Author: Chang Yan

2022 is undoubtedly going to be a big year for the new energy industry.

When product designs, parameters, and technologies exist only as abstract concepts on paper, the differences between different car companies seem minimal. However, when everything is brought into the real world, and the one-dimensional contents of cars are stimulated by two major catalysts of sales and production capacity, the competition between brands becomes real and brutal.

This year, we have seen the products of leading manufacturers entering the next generation in terms of design innovation and functional invention. Innovative and controversial best-selling models are far ahead of the same-year models of following manufacturers, such as the NIO ET7, whose user discussion and enthusiasm have remained high since the early test drive.

When leading car manufacturers are investing in multiple models in a year, they are releasing and amplifying these differences exponentially.

After the NIO 2021 Q4 and full-year performance communication meeting held this morning, this sensation will be even stronger, especially given their technical and financial resources.

Delivering Three Models, Upgrading Three Models

Last year, we learned about the three NT2.0 models that NIO plans to launch this year.

What’s most impressive is that all three vehicles will be delivered this year, even though we haven’t seen one of them yet.

“What you see is what you get” is a long-awaited concept in the electric vehicle industry.

The most popular and least controversial model, ET5, is expected to break the record for the NIO family in terms of order and delivery numbers.

On March 16th, the first ET5 prototype was produced and is expected to be delivered beginning in September.

Compared with the ET5, the ET7 has entered the next stage, and yesterday, the first batch of mass-produced ET7 cars were officially produced. As we approach delivery, the industry is more concerned about the potential of the ET7’s increase in imagination.

During a phone conference, someone asked Li Bin a question: “Recently, media reported that there are 15,000 orders for ET7, and the monthly sales can reach 5,000. What are NIO’s expectations?”

Although Li Bin did not give specific numbers, his response was straightforward: “What I can say is that the number is definitely more than what media rumors suggest.”

Li Bin’s prediction for future sales volume also follows two reference values. Firstly, ET7 is on par with BMW 5 Series, Mercedes-Benz E-Class, and Audi A6, which all have monthly sales in China ranging from 12,000 to 15,000 units. This can be regarded as a long-term target. Secondly, NIO’s “866” three SUV models currently hold a 23% market share among all gasoline and electric SUVs priced above RMB 350,000 in Shanghai, and its overall sales volume ranks first. By taking these two numbers into account, we can have a final estimate of ET7’s long-term sales volume.

The “ES7”, which has only been heard but not seen, becomes the highlight of this year.

Originally relying on the Beijing Auto Show for publicity, ES7 was not affected by the postponement of the Beijing Auto Show. Li Bin stated that ES7 will also be delivered in the third quarter of this year, making it NIO’s product with the shortest time span from unveiling to delivery.

BMW X5L has become the best template to understand this car. From the disclosure of the existence of ES7 to this financial report conference, the name of ES7 has always been associated with the BMW X5L. The latter half of Li Bin’s statement, “ES7 is our most advanced “three-electric three-smart” technology, emphasizing high performance and luxury,” may reveal the answer through X5L’s image.

## Production Battle Behind the Model Battle

## Production Battle Behind the Model Battle

ES7 is positioned as a “large five-seat SUV based on the second-generation technology platform NT2”, “currently with a capacity of over 200,000 vehicles and still growing.” “I believe we still have great confidence to compete with X5.”

“We believe it can attract users who have higher requirements for the performance and quality of this type of product. We do not think it will have any impact on the sales of the current 866 SUV. I think it should be an increment.”

It is hard to imagine that three models representing NIO last year have become an existence beyond the hottest topic this year, but they will also usher in their own new key configurations. At today’s meeting, Li Bin stated that 866 will update the 8155 chip and 5G communication module and other optimizations during the year’s model update, “product strength will achieve significant upgrades,” which also laid the groundwork for our final topic.

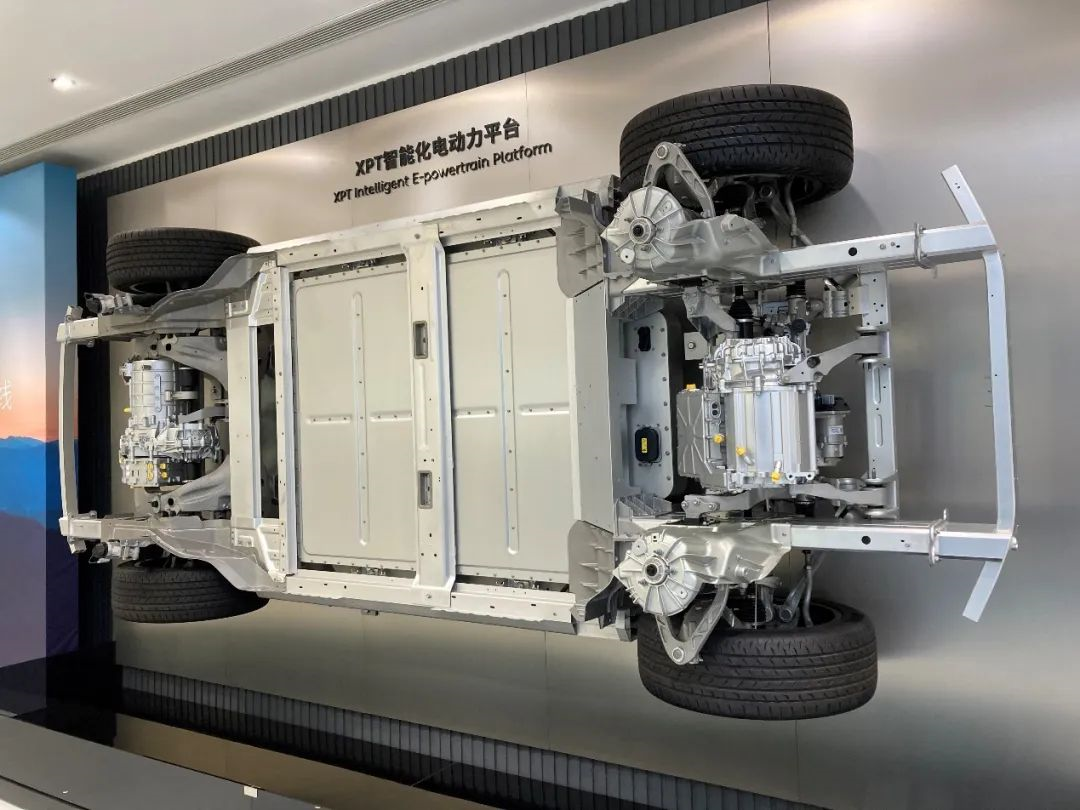

Behind the model battle is a production battle. NIO already has two factories.

The familiar JAC NIO Advanced Manufacturing Base is in the process of capacity upgrading. “The goal is to increase production rhythm to 60 JPH by mid-year.”

This production rhythm can be consistent with the second production base and meet the production capacity requirements of the models as much as possible.

The factory building construction and equipment installation of the second production base located in the Hefei New Bridge Intelligent Electric Vehicle Industrial Park have been basically completed. The planned capacity is 60 JPH, and it is currently in the debugging phase.

This capacity means that the annual production capacity of a single plant can reach 240,000 vehicles according to a working time of 4,000 hours. If the working hours are increased to 5,000 hours by overtime, the annual production capacity can reach 300,000 vehicles.

Although it looks good, both production bases are in their own critical challenge periods.

The first factory is about to undergo the most complex merge transformation.This factory needs to ensure the continuous production of 866 in the current order, and cooperate with the new technology and new suppliers introduced by ET7 to increase production capacity. At the same time, it also needs to debug the production line for ES7, which is about to be put into operation.

Considering that even the platforms for these cars are different, this poses a considerable challenge for overall scheduling, planning, and dispatch.

Although the second factory only needs to be responsible for the production of the ET5 model in the early stage, considering the subsequent sales of the ET5 model, the capacity hell and climbing challenge of many brands have become the new checkpoint BOSS.

I am looking forward to NIO sharing the construction layout and process innovation of the second production base with the public soon.

New Cars + New Factory: Should Prices Go Up?

Back in the days when new energy vehicles continuously reduced prices, the heat and traffic it generated made it difficult to imagine any topic surpassing it.

Until time quietly gave us the answer:

Only price increases can beat price cuts.

Although the heat of recent price increases by various brands will not be mentioned, after everyone raises prices, many are curious about NIO, which has been neither reducing nor raising prices.

Will you raise prices or not?

Li Bin did not give a definite answer, but the point of view he gave broke the judgment that many people believed that electric car price increases were inevitable.

“In response to the recent market’s focus on the surge in the price of lithium carbonate, which has caused the cost to rise, NIO believes after market research that the problem of speculative price increases in lithium carbonate is greater, and the gap between supply and demand is not too significant. The MIIT is currently coordinating price setting, and NIO also calls on upstream raw material manufacturers not to raise prices driven by personal speculation for their long-term benefit. It is not good for the industry.”

At the same time, NIO has not completely closed the door to price increases, and Li Bin has repeatedly stated that they will formulate reasonable listing prices based on the launch of new products. Traditional 866 is also among them. When the updated chip model appears, NIO will make another judgment on whether to adjust the price.

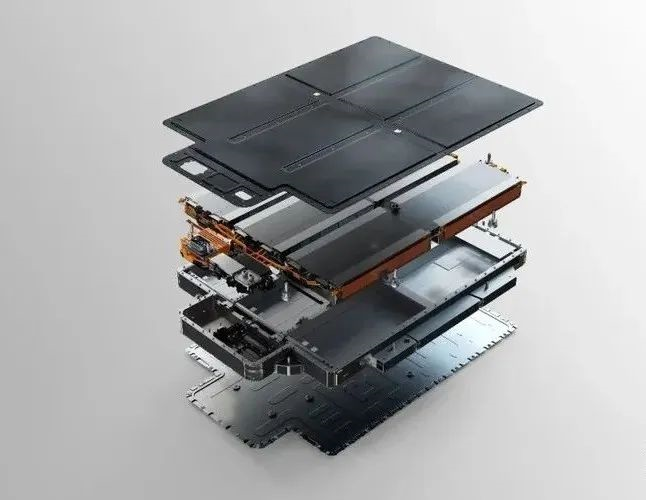

Li Bin stated that although various brands are currently facing considerable pressure in battery supply, NIO has “increased production lines based on our requirements with CATL since last year,” and the batteries should meet NIO’s needs this year.

“However, the uncertainty of the supply comes more from the chip side: ‘Chips are a very big challenge because we use over a thousand chips in each car, and 10% of them may have supply shortages.'”

“In the second half of this year, the production capacity of the whole vehicle and electric vehicles is okay, but the main issue lies in the supply chain volatility, especially the volatility of basic chips which has a relatively large impact on us, this is the current situation.”

The contribution of technical research and development to the balance of vehicle prices has also been made. NIO’s newly upgraded ternary lithium iron phosphate battery pack is more cost-effective than the previous 70kWh battery pack. In this situation, NIO believes that it can still maintain 18-20% gross margin for the whole vehicle this year.

This trend will affect the next few years, and NIO will continue to increase investment in key technologies, especially in the critical areas of full-stack autonomous driving technology and power battery.

A stable or even rising price does not mean that NIO will give up the low-end market. Li Bin’s thinking is that the priority for a brand should be to reasonably cover the market segment it can, and NIO’s brand currently reasonably covers the market segment of single-car market priced between $50,000-$100,000. There is still a great demand for products priced between $30,000-$50,000 with the same reasonable gross margin, and this requires another brand to occupy.

This is not simply a matter of operating a brand. It also requires “comprehensive and systematic efficiency thinking from the definition of products, basic architecture, and the use of materials.”

As for the long-rumored new brand, the final decision has been made during this financial report meeting. “Our business in the mass-market brand is progressing smoothly, the core team has been established, the strategic direction and development strategy have been defined, and the first batch of products have entered the critical R&D stage.”

The wonderful NIO in 2022 has probably not yet appeared in front of us.

Don’t underestimate the difficulty of production.

And don’t underestimate the impact of scale on pushing the battle forward.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.