Author: Zhu Yulong

Last month, On Semi released its FY2021 Q4 and annual performance, which included its power semiconductor (SiC) and intelligent sensor businesses. This is still worth our attention, so I would like to take some time to organize On Semi’s business situation in the automotive sector.

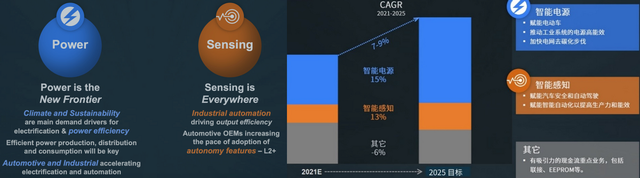

From a historical perspective, On Semi’s focus on profitable growth and sustainable development, as well as focusing on strategic markets, has achieved very good results, especially interesting is their focus on power and sensing.

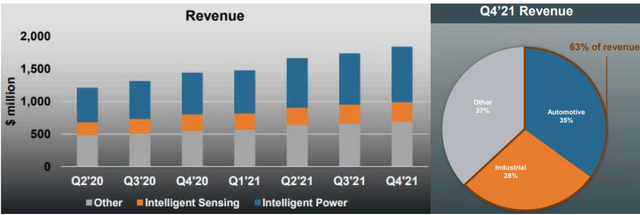

Background: On Semi’s Q4 2021 revenue was $1.85 billion, a YoY increase of 28%, and a MoM increase of 21%. Automotive and industrial accounted for 63% of total revenue. FY2021 revenue was $6.74 billion, a YoY increase of 28.3%, automotive business increased by 36% YoY, and industrial revenue increased by 33%.

On Semi’s Silicon Carbide Development

(1) Revenue and Capacity

It is expected that Silicon Carbide (SiC) revenue will increase more than twice YoY in 2022 (customer orders increased by 42% YoY in 2021, mainly in the second half of the year).

By 2024, SiC revenue will exceed $2.6 billion, and SiC modules will provide power to the latest generation of electric vehicle platforms for Mercedes EQXX (620 miles).

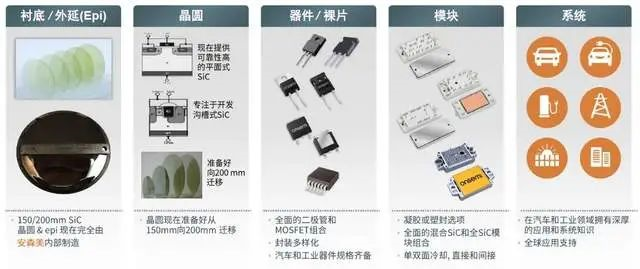

In order to support the rapid growth of SiC revenue in the next few years, On Semi plans to increase SiC substrate capacity by more than four times by the end of 2022 and expand investment in SiC device equipment and module capacity. After the $415 million acquisition of GT Advanced Technologies (GTAT) in November 2021, On Semi continued to invest in GTAT until the end of 2022, which will double its production capacity, and will double it again in 2023. As GTAT’s capacity expands, On Semi will transfer more substrates to internal supply.

Most of the $650 million in capital expenditures will be used for SiC and East Fishkill, including the expansion of the 300mm wafer factory. On Semi targets to produce 65% of its own products internally, and will exit smaller scale wafer fabs and transfer them to more efficient fabs (300mm).

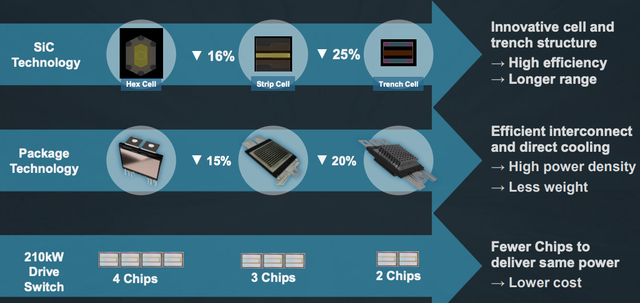

(2)Technological Direction

In this round of pure electric vehicles, the trend is to increase the power and torque, with SiC having opportunities on both charging (due to the rise of 800V system voltage) and discharging ends, namely increasing from 150 kW to 250 kW.

AnSenMoi’s technology in this area is called VETrac Dual, which enables power extension with ease. It can achieve 150 kW power by using three half-bridge modules, and also combine two 150 kW modules to achieve 300 kW power. In the double-sided cooling module, the intelligent chip can incorporate temperature and current sensors for better temperature detection and circuit protection.

In terms of SiC packaging technology of the inverter, AnSenMoi will transition from double-sided indirect water cooling to direct water cooling mode in mid-2023, and will realize double-sided direct water cooling by the end of 2023. In mid-2024, it will further optimize to double-sided direct water cooling + scheme. From the design perspective, the goal is to continuously reduce the thermal resistance of the device.

Image Perception Technology

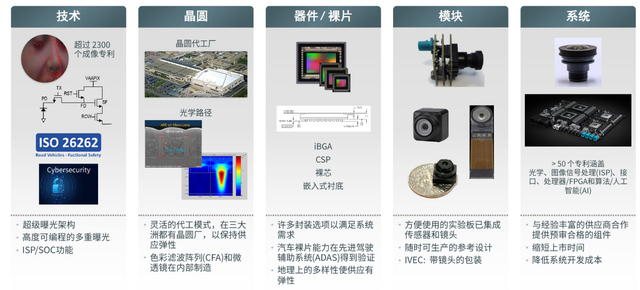

(1)Camera

Currently, the least controversial technology in perception is the camera. More and more automotive subdivided functions, such as front-view camera perception, automatic driving panoramic perception, surround-view and automatic parking, rely on cameras to achieve. There are also combination applications such as front-view cameras with DVR or AR functions, blind-spot AD cameras + surround-view, rear-view AD + electronic rearview mirrors, etc.

The number of cameras is increasing, and the camera pixel has increased from the previous 1 million/2 million pixels to 8 million pixels nowadays. The use of RGB-IR image sensors in intelligent cockpits is popularizing, which is helpful for miniaturizing the camera size. In this field, Ambarella integrates image sensors and lenses. Compared with the current 3cm^3 cockpit module, the IVEC product volume is only 0.5cm^3, which is reduced by more than 6 times in size. For cockpit developers, the work of designing camera modules is simplified, and optical debugging is not required, which facilitates saving production capacity and flexible manufacturing.

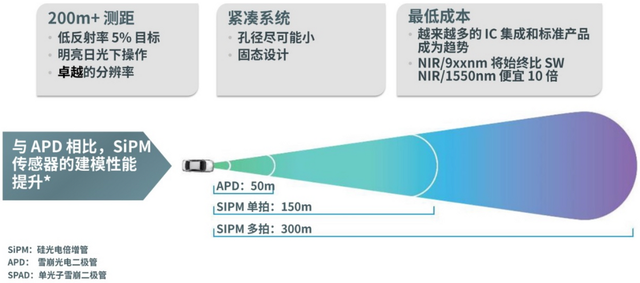

(2) LiDAR

Ambarella provides Silicon Photomultiplier (SIPM), which has better uniformity and supports single-shot detection distance of 150m and multi-shot detection distance of 300m. The photon detection efficiency (PDE) performs well. The ability to detect a single photon allows the system to monitor distances within 300 meters. It can also identify objects with low visibility and has good performance in a smoky environment. This detector technology can be used for single-pixel, line array, or area array sensors.

Conclusion: The cost of electronic components in traditional internal combustion engine cars is only $50, while for level L2 and above electric vehicles and hybrid vehicles, the cost of electronic components is $750. For future level L4/L5 autonomous vehicles, the cost of electronic components can reach $1600 per vehicle.

Currently, the cost of automotive electronic components has increased from $131 in 2019 to $715 in 2022. This process allows us to pay more attention to companies that produce automotive electronic components and the overall development through their technological innovations.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.