On the morning of March 23rd, Ideal ONE suddenly announced a price increase of 11,800 yuan, leaving “wait-and-see” consumers stunned, wondering why they waited and ended up “losing money.”

However, let’s go back to more than half a year ago, a golden age for “wait-and-see” consumers.

On July 8, 2021, Tesla suddenly launched the Model Y Standard Range version priced at 276,000 yuan. Compared to the long-range version, the range was only 69 kilometers less, the acceleration was only 0.6 seconds slower, but the price was 71,900 yuan less. Only 3 weeks later, the price of the Standard Range Tesla Model 3 was suddenly reduced by 15,000 yuan. Two months later, on September 30th, XPeng added two models, the 480G and the 670G, which were seen as “price reductions and increased configurations.”

For a while, “wait-and-see” became a “mindset stamp” in the new energy vehicle field, and “buy early to enjoy, buy late to enjoy discounts” became a consensus. But soon, the dream of “wait-and-see” consumers was shattered.

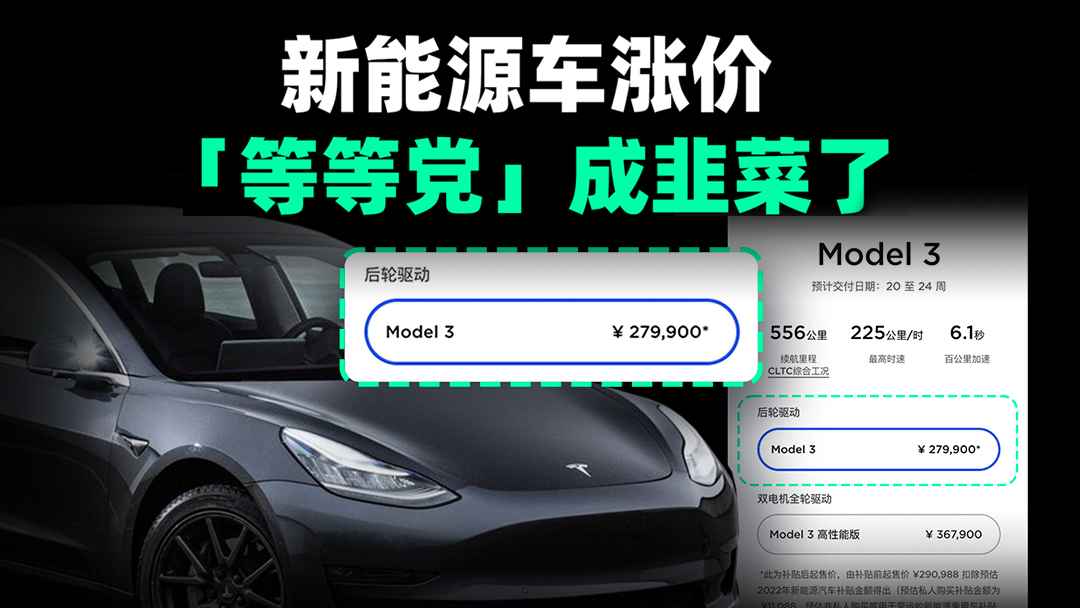

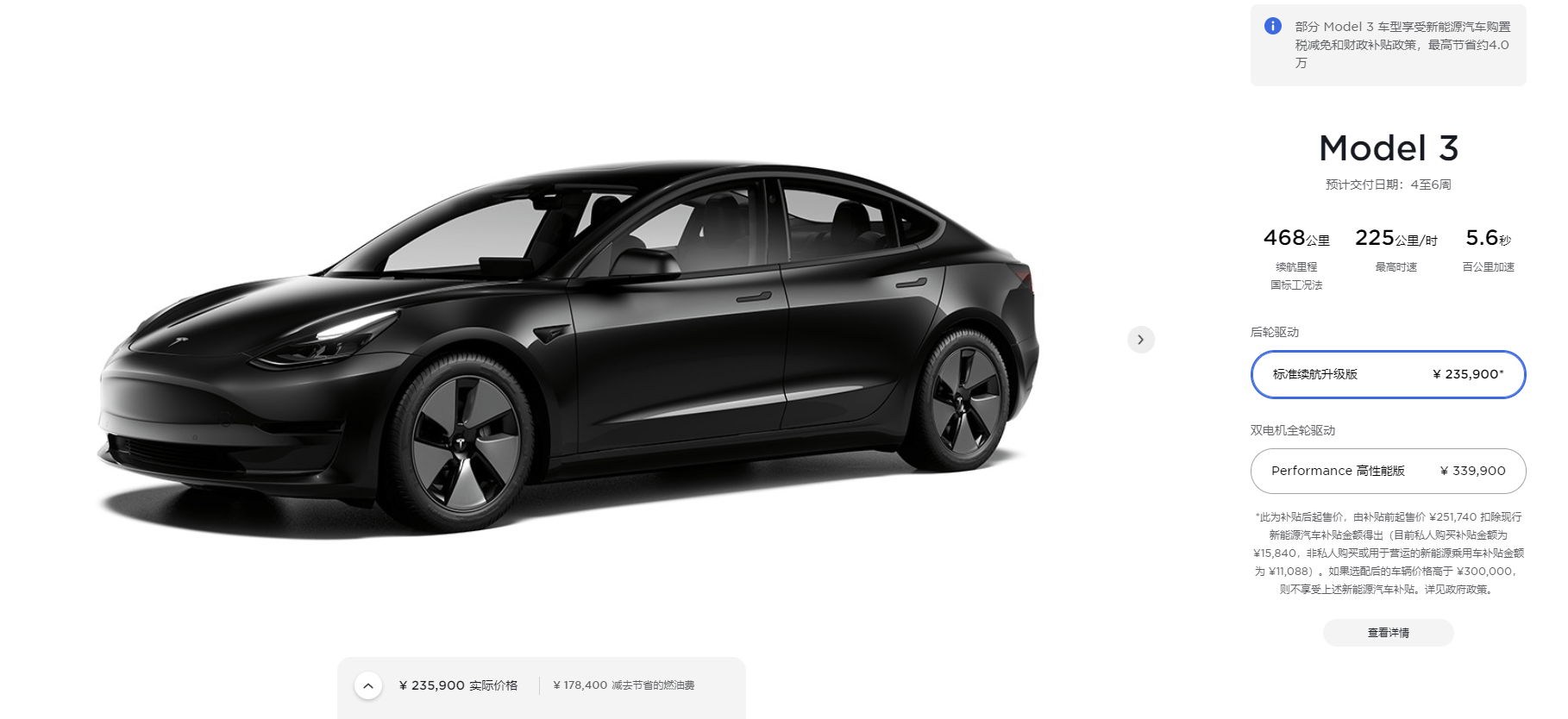

In addition to the recently mentioned Ideal ONE, nearly 20 new energy vehicle companies have announced price increases of more than 40 electric vehicle models, ranging from a few thousand to tens of thousands of yuan. Among them, the ZERORUN C11, known as the “cost-effective king,” has suddenly increased by 20,000 to 30,000 yuan, and the Tesla Model 3, which was only 235,900 yuan more than half a year ago, has increased by a total of 44,000 yuan, with a slower acceleration of 0.5 seconds.

In the current “internal competition” level of China’s new energy market, manufacturers will not resort to “price increases” unless absolutely necessary, and the direct cause is the rise in raw material prices, but fundamentally it is a game between supply and demand.

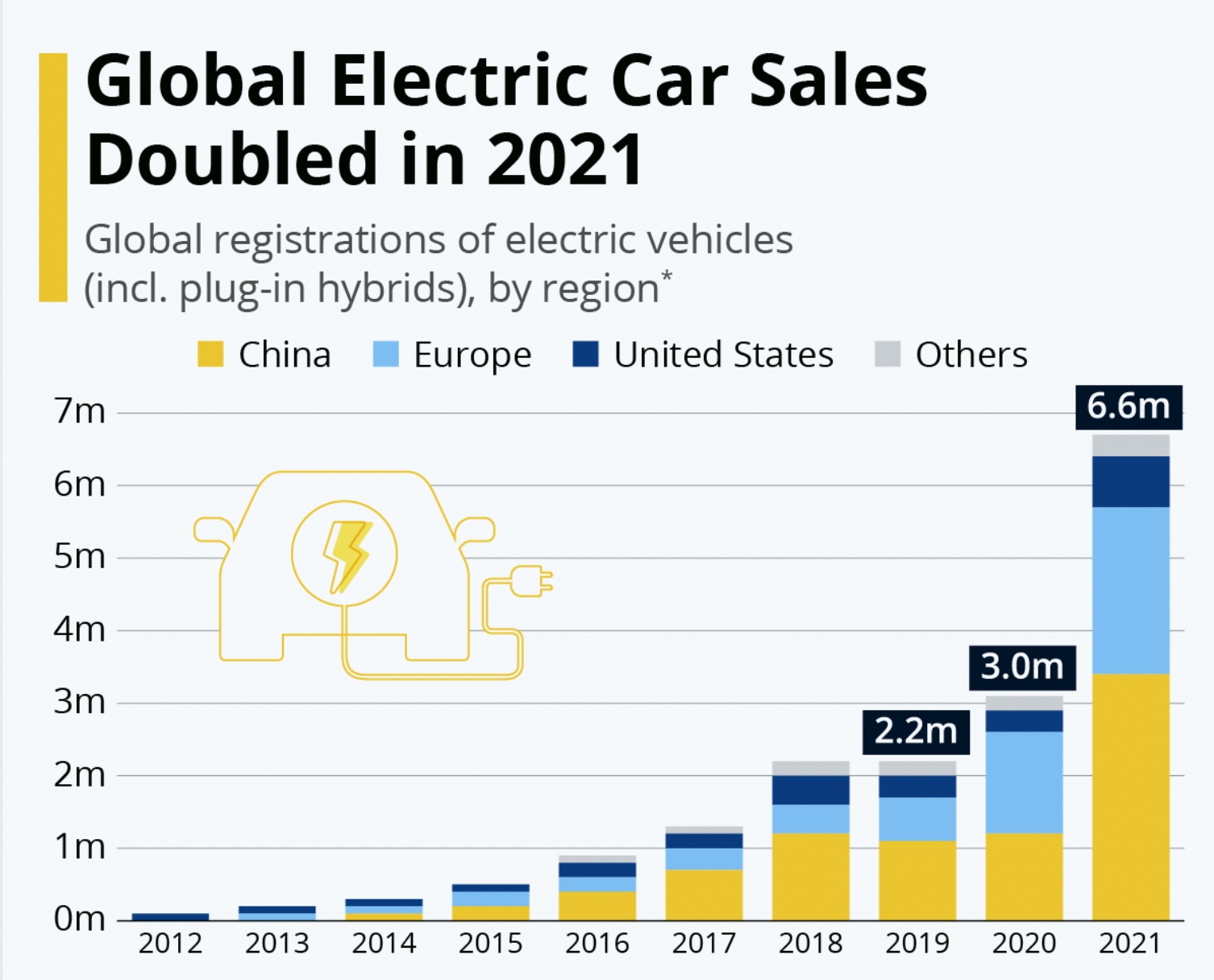

Demand: The Butterfly Effect Caused by China, America and EuropeAccording to data from the Ministry of Industry and Information Technology, the sales volume of new energy vehicles in China reached 3.521 million in 2021, an increase of 1.6 times compared to the previous year. And the momentum of this “rocket” growth has not weakened at all – according to data from the China Association of Automobile Manufacturers, the sales volume of new energy vehicles in January to February 2022 reached 765,000, an increase of 1.5 times compared to the previous year. Relevant agencies predict that the sales volume of domestic new energy vehicles will exceed 5.5 million in 2022, an increase of over 70\% compared to the previous year, and the penetration rate of new energy will reach 22.1\%. By 2025, the sales volume of domestic new energy vehicles will exceed 10 million, and the penetration rate of new energy will exceed 40\%.

At the same time, although Europe started its new energy strategy later than China, its catching-up momentum is very strong. In 2021, the sales volume of new energy vehicles in Europe reached 2.142 million, an increase of 68.7\% year-on-year. Among the eight major CR8 countries, the penetration rate of new energy reached 21\%, which is higher than that in China. It is expected that by 2025, the sales volume of new energy vehicles in Europe will reach 5.915 million.

What is more surprising is the United States. Except for Tesla, it has always been ridiculed as “American-style big V8, environmentally friendly? Go f*** yourself”. However, after President Biden took office, the United States has also started to fully embrace new energy. In 2021, Biden proposed to invest $174 billion in developing the electric vehicle industry, $100 billion of which will be used for subsidies. If it is a domestically produced electric vehicle, it can receive up to $12,500 in subsidies.

Against this background, the sales volume of new energy vehicles in the United States reached 652,000 in 2021, an increase of 101.2\%. It is expected that the sales volume of new energy vehicles in the United States will continue to maintain high growth in 2022. Institutions predict that the sales volume of new energy vehicles in the United States will reach 1.4 million in 2022, an increase of 114.7\% year-on-year. It is expected that by 2025, the sales volume of new energy vehicles in the United States will reach 5.62 million, almost nine times that of 2021.

China, the United States, and Europe, the world’s three largest markets, are almost developing new energy at the same time. Under the “resonance” of the three major markets, institutions predict that the global sales volume of new energy vehicles will exceed 10 million in 2022, an increase of 64\% compared to 2021.To achieve such a grand goal of new energy vehicles, battery supply is naturally the top priority.

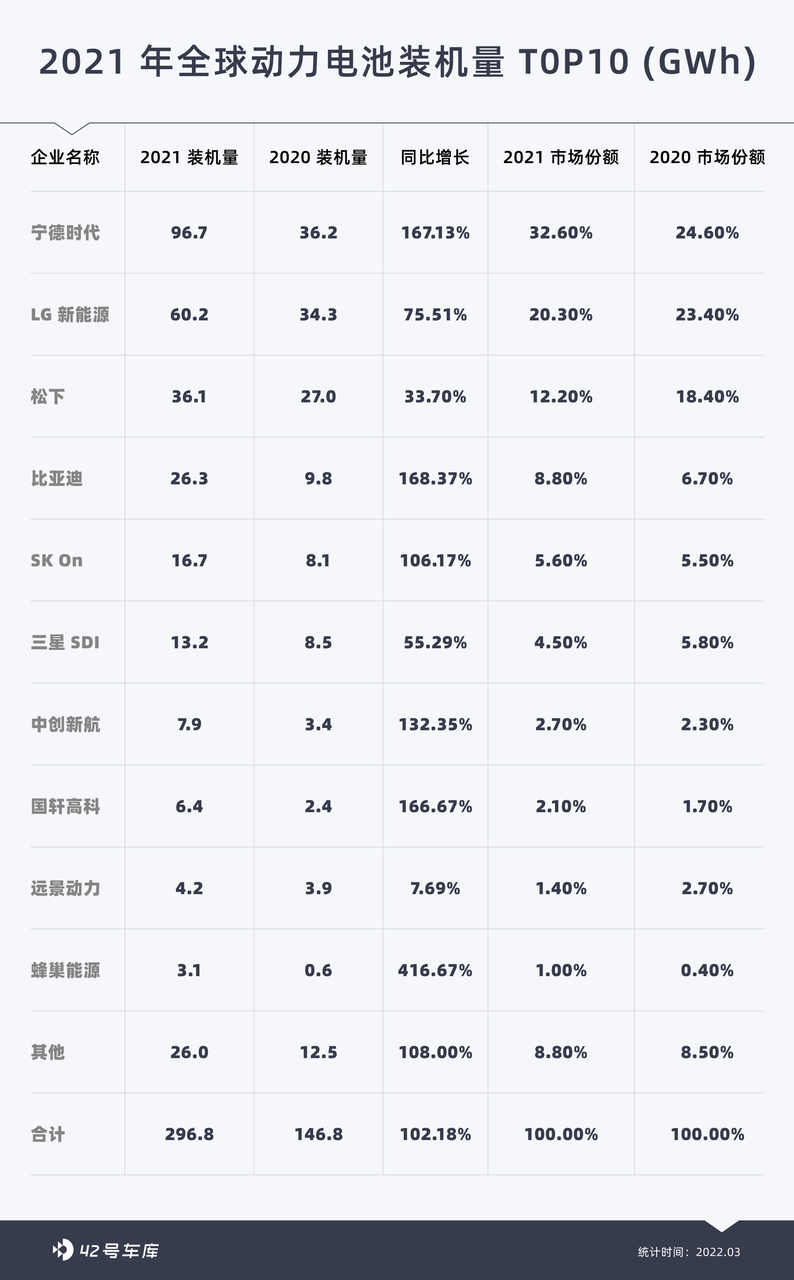

According to the latest data released by South Korean research firm SNE Research on February 7th, the total installed capacity of global power batteries in 2021 was 296.8 GWh, an increase of more than 100% compared to the previous year, consistent with the growth of new energy vehicles.

Among them, Chinese battery manufacturers occupy more than half of the market share, with only Ningde Times, which ranks first, occupying 32.6% of the global market share. In addition, three South Korean battery manufacturers occupy 30.4% of the market share. It can be said that it is a battle between China and South Korea.

However, as Europe and the United States invest more in new energy, it is naturally impossible to completely hand over the most important part of new energy vehicles—batteries to foreign companies. Currently, Europe and the United States are both consciously supporting the local power battery industry. For example, Northvolt in Europe plans to achieve a battery production capacity of around 150 GWh by 2030, occupying 25% of the European market share. ACC also plans a capacity of 120 GWh, with shareholders including Daimler and Peugeot. In addition to Tesla, local companies in the United States are also actively attracting enterprises such as Samsung SDI and LG New Energy to build battery factories locally. Recently, there has been news that Ningde Times and Guoxuan High-tech also intend to build factories in the United States and cooperate with local companies such as Tesla.

After everyone has joined the battlefield of power battery competition, battery production capacity will usher in a new wave of explosive growth, making the competition for upstream raw materials even more intense.First of all, lithium batteries cannot do without “lithium”. Since Sony commercialized lithium batteries in 1991, lithium batteries have been developing well. However, compared with the demand for lithium in electronic products and household appliances, the demand for power batteries is small potatoes. Can the capacity increase of hundreds of GWh upstream in recent years really sustain it?

Supply: South America and Australia’s expansion is not strong.

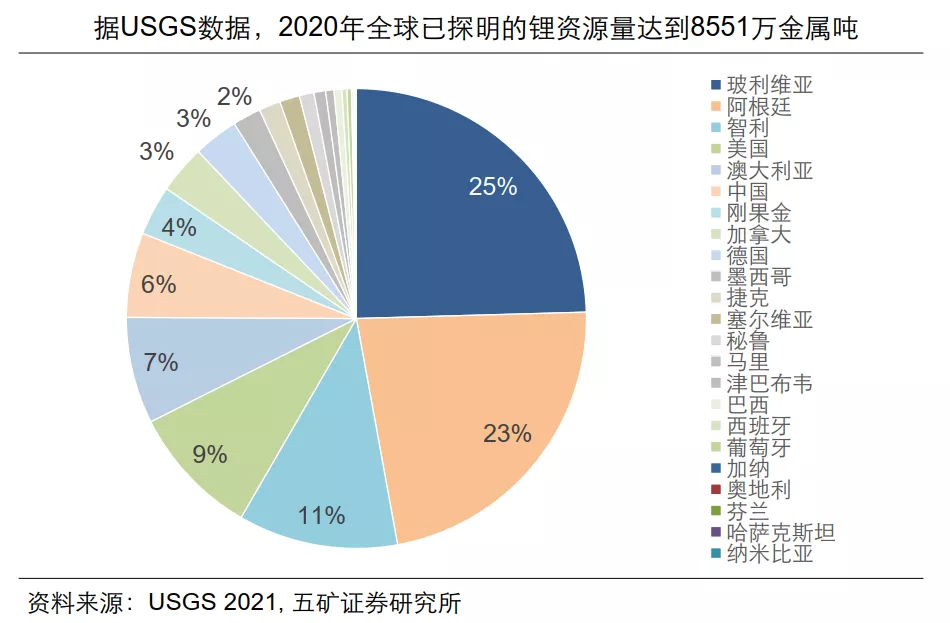

Since 2014, China has been the world’s largest consumer and manufacturer of lithium batteries, but in terms of raw materials, 70\% of upstream raw materials for lithium salts rely on imports. According to data from the USGS, in 2020, China accounted for only 6\% of the identified lithium resources, and the vast majority of reserves are distributed in the “Golden Triangle” of salt lakes in South America and lithium mines in Western Australia.

The peak period for the expansion and exploitation of salt lake resources in South America was in 2021, and the development cycle of resources has objective cycle rules. At the same time, the infrastructure in the South American region is relatively backward, making the construction of salt fields difficult. It is estimated that there will not be a considerable increase until at least 2023 and later.

In addition, the quality of lithium concentrate produced by South American salt lakes is generally poor, and it needs to be transported back to China for conversion. However, China’s conversion capacity has basically been saturated, and increasing this capacity also requires time.

On the other hand, the expansion of Australian lithium mines is still full of uncertainties. Due to the “lying flat” protection measures against COVID-19, many workers are absent from work due to illness. Moreover, Australia is facing a shortage of labor, and the quality of mined ores is declining. Even the production of lithium concentrate in the fourth quarter of 2021 has decreased by 6\%.

The contradiction between supply and demand is difficult to solve in a short time, and we must also be wary of IGBT price increases.

At present, it is difficult to solve the contradiction between supply and demand for “lithium” in a short time. The price of lithium carbonate has risen from around 50,000 yuan per ton last year to around 500,000 yuan per ton now, and is expected to remain at a high level in the future.

If a car is equipped with a battery pack with a capacity of 60 degrees, it will consume about 50 kg of lithium carbonate, and the cost of this item alone has increased by approximately 22,000 yuan compared to the lowest point last year.

In addition, other positive electrode materials for ternary lithium batteries, such as nickel and cobalt, the electrolyte material lithium iron phosphate, and the positive and negative electrode current collector fluids copper and aluminum, have all increased to a certain extent. Therefore, an increase of 2 to 3 yuan in the cost of a battery is not too much.

And from upstream to consumers, there is a portion of the costs absorbed by manufacturers themselves. Therefore, there are also some car models on the market with small or no price increases, such as NIO’s SUV models, Zeekr 001, and so on.

And from upstream to consumers, there is a portion of the costs absorbed by manufacturers themselves. Therefore, there are also some car models on the market with small or no price increases, such as NIO’s SUV models, Zeekr 001, and so on.

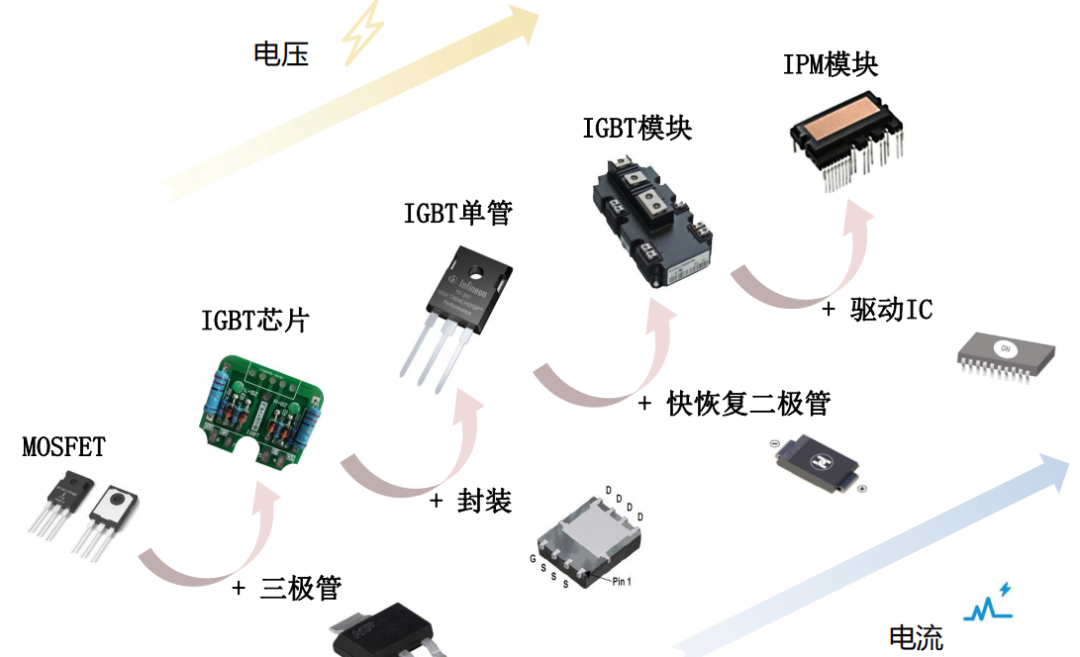

However, in addition to batteries, new energy will also face another major price increase threat – IGBT power semiconductors. Since 2021, the general shortage in the automotive industry is not in batteries, but rather in MCU control chips. With the rapid development of new energy, the power chip IGBT is also in short supply.

IGBT chips are not cheap, accounting for 8-10\% of the cost of the entire electric vehicle. Currently, the production capacity of 6-inch chips foundries is fully loaded, and new production capacity cannot be put into operation for a while. In addition, the strong demand of industries such as electric vehicles and photovoltaics has caused the price of IGBT to increase cumulatively by 22\% from October last year to the present. Infineon raised the price of its orders for Huawei and Sungrow by 6\% in January of this year and issued a price increase letter in February. Industry insiders currently expect that the tight supply of IGBT will not be significantly relieved until 2023, so car manufacturers will still face considerable price pressure in 2022.

With batteries in front and IGBTs in the back, it seems that the “wait and see party” has completely lost. The price of electric cars in 2022 is still dominated by the word “increase.” Will the price of lithium mines fall? Are there enough minerals on earth for electric cars?

Starting from first principles, are there enough minerals on earth for electric cars?

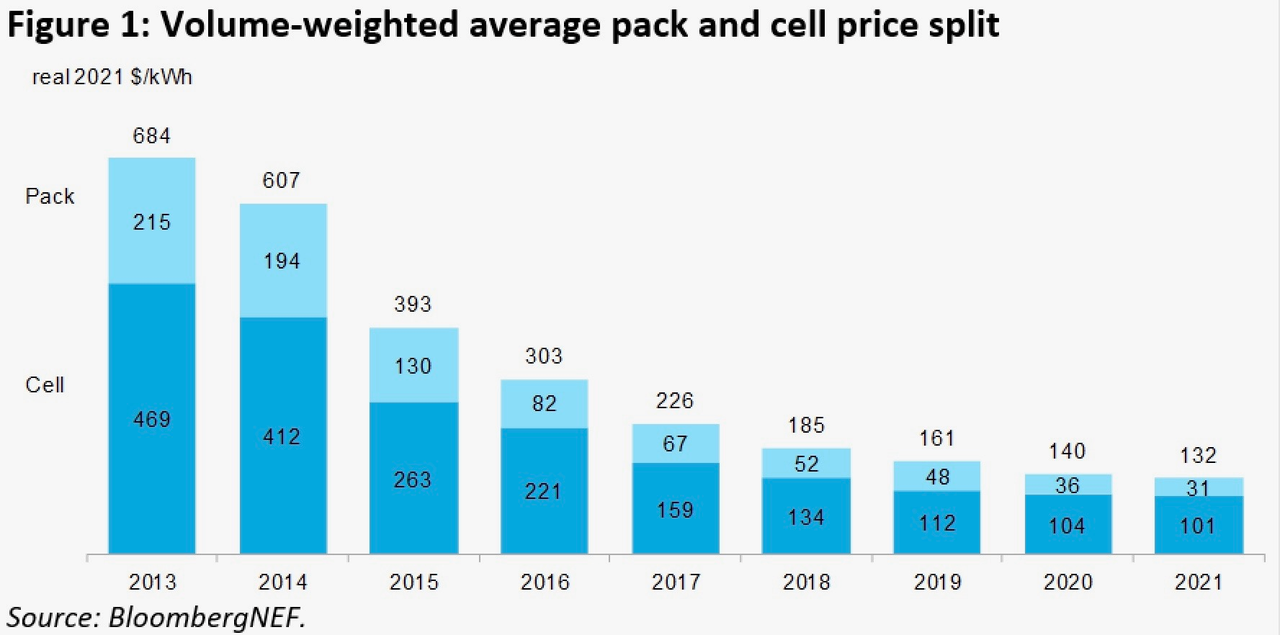

Going back to more than a decade ago, the cost of lithium batteries was as high as $684 per kwh. At this time, if you built an 85 kwh electric car, the battery cost alone would have been at least $50,000. But starting from the first principles, if you buy the lithium, nickel, cobalt, manganese and other raw materials needed for batteries from the London Metal Exchange (LME) and assemble them, the cost is only 80 cents per kwh. If the cost of batteries continues to decline, eventually reaching $80 per kwh, then electric cars will naturally defeat gasoline cars.Currently, the further cost reduction of electric vehicle batteries has encountered some setbacks, and the speed of replacing fuel vehicles may slow down. However, over a longer time horizon, as the lithium production in South America and Australia increases, the “demon lithium” and “demon nickel” will be things of the past. So, another question arises: if everyone in the world drove electric cars, would the earth have enough minerals?

Similarly, from a “first principles” perspective, according to the statistical data from USGS in 2021, the world’s current confirmed lithium reserves are 85.51 million tons. If each electric vehicle requires 6 kg of metallic lithium for 60 degrees of electricity, and there are 8 billion people in the world, assuming that the number of cars per thousand people is 700, a total of 33.6 million tons of lithium will be consumed, which is entirely sufficient, and there will be many new lithium mines and salt lakes discovered in the future.

As for the nickel and cobalt required for ternary lithium batteries, currently 70\% of nickel’s use is in stainless steel, with an annual output of millions of tons. So, diverting a portion of it to electric vehicles would suffice, and production can be further increased in the future.

Regarding the future shortage of cobalt metal, the industry’s development trend is indeed towards “cobalt-free” batteries. For example, lithium iron phosphate batteries do not require cobalt, and bee hive energy’s cobalt-free battery has been installed in cars since last year.

Overall, in 2022, due to the imbalanced supply and demand, the rising prices of battery raw materials, and the expected price hike of IGBT chips, price increases for new energy vehicles are inevitable. This trend may continue for some time, so here we advise those who are waiting to surrender. Take advantage of the many models that haven’t increased in price or have only increased slightly and cherish your purchases.

Finally, we welcome everyone to download the Garage App to learn about the latest new energy information. If you want more immediate communication, you can click here to join our community.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.