Solid-state battery development: diverging paths in China and globally

Author: Zhu Yulong

In the crowded market for e-bike batteries in mainland China, two Taiwanese companies, Gogoro and Huelong, have proposed solid-state battery solutions for battery swapping. Upon careful analysis of the current development stage of semi-solid and solid-state batteries, I believe that there is a certain level of divergence in China and worldwide.

In light of this topic, I would like to share my personal opinions.

- China

Currently, the major solid-state battery companies in China are all highly valued. As liquid batteries are expanding production capacity and high safety factor schemes can be achieved around lithium iron phosphate and 4680 high nickel from a system level, domestic solid-state battery companies have to do 2-3 years of solutions that can be put into practical use, meaning semi-solid-state solutions, compromising product availability for a realistic path forward.

The core conflict lies in the fact that since China has already planned 1TWh, 600GWh, and 500GWh series companies, it is difficult for these companies to develop further without expanding production capacity.

- Worldwide

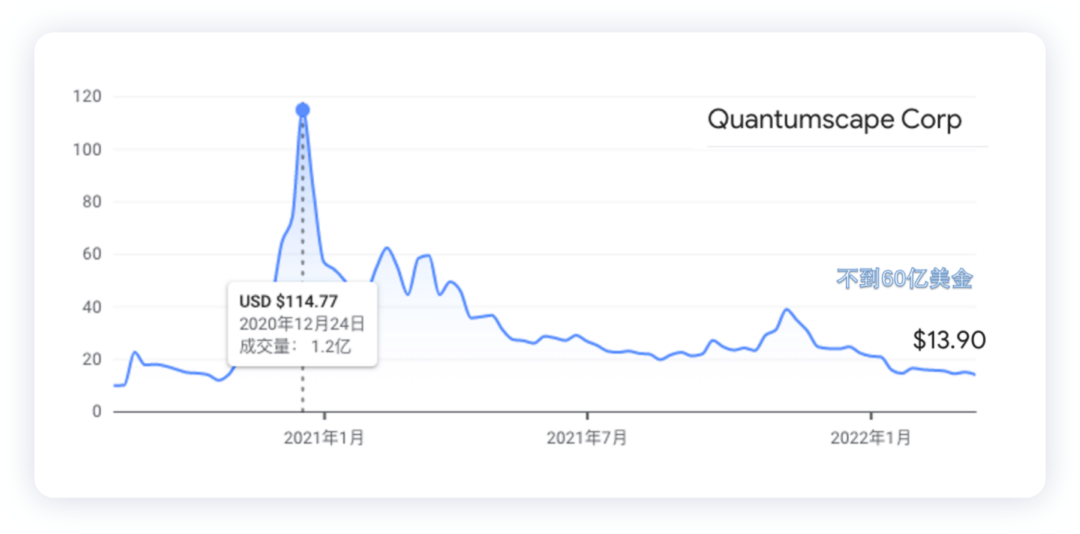

Currently listed solid-state battery companies are experiencing overall volatility in market value.

As of now, the market values for Quantumscape, a company that Volkswagen has heavily invested in, is less than $6 billion, roughly one-tenth of their peak; SES AI is valued at $2.2 billion, Solid Power at $1.3 billion. While only a handful of overseas companies are expected to use SPAC for their IPO, their core logic is that they can survive in the absence of a reliable power liquid lithium battery in Europe and the United States. Once they go public, they will need to satisfy automotive needs, which means another 4-5 years to go.

This means that if we focus entirely on the automotive sector, we will see several years of these overseas solid-state battery companies with no revenue, only development progress. As for China, with the improvement of CTP and CTC and the need to increase energy density under steady pressure, the high energy density of a “Pack” in soft packaging form must be considered along with other performance factors.

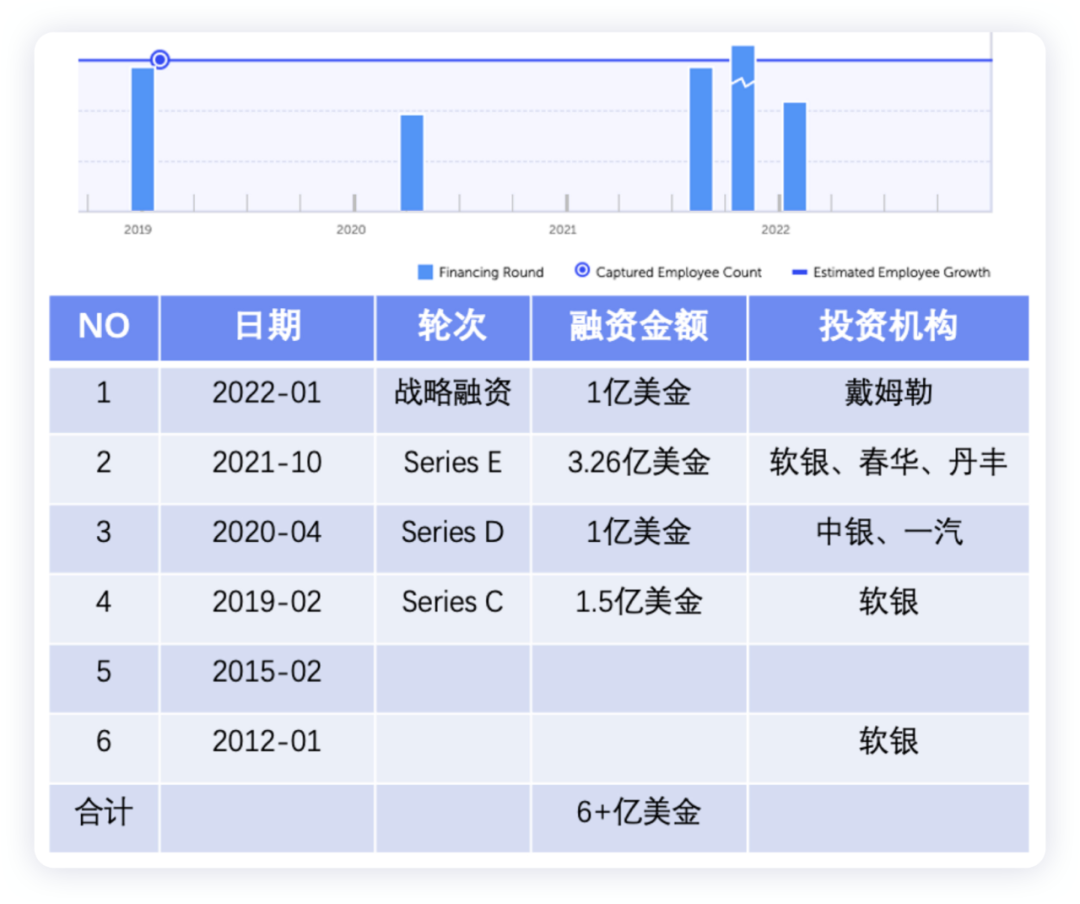

Financing process of Huelong

Huelong was established in 2006 and started commercial production of solid-state lithium batteries in 2013. In 2017, the Huelong G1 plant began automated roll-to-roll production with a capacity of 40MWh. Huelong mainly adopts a relatively light asset model, which mainly includes:

- Building certain production capacity in China: gradually entering the main cooperation mode of 1GWh and 2GWh capacity in 2022, involving core material production, equipment, and technology development.- The patent license for battery cells and solid-state battery system development and design granted by Huineng Technology (the main body of Huineng Technology Co., Ltd.) has 327 patents in 126 countries and regions worldwide, with pending patents accounting for approximately 33% and valid patents accounting for approximately 57%.

The market demand for the consumer sector was limited, so Huineng began to cooperate with automobile companies to explore market potential, including partnerships with newly established automakers such as NIO, Aiways, and Skyworth. At the same time, Huineng received Series D funding from FAW Group, which further strengthened their strategic partnership. In 2022, Mercedes-Benz also partnered with Huineng, providing global recognition for their product.

Huineng’s product lineup includes FLCB flexible lithium ceramic batteries, PLCB flexible pack lithium ceramic batteries, BLCB high voltage lithium ceramic batteries, and MAB multi-axial batteries:

- PLCB

Designed for large capacity applications, such as electric vehicles, drones, industrial applications with special safety requirements, and medical-related applications.

- BLCB

Based on PLCB, it improves the high-voltage performance, with a single cell voltage of up to 60V.

MAB battery pack technology improves overall battery performance and capacity by using modular grouping design similar to large battery modules. The electrode plates are directly connected in series and in parallel, forming a “bipolar battery.”

Compatibility between Gogoro’s Battery Replacement Service and Huineng’s Products

After Gogoro’s launch in the United States, a logic for the battery replacement model needs to be established. Here, high energy density can not only improve overall efficiency, but also reduce the difficulty for consumers to replace batteries. Therefore, Gogoro increased their battery capacity from 1.7 kWh to 5 kWh, which is 1.5 times greater than before, to effectively improve their overall operating efficiency, while conducting small-scale experiments. This is similar to what NIO is doing with their plan to allow users to try their 150 kWh batteries from 2022-2023.

The core of Gogoro’s electric scooter ecosystem is Gogoro Network, which was named by Guidehouse Insights as the leading light-duty urban vehicle battery swapping company in the world in 2021. Gogoro Network is based on an open and interoperable battery swapping platform. This swappable battery charging system is intelligent, scalable, constantly optimized and provides dynamic monitoring and multi-functional battery swapping services. With more than 450,000 riders and over 10,000 battery swapping stations in over 2,300 locations, Gogoro Network swaps 340,000 batteries every day. To date, the total number of battery replacements has exceeded 260 million. Gogoro’s battery swapping has become the de facto standard for electric two-wheelers in Taiwan, providing power for 95% of electric two-wheelers.

The core of Gogoro’s electric scooter ecosystem is Gogoro Network, which was named by Guidehouse Insights as the leading light-duty urban vehicle battery swapping company in the world in 2021. Gogoro Network is based on an open and interoperable battery swapping platform. This swappable battery charging system is intelligent, scalable, constantly optimized and provides dynamic monitoring and multi-functional battery swapping services. With more than 450,000 riders and over 10,000 battery swapping stations in over 2,300 locations, Gogoro Network swaps 340,000 batteries every day. To date, the total number of battery replacements has exceeded 260 million. Gogoro’s battery swapping has become the de facto standard for electric two-wheelers in Taiwan, providing power for 95% of electric two-wheelers.

In summary, I think in the field of battery swapping, there is a natural solution: Let some automotive applications that do not fully meet rigorous requirements be used for small-scale experiments and trials. Gogoro did so, which is more reliable than relying entirely on the development and certification of entire car companies abroad. In the end, new technologies must find their own stage for trial and error.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.