Author: Da Yan

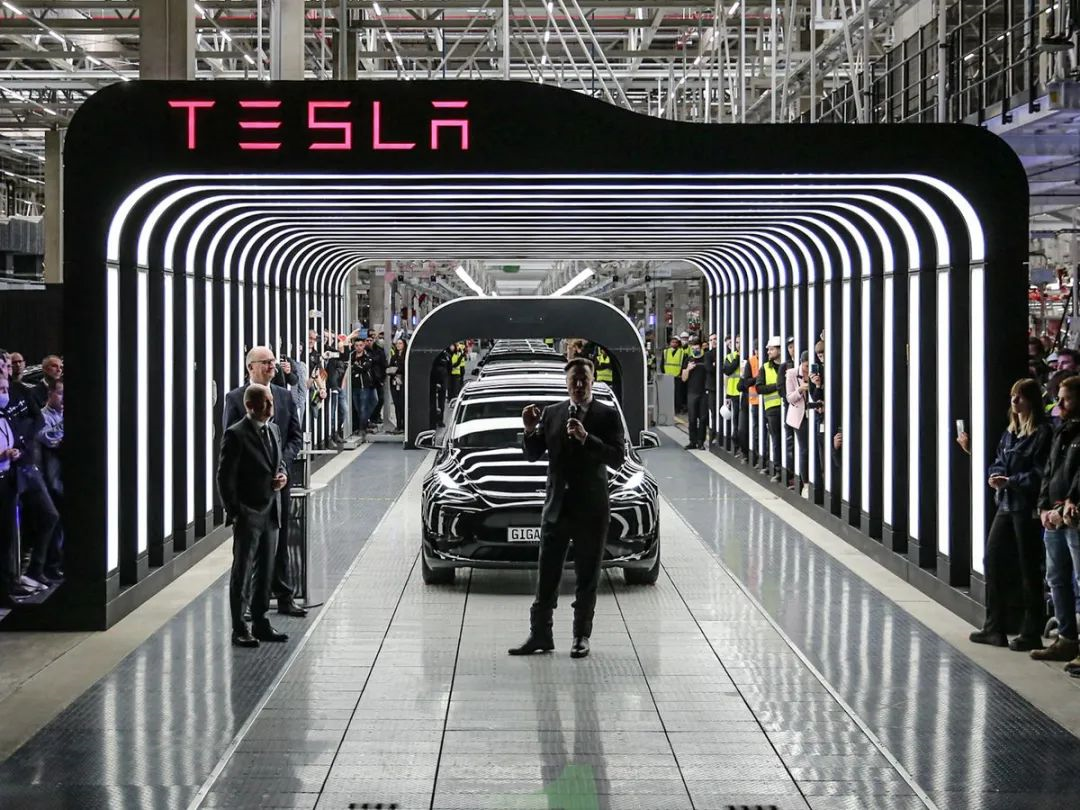

At 3pm on March 22nd local time, the Tesla Berlin factory held its opening ceremony.

We saw the familiar awkward dance performed by Elon Musk, just like he did at the opening ceremony of the Shanghai super factory. The dance represents Tesla’s or Musk’s determination to conquer the European market.

With the Berlin super factory, Tesla’s delivery time in Europe will be greatly reduced. In the European market, which is the friendliest to electric vehicles, Tesla will seek new breakthroughs.

The Berlin factory will help Tesla reclaim the top spot in the European market

This factory, which was announced to be under construction in November 2019, was originally scheduled to start production in July 2021, according to Tesla’s plan. Although it experienced various typical European-style protests in the meantime, it still began production smoothly, and at the right time.

Although Tesla’s performance in the European market is not bad, there are still concerns. According to JATO Dynamics data, Tesla’s sales in Europe in 2021 were about 168,000 vehicles, with Model 3 sales reaching 141,400, surpassing the Renault ZOE and becoming the best-selling pure electric vehicle model in the European market.

However, its market share in the European electric vehicle market has fallen from its peak of 31% in 2019 to 13.9% in 2021, with Volkswagen and Stellantis leading with shares of 25% and 14.4% respectively, ahead of Tesla.

This situation is not caused by the decline in Tesla’s product or brand power.

On the one hand, Volkswagen and Stellantis have been continuously launching electric vehicle models in the European market, especially Volkswagen, which has quickly introduced vehicles of various body types to the market based on the MEB platform, posing a considerable challenge to Tesla’s market share.

On the other hand, Tesla’s European business relies mainly on its super factory in Shanghai. The Shanghai factory has been straining to meet the demand of the Chinese market, let alone using its production capacity to fulfill orders from other overseas markets.

The first model to be put into production in Tesla’s Berlin factory is Model Y, and based on past experience in both China and the United States, as an SUV model, Model Y is more likely to be favored by consumers. Therefore, without any major surprises, the Berlin factory will help Tesla regain the title of the largest market share in Europe.

The first model to be put into production in Tesla’s Berlin factory is Model Y, and based on past experience in both China and the United States, as an SUV model, Model Y is more likely to be favored by consumers. Therefore, without any major surprises, the Berlin factory will help Tesla regain the title of the largest market share in Europe.

Tesla has the capital to fight a price war in Europe

The substantial production capacity and lower costs give Tesla the capital to wage a price war in the European market.

In terms of scale, the design capacity of the Berlin super factory is up to 500,000 units, although the relevant production needs to be ramped up in the first year or two. However, based on Tesla’s current factory operating experience, the goal of 500,000 units will not take too much time to achieve as long as there is no strike by a powerful union or other Black Swan event.

According to Volkswagen’s just-released financial report, MEB models sold just 452,900 units worldwide in 2021. As for Volkswagen’s next-generation SSP platform in Germany, it may not launch its first model until 2026. In the next few years, Volkswagen will continue to be impacted by Tesla in Germany and the European market.

The reduction in tariff costs will also be an immediate effect of localized production. As one of Tesla’s main sales drivers, the starting price for Model 3 Performance models in Germany is 61,990 euros (approximately RMB 4.353 million), while the same model is priced at 367,000 yuan in China. This price difference naturally includes the relevant shipping and tariff costs from China to Europe. With Tesla’s local production in Europe, these costs will be significantly reduced.

In the future, it can be foreseen that Tesla will have more flexibility in product pricing in Europe, aside from the fluctuation effects of commodity and rare metal prices. Once the overall environment stabilizes, it is very likely that the price wars previously sparked in the Chinese market will reappear in the European market. At that time, it remains uncertain whether Volkswagen and Stellantis can withstand Tesla’s bike gross profit margin of over 30%.

Another point worth mentioning is that with the launch of the Berlin factory, Tesla’s Shanghai super factory will also be able to better handle domestic order demand.Tesla’s official website shows that the delivery time for most of Tesla’s models in the Chinese market has reached 16-20 weeks. Although competition in the Chinese smart electric vehicle market is also fierce, there are almost no brands that can shake Tesla’s position in the domestic market.

With the pressure to deliver Model Y to the European market easing, the delivery time for Model Y, which is popular among Chinese consumers, will also be greatly reduced. In 2022, Tesla’s sales in the domestic electric vehicle market will not only further increase, but may even compete for a better ranking in the domestic SUV market leaderboard.

Mass production of Model 2 may be on the agenda

In Tesla’s arsenal, the $25,000 entry-level cheap Model 2 is regarded by many as a product capable of changing the rules of the market. The reason Tesla has not launched this model is partly because its current production capacity, which is already stretched to its limit even to meet current models, let alone produce a model with even greater demand.

On the other hand, lower-priced models may have lower gross margins per vehicle than existing models. Therefore, with strong demand in the market for existing models, Tesla has little motivation to mass-produce Model 2.

However, with Tesla’s capacity shortage gradually easing, especially with the large-scale production of the 4680 battery, the production of Tesla’s $25,000 entry-level model can be put on the agenda. After all, in order to achieve the goal of 20 million units by 2030, which is currently set by Tesla, the Model 2 and similar models are essential. Its mass production can not only significantly dilute the related R&D costs, but also further consolidate Tesla’s leading position in the global electric vehicle market.

If the opening ceremony of the Berlin Super Factory has the biggest surprise, besides Musk’s awkward dancing, the attendance of Germany’s new chancellor, Scholz, is also a highlight.

As an automotive industry powerhouse in Europe and the world, Germany not only has luxury car brands like BBA, but also large multinational auto giants with significant volume and scale, like Volkswagen. Scholz’s attendance undoubtedly shows to the outside world that the German government is not conservative. Even in the automotive industry, Germany still welcomes foreign companies to invest in Germany and continue to maintain its leading position in the era of smart electric vehicles.However, for BBA and Volkswagen, in the era of intelligent electric vehicles, Germany or Europe is still their home field, but the home advantage is being weakened. Faced with the challenge from Tesla, there are still many lessons for traditional German car companies to make up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.