Translation

Author: Zhu Yulong

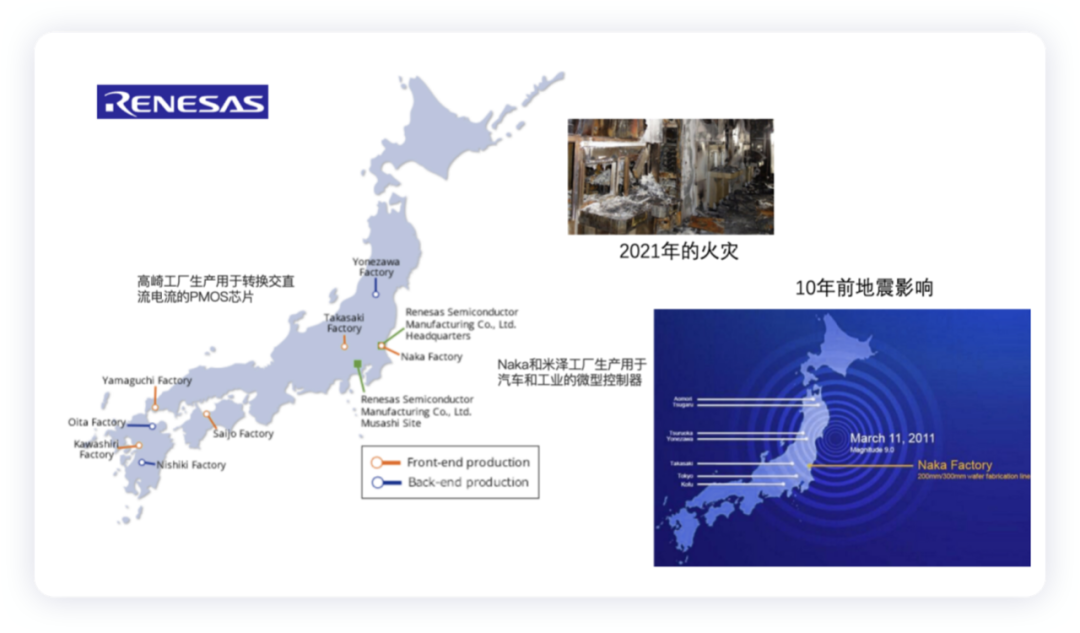

After the 7.1 magnitude earthquake in Northeast Japan on Wednesday night, the production of Renesas Electronics’ automotive chips in three factories near the epicenter has been affected: currently two factories are completely shut down, and one factory has partially stopped production. The production of Naka Factory (Ibaraki Prefecture), Takasaki Factory (Gunma Prefecture), and Yonezawa Factory (Yamagata Prefecture) has all been affected.

Of course, this is a temporary problem. I want to spend some time sorting out the current situation of Japan’s automotive semiconductor industry.

Note: Renesas’ Naka and Yonezawa factories produce microcontrollers for automotive and industrial applications, and the Takasaki factory produces PMOS chips for converting AC to DC. In March 2021, a fire occurred at Renesas Naka factory, destroying 11 machines, accounting for 2% of the factory’s production equipment.

Japan’s Semiconductor Industry and Automotive Section

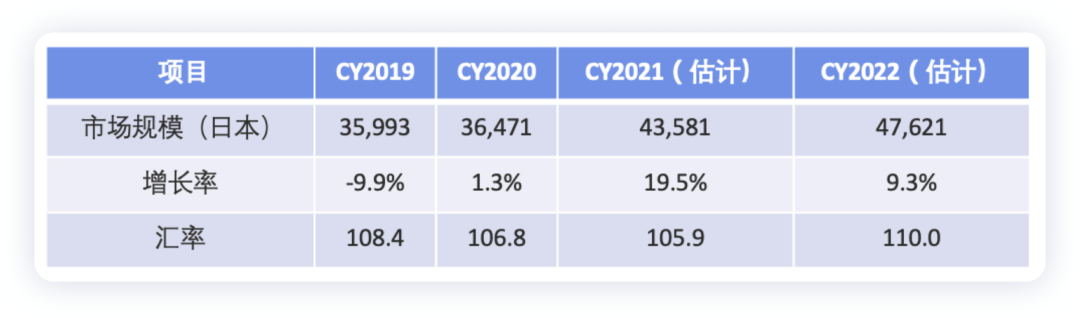

The world semiconductor trade statistics predict that Japan’s market size will grow to approximately 47.62 billion US dollars. IC Insights’ “2021-2025 Global Wafer Capacity Report” revealed the monthly wafer production capacity of each country in the world. Japan ranks third with 15.8%, second only to Taiwan and South Korea. Japan’s strongest area is still power semiconductors and NAND flash.

Recently, TSMC and Sony Semiconductor Solutions Corporation announced that TSMC will establish a subsidiary, Japan Advanced Semiconductor Manufacturing Co., Ltd. (JASM), which is expected to start production in 2024, with an investment of approximately 7 billion US dollars.

In the power electronics business, Japan’s industrial path is still very early:

-

Toyota produces semiconductor chips at its Higashiura Factory in Aichi Prefecture (a technology transfer agreement signed between Toyota and Toshiba in 1987). Since the 1980s, the Central Research and Development Laboratory (CRDL) of Toyota has been working with Denso to advance SiC research, and it may be implemented by Denso.

-

Rohm manufactures SiC power devices on 3-inch, 4-inch, and 6-inch wafers, acquired SiCrystal, a German SiC wafer manufacturer, and established a vertical integration production system. From a planning perspective, Rohm will invest JPY 60 billion to increase SiC power semiconductor production capacity by 16 times.## Renesas’ Development and Business in 2021

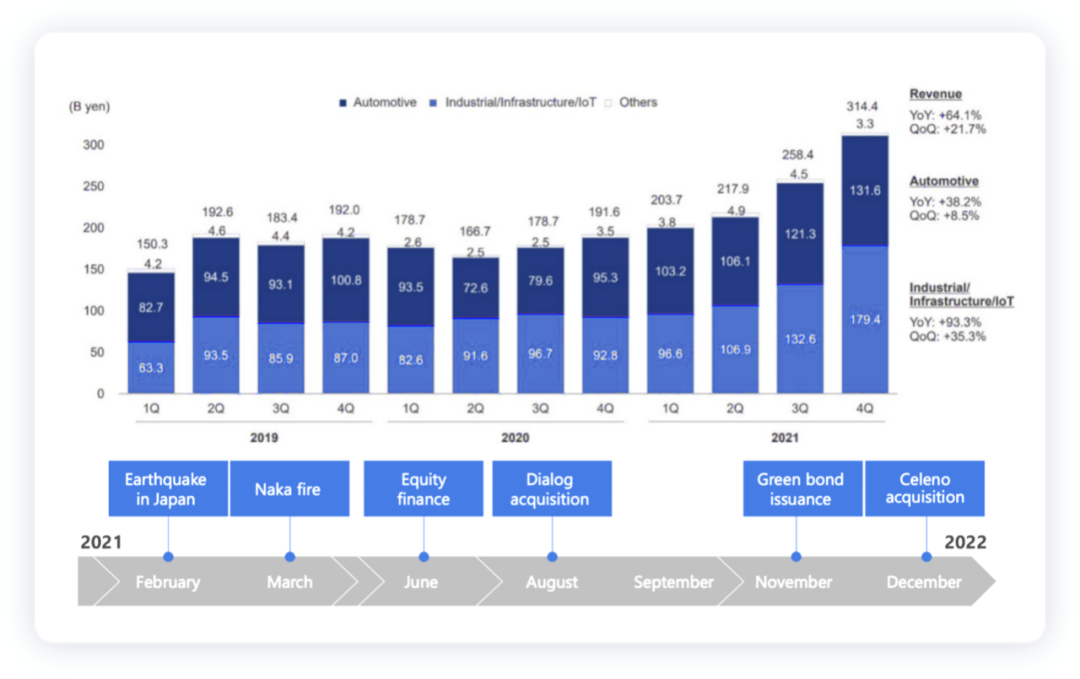

Renesas’ total annual revenue for 2021 was JPY 9,944.18 billion (USD 91.2 billion), showing a YoY growth of 38.9%, with an operating profit of JPY 1,836.01 billion, showing a YoY growth of 181.8%. The revenue from its automotive business in 2021 was JPY 4,623 billion (USD 31.9 billion), showing a QoQ increase and a YoY growth of 35.6%. Sales of both “Automotive Control” and “Automotive Information” categories have increased.

Regarding business expansion, Renesas has been actively acquiring companies. In February 2021, Renesas acquired UK-based IC design company Dialog for USD 5.9 billion, as well as IDT and Intersil for USD 6.7 billion and USD 3.2 billion, respectively.

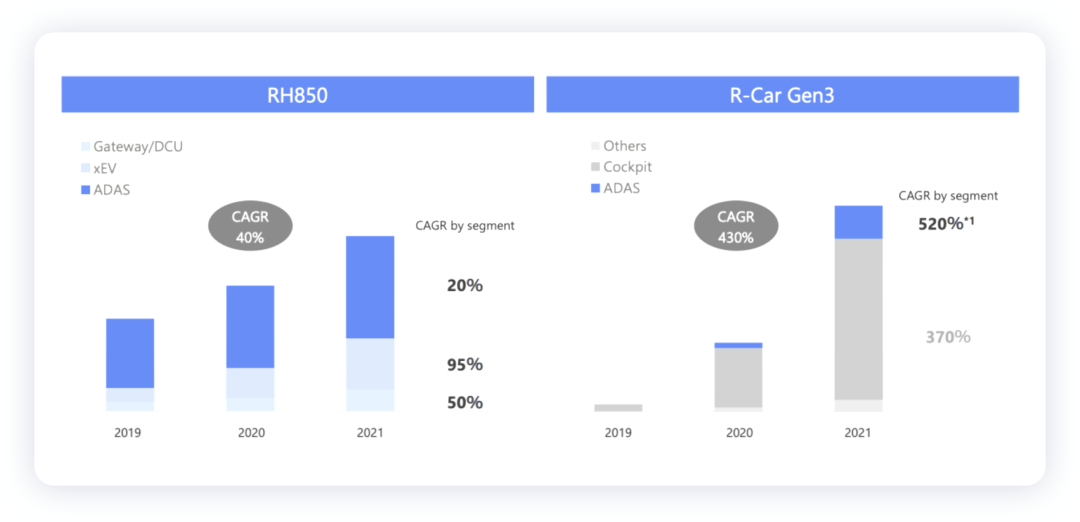

Renesas has been quickly transitioning from MCU products to SoCs, iterating R-Car Gen3 around the cockpit infotainment system, which is growing quickly, and ADAS. RH850 is widely used in ADAS and has shown fast growth when compared to 2020.

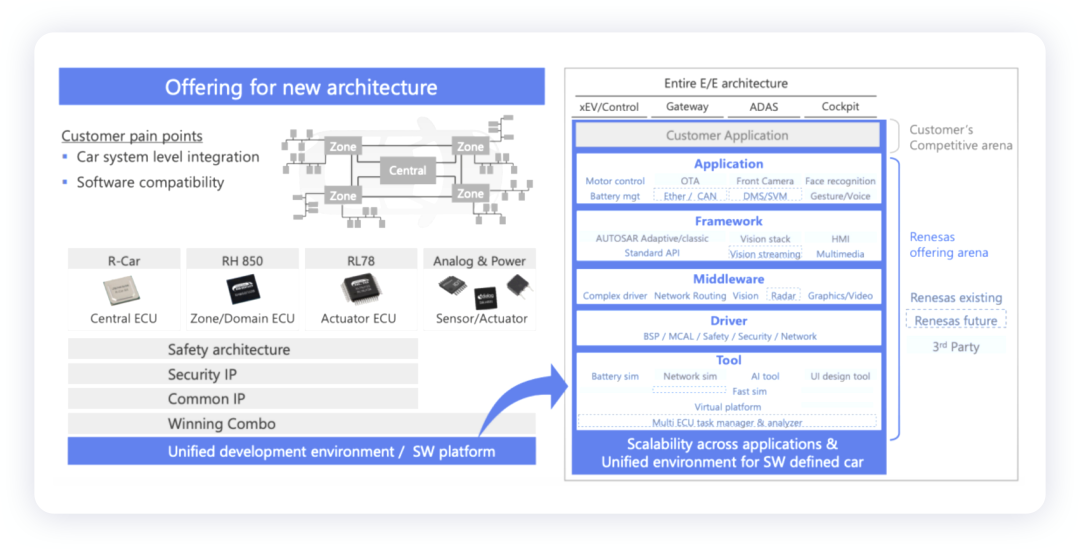

In the long run, R-Car series can be seen as a contender in the core computing platform, except for automatic driving computing power, while RH850 is used for Zonal Controllers, and RL78 is used for Actuator ECU Controllers.

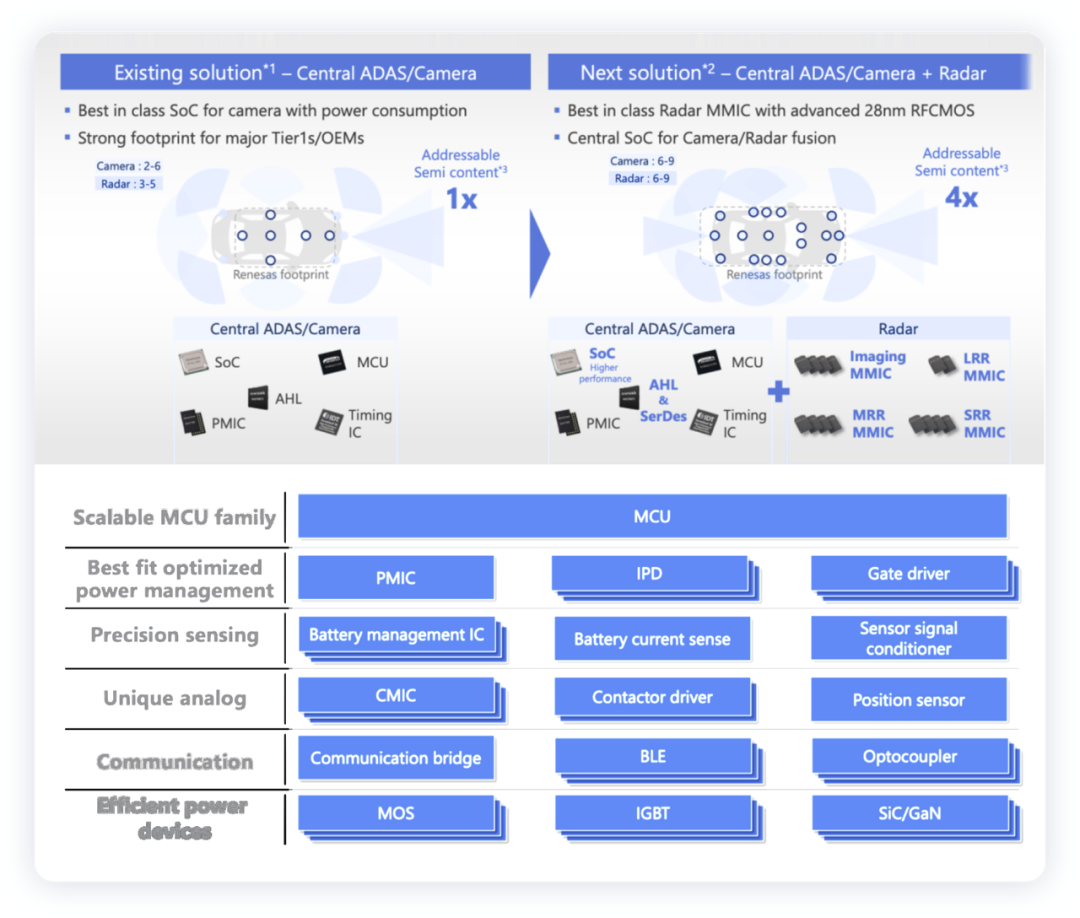

Regarding the global semiconductor market, the MCU sub-market is not very large, and Renesas is focused on MMICs for radar, transmission chips AHL and SerDEs, timing chips, and PMICs.

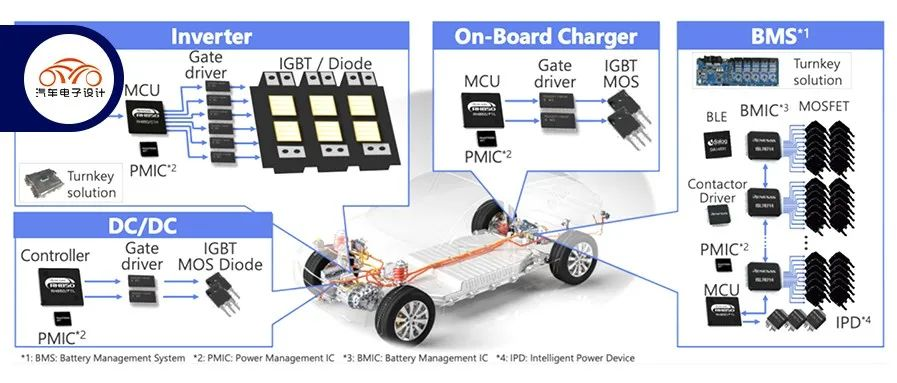

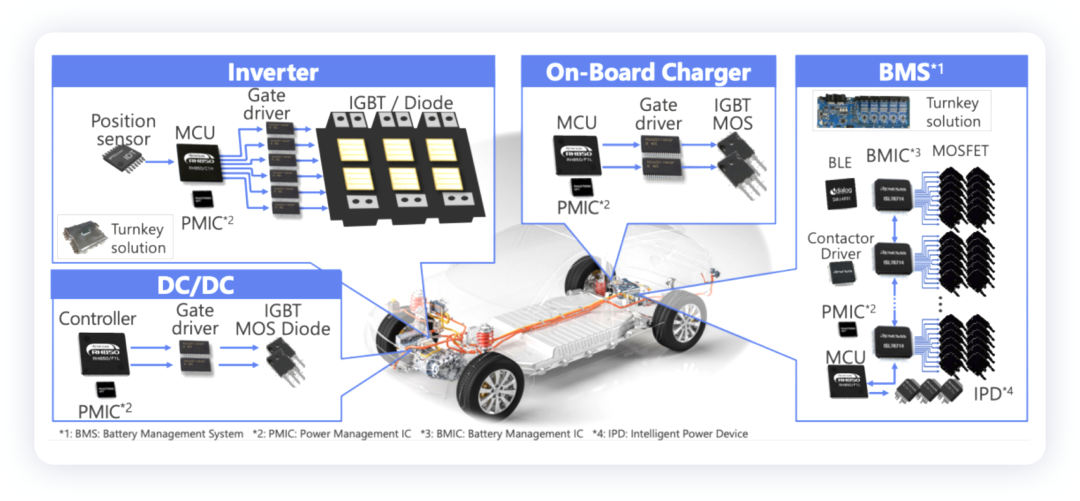

In the field of three electric vehicles, Renesas mainly focuses on the complete set of solutions for BMS sampling chips, contactor drivers, and BLE wireless chips, as well as the MOS of on-board chargers and DC/DC converters – which is not actually Renesas’ expertise. This may be the focus of Renesas’ future efforts.

Summary: After experiencing the chip crisis in 2021, global parts and automotive companies have shifted from zero inventory to chip storage logic (preparedness). Therefore, the shortage of automotive chips may continue until the end of 2022 or even the beginning of 2023. The next step for Japanese automakers and the industry will also strengthen semiconductor investment.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.