Author: Zhu Yulong

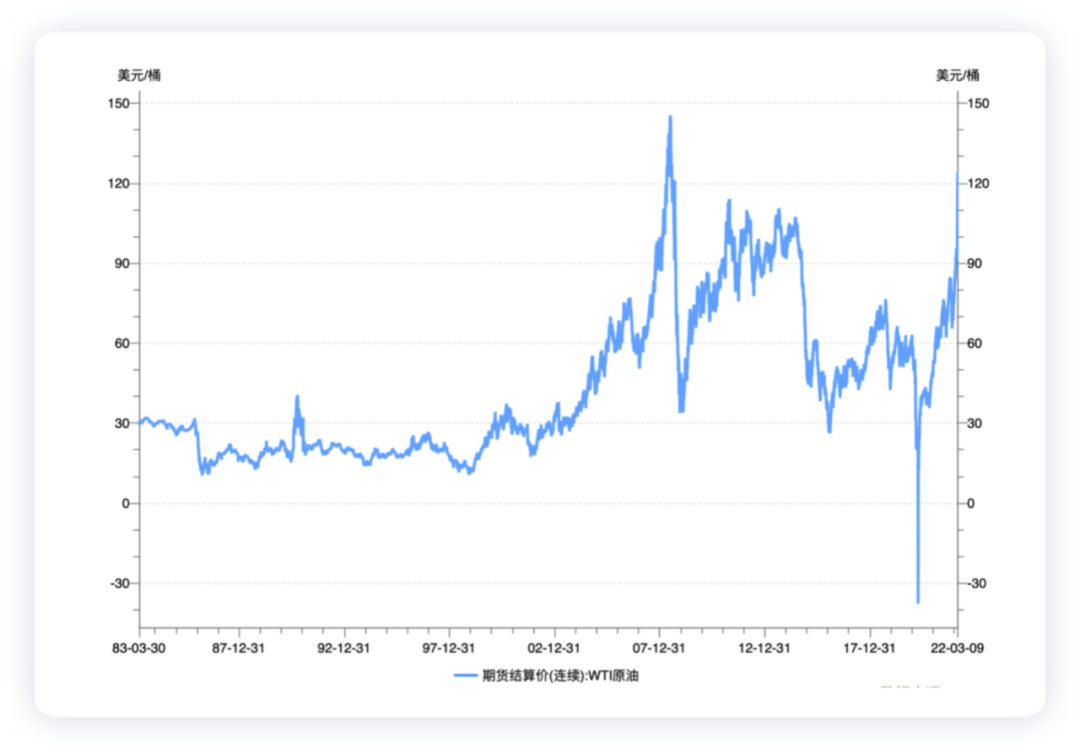

Recently, with the conflict between Russia and Ukraine, there has been a huge price fluctuation in global commodities, and the price of crude oil has surpassed 100 US dollars for the first time in nearly 8 years. Crude oil has broken through the 100-dollar mark three times in history, twice in March 2008 and January 2011 respectively. The first time reached a high of 147 dollars and lasted for 6 months; the second time reached a high of 128 dollars and lasted for more than three years. The last time, which is the rapid rise in oil prices this time, is a realistic case for global carbon emissions and energy security.

In our daily lives, as the prices of gasoline 92 and 95 have begun to soar, the impact on consumers is actually quite significant. From this perspective, the impact of oil prices has begun to show in the full life cycle cost of China’s new energy vehicles.

The Impact of Gasoline Prices

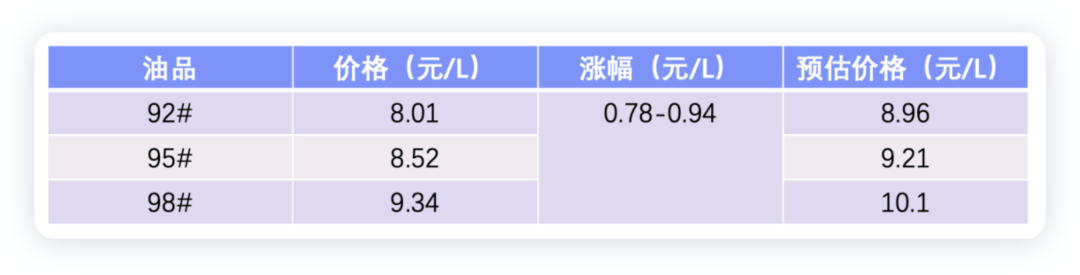

On March 3rd, domestic gasoline and diesel prices were raised by 0.22 and 0.2 yuan per liter respectively. The next round of price adjustment will be conducted on March 17th. March 8th was the third working day of the ten-day statistical cycle with a crude oil price change rate of 24.01%. It is estimated that the gasoline price will be raised by about 1040 yuan/ton or 0.78-0.94 yuan/liter.

- From the perspective of 2C

For consumers, the price of gasoline 92 in 2021 was only about 5.5-5.7 yuan/liter, and the gasoline price has quickly approached 9 yuan/liter. This growth rate is really hard to accept. The rise in oil prices has increased the cost of car use for users, which has become one of the reasons why some users choose new energy vehicles.

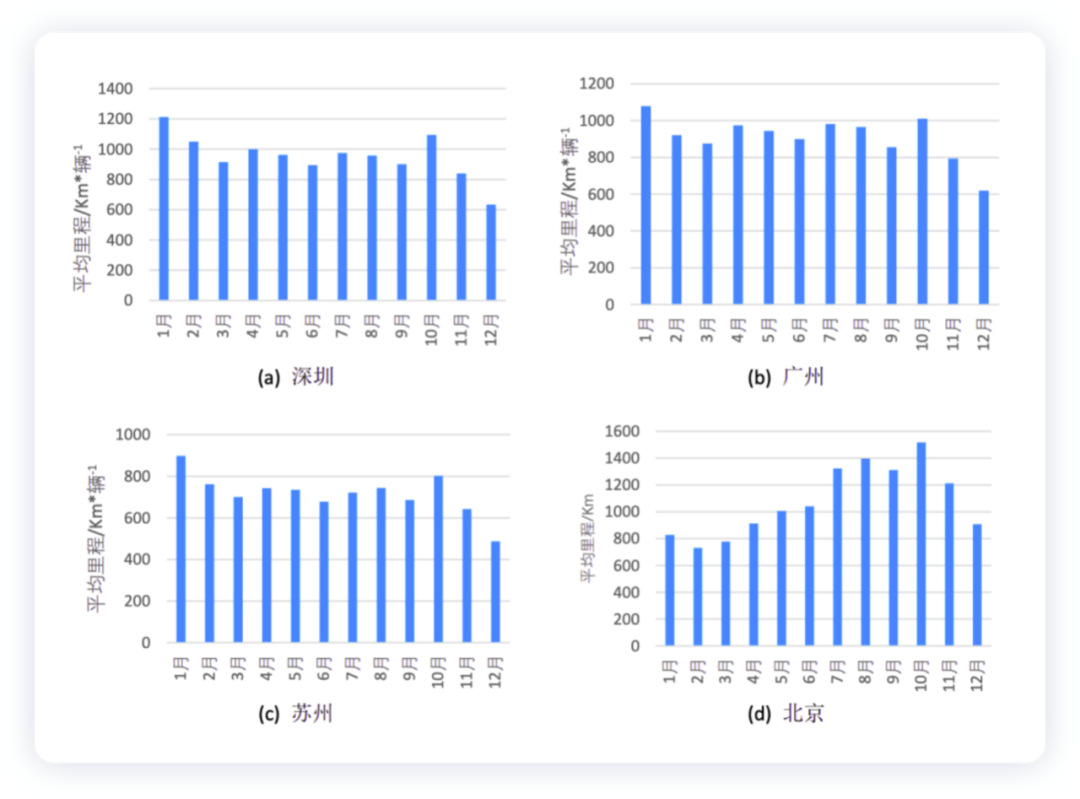

Taking a typical mid-size car as an example, with a high-speed driving preference and less driving in urban areas, the average fuel consumption is about 9L/100km. Calculated based on 10,000-15,000 kilometers of annual use, the required fuel cost is approximately 8100-12100 yuan.

If consumers have their own charging piles, they might only need 1500-2250 kilowatt-hour (15 kWh per 100 kilometers) of electricity, which could cost as low as 450-700 yuan if using residential electricity (0.3-0.35 kWh during off-peak hours). Even if calculated at the charging fee of 1.5-2 yuan per kilowatt-hour for external public charging piles, the cost of charging a car that runs 10,000 kilometers annually would be approximately 2500-4000 yuan. The lower operating cost of new energy vehicles has become an important factor for consumers to choose them, especially for commuting in urban areas. As the monthly commuting mileage increases, the price difference becomes more pronounced. In China, the development of new energy vehicles has gone from policy-driven to policy-and-market driven, and then to market driven.

If consumers have their own charging piles, they might only need 1500-2250 kilowatt-hour (15 kWh per 100 kilometers) of electricity, which could cost as low as 450-700 yuan if using residential electricity (0.3-0.35 kWh during off-peak hours). Even if calculated at the charging fee of 1.5-2 yuan per kilowatt-hour for external public charging piles, the cost of charging a car that runs 10,000 kilometers annually would be approximately 2500-4000 yuan. The lower operating cost of new energy vehicles has become an important factor for consumers to choose them, especially for commuting in urban areas. As the monthly commuting mileage increases, the price difference becomes more pronounced. In China, the development of new energy vehicles has gone from policy-driven to policy-and-market driven, and then to market driven.

- From the perspective of B2B:

Under the overload operation of ride-hailing and taxi services, the high oil price is accelerating the adoption of pure electric vehicles. Due to the large daily mileage – starting at 200 kilometers per day and averaging 6,000-15,000 kilometers per month for operational vehicles – this cost is particularly noticeable. So, my understanding is that the market transformation brought about by the driver’s economic calculations will reappear in 2022. This is because of the current operating conditions of ride-hailing services, where rising oil prices significantly increase the cost of oil-powered vehicles, greatly squeezing the cost-effectiveness of fuel-powered cars in this market.

In 2021, the total sales volume of new energy passenger cars in the operational vehicle market was 354,900, of which 342,700 were pure electric vehicles, accounting for a high proportion of 66.82%. The electrification of operational vehicles has become mainstream under government regulations, and the rise in oil prices means that ride-hailing and taxi drivers will make their own choices based on their accounting books.

Demand for charging piles

We can take a closer look at the situation of China’s public charging infrastructure: as of January 2022, there were 1.178 million public charging piles, including 486,000 DC fast charging piles and 691,000 AC charging piles. Currently, the cost difference brought by DC fast charging is becoming more important, so the demand for fast charging is truly rigid.

According to the number of new car insurance policies in the first week of March, the penetration rate continued to be 25.8% from the fourth week of February. In the first week of March, there were 94,000 new energy vehicles (PHEV accounted for 17,750 and BEV accounted for 75,839), 16,496 hybrid vehicles, and only 251,200 gasoline cars, with a total market of 363,000.Summary: Developing new energy vehicles is an inevitable choice from a global perspective, and the process involves government policies, the combination of market and policies, and ultimately full commercialization. The stimulation brought about by high oil prices is, in my opinion, a crucial factor in deeply ingraining the idea of new energy vehicles in people’s minds.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.