Volkswagen Group’s 2021 Performance Assessment:

-

Steady growth in electric vehicle models: ranked first in Europe, second in the United States, and four times the sales volume in China compared to 2020;

-

Improved operating efficiency: significantly reduced management costs, strictly controlled physical investments, and lowered the break-even point;

-

Doubled profit to 20 billion euros, with a sales return rate increased to 8\% (compared to 4.8\% in 2020);

-

Strong growth in regions: North and South America turned losses into profits, while leading in the European and Chinese markets;

-

New car strategy: made significant progress in the construction of leading technology platforms.

Next, take a look at the Q&A session of this media communication:

What is Volkswagen Group’s revenue situation in 2021?

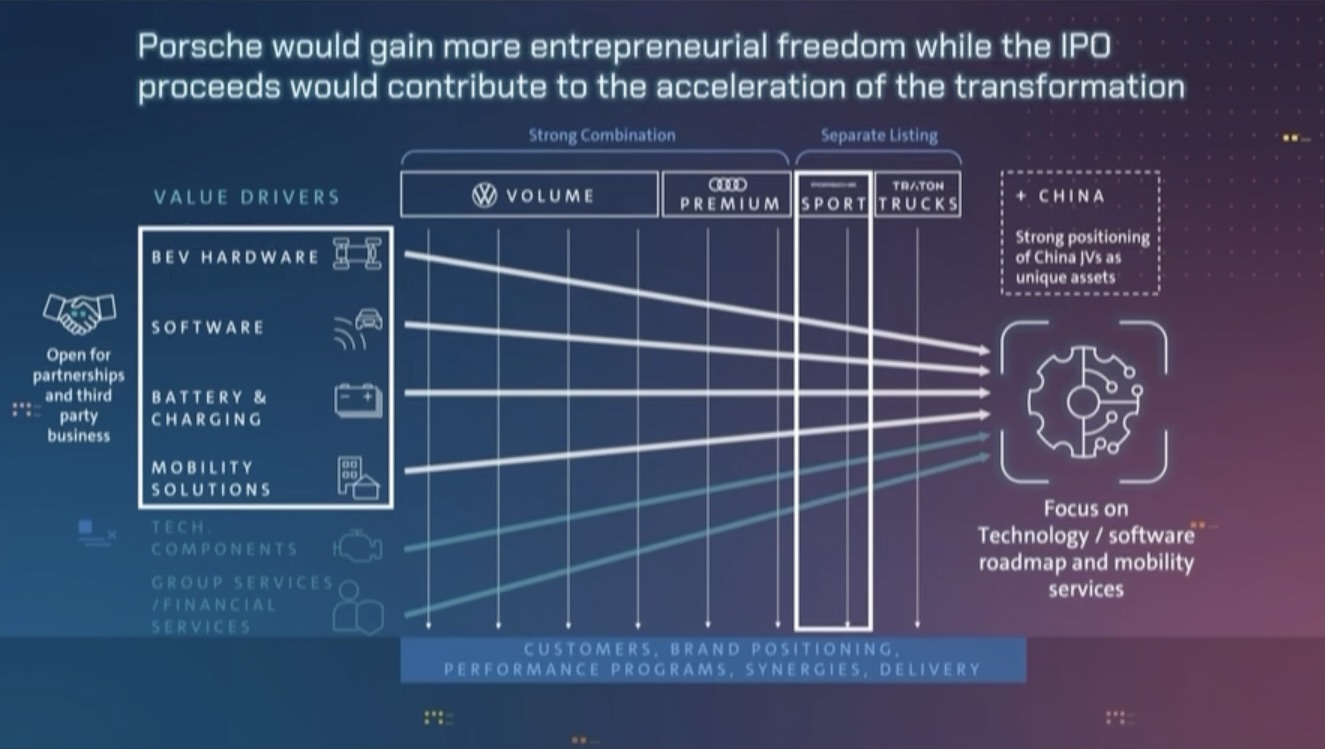

In 2021, Volkswagen Group’s total sales revenue was approximately 250 billion euros, with pre-tax profit reaching approximately 20.1 billion euros, a year-on-year increase of 72.5\%, achieving very good results. Porsche’s IPO independent listing brought huge value to Volkswagen Group, and the adjusted net cash flow of the automotive sector was 15.5 billion euros, which is equivalent to an increase of 5.5 billion euros compared to the previous year. As of the end of 2021, the net cash flow was 26.7 billion euros.

How does Volkswagen Group cope with the chip shortage that plagues the industry?

Volkswagen Group chose to prioritize the production and delivery of high-end, high-margin models of Bentley, Porsche, Audi, and other brands with scarce chip resources. At the same time, it focuses on internal collaboration, process optimization, and project streamlining within the group to minimize the pressure that the supply chain brings to production and delivery.

With the lingering effects of COVID-19 and supply chain pressure, how much impact will it have on Volkswagen Group’s revenue in 2022?

Taking into account issues such as the chip shortage causing supply constraints, Volkswagen Group expects sales revenue to increase by 8\% – 13\% year-on-year this year, the adjusted operating profit margin to increase by 7\% – 8.5\%, and new vehicle deliveries to increase by 5\% – 10\%.

How did Volkswagen Group perform in the European, Chinese, and American markets in 2021?

# Volkswagen Group’s Plans and Investments for the Future?

# Volkswagen Group’s Plans and Investments for the Future?

In 2021, Volkswagen’s pure electric vehicle series had a market share of 25% in the European market. In the past year, Volkswagen has delivered 93,000 pure electric vehicles in the Chinese market, while new pure electric vehicle models under the Volkswagen Group’s various sub-brands have steadily advanced in the Chinese market. In the US market, Volkswagen’s market share is 8%, ranking second among all manufacturers. Most of the users of Volkswagen’s main pure electric vehicle, the ID.4, in the US market are first-time buyers of Volkswagen products.

In terms of battery factories, Volkswagen invested in Guoxuan High-tech and Northvolt in 2021, holding 26.47% and 20% of the shares respectively, and is the largest shareholder of Guoxuan High-tech. The selection of the third Volkswagen battery factory in Europe has also begun in Spain.

In the area of pure electric vehicles, Volkswagen will steadily advance the new products of the MEB and PPE platforms in the European, Chinese, and American markets. The listing plan of the ID.5, ID.BUZZ, and more models, including the MEB platform-oriented models for different markets such as SEAT Born and SKODA Enyaq iV, will bring more choices to consumers. The Volkswagen Group believes that with the MEB and PPE platforms, it will eventually achieve comparable profit margins between its fuel-powered and electric vehicles.

Volkswagen’s first model based on the SSP (Scalable Systems Platform), the Trinity, will have a new R&D center and manufacturing factory established in Wolfsburg. The new factory will be an important part of Volkswagen’s Carbon Neutral Center and a model for Volkswagen’s other factories in the future.

In terms of fuel-powered vehicles, Volkswagen has designed several models based on the MQB and MQB evo platforms for the South American market. The sales and delivery of fuel-powered vehicles have contributed greatly to Volkswagen’s return to profitability in the South American and North American markets.

In terms of driver assistance, Volkswagen Travel Assist is already the most powerful driving assistance system in Europe. Its cooperation with Mobileye elevates it to another level, with significant software updates to be launched later in 2022, including Travel Assist 2.5, Plug & Charge, multi-stop route planning, and updated voice controls.# Volkswagen Group’s Investment and Collaboration Plans

Volkswagen Group continues to increase its investment in its subsidiary CARIAD. In 2022, CARIAD will focus more on technology iteration and resource integration to achieve further growth. The company has successfully integrated the camera software department of Hella and partnered with Bosch in level 3 autonomous driving. CARIAD will open branches in China and the United States this year to ensure that Volkswagen Group can customize software development according to the needs of various global markets and further streamline the process.

In terms of charging networks, Volkswagen plans to establish 45,000 high-power charging points (HPC) within the European market before 2025. The joint venture CAMS in the Chinese market for charging continues to expand, and Electrify America, Volkswagen’s partner in the US market, plans to operate 10,000 high-power charging points before 2025.

Volkswagen Group’s Collaboration with Other Manufacturers

Volkswagen Group has signed a partnership agreement with Ford, planning to start production of Ford’s first model based on Volkswagen’s MEB platform at Ford’s factory in Cologne, Germany in 2022. More collaboration projects between Volkswagen Group and Ford are expected to follow.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.