Financial Data for 2021 and Q4 of NIO Released

By Wu Xianzhi and Leng Zelin

Edited by Wang Pan

On March 25th, Beijing time, NIO released its financial data for the whole year of 2021 and Q4.

According to the financial report, NIO’s revenue for the whole year of 2021 reached 36.14 billion RMB, an increase of 122.3% year on year. The gross margin of the entire vehicle was 20.1%. The net loss adjusted for the whole year was 3.01 billion RMB, a decrease of 41.2% year on year.

In terms of a single quarter, NIO achieved a revenue of 9.9 billion RMB in the fourth quarter, an increase of 49.1% year on year. The gross profit was 1.7 billion RMB, an increase of 48.8% year on year, and the adjusted net loss was 1.75 billion RMB.

Previously, when Ideal announced its financial report for the same period, it had already achieved profit on a single-quarter basis, while the supply chain was still in difficulties. This fact showed that the competition for new car manufacturers has moved from simply staying afloat and delivering over 10,000 vehicles per month to the comprehensive operation of an enterprise.

Although the upstream raw materials for new energy vehicles are soaring, resulting in price hikes for automakers, Li Bin revealed during the conference call that NIO currently has no idea of raising prices. The pricing policy would be adjusted based on market conditions.

The Battle for Operating Efficiency

When deliveries exceeded 10,000 in a month, it became unreliable to look at the market competition solely based on delivery data, given the differences in user base, price range, and major vehicle models.

From just staying afloat to figuring out how to stay competitive, this would be what NIO needs to think about next.

For example, in December 2021, NIO delivered 10,489 vehicles, which appeared to be infinitely close to that of CHJ Automotive, with 10,127 vehicle deliveries in the same period. Yet, the two companies have completely different products, prices, and market strategies. Delivering over 10,000 vehicles in a month has a completely different meaning for these two firms – for CHJ Automotive, it meant gaining a foothold in the lower-tier markets, while for NIO, it meant not only expanding its user base, but also bringing more users to battery swapping services.

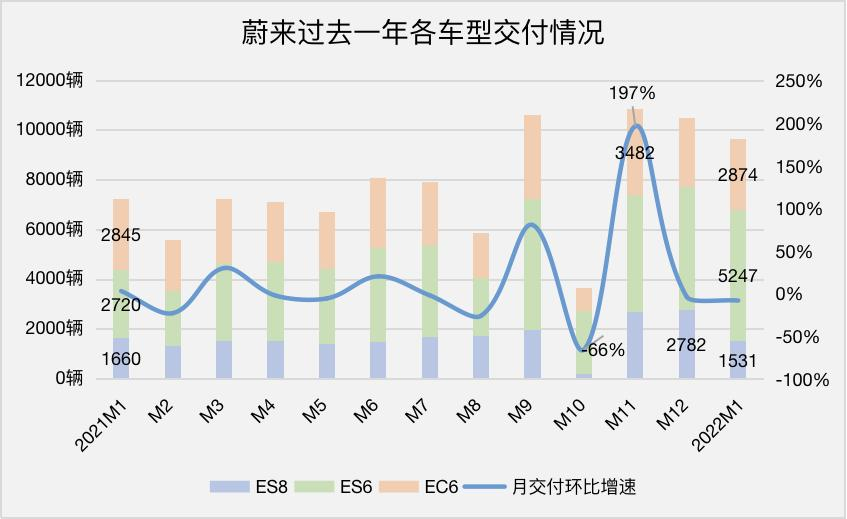

Photon Planet analyzed NIO’s monthly delivery data released in the past year and found that after the supply chain and workshop debugging issues in the second half of last year, the month-on-month growth rate of deliveries fluctuated dramatically. In August and October, which saw the lowest performance, ES6 suffered a sharp decline and severely dragged down the overall data.

Among the three SUVs, ES8, ES6, and EC6 that have been mass-produced, ES6 determines the stability of NIO’s overall performance from a 13-month delivery perspective. It is worth noting that in the second half of last year to this year, 400,000 middle and large-size SUVs including Voyah FREE, Ziyuanjia NV, Ideanomics L9, XPeng G9, and AITO Wanjie M5 have successively entered the market, which means that ES6 is facing unprecedented fierce competition.

In the past 13 months, ES6 total sales have reached 46,721 units, which is much lower than that of Ideal ONE. Moreover, there are other brands coveting the market share in the SUV battle, making it perhaps the most fierce competition among new energy vehicles.

In the past 13 months, ES6 total sales have reached 46,721 units, which is much lower than that of Ideal ONE. Moreover, there are other brands coveting the market share in the SUV battle, making it perhaps the most fierce competition among new energy vehicles.

Aside from its models, Ideal is the one with the highest gross profit margin among Li Auto and Xpeng, thanks to its efficiency and overall cost control, which enabled it to achieve profitability in the fourth quarter of last year. Similarly, Neo positions itself at the mid- to high-end market. With the maturing of its supply chain, workshops, and sales network, its gross profit margin is close to structural profitability after turning positive.

Since the second quarter of 2020, after the vehicle gross profit margin rose to 9.7%, Neo’s overall gross profit margin has been rising from 8.4% to 17.2% this quarter, with vehicle gross profit also at 20.9%.

In terms of costs, Neo maintains high growth in sales costs, which is the main obstacle to turning the net profit positive. Especially since 2021, various expenses have shown an accelerating trend of expansion. However, due to high overall operating costs, net profit has not been positive in the short term, despite covering market sales and management expenses with revenue growth.

This year, the tight chip supply will further hinder the high-end models from achieving high shipment volume. Earlier, some car companies revealed to Photon Planet that the OEMs often raise procurement plans based on actual demand to obtain more chips, and suppliers also inspect the demand reported by car companies to fulfill a certain proportion, considering their limited inventory.

It must be pointed out that only by increasing delivery can revenue maintain its growth momentum and cover rapidly rising sales costs. The gap between revenue and costs is the only way for Neo to turn losses into profits. Therefore, we believe that the launch of the new factory in Hefei will be a critical turning point for Neo to achieve profitability.

“Because the world is changing too fast, we need to establish a connection between goals and actions, to see if we can relate what we do in 2023, 2024, and what we’re doing now in 2021,” Li Bin told Photon Planet earlier this year.

Judging from its financial and delivery data, Neo’s relatively low operating efficiency is the main factor that gradually catches up with or even surpasses it. However, looking back on Neo’s changes over the past year, based on Li Bin’s account, Neo’s layout is unfolding like a painting.

The lack of new car deliveries in 2021 is the main reason why Neo’s delivery volume growth rate is lower than that of other OEMs. And going further back, this reason may be related to Neo’s “spending big” style.If Li Xiang is a model housewife who is thrifty and good at managing the household, then Li Bin is the pillar of the family who is good at socializing.

According to 36Kr, a former executive who resigned from NIO said in an interview, “NIO focuses on the product experience for the consumer market, and we almost do not consider the cost of the Bill of Materials (BOM) when we do research and development.”

We have heard too many cases where NIO emphasizes on services. Li Bin personally stands on the podium, participates in activities, and even throws away his gentlemanly and easy-going image to “scold” employees for their poor service. NIO does not spare any expense in building NIO centers and NIO spaces, among other things.

NIO’s emphasis on services and user experience has led to a rapid depletion of funds and indirectly occupied part of the research and development expenses, resulting in a lack of funds for timely product updates during the “winter” season. However, the relationship between NIO and its users is like a couple who have passed the honeymoon period, and it is difficult to sort out the gains and losses of either party.

In 2019, users saved NIO, but it can be foreseen that the role of services in competition may become increasingly lower. Therefore, the new energy boom in 2021 does not belong to NIO but is more like a buffer period for NIO.

NIO’s “Picture”

2021 is the first year NIO has not delivered any new cars, but in return, NIO will deliver three new cars this year. We interpreted NIO’s current strategy in part in “2022, NIO Routed”:

The ES6 and ES8 play an anchoring role (the same applies to sedans) and determine the overall price range of the NIO brand, whereas the ES7 taps into the needs of segmented users. Instead of continuing to explore higher-end or sinking like Tesla, NIO probably wants to deepen its brand strength in this range.

In the short term, this is the plan, but in the long run, NIO has already prepared for sinking. Li Bin has publicly stated multiple times that the NIO brand is mainly for entering the high-end luxury market, and NIO will establish a separate brand to launch lower-priced models.

The starting price of 328,000 yuan (with a BaaS plan of 258,000 yuan) for the ET5 has set the lowest price for the NIO brand. The introduction of the ES7 and the potential appearance of the ET6 are both aimed at further consolidating NIO’s position as a high-end brand. When the NIO brand product line is complete, it will be time for NIO to sink. Considering the entry of technology companies such as Xiaomi and Jidu and the competitive landscape in the mass market, NIO’s sinking action should not wait too long.

Relative to ideal single product strategy and XPeng’s brand strategy from the bottom up, the advantage of NIO’s initial layout in the high-end market is gradually becoming apparent.

In terms of the supply chain, due to the pandemic and chip shortage last year, the entire vehicle market was under the influence of insufficient production capacity. Apart from the price, NIO’s uncompromising attitude has also caused it to suffer in delivery, whereas Ideal and XPeng’s strategy of putting the vehicle on the road first and then settling accounts later has brought them certain advantages in data. The reason for this can also be understood as a part of the strategy for consolidating the high-end brand of NIO.

Of course, this cannot conceal the lack of supply chain management and emergency strategies. Although NIO has set up various emergency teams internally since 2019, the successive occurrence of similar events has prompted Li Bin to adopt various response strategies.

“In 2021, we have a very important thing, which is that we and our supply chain partners will discuss long-term planning for 3 to 5 years.”

Because the automotive supply chain is a very long chain, the time for demand transmission to the supply side is relatively long. The rapid increase in sales of new energy and the rapid popularization of intelligence last year resulted in a sharp increase in the demand for chips, and the corresponding market will appear “lag”. NIO’s opening of long-term strategic planning will help supply chain partners match production capacity in advance and improve overall efficiency.

Why did NIO start doing this now? This needs to be viewed from two aspects. On the one hand, the construction of production lines will consume a lot of time and money. After the construction is completed, whether the host factory has the ability to digest these production capacities will test the confidence and determination of the supply chain. On the other hand, in the automotive supply chain, mold opening and upgrading of production lines often means that the host factory needs to pay a “mold opening fee” ranging from hundreds of thousands to millions of yuan , and cars involve tens of thousands of parts, which is also a significant expense for the host factory.

NIO’s start of doing this things also means that the market confidence and funds they hold are enough to support this strategy. According to financial report data, NIO’s balance of cash and cash equivalents, restricted cash and short-term investments is RMB 55.4 billion.

In overseas markets, NIO is currently the most aggressive among the new forces in car-making. NETA has chosen the Southeast Asian market that matches its own products; XPeng has gone overseas through cooperation with local dealers in Europe; Ideal has established a team according to official news, but has not yet announced its offshore plan.

At present, only NIO adopts self-built channels and battery swapping stations in Europe. In the short term, it does not prioritize volume but is trying to overcome cultural differences, familiarize with market environments and policies.

Facing a market that may be completely opposite, Li Bin himself also expressed that he is not very concerned about delivery volume, but more concerned about user satisfaction when he met with the Norwegian general manager.

In China, NIO’s movements outside the automotive market are still not small. This month, NIO became the second main factory to announce its entry into the mobile phone industry after Geely.

As automotive intelligence and vehicle-to-vehicle interconnection are increasingly valued, they have attracted many Internet companies’ attention and are even regarded by the industry as the next “flow pool” in the post-mobile Internet era. The collision of hardware and software has also caused changes in industry rules, and roles such as Huawei that cannot be simply positioned as Tier1 have begun to appear.Talking about the current vehicle intelligence, leaving autonomous driving and car-road collaboration aside, software adaptation, dominant position, aftermarket maintenance – the division of labor in the industry chain is not as clear as in traditional fuel car. When the automakers enter the mobile phone field, it is actually a competition for control over the vehicle system. Is mapping the phone to the vehicle a lower-cost and more efficient option?

Conclusion

Of course, NIO has made great progress but there are still many issues yet to be resolved. They should be careful not to overstep their bounds. As for the sinking brand, will it share services and sales channels with NIO? If so, will it reduce the service advantage of high-end users and cause dissatisfaction? If not, will it spend a lot of effort and money to rebuild channels or pick up the franchise strategy that was once abandoned?

The niche market cultivation of NIO brand definitely lags behind the effective strategy of Xpeng and Tesla’s “long-term line and multi-point offense”. Now, with Ideal and Tesla having achieved profitability and Xpeng on the fast-growing road, only NIO seems to be in an adjustment period.

In 2021, we see NIO constantly adjusting its posture, digesting its backlog and brewing bigger strategies, while also setting itself bigger challenges.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.