Author: Big Eyes

On March 23rd, the annual NVIDIA GTC 2022 conference kicked off.

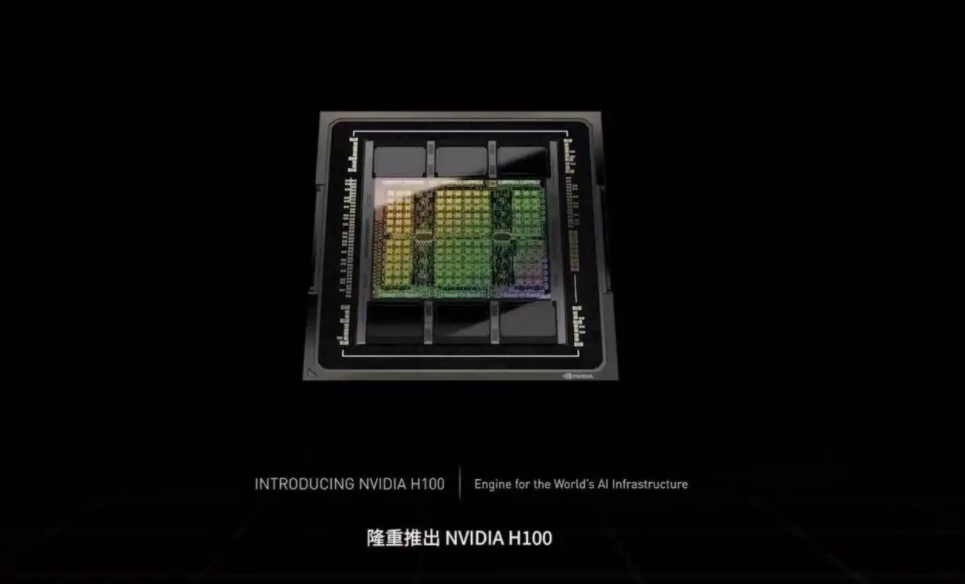

The company not only released the highly anticipated Hopper Architecture H100 accelerator card, but also launched the CPU processor Grace, designed specifically for AI and supercomputing, and the AI computing system “DGX H100.” However, it is undeniable that autonomous driving also occupies a considerable proportion at this year’s GTC.

Looking at global automakers, those hoping to enter level L3 or higher autonomous driving are few and far between who can bypass NVIDIA chips or autonomous driving platforms. And NVIDIA did not disappoint, releasing many positive messages in the field of autonomous driving at GTC 2022.

Not long ago, NVIDIA just released its fiscal year 2021 annual report. Annual revenue reached a record high of $26.914 billion, a year-on-year increase of 61%. Annual non-GAAP net profit was $11.259 billion. In terms of stock prices, NVIDIA hit a peak of $333.76 in November 2021, a significant increase from $59.02 at the beginning of 2020.

Looking at NVIDIA’s own business, the sales pillars are still gaming and data center divisions, starting with GPUs. However, it must be acknowledged that with the Orin chip, the autonomous driving business is becoming a new sales and profit growth point for NVIDIA.

Orin has not yet been launched, and Atlan has already appeared

At GTC 2022, NVIDIA announced that the autonomous driving chip Orin will officially enter production and sales this month. For many automakers who have already announced the use of the Orin chip, it can be considered as a reassurance. At the same time, NVIDIA launched the next-generation autonomous driving platform DRIVE Hyperion 9 based on the Atlan chip, and plans to mass-produce it in 2026.

As a brand new autonomous driving platform, Hyperion 9 supports L3 level autonomous driving and L4 level parking in parking lots. The most apparent improvement compared to the 8th generation is the significant increase in the number of perception hardware supported, including 14 external cameras, 9 millimeter-wave radars, 3 lidar sensors, and 20 ultrasonic sensors. The internal hardware supported includes 3 cameras and 1 millimeter-wave radar. Specifically, due to the increase of 17 perception hardware on Hyperion 9, the data processing volume will be more than twice that of the 8th generation platform, and the performance will be double that of the 8th generation platform.

As a brand new autonomous driving platform, Hyperion 9 supports L3 level autonomous driving and L4 level parking in parking lots. The most apparent improvement compared to the 8th generation is the significant increase in the number of perception hardware supported, including 14 external cameras, 9 millimeter-wave radars, 3 lidar sensors, and 20 ultrasonic sensors. The internal hardware supported includes 3 cameras and 1 millimeter-wave radar. Specifically, due to the increase of 17 perception hardware on Hyperion 9, the data processing volume will be more than twice that of the 8th generation platform, and the performance will be double that of the 8th generation platform.

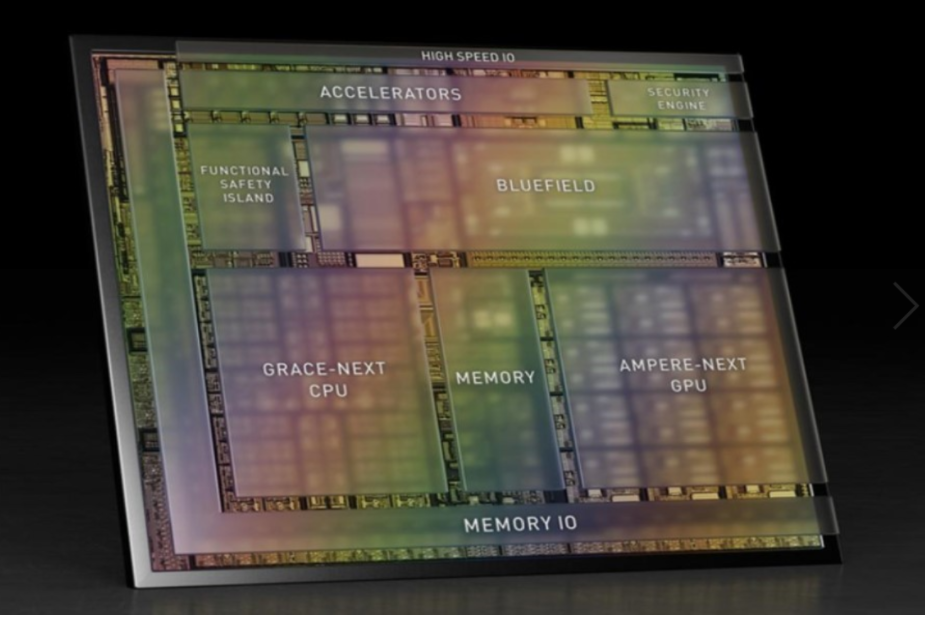

For the Hyperion 9 platform, the Atlan chip is the major highlight. Compared with the Orin chip from NVIDIA, which will be sold soon, Atlan has undergone a complete transformation in terms of chip architecture. The Atlan chip integrates the Grace-Next CPU, Ampere-Next GPU unit, and for the first time, a Bluefield data processing unit (DPU), which will have better performance in AI computing and autonomous driving. Especially in terms of the most critical computing ability, Atlan chip will achieve a significant leap from Xavier’s 30 TOPS to Orin’s 254 TOPS to Atlan’s 1000 TOPS. NVIDIA has made great progress in chip computing power. As for the worldwide market, currently, the basic level of a single chip for Mobileye, Huawei, and Horizon is tens of TOPS. Horizon’s latest Horizon 5, released last year, has a single-chip AI computing power of just 128 TOPS. As for the Qualcomm Snapdragon Ride that can compete with Orin, its computing power can reach up to 700 TOPS, but this chip will not be available until 2023.

Of course, computing power is not the only indicator for evaluating chips, and energy consumption and data transmission bandwidth also affect chip performance. However, Atlan’s high computing power undoubtedly lays a solid foundation for its performance.

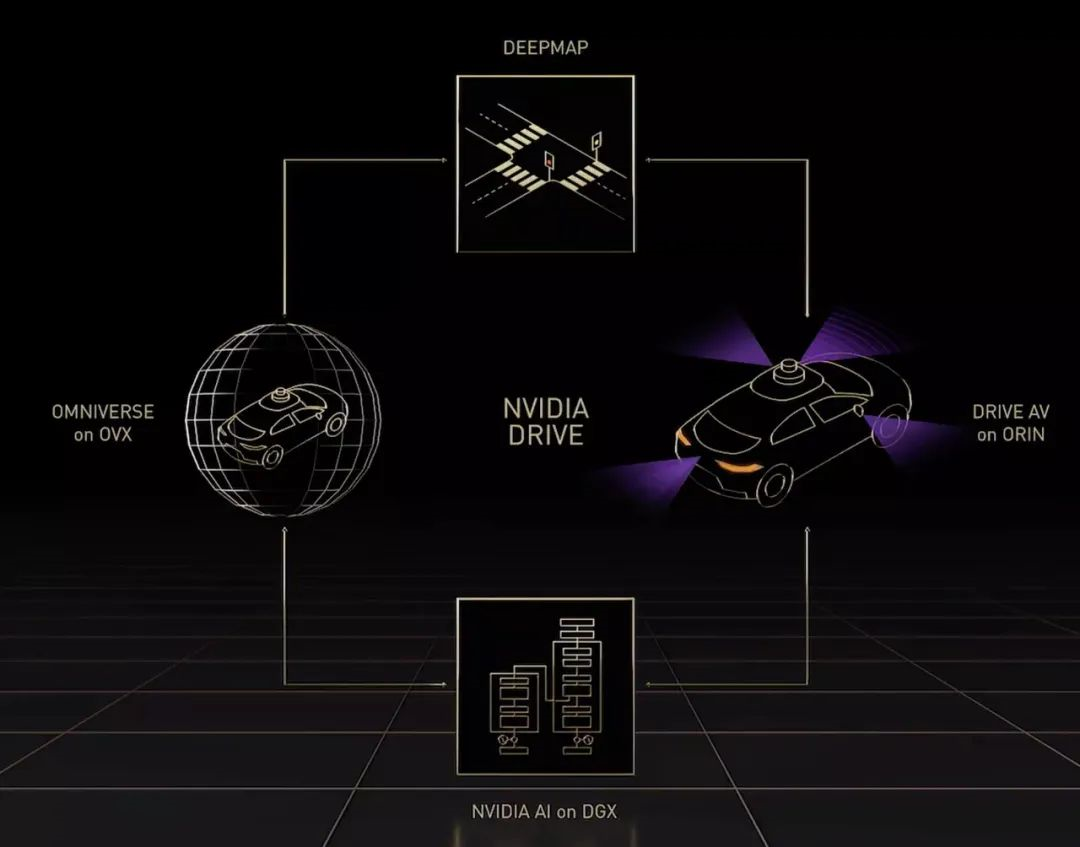

Multi-Modal Maps, NVIDIA’s New Weapon?For autonomous driving, the importance of high-precision maps goes without saying. At GTC 2022, NVIDIA also launched the DRIVE Map multimodal map engine which will take on the role of high-precision map acquisition, production, and updating, becoming a new weapon for NVIDIA to strengthen its leading position in the field of autonomous driving.

According to NVIDIA, DRIVE Map mainly collects data from cameras, radars, and LiDARs. Cameras correspond to the data on the visual perception level, including lane dividers, road markings, road borders, traffic signals, signs, and poles. The millimeter-wave radar is mainly responsible for collecting aggregated point cloud data of radar echoes. As for LiDAR, it can provide accurate and reliable 3D environmental data with an accuracy of up to 5 centimeters.

In order to meet the needs of different users and constantly improve the accuracy of high-precision maps, NVIDIA will provide two map engines, DeepMap and Crowdsource fleet maps, to achieve the best balance between mapping accuracy, accuracy, cost, and scale.

According to NVIDIA’s plan, by the end of 2024, it will complete the creation of DRIVE Maps on major roads in North America, Western Europe, and Asia, with a total highway mileage of 500,000 kilometers. Of course, for the domestic market that is more sensitive to map data and information collection, NVIDIA may need to cooperate with more domestic car companies and mapping firms to expand its circle of friends, in order to avoid the risks and resistance faced in the high-precision map collection process.

As NVIDIA gradually expands its circle of friends in the automotive industry’s autonomous driving field, high-precision maps, especially crowdsource maps, may become a new source of revenue and profit for NVIDIA.

Can a continuously growing circle of friends let NVIDIA take a breath of relief?

At this year’s GTC, the official announcement of the collaboration with BYD was undoubtedly a highlight outside of new products. As the largest domestic and second-largest new energy automaker in the world, BYD will start mass production of cars equipped with DRIVE Orin computing platforms in the first half of 2023. Previously, including NIO ET7, IM IM, and WM M7, all will be equipped with four Orin chips, with a total computing power exceeding 1,000TOPS. Many multinational automakers and autonomous driving technology companies apart from domestic automakers will also adopt NVIDIA’s Orin solution.However, for NVIDIA, being able to bring so many automakers under its roof is largely because there are not many products available in the market, especially for the AI chips required for L3 or above autonomous driving, which has gained recognition from many automakers. However, NVIDIA should be cautious of the other two emerging forces outside of its territory.

Firstly, traditional chip giants will not sit idly by and let NVIDIA monopolize the autonomous driving market.

Mobileye, which was previously acquired by Intel, is currently seeking a standalone IPO. This time, the IPO not only includes Mobileye’s own business, but also Intel’s entire vehicle autonomous driving-related projects. In the future, in addition to focusing on system-level products such as autonomous driving platforms, Mobileye may also enter the Robotaxi market.

As for domestic companies, Horizon Robotics and Black Sesame Technologies are also growing rapidly. For domestic automakers, the case of the United States exerting extreme pressure on Huawei is right before their eyes. Finding a domestic alternative for chip design is a major strategy to ensure the security of their own supply chain.

Secondly, automakers themselves have the impulse to design their own chips.

Tesla has previously demonstrated its self-developed dedicated chips for autonomous driving, which have advantages in releasing effective computing power compared to NVIDIA’s general-purpose chips. However, self-developed chips require huge investments not only in terms of funds, but also in research and development production cycle, which can last for three to five years. Chip design itself also faces the risk of failure. In addition to Tesla, NIO and XPeng, two domestic automakers, have previously announced the formation of chip design teams. Huawei, Alibaba, and Baidu have all launched high-process chip products in the market.

Currently, computing power is a crucial indicator for evaluating the quality of chips. For auto manufacturers, since L4 level automated driving is difficult to be fully implemented in the short term, it is important for the automated driving control chip to meet the recognized L4 requirements in computing power, and then unlock specific automated driving functions in certain scenarios through continuous software upgrades, thus gradually approaching L4 level automated driving.

Therefore, while chip enterprises are continuously improving computing power, it is even more important to provide auto manufacturers with a more open and efficient ecosystem. In this regard, Nvidia is the market leader with higher software openness, R&D of Nvidia’s own CUDA and TensorRT, etc., but its followers are catching up rapidly.

In Conclusion

Currently, it is the best time for Nvidia, and its accumulation in GPU and AI technology has led to a significant increase in market value, from only 59.02 US dollars in early 2020 to the peak of 333.76 US dollars in November last year, becoming a new player in the global chip market.

However, there is no joy without sorrow: Nvidia’s market value is higher than the sum of Intel, AMD, and Xilinx, but the industry unanimously opposed its acquisition of ARM. Meanwhile, AMD’s acquisition of Xilinx and Intel’s acquisition of Habana in the same period can be seen as the reconstruction of the global chip industry. Intel and Qualcomm are also seeking their own positioning in the smart electric vehicle market in their own way.

As for Nvidia, it is still far from lying on the laurels of history. With automated driving/driving assistance functions becoming standard in smart electric vehicles, the future market for automated driving chips will be an irresistible temptation for everyone.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.