Author: Zhu Yulong

There are many companies in the field of LIDAR racing, and it is interesting to track and analyze these companies.

In 2021, Ouster’s LIDAR shipment volume exceeded 6475, and revenue increased from $16.87 million in 2020 to $34 million, with each LIDAR costing around $0.525 million. The Q4 shipment volume exceeded 2400, a year-on-year increase of 198%. The net loss narrowed slightly from $107 million in 2020 to $94 million. These LIDAR companies started to launch into the market in 2020, and basically reached their market peak in early 2021, and then gradually went downhill.

Ouster OS1-64 Teardown

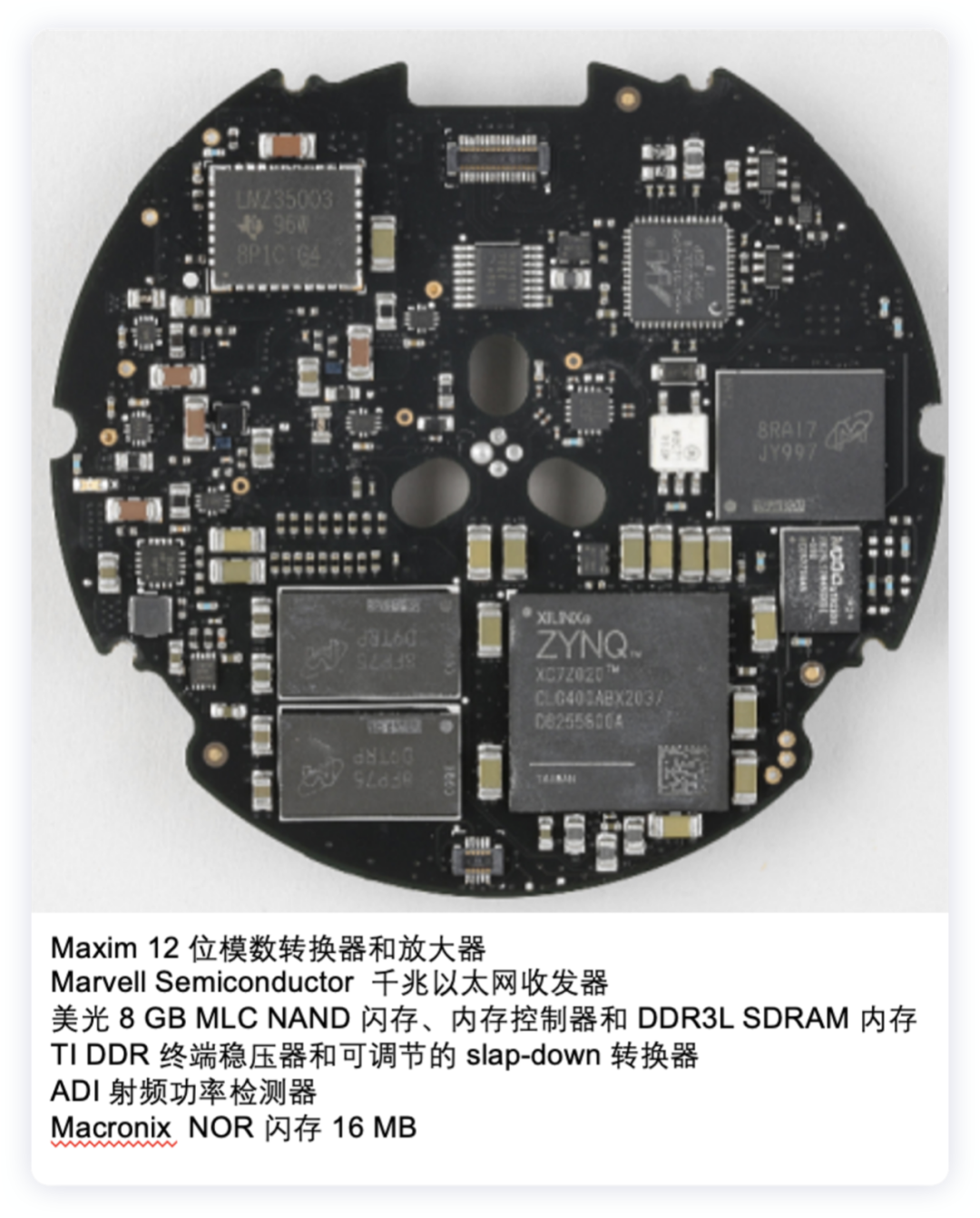

The teardown of Ouster OS1-64 (released in January 2020) was done by Electronics360, which gave us a general understanding of this product. The main board is divided into several parts, and the main chips inside are also sorted out, along with a cost structure.

The main board of the Ouster OS1 LIDAR sensor contains the processor of the LIDAR, including the Xilinx dual-core ARM Cortex-A9 and the on-chip programmable logic system. The components on the main board include:

- Maxim: 12-bit ADC and limiter amplifier

- Marvell Semiconductor: Gigabit Ethernet transceiver

- Micron: Chip memory 8GBMLC NAND flash, memory controller, and DDR3L SDRAM memory

- Texas Instruments: DDR terminal regulator and adjustable slap-down converter

- Analog Devices: RF power detector

- Macronix: Serial NOR flash 16MB

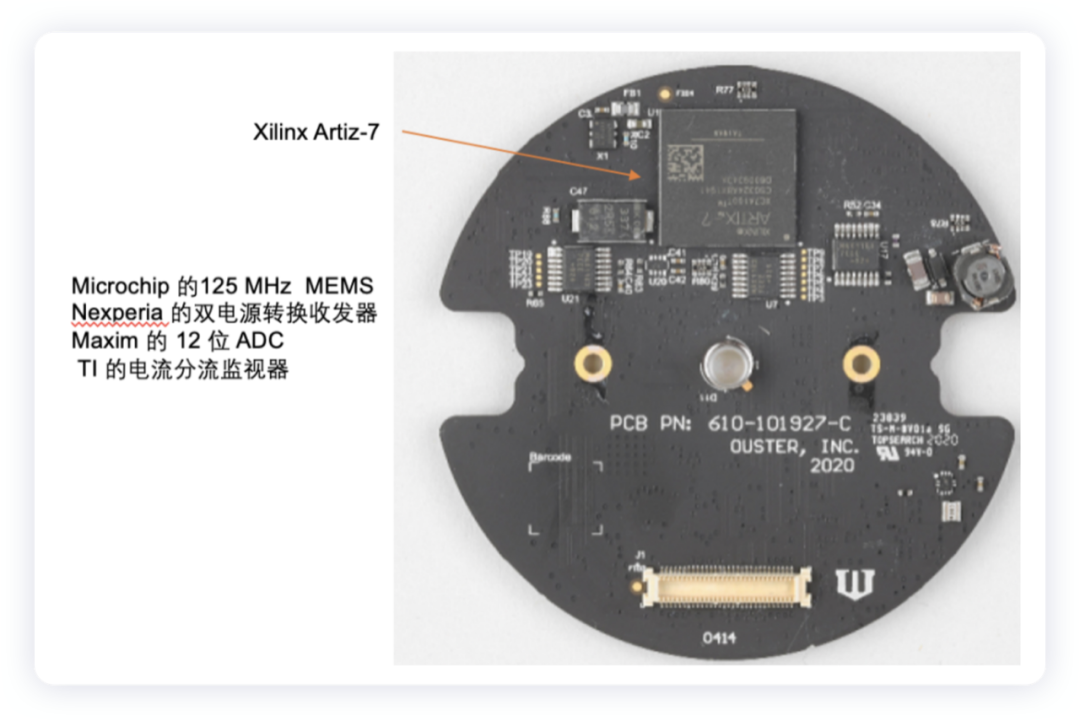

The internal rotor board is also used as the control unit inside the Ouster OS1, which includes Xilinx Artiz-7 field-programmable gate array (FPGA), Microchip’s MEMS oscillator, Nexperia’s dual power supply transceiver, Maxim’s 12-bit ADC, and TI’s current chip.

The motor board contains memory and other chips for communication between vehicles and lidars.

From dismantling, the costs of the main chips we see are as follows:

- $13.43 —Artiz-7 FPGA—Xilinx (quantity: 1)

- $10.93 —mounting base (quantity: 1)

- $10.46 —Small Active VCSEL Array (quantity: 1)

- $10.13 —Dual-Core ARM Cortex-A0 and Programmable Logic SoC—Xilinx (quantity: 1)

- $7.53 —Pettier Module (quantity: 1)

- $7.23 —SPAD array (quantity: 1)

- $6.51 —Lens #3 (quantity: 2)

- $6.47 —Lens #2 (quantity: 2)

- $6.43 —DDR3L SDRAM Memory 512MB Micron (quantity: 2)

- $6.29 —bottom shell (quantity: 1)

Outlook of Ouster

Both co-founders were previously employed by laser radar company Quanergy. Angus was a co-founder of Quanergy, which now appears not to be running to the end.- In 2021, Ouster completed the acquisition of Sense Photonics, a solid-state lidar startup company, and established a new business unit, Ouster Automotive, to promote cooperation with global automakers, with production expected to begin between 2025 and 2026.

- At the end of 2021, Ouster announced a partnership with NVIDIA to accelerate the deployment of self-driving cars, providing a dedicated NVIDIA DriveWorks plugin based on NVIDIA DRIVE.

- Of course, the biggest issue here is still the development of Sold State (Ouster’s VCSEL+SPAD solution, customized design, and integration of all required laser systems onto the same semiconductor chip, significantly reducing system complexity). It takes too long, meaning that although revenue increased in 2022, overall, the company is still in a loss-making state and will need to wait for the products to be massively introduced into cars to have a good chance of success. This is why Luminar is relatively better than other lidar companies at present.

- Summary: 2022 is the time point at which several lidar companies in China will gradually scale up production for installation in cars, and according to current logic, this field will accelerate as it is gradually implemented. Through the VC stage, convergence is inevitable, and demand for and validation of products will accelerate after installation in cars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.