English Markdown Text Output with HTML Tag

NVIDIA once again demonstrated its leading position in the field of autonomous driving.

On the evening of March 22, NVIDIA founder Huang Renxun announced at the GTC 2022 conference that its autonomous driving chip Orin has been officially put into production and sales this month. At the same time, NVIDIA launched the new generation autonomous driving platform DRIVE Hyperion 9 based on the Atlan chip and plans to mass-produce it in 2026.

NVIDIA also announced two new car manufacturer partners: BYD and Lucid Group. Over 25 car manufacturers and autonomous driving companies have already chosen NVIDIA. These partners will contribute more than 11 billion USD in revenue to NVIDIA in the next 6 years.

Orin in Mass Production, Hyperion 9 Catch up

NVIDIA controls both the brain and the nerve of autonomous driving.

The relationship between autonomous driving chip, platform, and model is not easy to understand. NVIDIA gave an illustrative analogy: the car is the body, the autonomous driving platform is the nerve, and the autonomous driving chip is the brain.

At this year’s GTC 2022 conference, the Hyperion 9 autonomous driving platform released by Huang Renxun belongs to the “nerve” category. The “brain” that matches this platform is the Atlan autonomous driving chip.

Hyperion 9 autonomous driving platform has the most noticeable change compared to the current 8th generation platform, which is support for a significantly larger number of perception hardware, up to 50. This includes 14 external cameras, 9 millimeter-wave radars, 3 lidars, and 20 ultrasonic radars; internally, it can support 3 cameras and 1 millimeter-wave radar.

Hyperion 9 has 17 more perception hardware, and the data generated will be more than twice that of the 8th generation platform. This means that Hyperion 9’s performance is twice as good as the 8th generation platform.

Hyperion 9 will support L3 level autonomous driving and L4 level parking in parking lots.Hyperion 9 is powered by the Atlan chip, which was unveiled at GTC 2021. Atlan has undergone a comprehensive architectural overhaul on the basis of the existing Orin chip. It integrates the Grace-Next CPU, Ampere-Next GPU unit, and the Bluefield Data Processing Unit (DPU) for the first time, to assist AI operations and enhance self-driving capabilities.

Although NVIDIA has not yet disclosed the specific core parameters of each module, Atlan’s target computing power is 1000 TOPS, while the computing power level of the Orin chip is 254 TOPS. Atlan’s computing power has increased by around three times.

In terms of delivery time, NVIDIA expects to deliver the Atlan chip in 2025, while the Hyperion 9 autonomous driving platform is expected to be delivered in 2026.

In addition to the “neurons” and “brain” required for autonomous driving, Huang Renxun also announced the launch of the DRIVE Map multimodal mapping engine at the conference. It is a map data platform required for the “brain” to make decisions. Although Huang did not specifically indicate the level of the map, from the accuracy and functionality, the platform is a high-precision map collection, production, and update platform.

DRIVE Map includes data from cameras, radar and lidar, which correspond to different levels of autonomous driving perception. Camera data corresponds to the level of visual perception, and DRIVE Map will provide data such as lane separators, road markers, road boundaries, traffic lights, signs, and poles.

At the millimeter-wave radar level, aggregated point cloud data of radar echoes will be provided to ensure safer autonomous driving in adverse weather conditions. At the lidar level, accurate and reliable 3D environment data with an accuracy of 5 cm will be provided.

DRIVE Map will have two map engines corresponding to the DeepMap engine and the crowdsourcing fleet map engine. The two map engines can meet the needs of different functions, achieving a win-win effect in data accuracy, freshness, and scale.

NVIDIA plans to complete the creation of DRIVE Map on major roads in North America, Western Europe, and Asia by the end of 2024, with a total highway mileage of 500,000 km.

The data generated by DRIVE Map will be imported into NVIDIA Omniverse to build digital twins in the virtual world for training autonomous driving engines.

With the acquisition of BYD and Lucid, NVIDIA has an absolute leading position in the market.Today, we are pleased to announce that the world’s second largest electric vehicle manufacturer, BYD, will begin production of vehicles equipped with the DRIVE Orin computing platform in the first half of 2023. Along with the announcement of new technology, Huang Renxun also announced a new partnership with the automaker.

Beyond BYD, companies that partnered with NVIDIA at this conference include Lucid, Wenyuan Zhixing, Elementov Investment, Yunji Zhixing, Outrider, and UpRun Technologies.

NVIDIA provides L3-level and above intelligent driving positioning services. As the inventor of the GPU, it dominates the GPU market in the automotive control chip and maintains a 70% market share.

NVIDIA’s automotive customers can generally be divided into three categories:

The first is new car-making forces, such as NIO (ET5, ET7), XPeng Motors (P5, P7, G9), Ideal (X01), WM Motor (M7), SAIC IM, R Automotive, FF, Lucid Group, etc.;

The second is traditional automakers, including BYD, Mercedes-Benz, Jaguar Land Rover, Volvo, Hyundai, Audi, Lotus, etc.;

The third is autonomous driving companies, including GM Cruise, Amazon Zoox, Didi, Volvo Commercial Vehicles, Kodiak, Tucson Future, IMa Technology, AutoX, Pony.ai, Wenyuan Zhixing, Elementov Investment, etc.;

The reason why NVIDIA can quickly obtain a large number of customers is largely because there are not many chips available on the market for enterprises that need to develop L3 or higher-level intelligent driving.

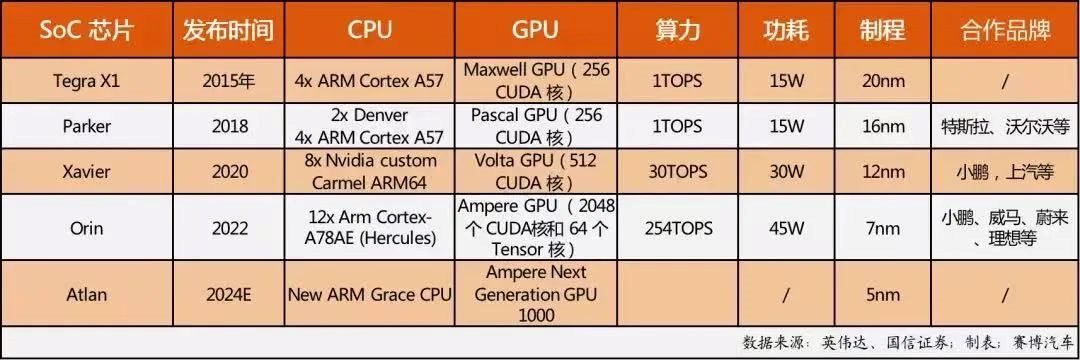

As early as 2015, NVIDIA launched the NVIDIA Drive series platform to empower the autonomous driving ecology.

At CES 2015, NVIDIA launched the first generation platform based on the NVIDIA Maxwell GPU architecture: DRIVE CX equipped with one Tegra X1, mainly for digital cockpits; and DRIVE PX equipped with two Tegra X1, mainly for autonomous driving.

Since then, NVIDIA has updated the Drive platform one or two times almost every year, and released a vehicle-grade SoC chip every two years, continuously increasing its computing power level.

In 2020, the Xavier chip’s computing power was 30 TOPS, and in 2022, the Orin chip, which will go into mass production and be installed in cars, will soar to 254 TOPS.# NIO Day 2021: NIO ET7 Unveiled as the First Mass Production Car of the Orin Series

On NIO Day 2021, the NIO ET7 was officially unveiled as the first mass production car of the Orin series.

Following this, IM Motors and WM Motor announced that they would also be equipping their vehicles with four Orin chips, bringing their total computing power to over 1000 TOPS. With the delivery of the NIO ET7 at the end of this month, mass-produced cars will enter the era of 1000 TOPS computing power for the first time.

The delivery of NVIDIA’s Orin chip will be a milestone event for electric vehicles, as the computing power of autonomous driving chips replaces traditional horsepower benchmarks and becomes a new competitive point in the automotive industry.

Mobileye, Huawei, and Horizon all have chips with computing power in the tens of TOPS, which is a significant difference from NVIDIA’s Orin chip. Qualcomm’s Snapdragon Ride, which is expected to have computing power ranging from 10 TOPS to 700 TOPS, will not be available until 2023.

Moreover, NVIDIA is widening the gap.

At the 2021 GTC Conference, NVIDIA announced Atlan, a chip with a computing power of 1000 TOPS. According to NVIDIA’s plan, Atlan will provide samples to developers in 2023 and will be produced on a large scale as a vehicle component by 2025.

In addition to computing power, automakers and autonomous driving companies choose NVIDIA because of its open and efficient research and development environment. Specific advantages of the ecosystem include the following five aspects:

- Decoupling of software and hardware, independent upgrade, and support for hardware and software upgrade paths

- NVIDIA is a leader in GPU technology, and its hardware advantage is evident

- NVIDIA has the most comprehensive official development kit in the industry

- High degree of software-level openness, with APIs open in DriveWorks (functional software layer) and Drive AV and Drive IX (application software layers)

- Development bundling, with all deep learning algorithm acceleration based on NVIDIA’s own CUDA and TensorRT, making its software development and research and development system inseparable from the NVIDIA platform

The combination of these advantages makes NVIDIA the best choice for companies pursuing higher-level autonomous driving.

The NVIDIA Era?

In 2022, with the mass production and delivery of the NIO ET7, the autonomous driving chip market will begin to enter the NVIDIA era of high computing power.

For competitors, what is frightening is not only NVIDIA’s leading market share but also that it is becoming a synonym for high-end reliability.But after winning the crown, NVIDIA will continue to face two major challenges.

One is that competitors who are currently behind NVIDIA will continue to strive to find ways to break through the market. For example, Chinese self-driving chip dark horse Horizon has already cooperated with many domestic automakers, entering the mid-to-low-end market, and attempting to penetrate the market from the bottom up.

The other is the self-revolution of traditional automakers. Some automakers, taking Tesla and Apple as examples, have put self-developed chips on the agenda. Shen Yanan, CEO of Ideal Auto, once talked about the logic of automakers’ chip layout. He said that automakers should first master the hardware capabilities of domain controllers, then master the capabilities of operating systems, and then develop a good chip.

Therefore, the war of self-driving chips is more like a contest of power. NVIDIA’s lead can be understood as a victory in a stage of the competition, but this competition is far from over.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.