WM Motor Posted in Front Passenger Temple

Intelligent Car Reference | Official account AI4Auto

In the latest quarter report, WM Motor has achieved another profit milestone.

Net profit reached 295 million RMB, which, though not a groundbreaking amount, still marks WM Motor as the only new car maker to achieve a profit thus far.

Moreover, this winter saw another quarterly profit for WM Motor, which also happened during the winter of 2020.

So the question arises: does WM Motor really have such coincidental success at the end of the year?

Why Does WM Motor Always Profit in the Last Quarter?

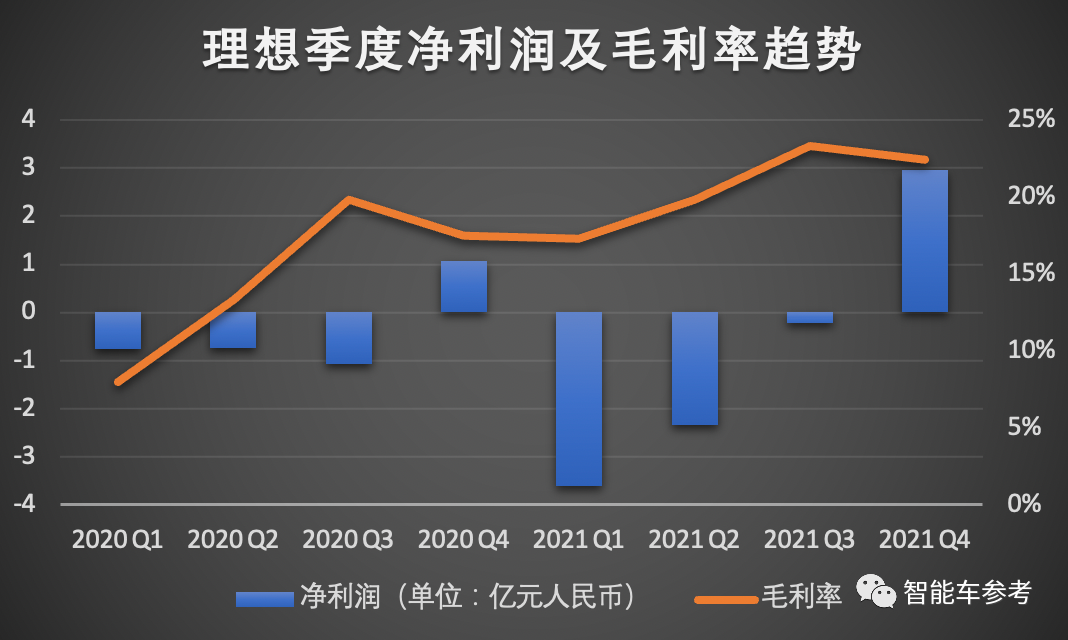

According to the latest financial report, in the fourth quarter of 2021, WM Motor turned around the loss from the previous three quarters, with a net profit of 295 million RMB.

The previous profit was also made in the fourth quarter of 2020, with a net profit of 107.5 million RMB.

So why does WM Motor always manage to turn its losses around in the winter?

Generally speaking, the level of net profit is mainly influenced by factors such as gross profit, operating expenses, others (mainly interest expenses and investment and interest income), and income taxes.

Let’s first look at the gross profit margin.

In the fourth quarter of last year, WM Motor’s gross profit margin was 22.4%; in the fourth quarter of 2020, WM Motor achieved a gross profit margin of 17.5%.

From the gross profit margin curve, it can be seen that the quarter in which WM Motor achieved profitability was not the quarter with the highest gross profit margin.

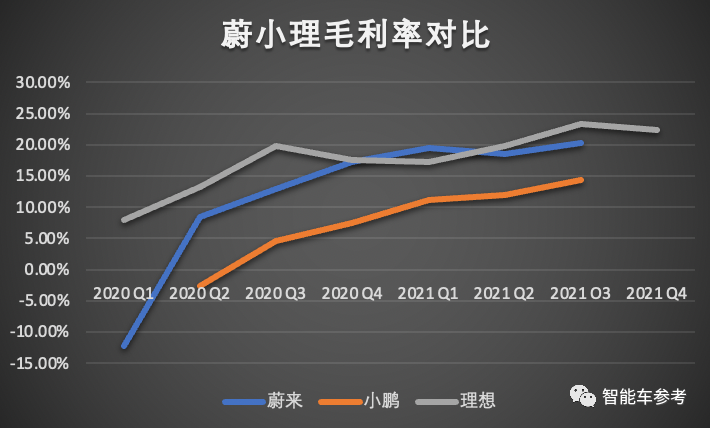

However, compared with NIO and XPeng, WM Motor’s gross profit margin has consistently remained high. Therefore, while cost control has laid a relatively large profit margin space for WM Motor, it is not the main factor in achieving profitability in the last quarter.

Next, let’s look at the profit level.

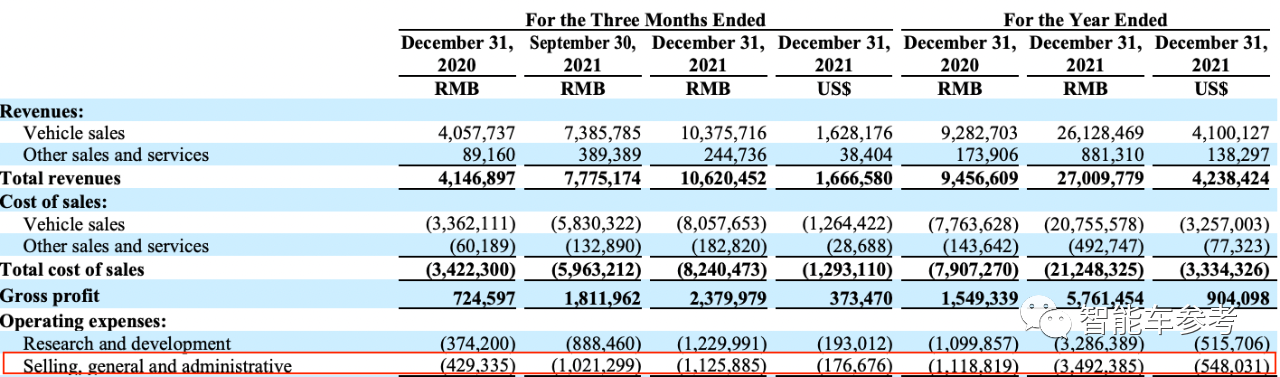

In terms of operating expenses, in the fourth quarter of last year, WM Motor’s sales, general, and administrative expenses were 1.126 billion RMB, accounting for approximately 10.6% of quarterly revenue. In the previous three quarters, this expense accounted for 14.1%, 16.59%, and 13.14% of the revenue, respectively. The comparison is clear.

Similarly, the selling, general, and administrative expenses of WM Motor in the fourth quarter of 2020 were 430 million RMB, accounting for 10.36% of quarterly revenue, also the lowest in that year.

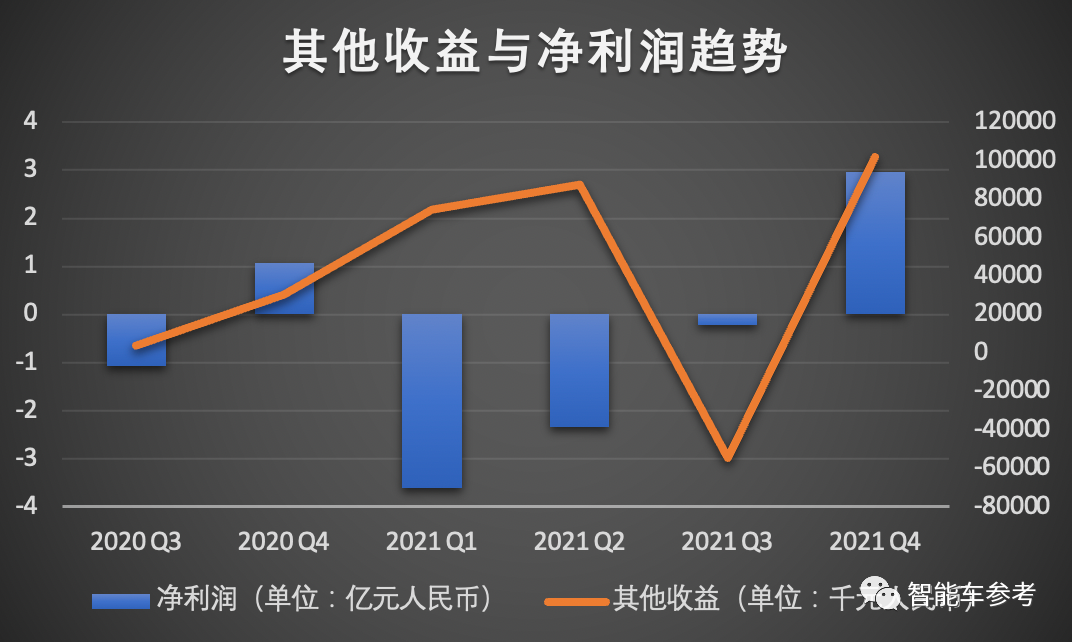

Therefore, from the perspective of profit performance, effective control in sales and functional management should be one of the important factors.The other profits, including interest expenses, investment income, and tax benefits, etc. are the last to mention.

However, it is very clear that there is no obvious correlation with the trend of net profit changes.

So, in conclusion, the secret to achieving ideal profitability lies in controlling operating expenses, especially sales, general and administrative expenses.

That is to say, reducing advertising expenses, compressing administrative expenses, and saving in the last quarter are the most important factors in achieving ideal profitability. In addition, this also matches the impression of the new car companies – it is said that Ideal is the most “penny-pinching” among them.

As the saying goes, what is saved is the profit.

What is the difference between two profitable quarters?

Although both are mainly achieved by reducing expenses, there are still some differences between the two “fourth quarters.”

The biggest difference is research and development (R&D) expenses.

According to financial reports, in the fourth quarter of last year, Ideal’s R&D expenses were 1.23 billion yuan, accounting for about 12% of the current revenue. Compared with the previous quarter, it basically increased synchronously with revenue.

In contrast, in the fourth quarter of 2020, Ideal’s R&D expenses were 374 million yuan, accounting for only 9% of the revenue for the accounting period, which was the lowest proportion among the four quarters of 2020.

In other words, the last time Ideal achieved profitability was somewhat based on reducing R&D expenses, while this time, sacrificing R&D expenses is no longer the price paid for profitability.

This is also related to Ideal’stransformation.

Compared with NIO and XPeng, Ideal has taken an easier path – increasing mileage, with relatively less investment in research and development (the technology is relatively mature), both oil and electric, more easily accepted by users, and achieved better financial results than the other two companies.

However, according to its Hong Kong IPO prospectus, the ultimate trend is still towards pure electricity, and heavy investment in R&D is also a necessary task for Ideal before the big test.

In fact, throughout 2021, Ideal’s R&D expenses have remained high. Financial reports show that its accumulated R&D expenses last year were about 3.3 billion yuan, accounting for more than 12% of the whole year’s revenue.Although there is still a large gap compared to XPeng, NIO’s expenditure ratio has been surpassed.

The focus of R&D expenditure is clear: pure electric vehicle models and battery charging networks.

At the financial report meeting, Li Xiang, the CEO of Li Auto, revealed that Li Auto has invested a large amount of manpower and funds in pure electric vehicle-related technology areas, specifically, the 4C battery, 850-volt platform system, and 400 kW charging piles and self-operated charging stations, to connect the entire pure electric vehicle closed-loop from the battery pack, high-voltage platform to charging and energy supplement.

According to Li Auto’s product plan, at least two pure electric vehicle models will be launched each year from 2023.

According to the information disclosed in Li Auto’s Hong Kong stock listing prospectus, before the launch of pure electric vehicle models in 2023, Li Auto will invest about 3 billion yuan in the field of pure electric vehicles.

This does not include Li Auto’s investment in strengthening and entering the field of smart driving, especially in intelligent driving.

Therefore, in summary, it is certainly a good thing for Li Auto to be able to “make money” first, but if the profit is due to a lack of investment in R&D, it cannot be considered a good thing.

Other Financial Data

After talking about net profit, let’s take a look at Li Auto’s overall operating condition last year.

Revenue scale reached 27.01 billion yuan, a year-on-year increase of 185.6% compared to 9.46 billion yuan in 2020, of which vehicle sales revenue was 26.13 billion yuan, an increase of 181.5% over 9.28 billion yuan in 2020, according to the financial report.

The annual gross profit margin was 21.3%, an increase of nearly 5 percentage points from 16.4% in 2020, with the gross profit margin of automotive sales being 20.6%, an increase of 4 percentage points year-on-year.

R&D expenditure was 3.29 billion yuan, an increase of 198.8% compared to 1.1 billion yuan in 2020.

Li Auto’s total net loss for the year was 321.5 million yuan, an increase of 111.9% compared to 151.7 million yuan in 2020.

In terms of cash flow, Li Auto had an operating cash flow of 8.34 billion yuan and a free cash flow of 4.33 billion yuan last year. As of the end of last year, Li Auto’s total cash and cash equivalents, restricted cash, time deposits and other short-term investments amounted to 50.16 billion yuan.

In terms of delivery, Li Auto delivered a total of 90,491 Li ONE vehicles last year, an increase of 177.4% compared to 3,624 vehicles in 2020.# Fourth Quarter Financial Data:

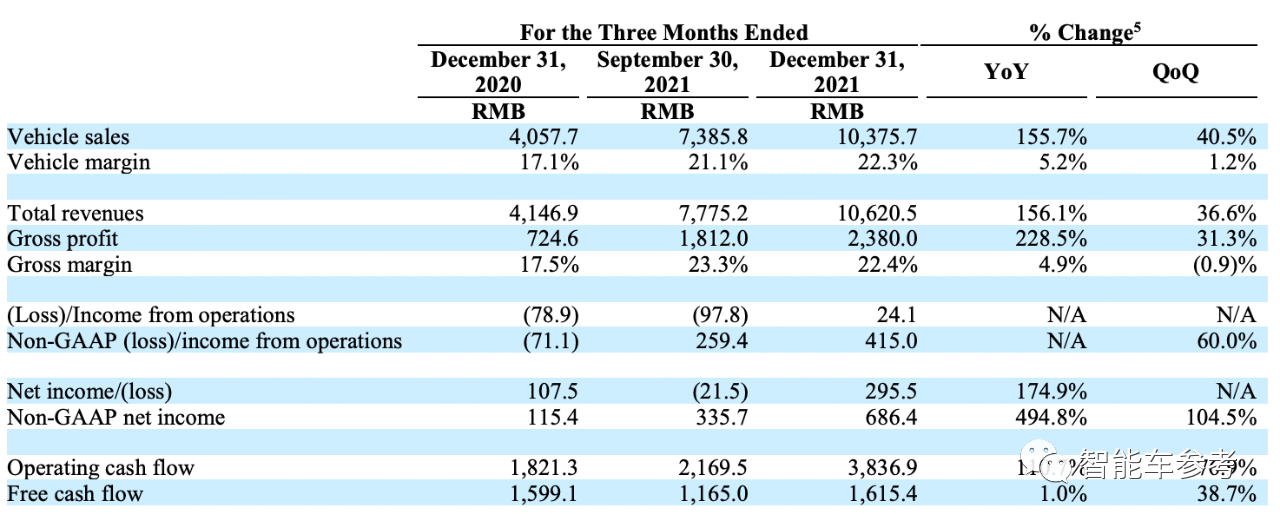

Revenue reached RMB 10.62 billion, breaking through the RMB 10 billion quarterly revenue threshold for the first time with a year-on-year increase of 156.1% and a quarter-on-quarter increase of 36.6%.

Among them, auto sales revenue was RMB 10.38 billion, an increase of 155.7% year-on-year and 40.5% quarter-on-quarter.

The gross profit margin for the fourth quarter was 22.4%, of which the gross profit margin for automotive sales was 22.3%, both growing by about 5 percentage points year-on-year.

As for R&D expenses, for the fourth quarter of last year, IDEAL set a new R&D investment record, with a total investment of RMB 1.23 billion, an increase of 228.7% year-on-year and 38.4% quarter-on-quarter.

In terms of deliveries, IDEAL delivered a total of 35,221 units of IDEAL ONE in the fourth quarter, a year-on-year increase of 144% and a quarter-on-quarter increase of 40.2%.

Overall, IDEAL’s fourth quarter financial report and annual report demonstrate a trait: the popular and well-received product, IDEAL ONE, was produced and delivered efficiently, and the company’s operation was focused on cash flow, showing maturity and an old school approach.

However, in analyst meetings and public settings, Li Xiang seems to be showing another side of himself – daring and outspoken.

one more thing

After the earnings conference, Li Xiang gave a long-term vision for the next ten years of IDEAL in front of everyone:

Looking at the ability of IDEAL ten years from now, I hope we can achieve the same level as Apple.

Li Xiang has set the benchmark of Apple for IDEAL in the smart car race.

Before, Li Xiang also talked about becoming the most influential and appealing player in the smart car race.

However, just dreaming and talking is not enough for IDEAL. The company has hard work ahead of them.

After all, Apple became the redefiner of mobile devices, especially the smart phone race with the help of its own core technology, from the operating system to the computing chip.

Currently, IDEAL has good product quality, but its overall look and business model are more like Lenovo and Xiaomi in the smart car industry.

But hey, everything is just getting started, IDEAL must exist, or maybe it will even surpass one day.“`

“`

— Finished —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.