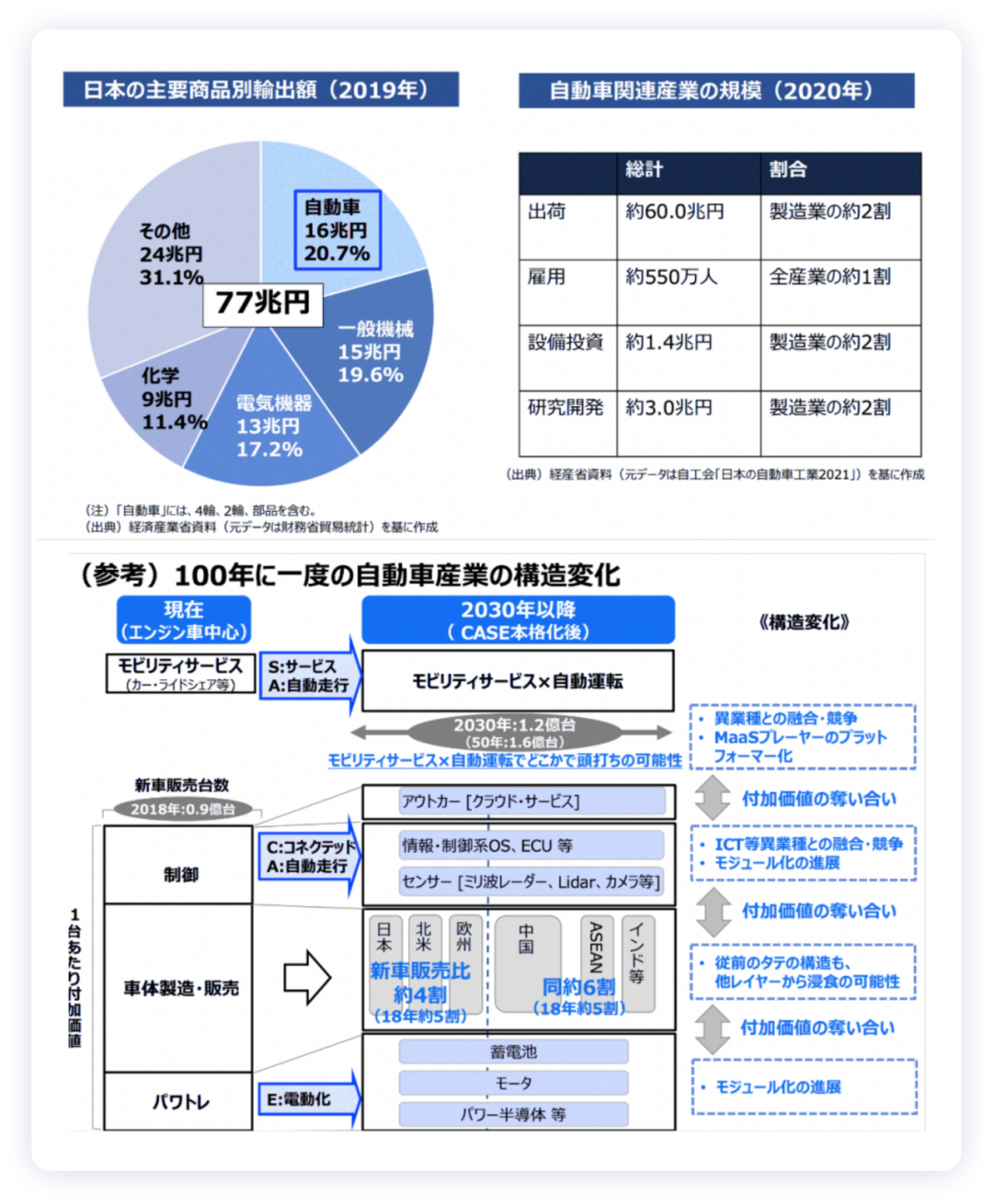

The domestic automobile industry in Japan has a shipment value of 60 trillion yen, accounting for 20% of the manufacturing industry. The automotive industry accounts for 20% of the total export value of 77 trillion yen, and the automotive industry employs 5.5 million people (10% of all industries). Equipment investment is 1.4 trillion yen, and R&D investment is 3 trillion yen. The automotive industry is undoubtedly the backbone of Japan, and the automotive industry is undergoing a once-in-a-century transformation, with the trends of the four new automotive technologies and carbon neutrality goals:

- Travel services x Autonomous driving

- Networking x Autonomous driving

- Electric vehicles and electrification trends

Demand for semiconductors will explosively increase, and it is essential to link it with digital infrastructure reform. The development of automotive semiconductors is indispensable.

Automotive electronics are mainly developed based on reliability. The technology currently used in the chip field has been used for more than ten years, and almost all of them are the previous generation stable technology of 40 nm or more (high reliability, high-temperature storage, high moisture resistance, and low defect rate, etc.). With the centralized design requirements brought by high computing power and the refinement/performance enhancement of image sensors required for autonomous driving, automotive semiconductor technology is beginning to shift toward the 20 nm level, and the 10 nm technology has already been applied in the high-end SoC areas of autonomous driving and networking domains.

In recent semiconductor shortages, due to the shift towards finer technology, automotive chip manufacturers are not actively increasing the supply of old technology. In 2020, when automotive demand cooled, more new product enterprises moved towards consumer electronics. Currently, semiconductor factory utilization rates have exceeded 90%.

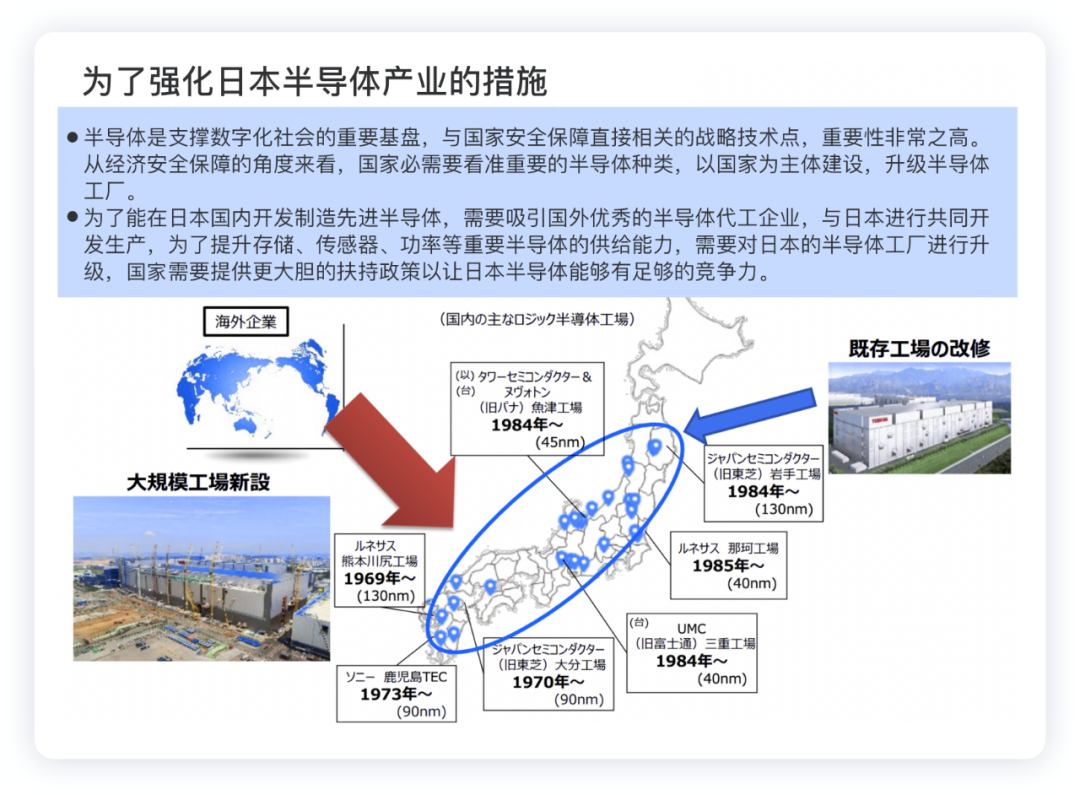

Japan’s Countermeasures## Translation

From the perspective of Japanese domestic semiconductor manufacturers, there are still some companies that can compete on a global scale in the areas of memory, sensors, and power outside of logic chips. However, they face the risk of falling behind in the face of increased investment from global enterprises and intensified competition, especially in the difficult situation of power semiconductors. The logic chip sector where Japan has no competitive advantage is considered the key to drive future digital products, but it only has production bases that use the 40nm or earlier generation technology. Considering future economic security and supply chains, the situation will be extremely dangerous if this key aspect is missing.

In terms of competition in the logic chip sector, the world has almost completely shifted towards horizontal division of labor, with TSMC having a market share of over 50% in the foundry business and having advanced manufacturing technology, which places it in an almost monopolistic position. The development of the most advanced technology is also co-creative with chip design, and through the strong collaborative relationship between major customers, such as Apple and TSMC, both parties have gained overwhelming positions. This co-creative relationship is important not only for advanced technology but also for the development of old technology and new technologies, such as highly reliable hybrid memories and next-generation stacked image sensor technology.

From the perspective of the automobile industry, it is crucial to have a production base that will become the mainstream 20nm generation technology in Japan and gradually establish technological and manufacturing advantages through co-creation with domestically designed products while also ensuring stable supply.

Three-Step Strategy

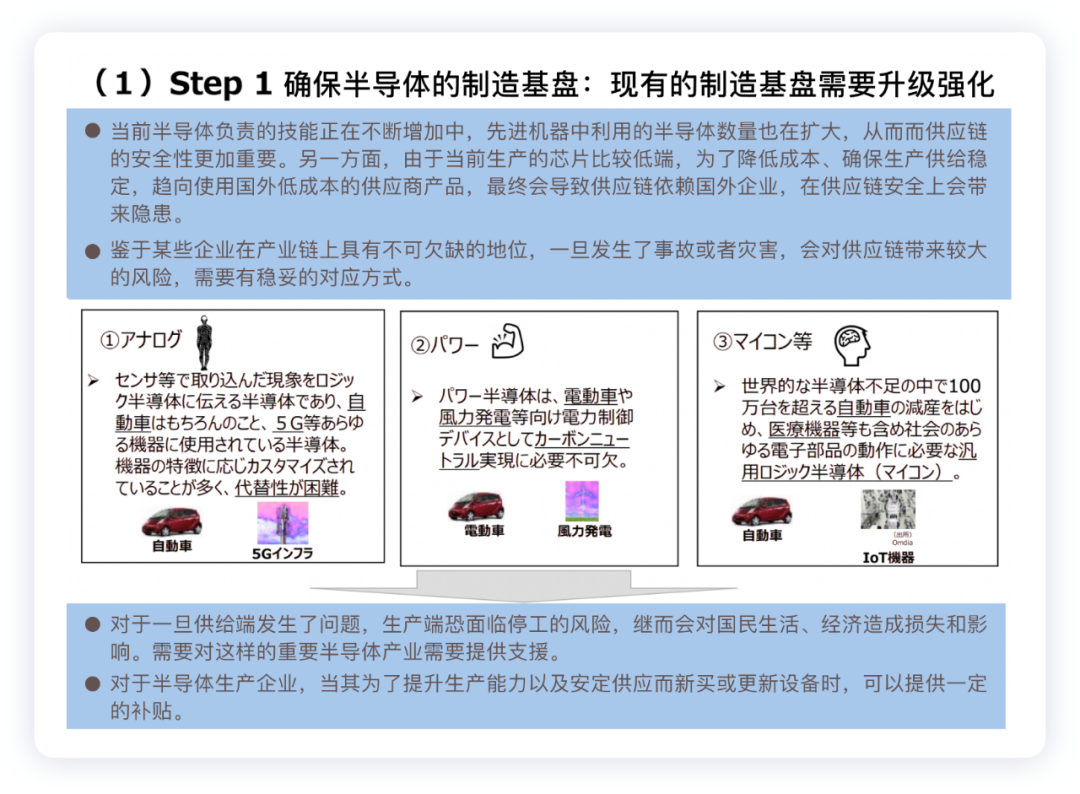

- Step 1

Urgently strengthening the infrastructure construction of IoT semiconductors: electric vehicles × autonomous driving.

From the perspective of economic security and supply chain security, Japan’s decision to allow TSMC, a Taiwanese semiconductor manufacturer, to build a 40nm semiconductor production line in Japan is questionable. This is a measure to ensure the manufacturing base.

The first is to ensure the stable supply of advanced semiconductors (logic and storage chips) from Japanese domestic companies and to ensure the ecological system (component/equipment manufacturers, regions) by securing production bases. The second is a measure to respond to supply chain risks by updating and upgrading existing manufacturing infrastructure such as analog devices, power devices, microcontrollers, etc. The automotive market is in the era of future automotive semiconductors such as high-end microcontrollers, integrated ECU products, image sensors, and the demand from Japanese domestic enterprises is significant. For the semiconductor industry, the 20nm generation domestic technology manufacturing base is indispensable.

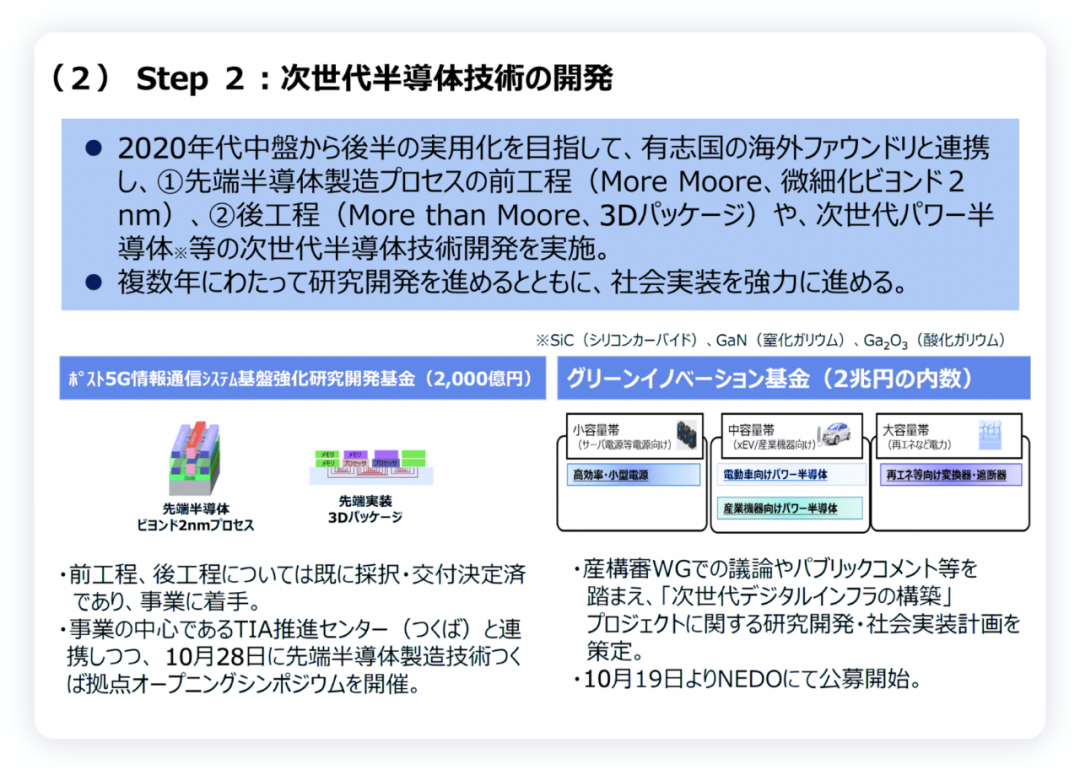

- Step 2

Japan-US cooperation to develop the next-generation semiconductor technology foundation.

Step 1 is with a strong sense of emergency, and step 2 is to begin a counterattack, including the development of advanced semiconductor front-end process (2nm), back-end process (3D packaging), and next-generation power semiconductors (SiC, GaN, Ga2O3).

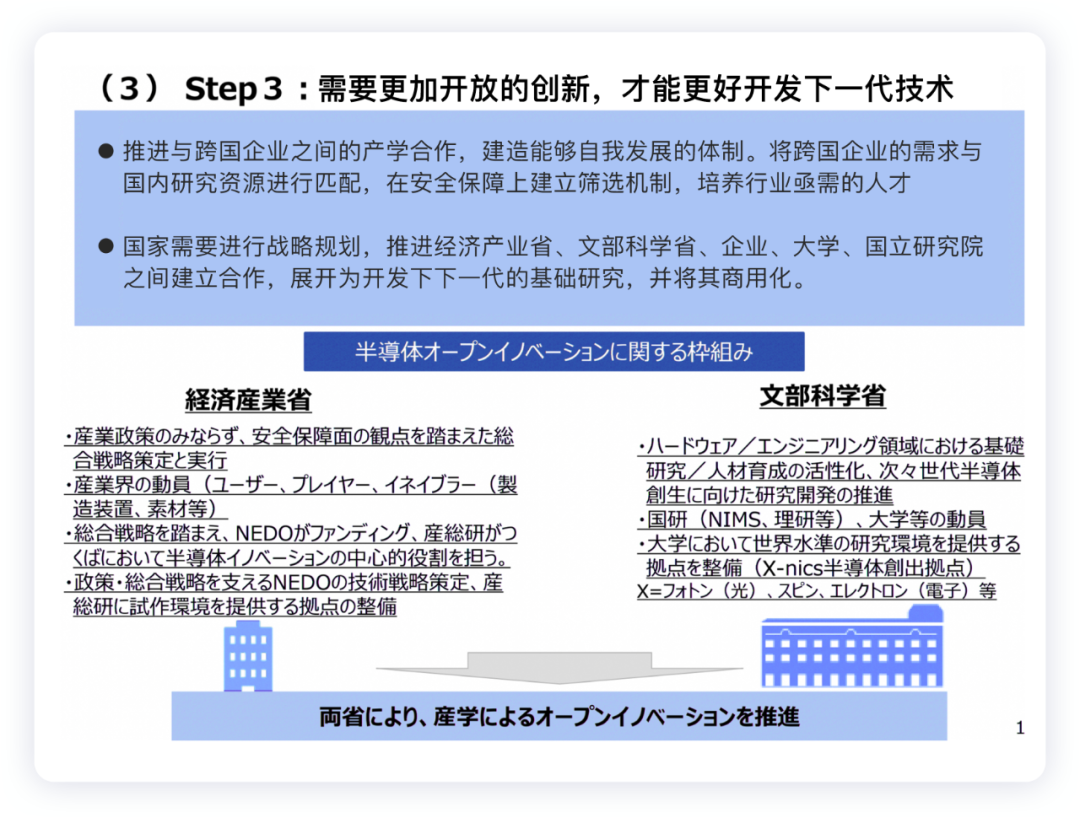

- Step 3

Global cooperation in research and development of next-generation technology-base-outstanding future technology by 2030.

The highlight is the photoelectric fusion technology. In the most advanced process, the loss of metal wiring is a fundamental limiting condition. Although refinement has limitations, the use of optical transmission technology is possible, and therefore research will be devoted to this issue.

Summary: There is a lot of discussion about Japan’s ability to produce power semiconductors. Currently, the third, fifth, and sixth largest global market share are all Japanese manufacturers, but the last two enterprises basically have no profits, which is a difficult situation faced by the component industry. The world-leading German company Infineon has acted quickly and established more and more 300mm wafer production lines to start operations and compete. The second-ranked American company On Semi and the fourth-ranked Swiss company STMicroelectronics have also started 300mm wafer production, leaving Japanese manufacturers far behind.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.