Author: Dayan

In July last year, Volkswagen Group announced its NEW AUTO strategy, stating that it aims to transform into a sustainable software-driven provider of mobile travel services by 2030. And as the backbone of the Volkswagen Group, the Volkswagen brand has also launched its ACCELERATE strategy.

In the past year, faced with the dual impact of the pandemic and chip shortage, both the Volkswagen Group and Volkswagen brand have turned in impressive performance. With the support of systematic capabilities, the Volkswagen’s core business transformation is steadily moving forward. As Volkswagen’s most important single market globally, Volkswagen China’s local R&D capabilities have also made significant progress.

Before the chip shortage, Volkswagen helped luxury and electric cars

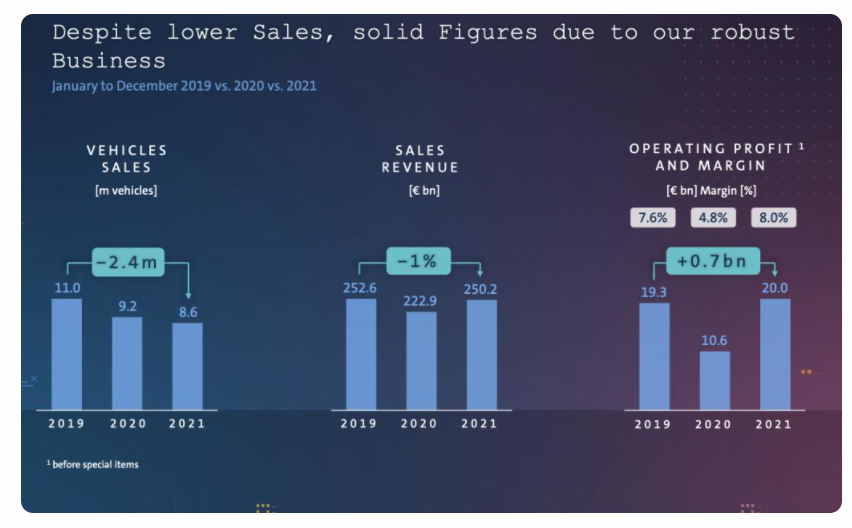

In 2021, major global automakers faced huge challenges from chip supply shortages. As one of the world’s largest automotive groups, the Volkswagen Group’s sales fell 6.3% YoY to 8.6 million units.

Despite the decline in sales, the group’s sales revenue increased against the trend by 12% to 250.2 billion euros. Adjusted operating profit, excluding special items, grew nearly twofold YoY to 20 billion euros. The adjusted operating sales return rate also increased from 4.8% last fiscal year to 8%.

Among them, the largest Volkswagen brand’s passenger car revenue reached 76.127 billion euros, up 7.1% YoY, and operating profit reached 2.503 billion euros, up 451.32% YoY.

Volkswagen’s ability to achieve rapid growth in sales revenue and profit margins in the face of declining sales is mainly due to a significant increase in sales of higher-margin premium models under the Volkswagen Group.

Looking at individual brands, Volkswagen brand passenger cars delivered 4.8969 million new vehicles globally, down 8.1% YoY; Audi brand delivered 1.6805 million new vehicles globally, a slight decrease of 0.7% from the same period last year; Porsche brand delivered 301.9 thousand new vehicles globally, an increase of 10.9% YoY; Bentley brand delivered nearly 14.7 thousand new vehicles globally, an increase of 30.8% YoY.

The noteworthy part is that Volkswagen’s electric vehicle deliveries have also rapidly increased to 452,900, nearly double the previous amount. In the European market, Volkswagen holds 25% of the market share and leads the electric vehicle market. In the US market, Volkswagen ranks second with a market share of about 7.5%. In the Chinese market, Volkswagen delivered 92,700 pure electric vehicles, four times the delivery volume of the 2020 fiscal year.

The noteworthy part is that Volkswagen’s electric vehicle deliveries have also rapidly increased to 452,900, nearly double the previous amount. In the European market, Volkswagen holds 25% of the market share and leads the electric vehicle market. In the US market, Volkswagen ranks second with a market share of about 7.5%. In the Chinese market, Volkswagen delivered 92,700 pure electric vehicles, four times the delivery volume of the 2020 fiscal year.

Therefore, in terms of overall sales, Volkswagen will prioritize using its limited chip resources to ensure higher-profit models such as Porsche, Bentley, and Audi. At the same time, in order to achieve the NEW AUTO strategy, the chip resources required for electric vehicles will also be prioritized.

According to Volkswagen’s estimates, if the chip supply crisis can be eased, the group’s product delivery volume in 2022 will increase by 5% to 10% compared to 2021, and sales revenue will increase by 8% to 13% year-on-year. In terms of operating profit, the group’s operating return on sales is expected to be between 7% and 8.5%.

The orderly advancement of the NEW AUTO strategy

NEW AUTO strategy: By 2030, the group will transform into a sustainable, software-driven, mobile transportation service provider.

Currently, with the help of the MEB platform, Volkswagen is quickly launching electric vehicle models in the global market and building a relatively complete electric vehicle matrix in a very short period of time. Recently, the newly released ID.Buzz has also received positive market feedback.

However, Volkswagen hopes that the MEB platform will not only be used to help launch new models, but also become an industry standard. Opening up the MEB platform means that Volkswagen can further reduce costs and dilute previous R&D investment. Companies such as Ford will launch 1.2 million electric vehicles based on the MEB platform in the next six years, further consolidating the strategic position of the MEB platform in the global electric vehicle market.

However, as the saying goes, “Cats do not teach tigers to climb trees.” While developing the MEB platform with Ford, Volkswagen is also focusing more of its energy on the SSP platform.The new platform will integrate MQB, MSB, and MLB three traditional fuel platforms, as well as MEB and PPE two electric platforms, to maximize the synergies of the Volkswagen platform. The first model, Trinity, based on SSP platform will be launched in 2026. This model will feature greatly shortened charging time, range exceeding 700 kilometers, and Volkswagen’s latest software, which supports L4 autonomous driving.

To meet the SOP deadline, Volkswagen invests 800 million euros in establishing a research and development center dedicated to the development of SSP platform, and invests another 2 billion euros to build a process-optimized SSP new factory adjacent to the Wolfsburg main factory.

It is worth mentioning that to match Volkswagen’s ambitious electric vehicle plan, Volkswagen plans to build 45,000 high-power charging terminals worldwide by 2025. Volkswagen will cooperate with local companies in Europe, China, and the United States to lay out charging terminals within less than four years on the condition of having already invested in 10,000 charging terminals.

As a pioneer of Volkswagen’s transformation, CARIAD is gradually becoming the main carrier for Volkswagen in the era of software-defined cars. In the field of autonomous driving/driving assistance, CARIAD has successfully integrated Hella’s camera software business and collaborated with Bosch in developing L3-level autonomous driving technology. In 2022, through OTA upgrades, CARIAD will further optimize the customer experience by launching new Full Journey Assistant System 2.5, Plug-and-Charge function, multi-point route planning as well as upgraded voice control function. It is worth mentioning that through its cooperation with Mobileye, Volkswagen’s full-journey driving assistance system technology is already at a leading position in the European market.

Regarding mobile travel, the acquisition of Europcar related transactions can be completed in the second quarter of this year. In this field, the automatic driving fleet will be the highlight of Volkswagen’s mobile travel. With ID.Buzz and ARGO AI software installed, ID.Buzz has already undergone road tests of autonomous driving in Munich.In 2023, relevant tests will be extended to the US market, and in 2025, Volkswagen will launch commercial autonomous ride-sharing services in Hamburg, Germany to achieve the comprehensive on-the-ground deployment of its autonomous driving technology in the mobile travel industry.

The Chinese Market is an important support point for Volkswagen’s transformation

China is a key element in the smooth realization of the NEW AUTO strategy.

According to Volkswagen’s plan, by 2030, it will increase its market share in the new energy vehicle market to the same level as its fuel vehicle market share. Compared with the European and American markets, the competition in the Chinese automotive market, especially the electric vehicle market, is more intense. Although the growth rate of the new energy vehicle sub-market in the domestic automobile market is the fastest, with over 100 products being sold simultaneously, the entire market competition has reached a white-hot stage.

For Volkswagen, strengthening its local R&D capability is the key to ensuring Volkswagen’s competitiveness in the domestic electric vehicle market.

On the one hand, as Volkswagen participates in the share reform process of JAC Motors, Volkswagen will further deepen Volkswagen (Anhui)’s R&D capabilities, becoming the key to Volkswagen’s better coping with domestic changes and increasingly fierce market competition.

At present, Volkswagen has a R&D team of over 6000 people in China. By better understanding the demands of local consumers and helping Volkswagen to occupy the largest market share in the fuel vehicle era, the same will also be the key to victory in the smart electric vehicle era. For Volkswagen China, with the easing of the shortage of chip supplies, the constant expansion of ID. city showrooms and ID. agents, as well as the provision of OTA remote upgrade functions, the ID. series models are expected to resume their high-speed growth in the domestic market.

On the other hand, CARIAD, which is of great importance in Volkswagen’s global layout, will continue to expand its team in China.

In the near future, the CARIAD team in China will double its existing team of 600 engineers to provide support for software localization. Through OTA, whether to repair software defects, unlock new features, or upgrade autonomous driving-related capabilities, a strong CARIAD team is the key to success.

Lastly2022, the global chip supply shortage is expected to be alleviated, but an unexpected Russo-Ukrainian war has cast a shadow over the global, especially European economic recovery.

For such a huge company like Volkswagen, various difficulties and obstacles are bound to be encountered in the transformation process. The adjustment of organizational structure, restructuring of personnel positions, and massive capital expenditures made for transformation may face the possibility of backlash and failure at any time.

However, if Volkswagen does not transform, it will not only be left further and further behind by Tesla, but also face the possibility of being surpassed by other new forces in the automotive industry. Therefore, this transformation is not only a personal challenge for Herbert Diess, but also a war that Volkswagen, as a whole, cannot afford to lose and cannot afford to lose.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.