Production: Plenty of Inventory for LFP Batteries

On March 12, the monthly data for February’s power battery production were released. In general, the following characteristics can be observed:

1) At the beginning of 2022, the production of power batteries in the first two months reached 61.46 GWh, equivalent to 73.6% of the full year production in 2020 (83.42 GWh) and 23.9% of the production in 2021 (219.68 GWh). If this rate of growth continues, there is hope that the production volume will reach 400-450 GWh this year.

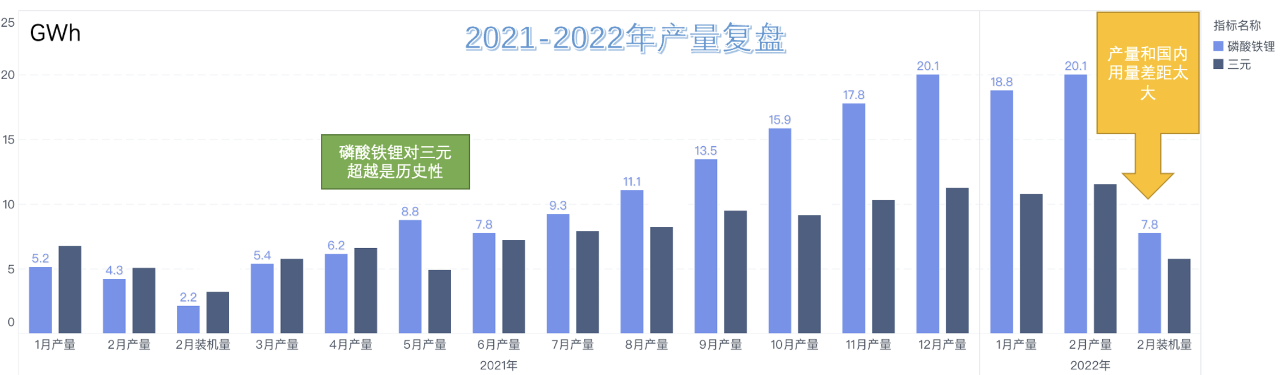

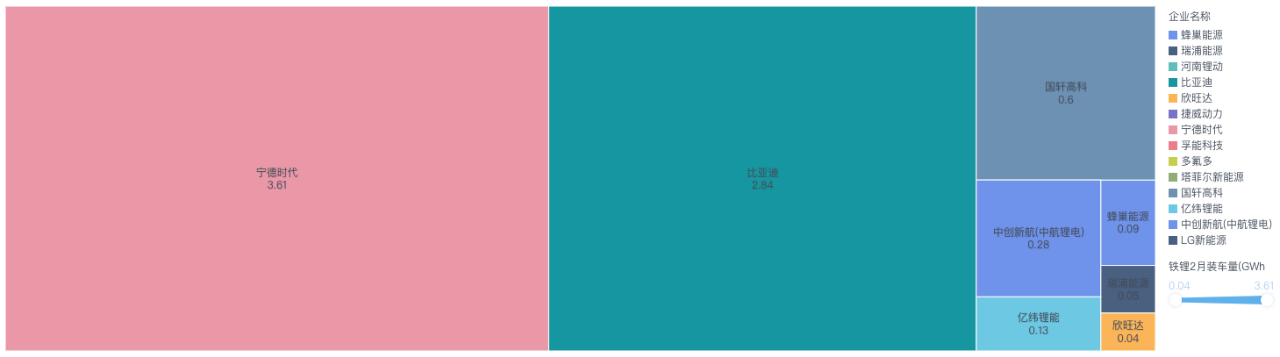

2) The production of lithium iron phosphate batteries (20.1 GWh) was nearly twice that of ternary batteries (11.6 GWh). In contrast, the installed capacity for lithium iron phosphate in February was only 7.8 GWh. In the future, lithium iron phosphate batteries will be used on a larger scale, and a considerable part of them will be exported to foreign countries, either as part of the exported vehicle models or directly shipped overseas.

3) The demand for pure electric passenger cars has become the most important pillar of power batteries, but due to the rising cost, plug-in hybrid vehicles have a good opportunity to enter the market. This will be a clear trend in 2022. The demand for commercial vehicles has greatly declined, and it is anticipated that there will be a breakthrough in the replacement of heavy trucks in the second half of the year.

4) More battery companies will begin to produce lithium iron phosphate batteries in the second half of the year. In addition, the distance between CATL and BYD in the market for lithium iron phosphate batteries is getting closer and closer.

[Free offer in this article: The data in this article comes from the China Automotive Power Battery Innovation Alliance. If you want to obtain the full version of the February report PPT of this organization, you can follow the “EV Observer” public account and reply “February battery” in the dialog box. Alternatively, you can screenshot this article to your friends or three WeChat groups as proof, and then ask the EV Observer editor (WeChat ID: ev_observer) for the original link to the PPT.]

Production Volume: A High Level of Inventory for LFP Batteries

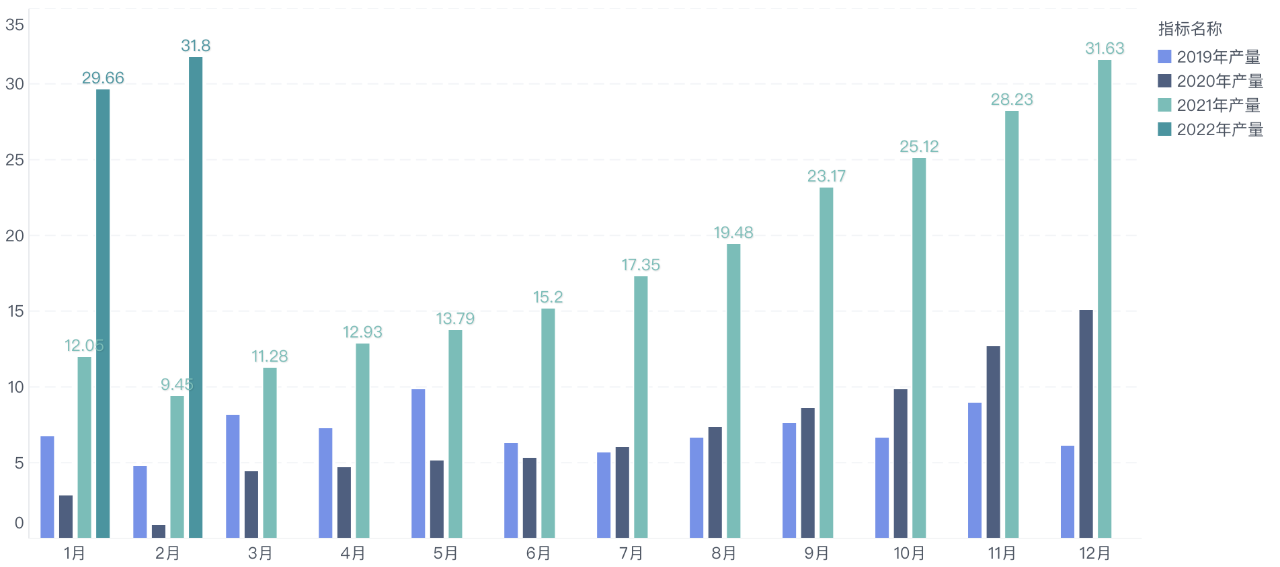

In February, the production of power batteries was 31.8 GWh, an increase of 236.2% year-on-year and 7.1% month-on-month.

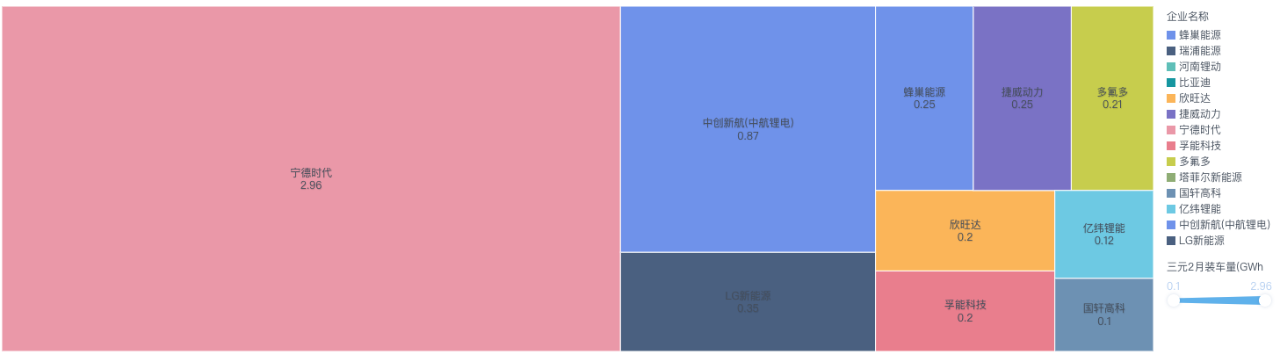

Even with the lengthy Spring Festival holiday in February, the production volume of power batteries still surpassed the historical peak of 31.63 GWh in December of last year. Such high production volume indicates that the demand for 2022 is high in the planning of battery manufacturers, so they rushed to produce batteries at the beginning of the year. Especially in the circumstances of high raw material prices, there is still very good profit even if batteries are made as inventory.From the perspective of the production of different types of batteries: the production of ternary batteries is 11.6GWh, currently only accounting for 36.6% – although it has grown by 127.2% year-on-year. Looking back to May 2021, ternary production was surpassed by lithium iron phosphate, and the gap has been widening ever since. Currently, the production of ternary batteries is only about half of that of lithium iron.

The production of lithium iron phosphate batteries is 20.1 GWh, accounting for 63.1% of the total production, and grew by 364.1% year-on-year.

The growth rates of these two types of batteries objectively reflect the direction of battery selection for updated models in 2021.

It is worth noting that in February, the production of lithium iron phosphate was 20.1 GWh, but the installed capacity was only 7.8 GWh. The difference between these two data points is increasing. The reasonable explanations are mainly:

1) More used for exported models. According to data from the China Association of Automobile Manufacturers, in January, 56,000 vehicles were exported, and 48,000 were exported in February, with a total of 104,000. If calculated based on 60 kWh / vehicle, there were approximately 6 GWh (3 GWh per month).

2) Lithium iron phosphate is growing rapidly in commercial vehicle applications and some of them are used for export;

3) The last one is inventory: batteries produced in January and February need 30-45 days to be stored in the manufacturer’s finished product warehouse, shipped to various automakers’ warehouses, and then loaded onto vehicles. Automakers with higher expected production will reserve batteries in advance. Since batteries are still in short supply in 2022, it is expected that these automakers will buy batteries in advance and install them in vehicles according to demand later.

In January-February 2022, cumulative production of power batteries was 61.4 GWh, an increase of 185.7% year-on-year. Among them, the production of ternary batteries was 22.5 GWh, accounting for 36.6% of the total, an increase of 87.6% year-on-year; the production of lithium iron phosphate batteries was 38.8 GWh, accounting for 63.2% of the total, an increase of 308.2% year-on-year.

2022 is still the era dominated by lithium iron phosphate. The high growth of power batteries will not reduce the demand for resources in the short term.

Installed Capacity: The Distance Between Lithium Iron and Ternary Has Not Widened

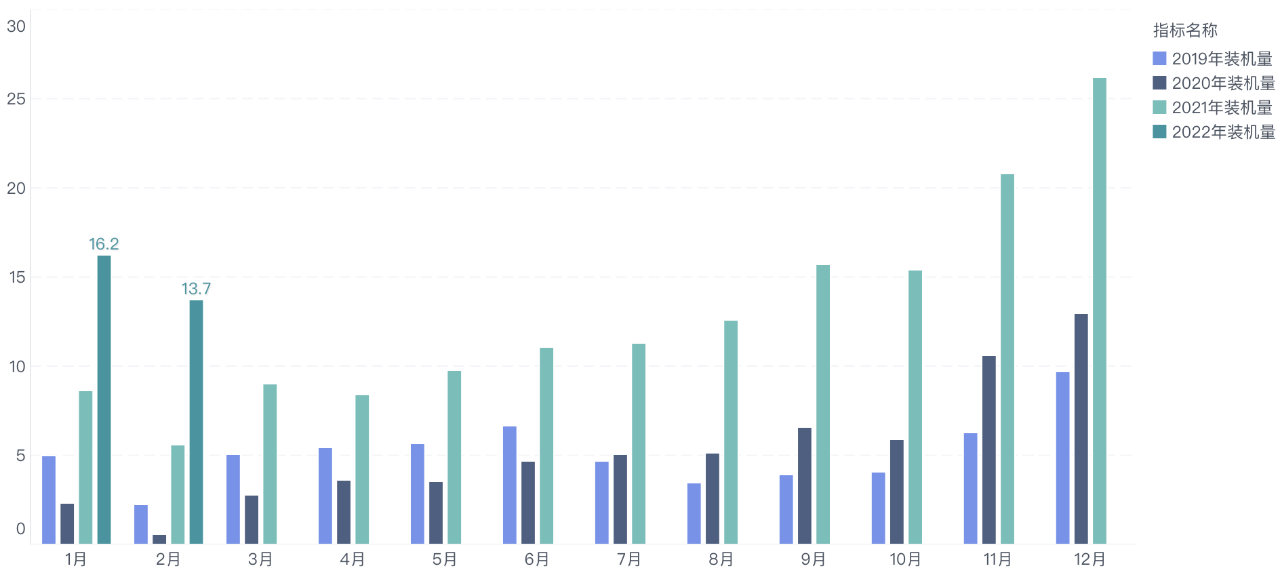

The installed capacity of power batteries in February was 13.7GWh, an increase of 145.1% year-on-year, and a decrease of 15.5% month-on-month.

Although the installed capacity has increased significantly year-on-year, when observed on a monthly basis, the installed capacity is roughly half of the peak — 26.22 GWh in December last year. This is different from the production data.

From the perspective of different battery types:

- The installed capacity of ternary batteries is 5.8 GWh, a YoY increase of 75.6%, and a MoM decrease of 19.9%;

- The installed capacity of lithium iron phosphate batteries is 7.8 GWh, a YoY increase of 247.3%, and a MoM decrease of 12.3%.

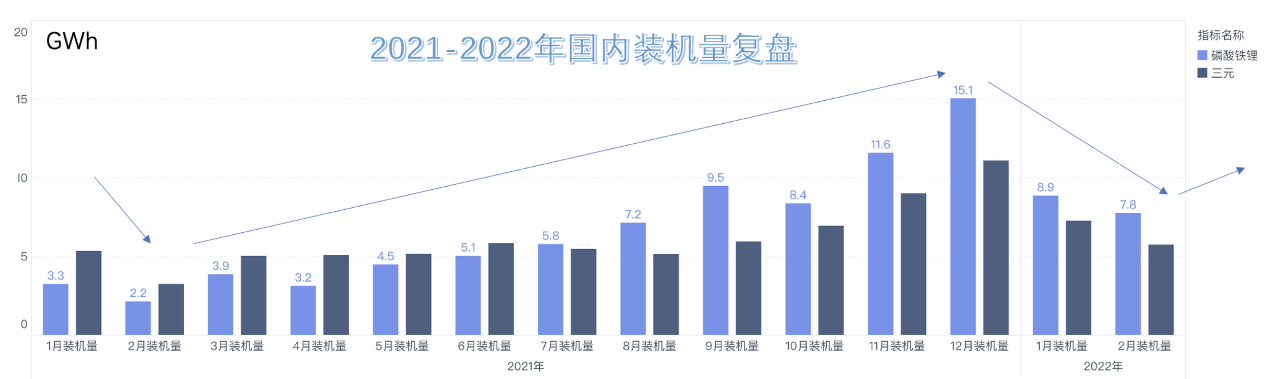

On the installation side, lithium iron phosphate surpassed ternary batteries in July last year, but overall, the difference between the two in terms of installation in 2022 is only about 2 GWh, much smaller than their production difference.

From the first two months of 2022, the cumulative installed capacity of batteries has reached 29.9 GWh, with ternary batteries accounting for 13.1 GWh, and lithium iron phosphate batteries for 16.7 GWh, accounting for 43.8% and 55.9% of the total installed capacity, respectively. The difference between the two has not widened.

Will the difference widen in the future? Not necessarily.

As the price of lithium carbonate rises sharply, the price difference between the two will shrink (lithium iron phosphate generally uses lithium carbonate as the source of positive electrode material, while ternary generally uses lithium hydroxide). Overall, mid-to-high-end car models do not care about this price difference; while low-end car models are still very sensitive to the use of lithium iron phosphate in terms of price. We need to keep an eye on this.

Breakdown of demand: Strong momentum for plug-in hybrids

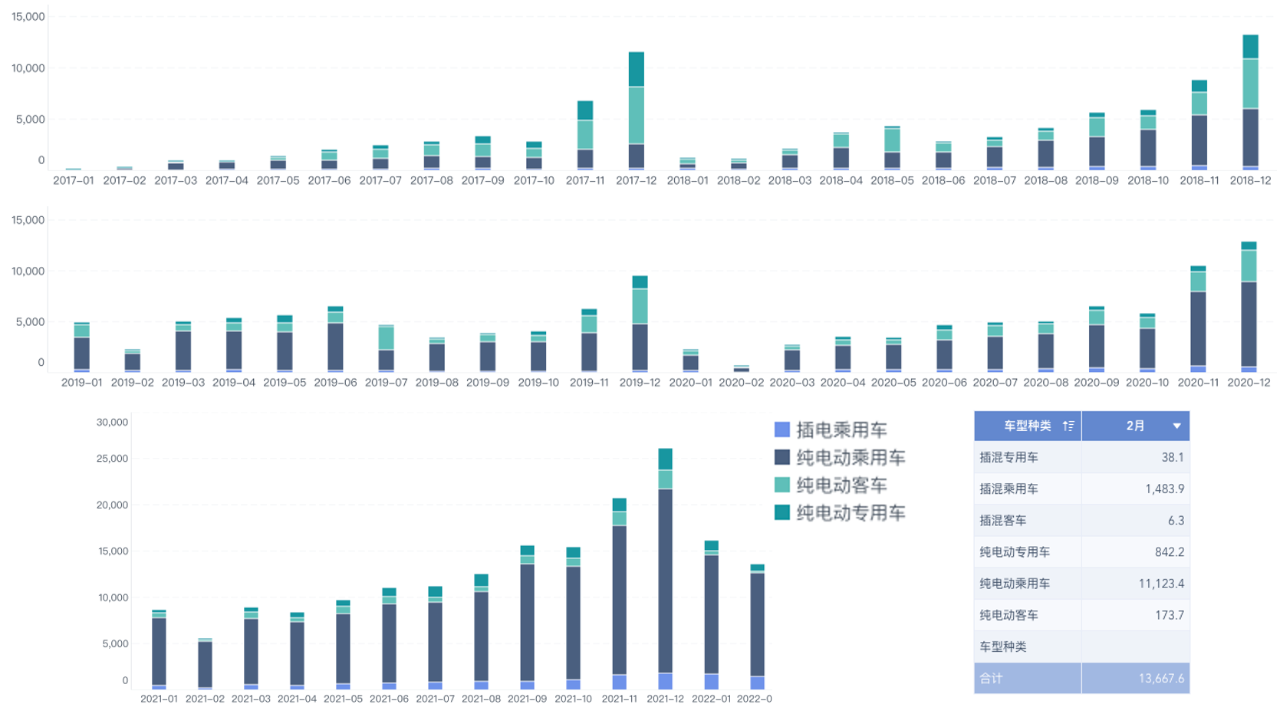

From a longer-term perspective, the demand for power batteries has been changing.

Let’s break it down:

- In 2017, the main demand for power batteries was buses and special-purpose vehicles, which was the era of lithium iron phosphate;

- In 2018, the proportion of pure electric passenger cars increased, and ternary batteries began to be widely used;

- In 2019, buses and special-purpose vehicles gradually began to decline, and pure electric passenger cars became the main demand;

- In 2020, under the influence of the epidemic, pure electric passenger cars became the demand with the highest growth rate;

- In 2021-2022, the demand for commercial vehicles has become a small proportion, and by February, the installed capacity of power batteries for plug-in hybrid vehicles has surpassed the sum of special-purpose vehicles and buses.

From a cost perspective, plug-in hybrid passenger cars are very attractive in the face of high oil prices. The demand for plug-in hybrid passenger cars will be very strong in 2022.

In 2022, demand for power batteries for buses may continue to decline, and the incremental demand for commercial vehicles will mainly focus on special-purpose vehicles, especially the possibility of rapid breakthroughs in the battery-swapping heavy truck area mentioned earlier.

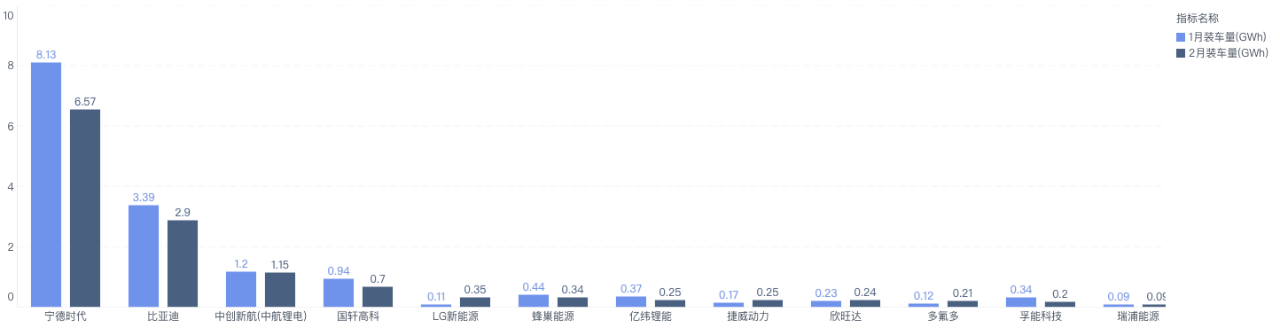

The Matthew Effect of Battery Suppliers

In the February market for new energy vehicles, only 35 power battery companies achieved matching vehicle installations, further increasing concentration rates.

The top three and top five combined amounts were 10.6 GWh and 11.7 GWh, accounting for 77.7% and 85.4% of the total installed capacity, respectively.

Looking at the situation of lithium iron phosphate, BYD’s rapid increase has narrowed the gap with CATL. Second-tier battery companies, such as CALB, Eve Energy, BAK Power, and Lishen Battery, are rapidly developing supporting technology for lithium iron phosphate. Looking at current technological trends, these enterprises will also provide more optimized lithium iron phosphate battery solutions to smaller vehicle manufacturers in 2022. These smaller vehicle manufacturers are facing higher price increases than leading vehicle manufacturers and need to quickly switch and develop their supply chains to cope with these price increases.

On the ternary side, it is mostly dominated by CATL, followed by CALB.

It is worth noting that as the installed capacity of ternary batteries in China gradually reaches a relatively stable state, there are not many enterprises making a strong push in this field. As ternary batteries are mainly installed in medium and high-end vehicle models, second-tier vehicle manufacturers have been working on this for many years and have not received particularly good results.

Conclusion

We are still unsure about the overall impact of macroeconomic factors on new energy vehicles in 2022. In the era of high oil prices, it is obvious which direction consumers will choose. However, all cost increases in materials need to be passed down to the vehicle manufacturers, and in order to cope with price pressure, there need to be some time for vehicle manufacturers to pass on costs to the final consumer.

In the current market, battery companies need to increase production quickly, and turn materials into batteries, both in terms of competition and supply.

Overall, from the power battery industry data of February, battery companies have more confidence than vehicle manufacturers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.