Author: Zhu Yulong

Currently, semiconductor technology is the main driving force behind the evolution of intelligent cars and a core component in promoting electrification. Therefore, tracking global market and technological changes, observing the dynamics of major car manufacturers and new entrants is very interesting.

From the perspective of revenue and business development in Europe, the three companies worth focusing on are Infineon, NXP, and ST. I will summarize their performance and business development focus in 2021.

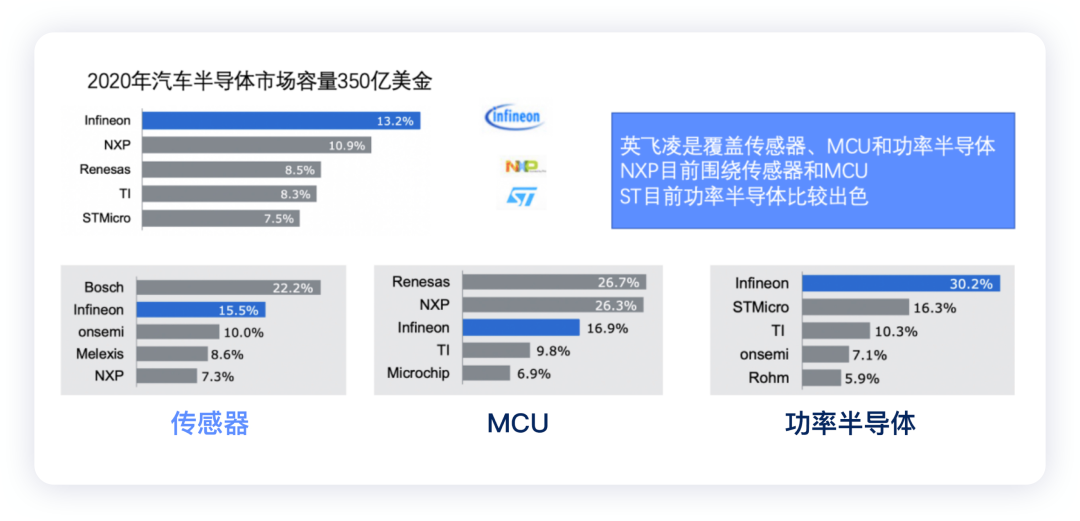

The main reason for tracking these companies is based on the revenue of the automotive semiconductor market in 2020 and the current situation of existing businesses. However, it should be noted that sensors, MCUs, and power semiconductors are not the entirety of automotive semiconductors.

Infineon’s Situation in 2021

Infineon

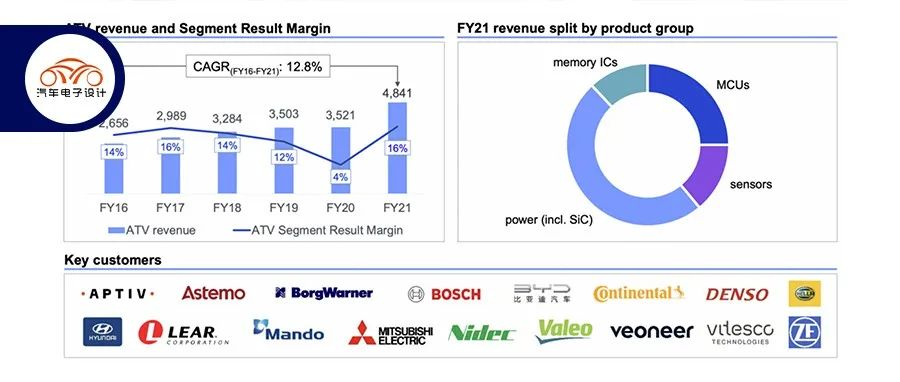

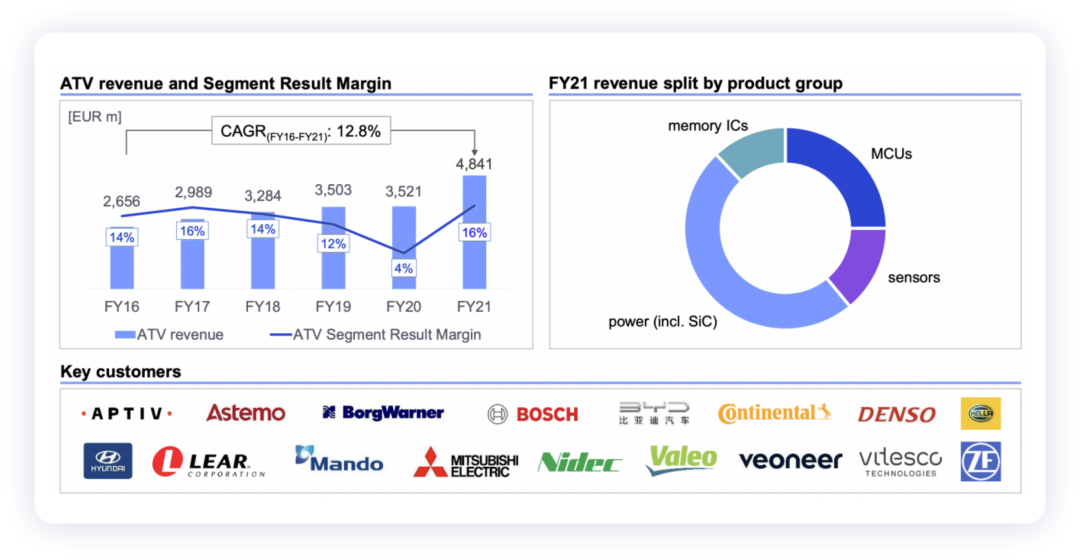

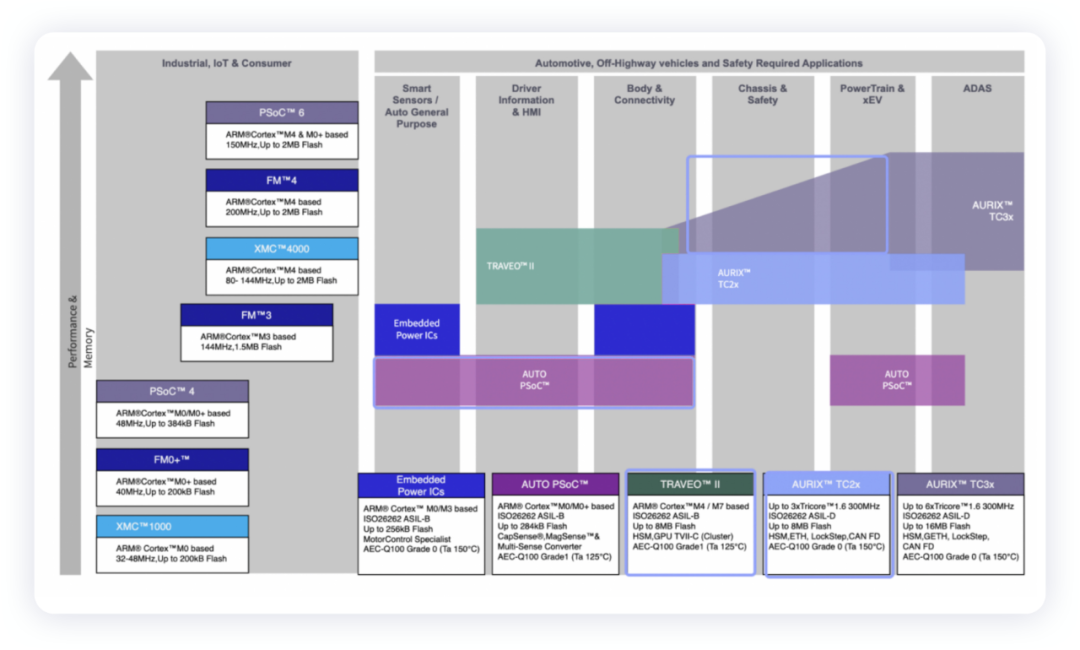

Infineon’s overall revenue in 2021 was 11 billion euros, an increase of 29%, with an operating profit margin increase from 13.7% to 18.7% (a new high since 2008). Automotive business revenue was 4.8 billion euros, an increase of 37.5%. Approximately half of the automotive products are power semiconductors, mainly discrete components, IGBT, and MOSFET; MCU accounts for approximately 25%, sensors for approximately 18%, and storage for approximately 7%.

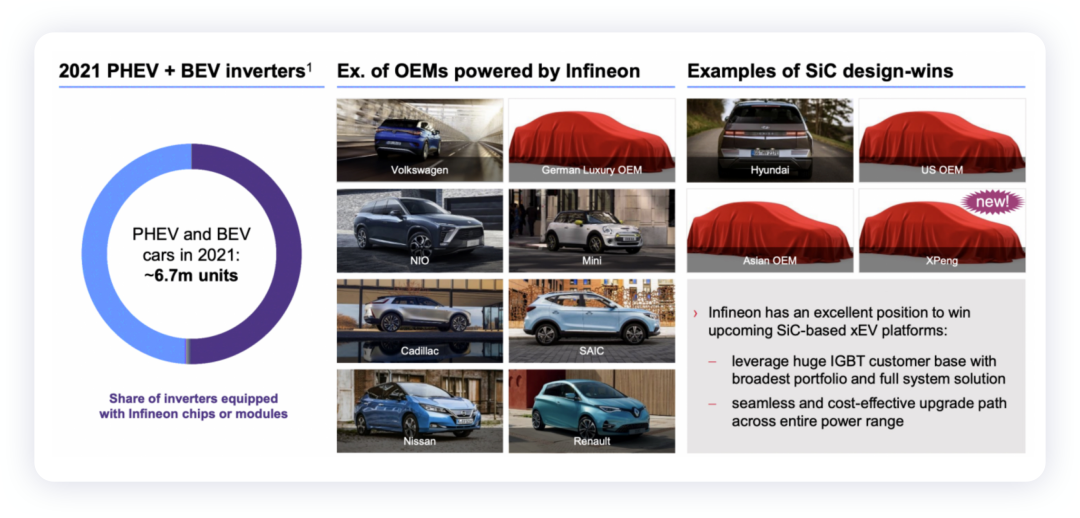

In terms of power electronics, Infineon is the world’s largest supplier of automotive IGBTs (with a market share of over 50%), with BYD as its customer. If we consider wafer cutting and packaging, Infineon’s market share in China is over 60%.

In terms of SiC, Infineon’s business has just begun, with XPENG, Hyundai, Japanese, and American automakers as customers. It’s predicted that the SiC market will reach $1 billion by 2025, and Infineon’s market share may reach 30%.

In terms of investment, Infineon’s main focus is on third-generation power semiconductors, with an investment of over 2 billion euros to expand SiC and GaN semiconductor production capacity. Construction will begin in June 2022, and the new wafer fab in Kulim Factory, Malaysia will be completed in the summer of 2024, with the first wafer scheduled to be produced in the second half of 2024.

Infineon’s top ten customers in the automotive field are: Bosch, Continental Automotive, Hitachi, Denso, Amphenol, Beijing B33, Valeo, Wanchuang, Hella, and BYD. Currently, Infineon has a significant advantage in the power and chassis field MCU (TC3x), mainly relying on the binding of the top few customers.

NXP and ST

NXP

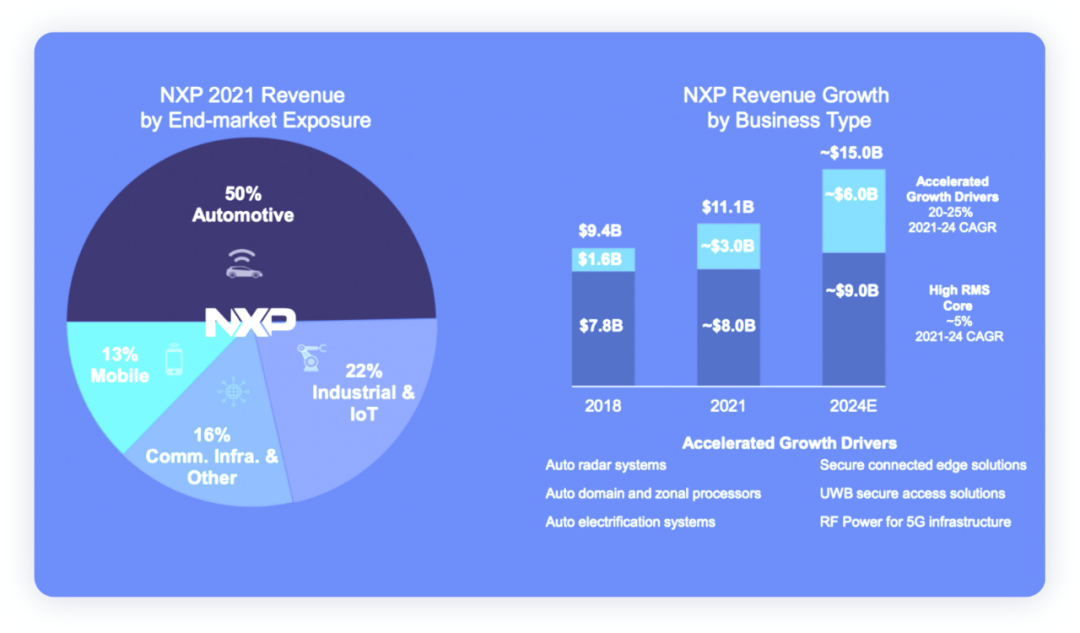

In 2021, NXP’s overall revenue was $11.1 billion, a year-on-year increase of 29.1%, and automotive business revenue reached $5.5 billion, a year-on-year increase of 44.7%.

Due to its focus on MCUs and perception, NXP began to seek innovation in technology and began to introduce TSMC’s 16nm FinFET process (previously the most advanced was 28nm FD-SOI process). The first to use the 16nm process are S32G2 and S32R294. S32R294 is a chip for 4D millimeter-wave radar, and then there is S32R45, which introduces ARM Cortex-A53 core and Cortex-M7 core. Specific research will be conducted in-depth in a separate topic when time allows.

ST

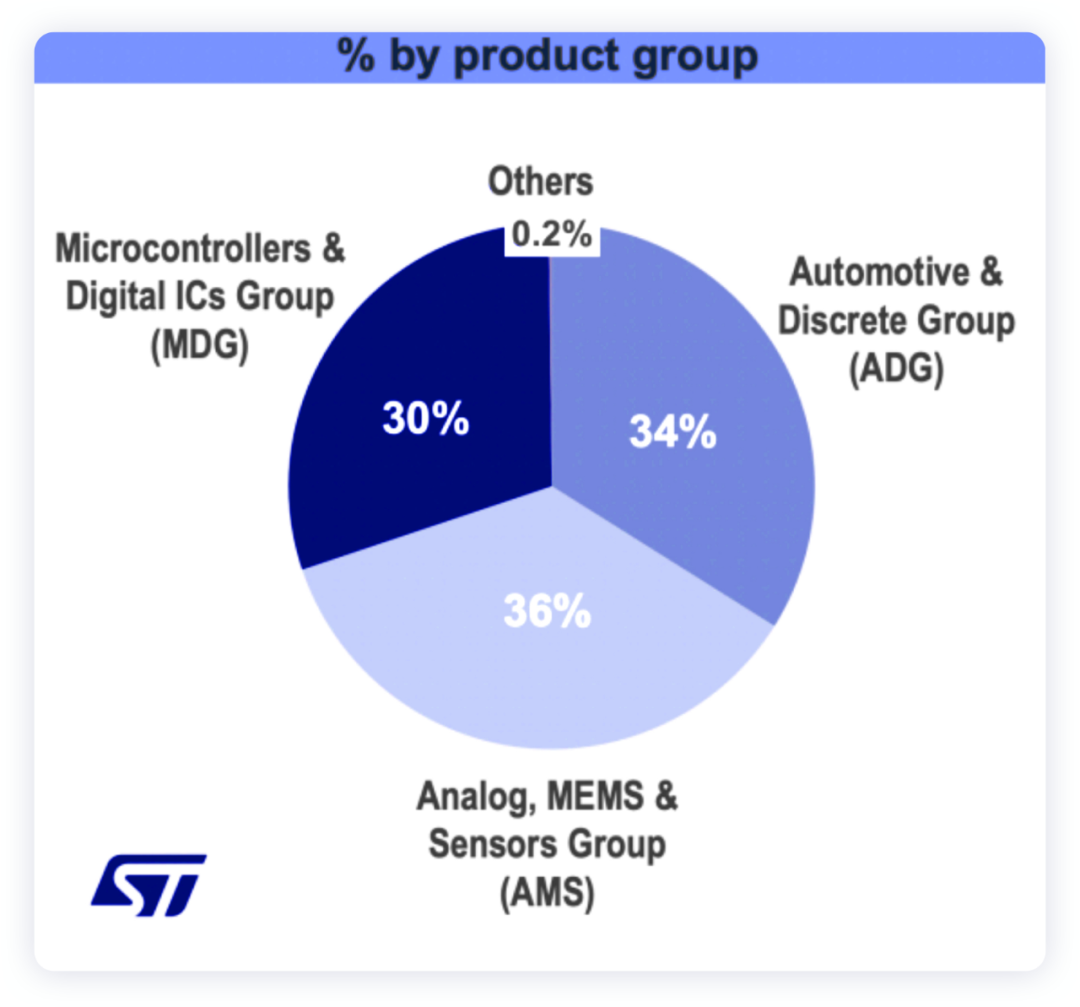

In 2021, ST’s revenue was $12.76 billion (a year-on-year increase of 24.9%), and the operating profit margin increased from 14% to 19%. ST’s automotive business accounts for 34% of its total revenue, and the top ten customers are in the following order: Apple, Bosch, Continental Automotive, HP, Huawei, Mobileye, Nintendo, Samsung, Seagate, and Tesla.

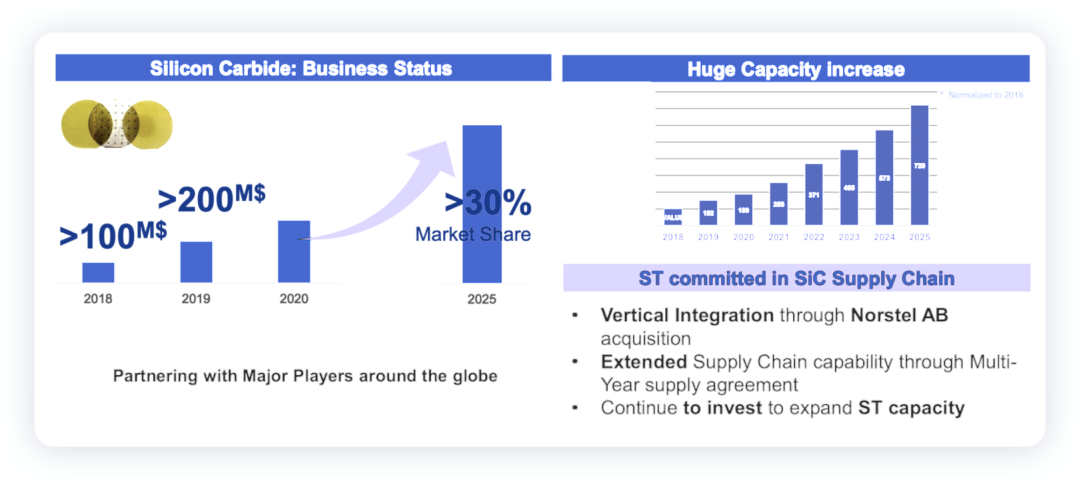

From the perspective of the automotive businesses, ST is the exclusive supplier (OEM model) of Tesla SiC MOSFET, with the new additions mainly focusing on supplying advanced power semiconductor chips to modern automotive and establishing strategic alliances with Renault. At present, ST holds a market share of over 60% in the SiC MOSFET market for automotive applications.

From the perspective of the automotive businesses, ST is the exclusive supplier (OEM model) of Tesla SiC MOSFET, with the new additions mainly focusing on supplying advanced power semiconductor chips to modern automotive and establishing strategic alliances with Renault. At present, ST holds a market share of over 60% in the SiC MOSFET market for automotive applications.

Summary: With more and more semiconductor companies entering the automotive market, especially many new forces willing to add non-safety-related, fun functionality, the automotive semiconductor suppliers actually have much better development opportunities than before, especially for the expansion direction of traditional automotive semiconductor companies – power semiconductor and perception.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.