Wen | Aohu Hu

After three years of rapid growth, the new energy vehicle industry has hit the first wall in 2022.

This spring brings many challenges. We see crude oil prices soaring to over $130 per barrel, we see London Nickel futures soaring 2.7 times in just two trading days, and we see lithium carbonate surging by more than ten times in the past year, almost reaching 500,000 RMB per ton.

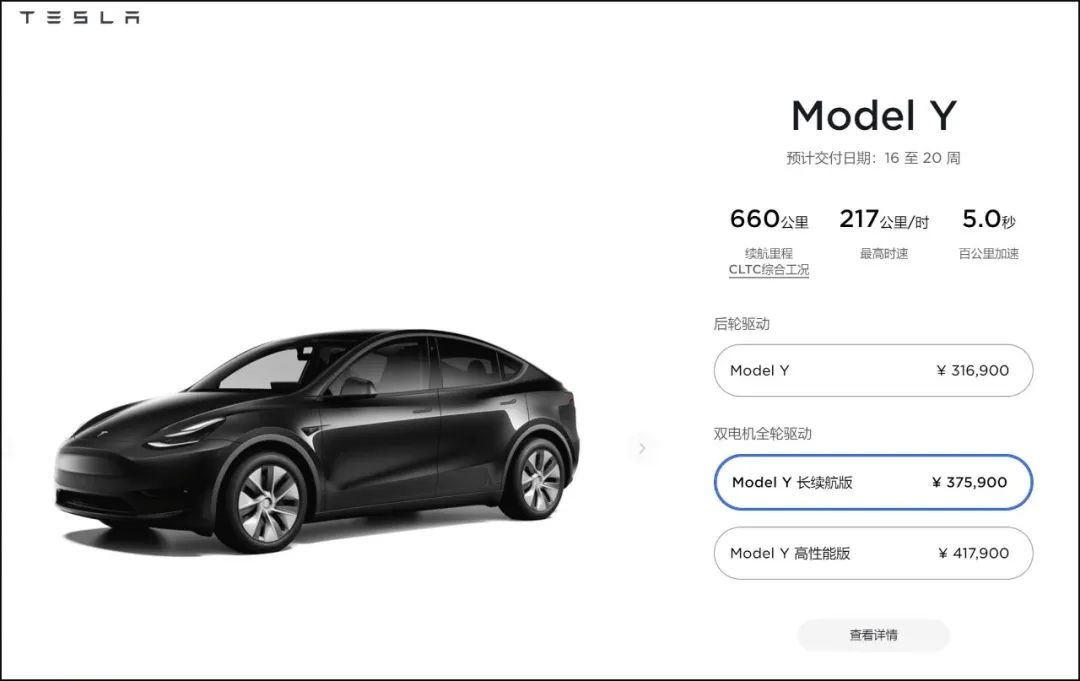

Immediately following this, petrol prices around the country are queuing up, heading towards the era of 9 yuan. Almost every electric vehicle company has announced price hikes, and the increase in the representative models has reached 5% to 8% of the original price.

In January and February of this year, sales of new energy vehicles continued the momentum of last year, but the first two months were not influenced by the widespread price hikes. If the market status was only “continuing from last year,” under the series of adverse factors in March, it is unlikely that subsequent sales will reverse and maintain growth.

More importantly, who can say that the raw material prices have already peaked?

“Also consider the historical process”

Just one year ago, crude oil had risen to over $70, surpassing pre-pandemic levels. The prices of basic metals also reached historic highs. The rise of bulk commodities set new records, so I posted a circle of friends urging my friends and family to buy cars early…

However, who could have predicted that even when the price was already so “high” at that time, the price of crude oil, aluminum, and nickel would rise by more than 50% in the following year, and the price of copper would rise by another 14% (The price of nickel here is still calculated before the “demon nickel” incident).

In recent days, with the media’s constant reports, everyone should know that the reason why the “demon nickel” tripled in 48 hours is related to a certain well-known geopolitical conflict.

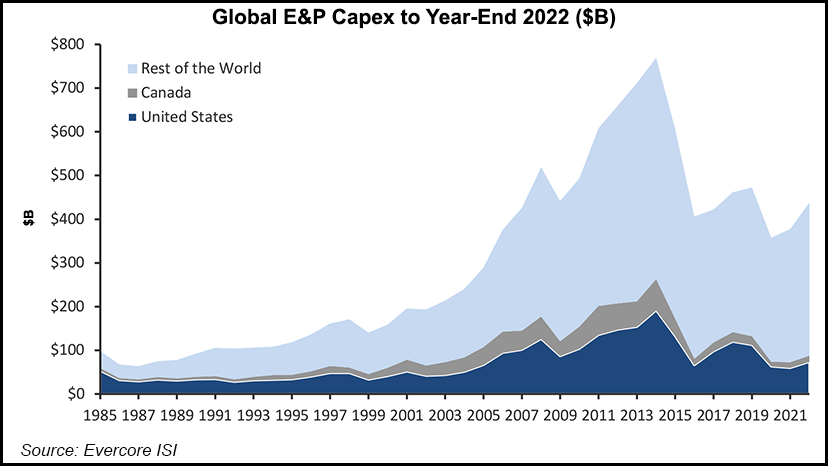

However, unfortunately, various metal futures had been steadily rising for 1-2 years before the outbreak of this conflict. There are few exceptions in the entire bulk commodity market. Everyone has noticed that the Russia-Ukraine conflict caused a short-term surge in crude oil prices, and Brent oil prices once exceeded $130. But in fact, before this, Brent had already risen from $70 in December last year to $100 in February this year, an increase of more than 40%.

Among major industrial metals, aluminum, tin, zinc, etc. are at their highest levels in history, and copper, lead, and nickel (before the surge) are all in the highest price range in history. These metal futures have experienced nearly two years of continuous doubling since the beginning of 2020, and have continued to rise to today after returning to pre-epidemic prices.

The rise in raw material prices has been going on for a long time, and geopolitical conflicts are just the final trigger, so don’t count on the conflict easing and a significant natural drop. Behind this is the long-term mismatch between supply and demand in basic industries, the increasingly disorderly credit expansion of the Federal Reserve and the offshore dollar system, and the extreme trend of global ESG. If forced to establish a causal relationship, the conflict is more like a result than a cause.

It wasn’t until this point that people realized – perhaps they haven’t realized yet: the prosperity of the electric vehicle market and the takeoff of the lithium battery industry in the past three years were actually built on the far-forward fair price of its special raw materials, which have not yet been fully “discovered”.

Compared to gasoline cars, electric cars (of course) require more expensive metals. In addition to battery materials such as nickel, cobalt, and lithium, which gasoline cars almost do not need, electric cars also require more than twice as much copper (wires); for mid-to-high-end models, due to the weight reduction pressure brought by cruising, electric cars also need a lot more aluminum than gasoline cars.

The rise in raw material prices also affects gasoline cars, but to a much lesser extent. Due to differences in the required raw materials, the cost of three-element lithium> lithium iron phosphate> gasoline cars has risen.

“Just a transition”, a sentence of nonsense

Don’t think that this article is “singing bad” about electric vehicles, new energy, and low-carbon sustainability just because you read it to this point. There is no excessive explanation about this, just because I assume that readers of this article have long since escaped from the “either A or B” thinking of “from extreme to extreme”. Perhaps, if electric vehicles continue to struggle in the future, you will also see the new posture of this article “supporting” electric vehicles.# Direction is Not the Issue, There Are Twists and Turns Ahead, with Fast and Slow Rhythms. When You Need to Brake, It’s Not to Stop You from Moving Forward, But to Prevent You from Falling off and Becoming Unable to Stand up Again.

Starting from the beginning of last year, our column has been repeatedly talking about the self-owned brand hybrid technology, especially the new generation hybrid technology based on DHT. As expected, DHT hybrid technology is being quietly prosperous, and DHT-based PHEV is regaining new life.

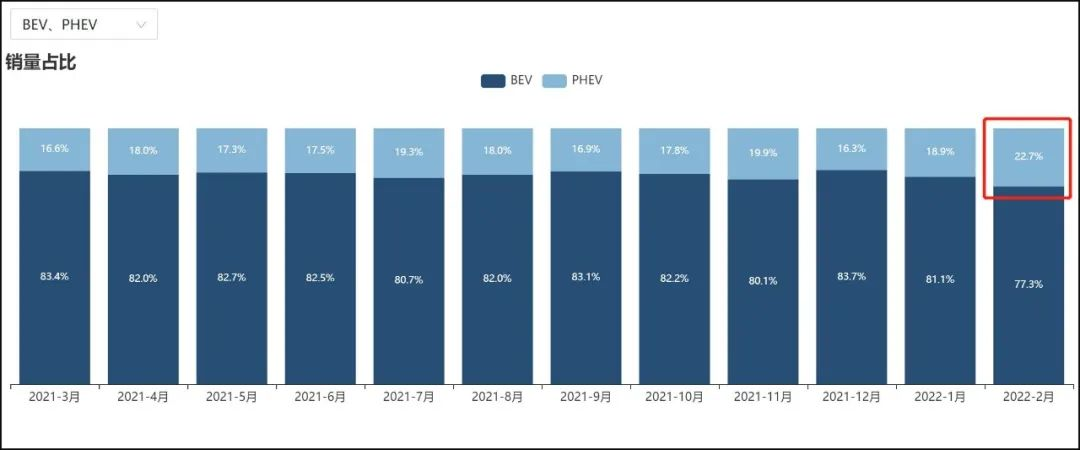

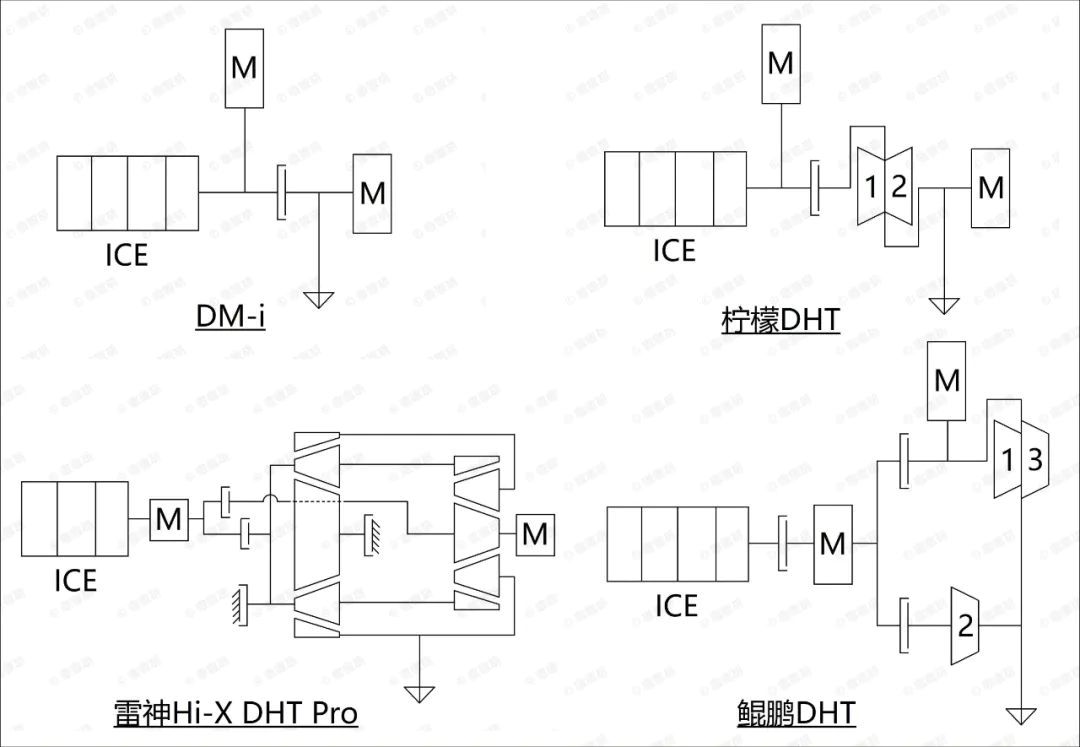

In February of this year, the sales of pure electric vehicles increased by 162% year-on-year, while PHEV reached 350%; PHEV has exceeded 20% for the first time in the proportion of new energy vehicles, reaching a recent high of 22.7%. The main driver behind this trend is the fierce momentum of DHT PHEV represented by BYD DM-i for a year, while DHT of brands such as Great Wall, Geely, and Chery has not yet started to exert force.

Even today, there are still quite a lot of friends who understand hybrid power as a simple “transitional product.” There are also smart people on the internet who like to point out: Hybrid is just a transition, pure electric is the endpoint. Hu has explained this in “The Real Trend in 2021 is Not Electric Vehicles”: (even if) it is a transition, but SO WHAT?

Using Keynes’ words, in the long run, we are all dead. Even if you blindly affirm the final theory of pure electric, there are still tens of billions of people who eat, drink, and live on the road to this future, let alone the present consumption. Don’t indulge in the abstract grand historical narrative from the god’s perspective.

If hybrid power is “just a transition” in the long history of automobiles, isn’t our several decades of life in human history “just a transition”? Just because you and I will be buried someday, does it mean that we can live our lives as if we are waiting to die? “Just a transition” in that case.

Fortunately, while capital is rushing into pure electric vehicles, quite a few practitioners still recognize the importance of “transition” in a timely manner. In the difficult beginning of 2022, the maturity and application of new-generation hybrid technologies have more practical significance, and any business that cannot quickly create a positive cash flow will be a dead end in the coming era of credit tightening and high inflation.

From a global perspective, Chinese indigenous brands have become the main force in DHT hybrids. From hybrid-exclusive engines to hybrid-exclusive transmissions DHT, to three-electric system suitable for hybrids, China’s indigenous automakers are “overtaking in curves” and are truly becoming a reality in the field of hybrids – the kind that can immediately be transformed into cash and performance.

BYD DM-i, Great Wall’s Lemon hybrid DHT, Geely’s Lynk & Co 01+ Hi・X, Chery’s Kunkun DHT. Our column just recently introduced these four indigenous DHT hybrids that are already on the market (please jump to “Only for Better Mixing, DHT Universe Goes Crazy”). Last week, the “2022 International Summit Forum on Vehicle Powertrain Systems,” guided by the Professional Committee of China’s Passenger Car Powertrain held by the Geely Group, detailed Geely’s DHT hybrid technology as one of the organizing parties.

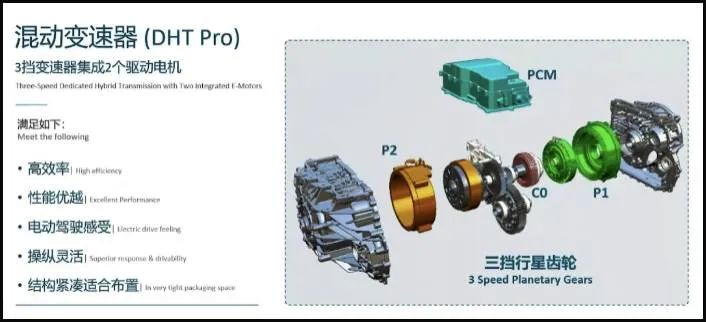

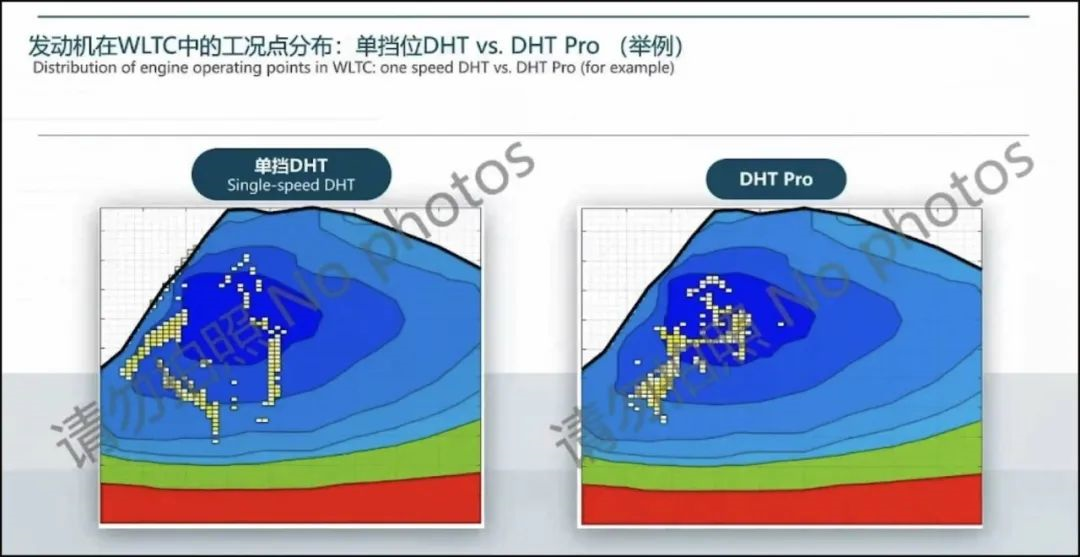

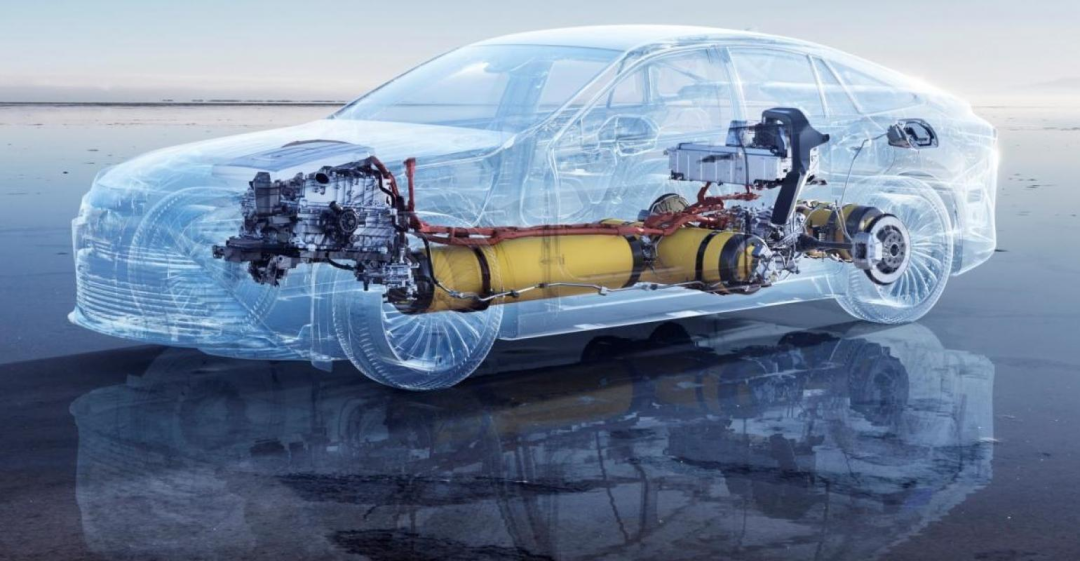

The DHT Pro version of Lynk & Co 01+ Hi・X hybrid is the first DHT hybrid with three gears, which relies on a dual-planetary gear set to achieve multi-gear direct drive. Multiple gear speed ratios enable the engine to be connected in parallel at speeds as low as 20km/h, greatly reducing the scenario where the electric motor is under relatively low efficiency (such as 70%) by operating independently.

Also, since the double-planetary gear set is still in the transmission path when the engine power is cut off, DHT Pro of Lynk & Co 01+ Hi・X can also have multiple gear ratios in pure electric drive/series hybrid mode, which also reduces the level of electric consumption benefits from multi gear ratios.

For HEVs that rely entirely on their own electric power or PHEVs that do not use electric power from the grid, more delicate oil-electric cooperation and care for low-efficiency areas of the motor means a higher overall energy utilization rate. Lynk & Co’s compact SUV, the 01+, which uses the Hi・X hybrid system, has a comprehensive fuel consumption of only 4.3L/100km, while the A-Class sedan in development can be as low as 3.6L.

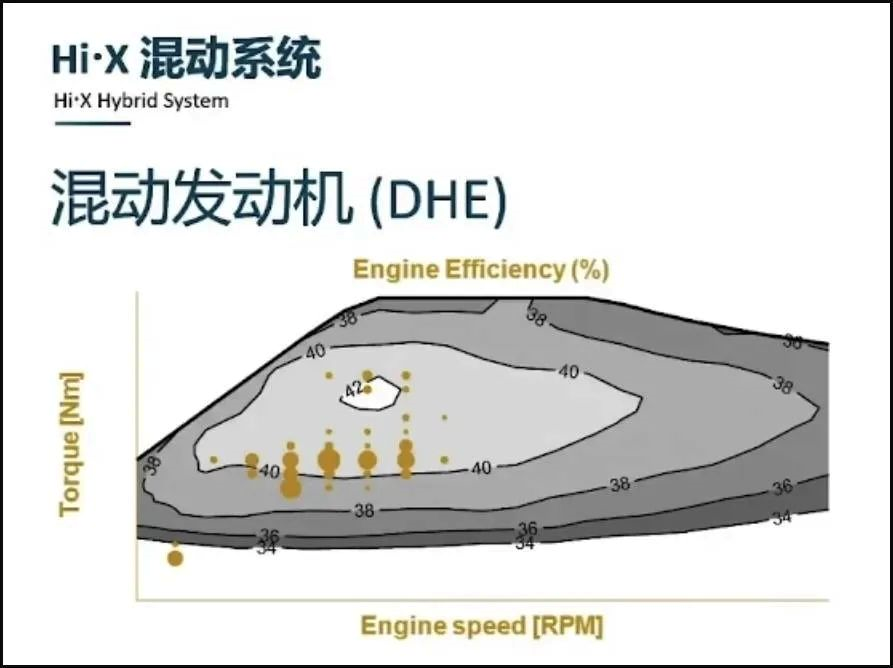

Coupled with the DHE15 hybrid engine developed by Lynk & Co, we already know that its peak thermal efficiency reaches 43.32%. Taking advantage of the opportunity of this summit forum, Geely disclosed the BSFC (break specific fuel consumption) fuel consumption diagram of this engine. It can be seen that the range of efficiency above 40% covers a considerable area, and the high-speed direction extends to about 4500rpm. The high-efficiency area of over 38% almost covers the entire speed range.

Gasoline vehicles face the direct predicament of fuel prices, which is the use cost; electric vehicles face the increase of the vehicle price, which is the purchase cost. The hybrid electric vehicle in between may have more space because of the lower fuel use cost and less impact on the vehicle cost by the three electric components.

However, if the sales of pure electric vehicles continue to be suppressed by the cost end, PHEV with high energy utilization efficiency based on DHT hybrid will be a good stage supplement and an important tool to maintain and promote the trend of electrification.

Are we putting all the eggs in one basket?

The impact of rising raw material prices on the price of pure electric vehicles is not just a simple market sales pressure.

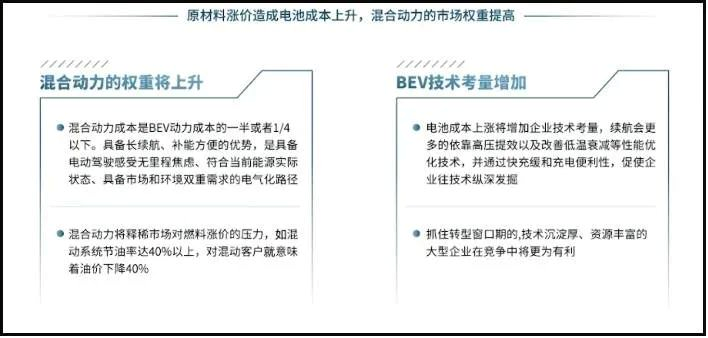

First of all, as summarized by Wang Ruiping, senior vice president of Geely Automobile Group and chairman of the Committee of Automotive Powertrain, the rise in raw material prices will bring two direct consequences: the weight of the hybrid electric power in new energy sources will increase, and the technical considerations for pure electric vehicles will increase.

We have already discussed the first point above. The second point brings new challenges to the development of pure electric vehicles: how to continue to improve performance in a situation where the prices of major raw materials are increasing. In the past, energy density could be increased by increasing the nickel content, but now the price of nickel fluctuates daily; in the past, lightweighting could be achieved by using a large amount of aluminum materials, but today the price of aluminum repeatedly hits new highs.

If we look further ahead, the development and popularization of pure electric vehicles based on lithium-ion batteries will encounter obstacles and slowdown, which also means that other new energy routes have more time and opportunities.

One such alternative energy source is hydrogen, which has received considerable attention and is viewed as an ideal energy source by many. When the price of lithium-ion batteries rises sharply due to raw material costs, the relatively hidden advantages of hydrogen fuel cells become more attractive: less heavy metal usage and easier recycling.

The precious metal needed for hydrogen fuel cells is mainly platinum. Although platinum is expensive and has a low reserve, if hydrogen fuel cells are widely popularized, platinum prices may also rise due to increased demand. However, they no longer require more expensive metals, and the cost of rare materials is lower. Platinum itself is stable in nature and is a catalyst in fuel cells, whose reuse is much lower than the recycling of various rare metals in lithium-ion batteries.The fact that electric cars become more expensive does not mean fuel cell vehicles will replace them. The tremendous practical challenges of fuel-cell vehicles are still present, and there is no absolute advantage of one technology over the other. However, to ignore the development trend would be unwise. If the popularization of lithium-ion battery electric vehicles and the replacement of fuel vehicles are slowing down, it will give new energy options, including hydrogen fuel cells, more windows for development and maturity.

At least for now, both lithium-ion battery electric vehicles and hydrogen fuel cell vehicles still face challenges that are difficult to solve. The uncertainty is real, and any statement made with certainty is at least a false statement.

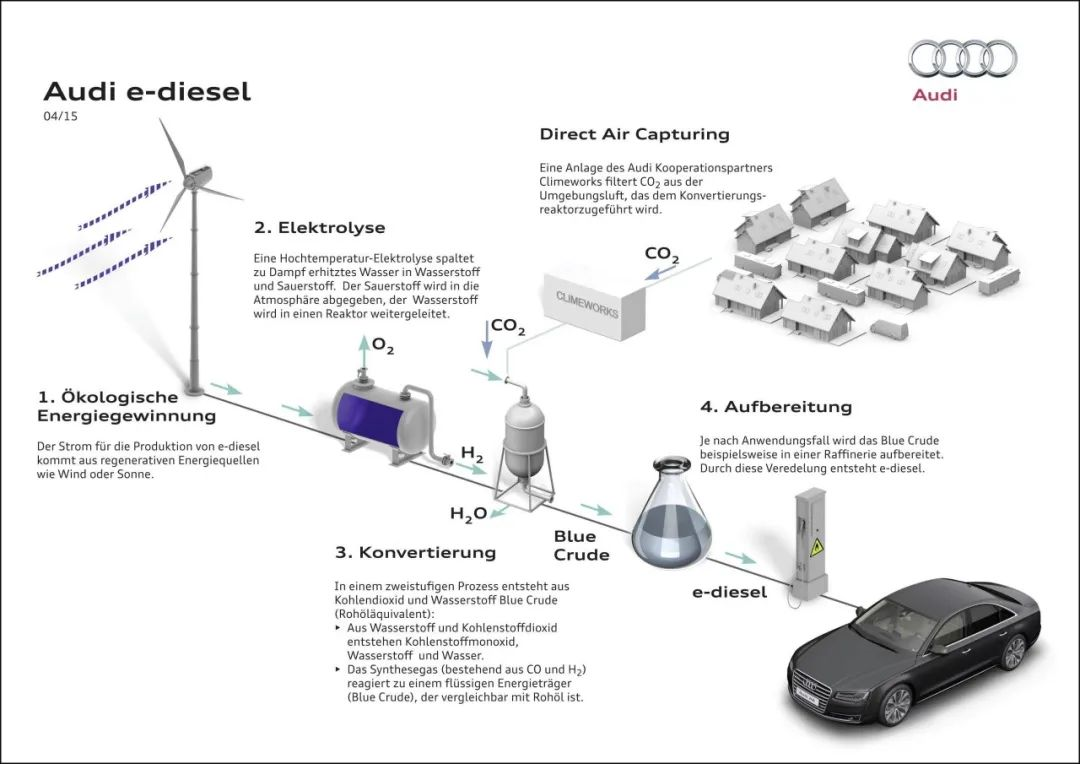

It is precisely because “there is not yet an unbeatable technology”-although lithium-ion battery electric vehicles have made the most progress-that the industry is still researching more new energy automotive paths. Especially the mutual utilization and conversion between lithium-ion batteries, hydrogen, and liquid fuel, combined with lithium-ion battery’s energy storage, hydrogen’s long endurance advantage, and liquid fuel’s storage and transportation advantages.

In the future, perhaps no single energy source will dominate. Our automotive energy revolution, whether it is “oil to electricity” or “oil to hydrogen,” may still lack some imagination. More boldly, it can be a revolution of “single energy to compound energy.”

Fortunately, at this 2022 Automotive Power Forum, we still see many industry experts who are steadfast in their position and are steadily innovating step by step. Even veteran petroleum and chemical companies like Shell are still studying low-friction carbon-neutral lubricants. Old state-owned enterprises like Hongqi are exploring the rapid replacement role of hydrogen internal combustion engines in the popularization of hydrogen energy.

Some conclusions are becoming clearer. Just as the destruction of the natural environment by humans in the past was due to brainless pursuit of economic development, today’s exploration of future energy, pursuit of sustainable development, and consideration of future generations will require our generation to pay real costs.

The cost of sustainable development is necessary, but it must be controlled. The pace and form of the cost of sustainable development that falls on us directly affects the real cost of life for each of us. Energy revolution is not only about lithium ion batteries, photovoltaics, trillion-dollar market, and NASDAQ, but also about every aspect of our daily life such as clothing, food, housing, transportation, and basic necessities.

The development of new energy cannot blindly rush forward at all costs. No one wants to see ESG, which should be beneficial to all mankind, being ruined by some people’s blindness and shortsightedness, resulting in stagnation and chaos, and eventually killing themselves.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.