Writing | Roomy

Editing | Zhou Changxian

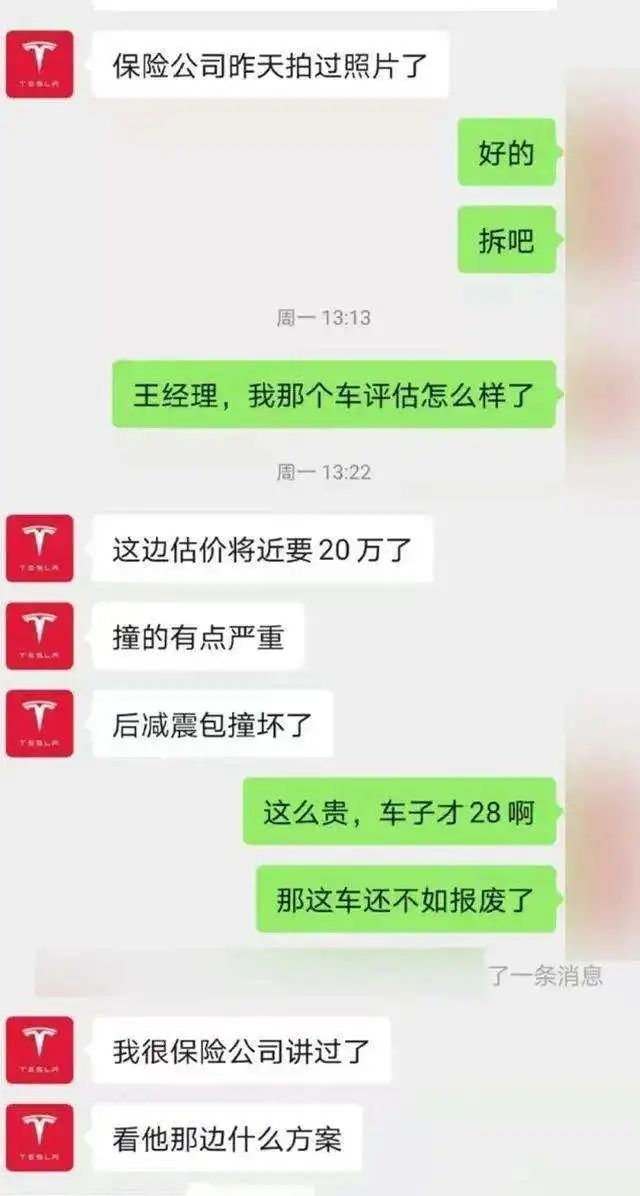

Recently, news of a Tesla Model Y with a repair cost of nearly 200,000 yuan has been widespread. In addition to the industry’s frequent criticism of Tesla’s “money-making” behavior, the complaints from owners of various brands of electric vehicles are also becoming increasingly difficult to ignore.

“The more you use it, the more expensive it gets. Except for cheaper electricity prices than oil prices, all other costs become more expensive as time goes on.”

A certain brand owner, looking at his electric vehicle that has been used for more than three years, is somewhat anxious. Selling it is not an option as the resale value is not high. “I have researched it, and after three years, the resale value is less than 50%.” Continuing to use it will only result in increasingly expensive maintenance costs.

“Sometimes I feel like it’s a hot potato.” This is not an isolated case.

“I plan to buy a gasoline car instead of an electric car.” When saying this, Ms. Cao, from Shanghai, held a Shanghai license plate that she had been waiting for half a year, for a gasoline car that had not yet been released. I can’t help but recall what an engineer from a car company said at the end of last year, “Intelligent gasoline cars may be a major choice in 2022.”

With the impact of the pandemic and the Russia-Ukraine conflict, coupled with the rise in insurance premiums and the reduction of subsidies, automakers not only have to cope with the sharp reduction in subsidies, but also have to bear the rising costs caused by chip and battery shortages. Under the pressure of multiple factors, electric vehicles have unsurprisingly ushered in a wave of price increases.

“The wool comes from the sheep itself. Consumer complaints, combined with the near 22% penetration rate of new energy vehicles in February, have formed a sharp contrast.”

“The rise of the new energy vehicle industry and the vicious cycle between the immature new energy used car sector and the aftermarket services are not conducive to the integration and improvement of the industry chain in the long run,” a market analyst who declined to be named expressed concerns. “The fact that electric cars are getting more expensive to use is a dangerous signal.”

The price gap between selling and buying

What car owners didn’t expect was that prices were expensive initially due to the price of the car.

The long-term shortage of chips and the increase in raw materials costs have resulted in another factor this year: the reduction of subsidies.

Previously, four ministries jointly issued the “Notice on the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles in 2022”, which clearly stated that starting from January 1, 2022, the subsidy standard for new energy vehicles will be reduced by 30% based on 2021.

Converted into a math problem, it looks something like this. Pure electric passenger vehicles with a range of less than 300 kilometers will not receive subsidies. Pure electric vehicle models with a range of 300-400 kilometers will receive a subsidy reduction of 3,900 yuan compared to the previous year. Pure electric vehicle models with a range greater than or equal to 400 kilometers will receive a subsidy reduction of 5,400 yuan compared to the previous year. Plug-in hybrid vehicle models will receive a subsidy reduction of 2,000 yuan compared to the previous year.To cope with the declining subsidies, automotive companies have also implemented corresponding strategies, both strong and weak. For instance, Tesla, which has been frequently criticized, chose a tough stance by directly raising prices officially. There are also those who take a less aggressive approach, such as XPeng Motors, which maintains the subsidy before the price reduction within a limited time frame.

Even so, most automotive companies still choose to release “price increase announcements,” which, although not as aggressive as Tesla, clearly indicate a “price increase.” Including BYD, Wuling, Zeekr, Polestar, NETA and others, have completed their price adjustments.

Rough estimates indicate that the price increases for the two models of Model 3 and Model Y are between 10,000 and 20,000 yuan, XPeng has increased prices by about 4,000 to 6,000 yuan, and BYD has raised prices by varying degrees of 1,000 to 7,000 yuan. The prices of the two Volkswagen models, ID.4 CROZZ and ID.6 CROZZ, have increased by 5,400 yuan…

Consumers were caught off guard by this wave of price increases.

It is not difficult to understand the reasons why automotive companies have decided to raise prices. With the soaring prices of upstream raw materials, the profits of battery and chip suppliers have been squeezed, putting pressure on suppliers, which in turn is transferred to the entire car factory.

On February 14th, the Ora brand Black Cat and White Cat stopped taking orders. Ora explained that they could no longer afford to sell any more. After the significant increase in raw material prices in 2022, the Black Cat lost more than 10,000 yuan for each car sold.

This cycle results in users bearing the brunt. In February, the penetration rate of electric vehicles reached 22%, partly due to the psychological factor of “depositing now, and it will still rise in the future.”

On one hand, electric cars are becoming more expensive to purchase, and on the other hand, the resale value of used cars is causing headaches for consumers. This has become a rather divisive contradiction.

As mentioned by the owner of an electric car from a certain brand in the previous article, “the electric car, which has been used for about three years, has become a hot potato.” The upgrading frequency of electric cars is too fast. For example, the endurance in 2017 was generally 400 kilometers, but after more than three years, it can reach 700 kilometers. Coupled with battery loss, used cars are no longer valuable.

“I bought it for over 200,000 yuan less than three years ago. Now, I can only sell it for a maximum of 50,000 yuan. The resale value is causing headaches, and even used car dealers don’t want to accept it.” In the used car market, new energy car models are not popular, and they may even be subject to some discrimination.

There are two reasons for the low resale value: battery depreciation levels and the speed of intelligent upgrading. Although car companies and battery manufacturers are accelerating the research and development of battery technology, there is still no good solution to battery depreciation.Car companies are also making some efforts, such as laying out the power battery recycling business and reclaiming materials from scrapped battery packs. However, it is currently a “losing business”.

Experts have indicated that the cost of recycling one ton of lithium iron phosphate batteries is around 8,500 yuan, but the market value is only 8,000 yuan. This means that each recovered power battery will incur a loss of about 500 yuan.

“The scrap material is more expensive than new goods, and the price of recycled power batteries has risen too quickly, which has exceeded expectations,” said Cai Zepeng, a supplier of scrap batteries.

For materials such as nickel-cobalt-manganese lithium, an inverted phenomenon with a discount factor of over 100% has already emerged. “Some customers can supply at a factor of 115% to 120%.”

Power battery recycling is still a blue ocean, and investment and revenue are inverted, requiring scale solutions. The current layout scale is still inadequate.

The price gap between buying and selling is becoming increasingly significant.

“Zero-to-whole ratio” is a major pain point for electric vehicles

The second layer is expensive in terms of use and maintenance.

In the era of fuel vehicles, the “zero-to-whole ratio” coefficient was often used to indicate the costliness of brand vehicle maintenance. Simply put, the high or low cost of repairs will depend on the price of car parts in the automotive aftermarket, with higher-priced car models having higher maintenance costs later on.

In a set of survey data released by Zhongtong Auto Service in 2021, the Mercedes-Benz C-Class had the highest zero-to-whole ratio at 823.87%. In other words, for a 300,000 yuan vehicle, if disassembled and sold in parts, it can be estimated at 2.4 million yuan based on the 823.87% ratio.

Of course, this idea is not practical. However, the high or low zero-to-whole ratio is closely related to maintenance costs. In the era of new energy, the “zero-to-whole ratio” is also a major pain point, with expensive parts being an important reason for high aftermarket repair prices.

Professional data company We Predict has studied the service and maintenance of nearly 19 million vehicles in the past five years and found that electric vehicle maintenance costs are 1.6-2.3 times that of fuel vehicles.

“If it’s a Mercedes-Benz electric vehicle, according to the zero-to-whole ratio, doubled, wouldn’t it be unaffordable and unrepairable?” said a Mercedes-Benz C-Class owner, who is not planning on replacing their electric vehicle from Mercedes-Benz, perhaps suggesting that luxury brand electric vehicles are currently not within consideration.In the era of gasoline cars, a common sense has been proven over and over again: car models with low maintenance costs usually have a large number of holdings and cheaper aftermarket parts. Currently, it is difficult to find such a situation in the new energy vehicle market.

There are two sets of data. The retail sales of new energy passenger cars in 2021 are nearly 3 million, which is the total sales of the three years from 2018 to 2020. As of the end of 2021, the national stock of new energy vehicles has reached 7.84 million, accounting for only 2.60% of the total number of cars. Overall, the stock is small and only a few models have sales of over 10 thousand.

In addition, repairing pure electric vehicle models is expensive and it is due to the use of more advanced technology. For example, various types of sensors, intelligent headlights and other covers, all-aluminum body design, three-electric aspects, etc.

Therefore, the frequently criticized 200,000 yuan maintenance cost of Tesla Model Y is not so difficult to understand. The maintenance personnel stated that once the integrated die-cast aluminum alloy body of a Tesla is damaged, the structure cannot be repaired and can only be replaced with original factory new parts.

The application of new technologies such as all-aluminum body and three electrics has exposed the impact on maintenance costs in the later stage. “The money saved from the fuel cost is spent on maintenance instead,” which has almost become the voice of all electric vehicle owners, “it gets more expensive every year.”

“Before, when driving a gasoline car, I didn’t want to go to a 4S store for maintenance, so I went to a shop outside, the price was much cheaper. Now, electric cars cannot be repaired outside.” This kind of distress is not an individual case, but almost a common problem for all electric vehicle brands.

The fundamental reason is that there are relatively few aftermarket parts in the new energy vehicle aftermarket, and the technical threshold is high. For third-party parts suppliers, “they cannot master it and it is not a cost-effective deal with small quantities.”

Difficulties in maintenance have become another problem affecting the sales of electric vehicles, so what should be done?

Car companies have to figure out a solution. As a leading company, NIO chose to open its own repair shop. On March 1st, NIO added an external investment, and the target was “Shanghai Shouwu Auto Maintenance Service Co., Ltd.”, with a 100% investment ratio.

In addition to reducing parts costs, NIO’s consideration for opening repair shops on its own is also to cultivate talents. Currently, there is a huge shortage of electric vehicle repair personnel. They not only have to know how to repair cars but also understand the concept of OTA software upgrades. It is clear that the talent reserve required by the times is not as complete as displayed by the waves.”I studied in the vehicle department of the university, only to find that electrification has become the mainstream after graduation.” Little Wu, who has been sending resumes to new car-making forces, expresses a slightly helpless tone, which indicates the transformation trend and the gap behind it.

“The Money Saved on Electric Cars Goes to Insurance”

Cars are expensive to buy and repair, and this has led to a 10% increase in premiums for new energy vehicles.

After the launch of exclusive insurance for new energy vehicles, 12 major insurance companies in China participated, breaking the historical rule of the same price policy for oil-fueled and electric cars, and expanding the protection scope to the vehicle’s ignition, the “three-electric” system, and even the charging pile outside the car.

This brings great pressure to insurance companies. Further expanding the protection scope inevitably leads to increasing costs. At the end of last year, some car owners complained that the premium had become more expensive, and even when they didn’t buy insurance until one day later, it increased directly by 6,000 yuan.

An insurance salesperson who was interviewed said that before the reform of new energy vehicle insurance last year, premiums for those vehicles were almost the same as traditional fuel vehicles. After the reform, many insurance companies raised the premiums for insuring new energy vehicles.

“Take Tesla as an example. Before the reform, the premium for 2 million coverage was around 6,000 or 7,000 yuan. Now it’s probably over 9,000 yuan a year.”

However, the fuel vehicles of the same price category have not changed much. Previously, the huge premium caused by the costly Tesla pushed it to the forefront. For a Model Y long-endurance edition priced at 347,900 yuan, the insurance cost exceeded 15,000 yuan at its peak.

Many car owners said that the total premium for the second year was nearly doubled compared to the first year. They also showed the renewal insurance policy for Model3, which cost more than 9,700 yuan based on a 30% discount, without accidents last year.

In addition to Tesla, the premiums for XPeng and Li Auto have also increased to varying degrees, and NIO’s premium increase is around 10%. Some car owners are frustrated, saying that “the money saved on electric cars goes to insurance instead.”

The fundamental reason for the increase in premiums for new energy vehicle insurance is that the accident rate is higher than that of fuel vehicles. Analysis reports from ZhongAn Trust show that the accident rate for new energy vehicles is 11.7% higher than that of fuel vehicles, and the payout rate is 5.4% higher.

The body and the “three-electric” system of new energy vehicles are covered by commercial insurance for driving, parking, and charging processes. Under this circumstance, the liability insurance coverage for third parties has also increased accordingly. The maximum coverage for third party liability insurance is 10 million yuan, while the maximum coverage for new energy vehicle exclusive insurance can reach 40 million yuan.

An insurance salesperson candidly said that “insuring new energy vehicles is basically losing money.” A minor collision could also cause damage to integrated components, and the insurance company’s reimbursements could easily cost tens of thousands of yuan.

“Full compensation for battery fires, damaging a single battery can cost tens or even hundreds of thousands of repair fees.” Therefore, accidents such as battery collision are often rejected by some insurance companies.

In addition to the 12 mainstream insurance companies participating in exclusive insurance for new energy, some insurance companies classify electric and hybrid vehicle models as “high-risk models” because “the prices after accidents are very high.” In addition, there are not enough accident data at present, so many small and medium-sized insurance companies choose to “keep their distance.”

For insurance companies, the biggest part of claims is parts. The monopoly of new energy vehicle parts leads to a single repair channel and high compensation costs. In addition, depreciation is difficult to define well, and potential risks increase as the vehicle age increases.

However, even so, the trillion-level aftermarket service is still an important source of future profits. Musk once said, “Insurance will become Tesla’s main product, and the value of insurance business will account for 30% to 40% of the value of the entire vehicle business.”

No one wants to miss out on this fat, and the trend of new energy vehicle companies entering the insurance field is becoming more and more obvious.

Finally, who will benefit from all of this? The answer is not difficult to guess.

Closing Remarks

Between buying and selling, if a virtuous cycle cannot be formed, it will have a significant impact on the popularization of new energy vehicles and the improvement of the industry chain.

Currently, the China Association of Automobile Manufacturers has raised its 2022 sales forecast for new energy passenger vehicles from 4.8 million to more than 5.5 million. But expectations are mirrored, corresponding to difficulties such as chip shortages, raw material price increases, and rising insurance costs. 2022 is seen as a “difficult year.”

As sales of new energy vehicles increase, the accompanying problems are increasing every day, and there is no way to balance growth expectations and real-world problems.

It is a new round of tests for the industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.