Author: Zhu Yulong

In 2020, 2021, and 2022, the automotive industry has been constantly turbulent and iterating, and the European automotive parts industry is also constantly changing.

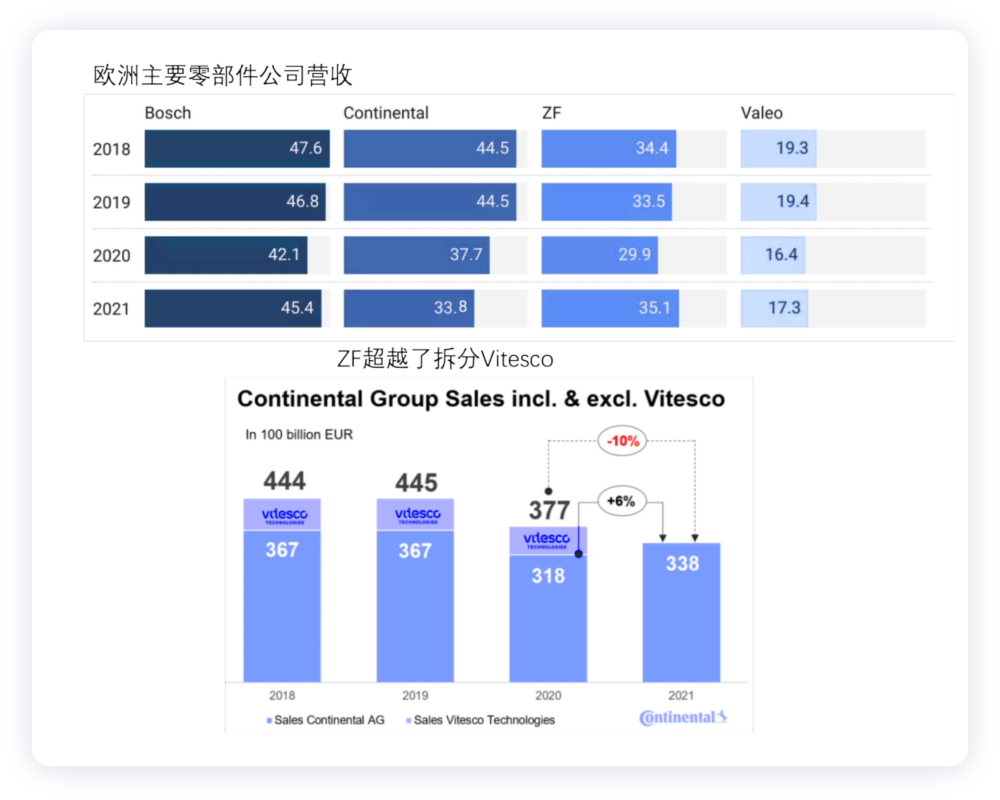

The major European component companies have all recovered in 2021. Industry leader Bosch’s automotive business bounced back to 45.4 billion euros in 2021; ZF Friedrichshafen’s automotive revenue exceeded Continental Group, rising from 32.6 billion euros in 2020 to 35.1 billion euros; Continental Group’s sales dropped 15.0% to 37.72 billion euros in 2020. After the split of Vitesco in 2021, sales have increased by 6% to 33.8 billion euros.

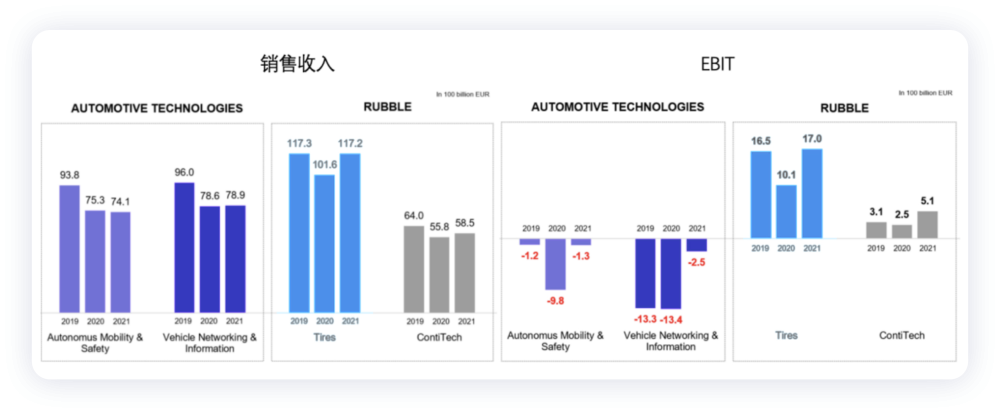

From the current automotive business of Continental, the two business segments of autonomous driving & safety and vehicle connectivity & information have been in a continuous loss state for three years in a row, with losses of 130 million euros and 250 million euros in 2021. There are rumors that the autonomous driving business may be split, and even other automotive businesses may be separately split.

Market Value of Continental

Currently, Continental’s market value is only 13.488 billion euros. In 2018, Continental’s stock price once reached as high as 251 euros/share. Now the market value has fallen by 73%. In September 2021, the powertrain division was successfully listed independently under the name Vitesco AG, although the current situation is not particularly good.

Continental’s current organizational structure mainly includes three business segments: the Automotive Group, the Tire Group, and the ContiTech Group. Among them, the tire business earned 2.2 billion euros, while the automotive business had a loss of 370 million euros. CFO Katja Dürrfeld said that an additional 2.3 billion euros in expenses will be needed in the 2022 fiscal year to cope with the increase in procurement and logistics costs.

# The tough situation of the automotive industry in 2021

# The tough situation of the automotive industry in 2021

The automotive industry in 2021 is really tough. Besides considering the chip issue, it also needs to continue investing in meeting the demands of car companies in the future. Therefore, from a logical perspective, decisive actions must be taken, otherwise, the valuation of 7.41 billion euros for autonomous driving and safety business plus the 7.89 billion euros for the electronic and electrical business will indeed be unsightly.

-

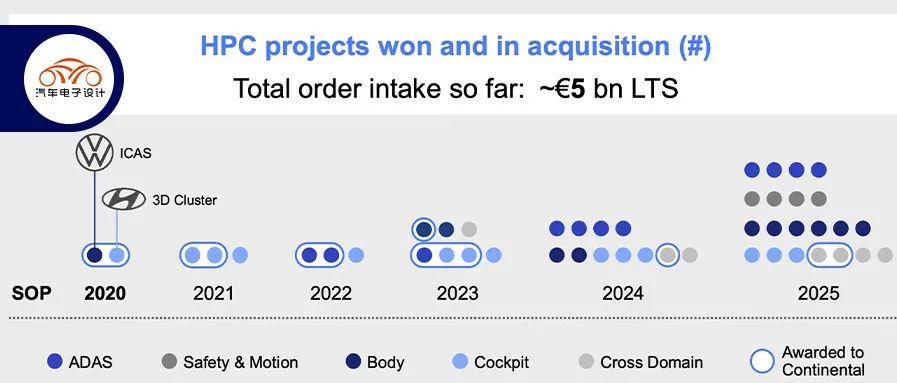

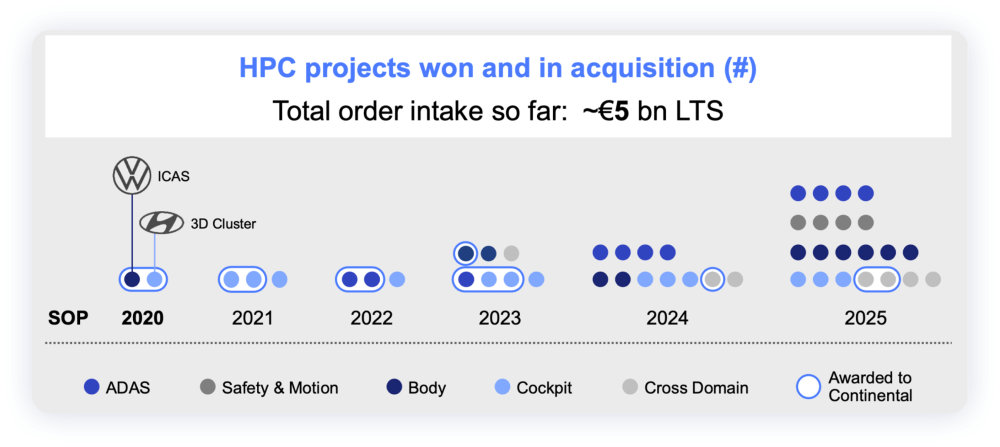

Body HPC

In 2023, there will be three OEMs: China, France, and Germany. -

Cabin HPC

Renault, BMW and German clients. -

Autonomous driving HPC

In 2022, German and Japanese clients.

What are the valuable products in China?

Autonomous driving business

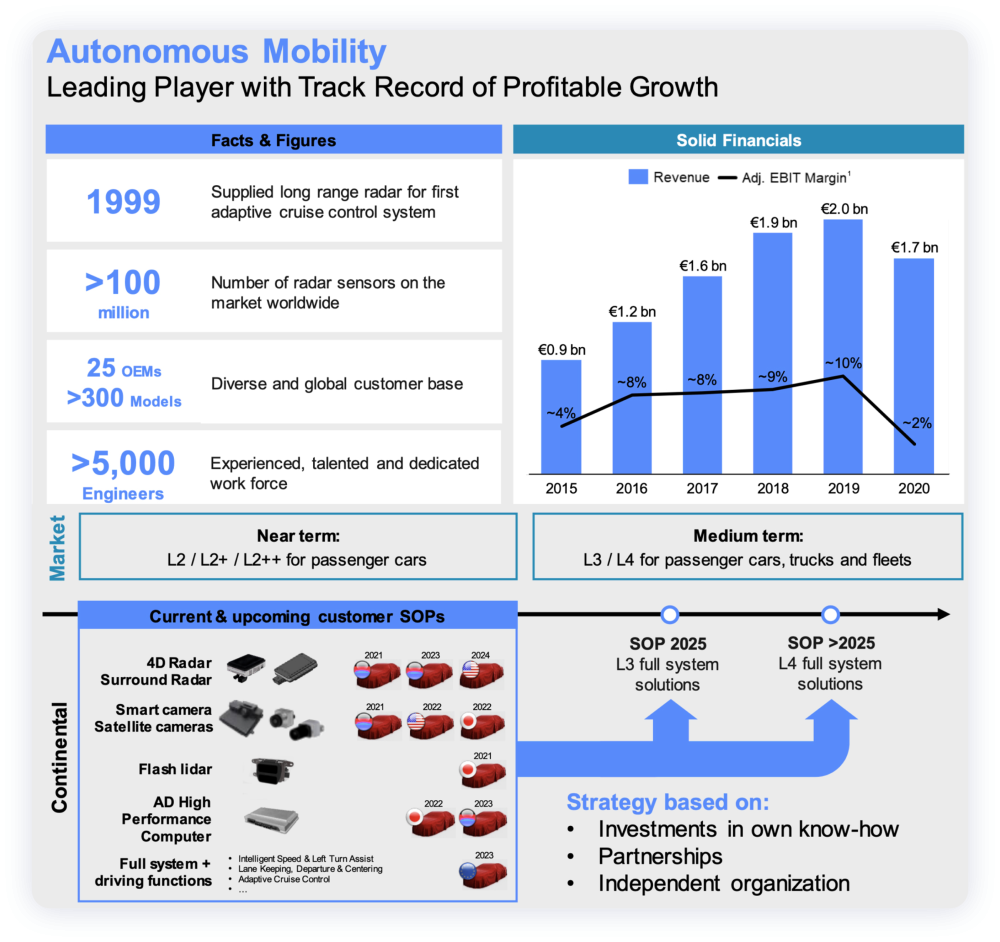

The truly autonomous driving business is worth about 1.7 billion euros, but it is not very profitable. The annual R&D cost for autonomous driving business is as high as 1 billion euros, and the main products are:

-

4D mmWave radar

SOP on German and American client car models in 2023 and 2024, respectively. -

Intelligent camera + Satellite camera

SOP on American and Japanese client car models in 2022. -

Flash Lidar radar

SOP on Japanese client car models last year. -

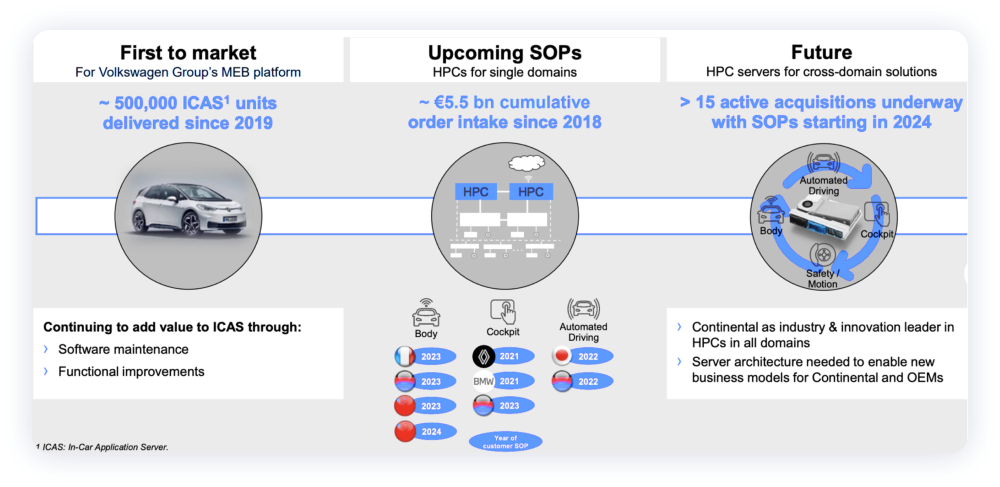

Autonomous driving aid HPC computing platform

SOP on Japanese and German client car models this and next year, respectively. -

Complete system

Batch production on European client car models in 2023.

The problem currently is that the China group has not done well in the autonomous driving business in China.

From the current perspective, autonomous driving needs to connect with a lot of resources:

-

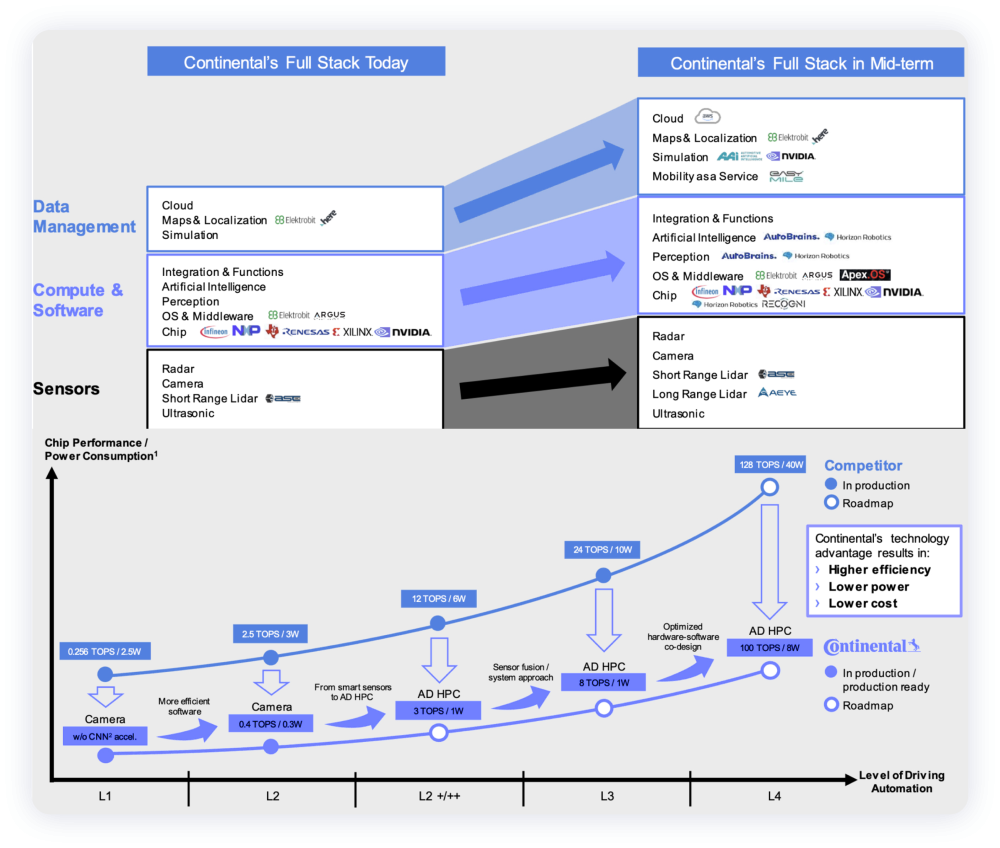

Data management

Cloud import on Amazon, map cooperation with EB and Here, including policy packages such as AAI and NVIDA. -

Computing platform software

Software primarily includes EB, ARGUS expanding to subsequent APEXOS, AI and perception processing cooperating with AutoBrains and Horizon, and chip cooperation with RECOGNI, adding to Infineon, NXP, Renesas, XILINX and NVIDIA. -

Sensors

Lidar is divided into short-range ASE and long-range AEYE.

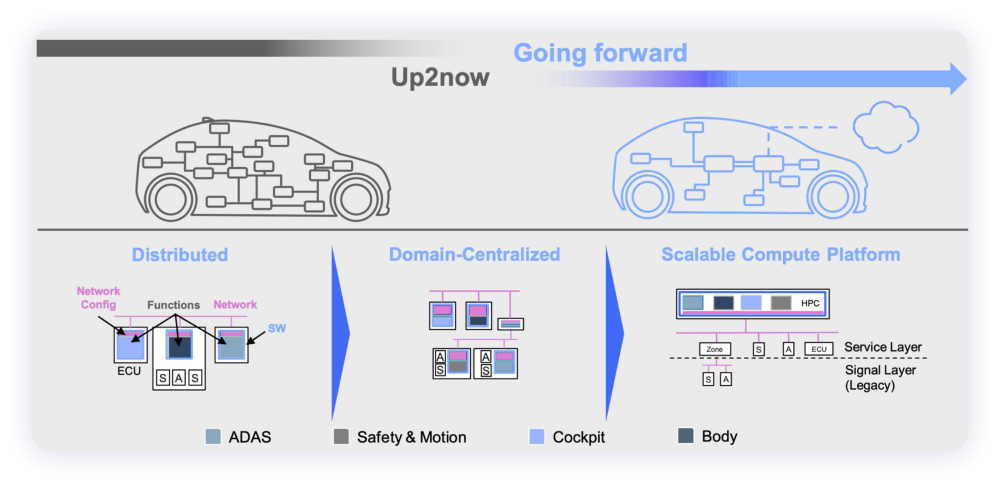

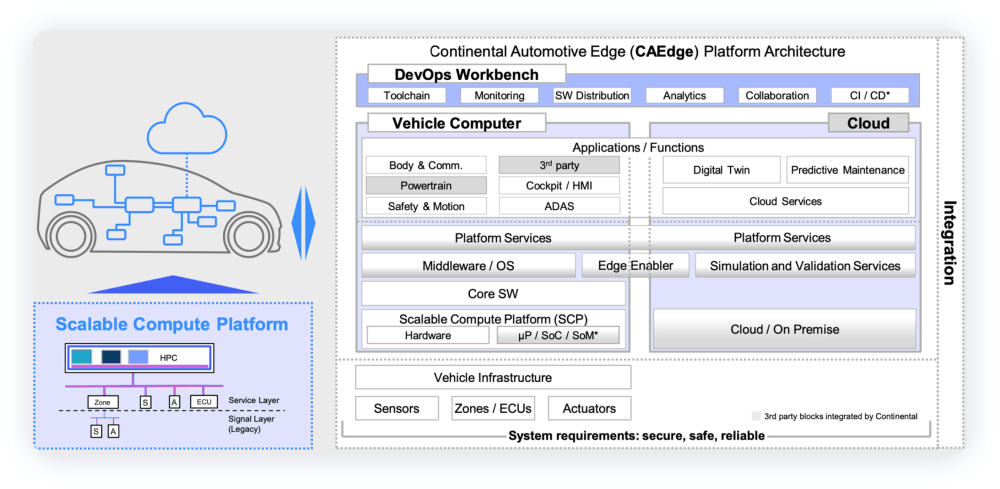

Electrical and electronic architectureThe focus of the mainland’s automotive industry is currently on the body and cockpit, with extensions to chassis safety and cross-domain control, as autonomous driving is not particularly dominant.

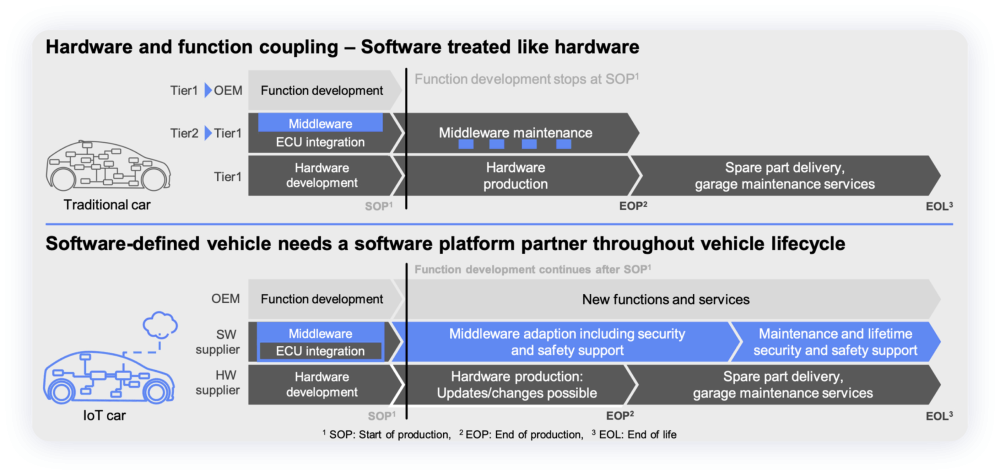

From the current perspective, not only Tier 1 but also car companies are involved in this business, and the division of labor between existing Tier 1 and car company software and hardware development departments on the expandable platform is not yet clear.

Suppliers of software middleware are also competing with traditional Tier 1 suppliers in the intelligent era.

Essentially, this independent edge computing architecture in mainland China needs to be assembled and compatible with different OEMs.

Summary: Regarding Vitesco’s situation, we will arrange it separately later. At this stage of the automotive computing platform, there is still no good communication between huge investment and automotive OEM and chip manufacturers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.