Jia Haonan, the Vice Driving Temple, posted by AI4Auto on WeChat Official Account

Smart Car Reference

Following NIO, XPeng, and Li Auto, the fourth new car-making force to sprint for IPO is Zero Run Automobiles.

On the evening of March 17th, Zero Run Automobiles, a new car-making force in the second echelon, officially submitted a prospectus to the Hong Kong Stock Exchange, with CICC, Citigroup, J.P. Morgan, and CCB International as joint sponsors.

With its soaring sales volume in 2021, Zero Run could not have picked a better time to knock on the door of IPO.

However, there are two conflicting logics in the Zero Run Automobiles’ prospectus:

First, as the only carmaker with the ability of self-research and manufacturing in the entire new car-making force, Zero Run has only accumulated less than 1.4 billion yuan in R&D expenses over the past three years, far lower than the top players such as NIO, XPeng, and Li Auto.

Second, the market positioning of Zero Run is high-end market, but nearly 90% of its sales are handled by A00-class small cars with low prices not exceeding 100,000 yuan and meager margins.

These two unreasonable situations need to be answered and resolved, especially when Zero Run’s delivery rate has been steadily increasing.

Overview of Zero Run

Zero Run Automobiles was established in December 2015 as a new car-making company in the first wave of new car-making firms.

The business of Zero Run Automobiles focuses on smart electric vehicles with the core tag Full-stack self-research and manufacturing. Zero Run is claimed to be the only carmaker with the ability of self-research and manufacturing in the entire new car-making force.

In terms of products, Zero Run’s main target is the 150,000 to 300,000 yuan high-end pure electric vehicle market.

According to the official website of Zero Run, there are currently three models available, including the 2019 Zero Run S01 sedan, the low-end A00 model Zero Run T03 launched in May 2020, and the mid-end pure electric SUV Zero Run C11 launched in September last year, with a price range of 150,000 to 200,000 yuan. This is currently the most expensive model available from Zero Run.

In addition, there is also a Zero Run C01 sedan planned to be released during this year’s Beijing Auto Show, but there is no more information available at the moment. However, rumors have it that the C01 is positioned in the same way as the XPeng P7.

In terms of delivery, although Zero Run was established almost at the same time as NIO, XPeng, and Li Auto, it was relatively late in delivering its vehicles.

According to its prospectus, Zero Run Automotive delivered a total of 43,000 vehicles in 2021, leading the race and increasing by 443% compared to over 8,000 vehicles in 2020. The company ranks fifth among new car makers.

According to its prospectus, Zero Run Automotive delivered a total of 43,000 vehicles in 2021, leading the race and increasing by 443% compared to over 8,000 vehicles in 2020. The company ranks fifth among new car makers.

In terms of model distribution, Zero Run Automotive’s microcar, the T03, which primarily targets the low-end market, accounts for the highest proportion of vehicle deliveries at 38,463. Although Zero Run Automotive is positioning itself in the mid-to-high-end market, low-end market sales currently serve as the company’s main source of revenue.

Regarding management, Zero Run Automotive has four key components: revenue growth, cost reduction, and widening losses.

According to the prospectus, in 2021, Zero Run Automotive’s revenue scale was ¥3.132 billion, representing 400% growth compared to the previous year. Gross margin was -44.3%, an increase of 6% from the previous year’s -50.6%, whereas net losses surged 181%, increasing to ¥2.63 billion from the 2020 figure of ¥0.935 billion.

Moreover, in terms of R&D investment, Zero Run Automotive seems to differ from its “full-stack self-research” label.

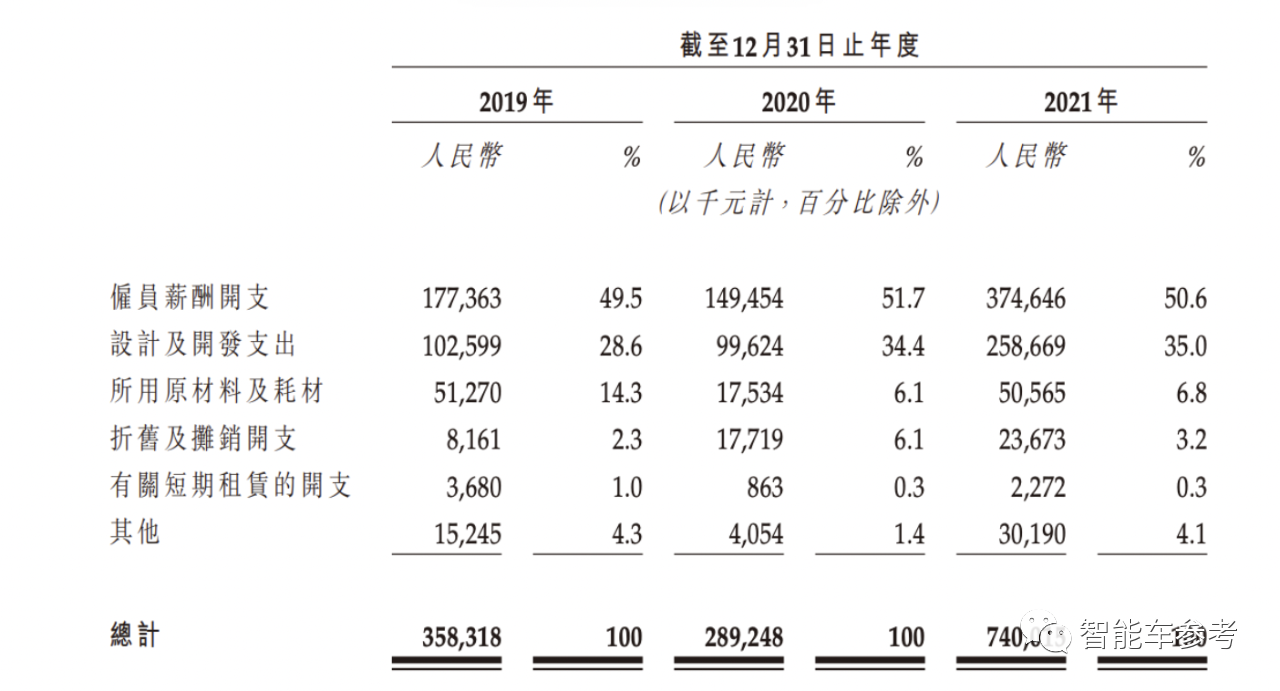

According to the prospectus, Zero Run Automotive’s cumulative R&D expenditure from 2019-2021 was ¥1.387 billion, of which the 2021 expenditure of ¥740 million accounted for 23.62% of the revenue scale within the accounting period. The figures are even lower than those of Ideal, which is known for being “stingy” with money. Public information shows that in 2019, a year before the company went public, Ideal’s annual revenue was ¥284 million, yet spent over ¥1.1 billion on research and development.

As for assets, as of the end of 2021, Zero Run Automotive’s total assets were ¥1.2526 billion, representing an increase of 283% from the previous year-end. However, due to the continued expansion of losses, the company’s net cash outflow from operating activities in 2021 was ¥1.019 billion, an increase of 39% from the ¥0.732 billion in the previous year.

As of the end of 2021, Zero Run Automotive’s cash and cash equivalents amounted to ¥4.338 billion, a more than 40-fold increase from the ¥101 million at the end of the previous year, mainly due to the company’s significant fundraising activities.

Who built Zero Run Automotive?

Starting in 2021, Zero Run’s sales began to rally, surpassing WM Motor and entering the top echelon.

Throughout the year, the company delivered 43,121 new cars, coming in fifth after Polestar.This year is also the first year that Leapmotor has been widely recognized.

However, Leapmotor is actually a “veteran” among the new forces, founded in 2015, along with “We Xiaoli”.

Leapmotor was incubated in Dahua Technology. Yes, it’s Dahua Technology, the security giant second only to Hikvision.

Two key core figures are also Dahua’s founding veterans.

Fu Liquan, the founder of Dahua Technology, graduated from Zhejiang Electronic Industry School and founded Dahua Technology from scratch. He made it the second largest AI security industry in the world. He claimed to have a dream of a market value of 100 billion, but the global security market is only worth 100 billion, so he turned his attention to the automobile industry.

This brings out another key figure in Leapmotor: Zhu Jiangming.

Zhu Jiangming is a co-founder of Dahua Technology. He started a business with Fu Liquan with his entire personal wealth of 5,000 yuan in the early years and they are intimate comrades who have gone through thick and thin together.

Zhu Jiangming has a technical background and graduated from Hangzhou University with a major in electronic engineering (now merged into Zhejiang University). Before Leapmotor was founded, he was the CTO of Dahua Technology. The key products of Dahua’s growth, breakthrough, and high-speed development period were all developed under the leadership of Zhu Jiangming, including automotive security products.

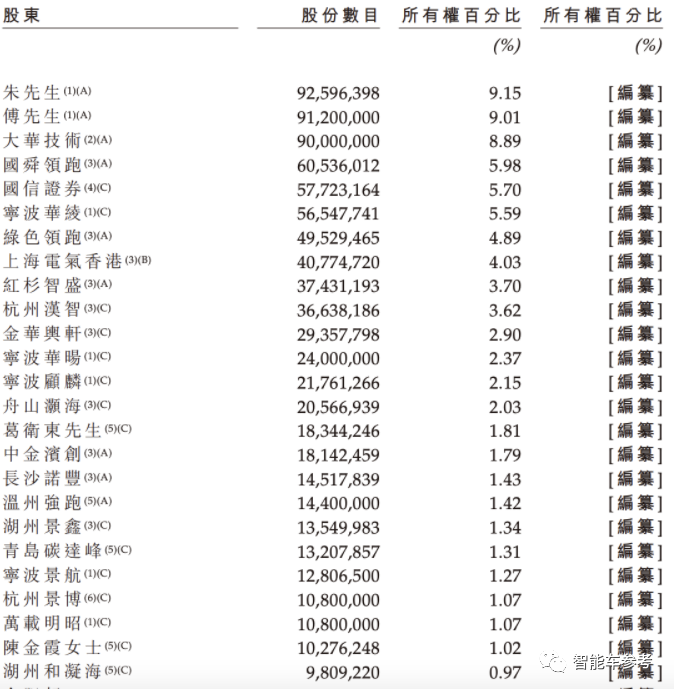

After Leapmotor was founded, Zhu Jiangming gradually resigned from his position related to Dahua and took overall responsibility for Leapmotor’s management and operation. He is also the chairman and founder of Leapmotor and the largest individual shareholder, holding a 9.15% stake.

Fu Liquan, on the other hand, retreated to the background and became the second largest individual shareholder of Leapmotor, holding a 9.01% stake.

In addition, the prospectus also disclosed that the total amount of Leapmotor shares indirectly held by Zhu Jiangming and Fu Liquan through their families and affiliated holding companies is 31.01%, making them the absolute largest shareholder group.

Zhu and Fu have also reached an agreement to take unified action. In case of differences, Zhu Jiangming’s decision shall prevail.

In other words, the actual controller and highest decision-maker of Leapmotor is currently Zhu Jiangming.

However, the First Electric Network previously reported that in an early interview, Zhu Jiangming recalled being a complete “rookie” and even unaware that qualifications were needed to make cars. He thought that passing quality inspection was enough to go public for sales.

When Leapmotor started its business, the environment was still “cheating subsidies and suffocation flying together.” Over the years, many players have been eliminated.

However, Leapmotor not only survived smoothly, but also launched its first mass-produced car, the S01, in January 2019, which is closely related to Zhu Jiangming’s technical and management background.

In the management team of Leapmotor, important names include Wu Baojun and Cao Li, both of whom are executive directors.

Wu Baojun, born in 1970, graduated from the Automotive and Tractor Specialization of the College of Automotive and Agricultural Engineering at Geelyn University.

Wu Baojun is currently the CEO of Leapmotor, and his career mainly focuses on automotive sales, market services, and automotive insurance. He has long been employed by GAC and has served as the marketing director for several GAC-owned brands.

Cao Li graduated from Zhejiang Sci-Tech University. He is the Vice President and General Manager of the Vehicle Research and Development Department of Leapmotor and is currently in charge of the technology and product development. He is from the Dahua Group and has been engaged in design work for a long time.

As of December 31 last year, Leapmotor had a total of 3,190 employees, of which R&D personnel accounted for 33.9% of the total number of employees.

What is the treatment of Leapmotor’s R&D personnel? It was not disclosed, but we can make a rough estimate.

According to the prospectus, Leapmotor’s R&D expenditure was CNY 740 million last year, of which R&D personnel salary accounted for 50.6%, or CNY 375 million, which translates to an average of RMB 3.57 million per 1,000 R&D personnel for the company’s R&D expenditure “per capita.”

In comparison, Ideal Auto, which is not labeled as focused on technology and intelligence, spent CNY 3.29 billion on R&D in 2021, with a R&D team size of over 2,000 people.

Therefore, compared with leading companies, Leapmotor’s R&D level and scale are still significantly different. However, this is also related to the fact that Leapmotor is not as wealthy as its peers in terms of funding.

Li Bin once said that without CNY 20 billion, one cannot expect to build a car. According to the prospectus, Leapmotor has conducted eight rounds of financing since its establishment, with a total of CNY 11.86 billion.

Investors include Sequoia Capital China, Shanghai Electric Group (Hong Kong), Guosen Securities, and Hangzhou City, among others.

The largest investor is still Dahua, as well as the related enterprises of Fu and Zhu (Ningbo Huayang and Zhoushan Haohai, among others).

Compared with its peers, the funding is indeed not that much. Moreover, more than CNY 6 billion of the funds were obtained in the C-round financing in August of last year.

This means that Leapmotor has been in a difficult financial situation until its sales took off in 2021, and most of the financial support came from Dahua and related enterprises.

Compared with other automotive startups that are constantly in the limelight and have been favored by funders, Leapmotor has indeed embarked on a difficult entrepreneurial journey.

Where does Leapmotor go from here?For Link Tour, car manufacturing is also called “keeping the clouds open and seeing the moonlight”. After six difficult years, sales have taken off, the reputation has gradually become established, and, most importantly, investors have started to pay attention to it. In fact, since last year, Link Tour has passed its infancy and entered into rapid growth.

Link Tour’s strategy, technical path, advantages, and challenges have also been gradually revealed by the company.

In the prospectus, Link Tour believes that its advantage lies in self-research and cost. According to Link Tour, they are a full-stack self-research intelligent automobile company, with hardcore strength similar to Tesla and XPeng.

The hardware includes whole vehicle research and development, design, wire-controlled chassis, battery pack (except for the core), drive motor, high-voltage charging technology, etc.

Software includes autonomous driving algorithms, intelligent cabin operating systems, and other automotive software.

There is even a chip. Link Tour established a chip subsidiary with Dahua last year to begin developing the vehicle-mounted AI chip.

Even though Link Tour’s full-year research and development investment level is only equivalent to one quarter of that of other new forces and the team size is not large, this does not prevent Link Tour from laying out according to Tesla’s technical standards.

According to Link Tour, the vertical integration capability is the best in the industry when extending the advantage of full-stack self-research.

This means that Link Tour’s self-researched technology, together with supply chain companies invested in or controlled by Dahua, can minimize the cost of manufacturing cars for Link Tour and maximize efficiency.

An example is the security system on Link Tour’s automobiles.

So what are the challenges for Link Tour?

Obviously, the research and development investment in technology is not enough. “Exceeding Tesla in three years” is extremely challenging.

In addition, Link Tour currently faces a problem, which is that it does not have a core flagship product that opens up sales.

Since the end of 2020, Link Tour’s sales have taken off, and it has surged into the top tier by the end of last year, relying solely on a small A0-level vehicle, T03. This product is very much like the Wuling MiniEV, which takes the ultra-high cost-effective route.

Naturally, such a product cannot have much technological content, profit margins are also low, and there is no core competitiveness to speak of.

The entry bar for small A0-level vehicles is too low; anyone can do it. In the future, competition will only move towards the infinite cost suppression of internal winding.

Wuling can still lean on SAIC; all it needs to do is complete the new energy points task. Making money or not is not important. But Link Tour can’t.# Zero Run’s Clear Business Plan

If the mainstream market of over 150,000 yuan cannot be reached, not only will the so-called “smart car” never be realized, but also survival will be a problem. Therefore, Zero Run’s next step in business planning is very clear:

Firstly, there is the C11, Zero Run’s first medium-sized SUV, which began delivery in October of last year and has received more than 20,000 orders. This year, it will complete the task of climbing the production capacity curve and gradually replace the T03 as the main product.

Secondly, Zero Run will release a sedan, C01, which shares the same platform as C11 and is positioned as medium-to-large-size vehicle, with a length of over 5 meters. A major technology highlight is Zero Run’s self-developed CTC integrated battery chassis.

Regarding intelligence, it is consistent with the current C11, with sensing hardware including 5 millimeter-wave radars, 1 binocular camera, 9 cameras, and 12 ultrasonic radars. In addition, Zero Run began developing the A platform at the end of last year, which is positioned in the compact segment.

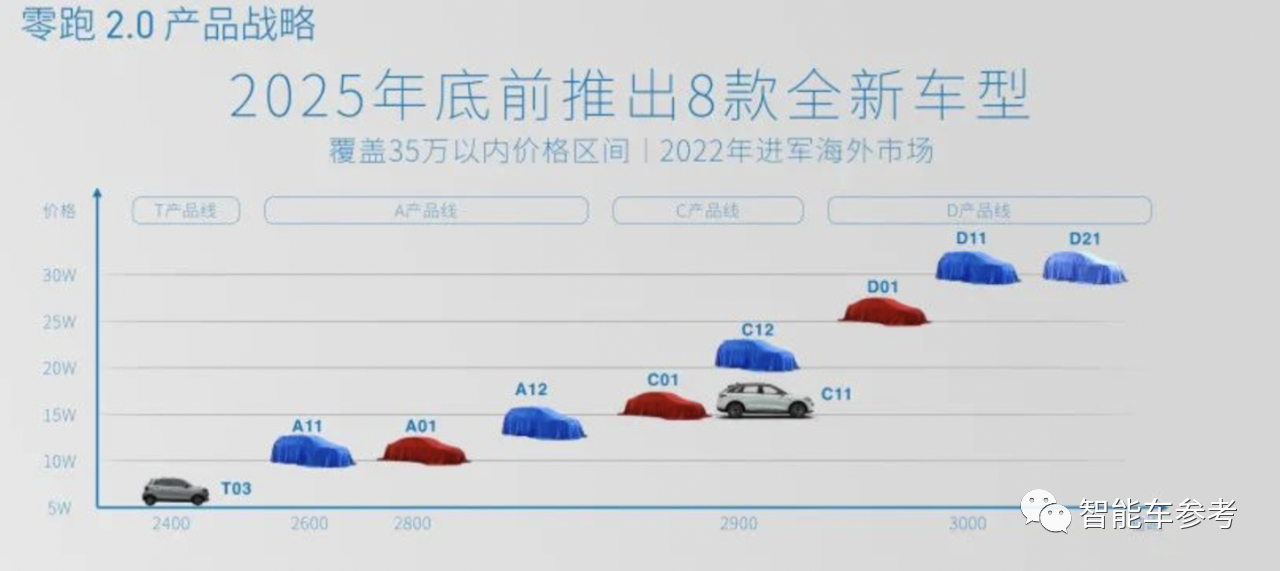

In the next 3 years, Zero Run will enter the phase of launching multiple new models.

By the end of 2025, Zero Run will launch eight new models, including three sedans (coupes and micro-cars), four SUVs, and one MPV.

Judging from the Zero Run Car 2.0 product layout, in addition to the known C01, Zero Run will also launch two sedans with internal code names A01 and D01, positioned respectively between 100,000 to 150,000 yuan and 250,000 to 300,000 yuan.

It can be seen that Zero Run’s vehicle layout trend is toward larger and more high-end models, with a coverage range from 100,000 to 300,000 yuan.

The extent of Zero Run’s self-developed technology strength will also be revealed in its new models in the future.

However, all of this is premised on money. Zero Run needs to increase R&D investment while continuing to expand production capacity, build new factories, and increase sales outlets. Under such expansion pace, it may not be certain whether it can be successful with just one Hong Kong IPO.

But Zero Run has no doubt about its own strength, as Zhu Jiangming once said:

“Zero Run is likely to be their (investors) last ticket.”

The question is, if Zero Run goes public in Hong Kong, will you buy a ticket and get on board?

—End—

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.