Power Packaging

During the weekend, I had tea with Mr. Liu and some other people, mainly discussing the development direction of in-car power supplies. One of the topics was that OBC and DCDC would choose encapsulated power modules to replace the original discrete solutions. In other words, modularity is becoming more prominent in the automotive field, from inverters to all high-voltage power parts we see today. According to Yole’s analysis report, the MOSFET market is expected to reach 9.4 billion US dollars by 2026, the IGBT market will reach 8.4 billion US dollars, and the packaging material market for power modules is expected to reach 3.5 billion US dollars in 2026.

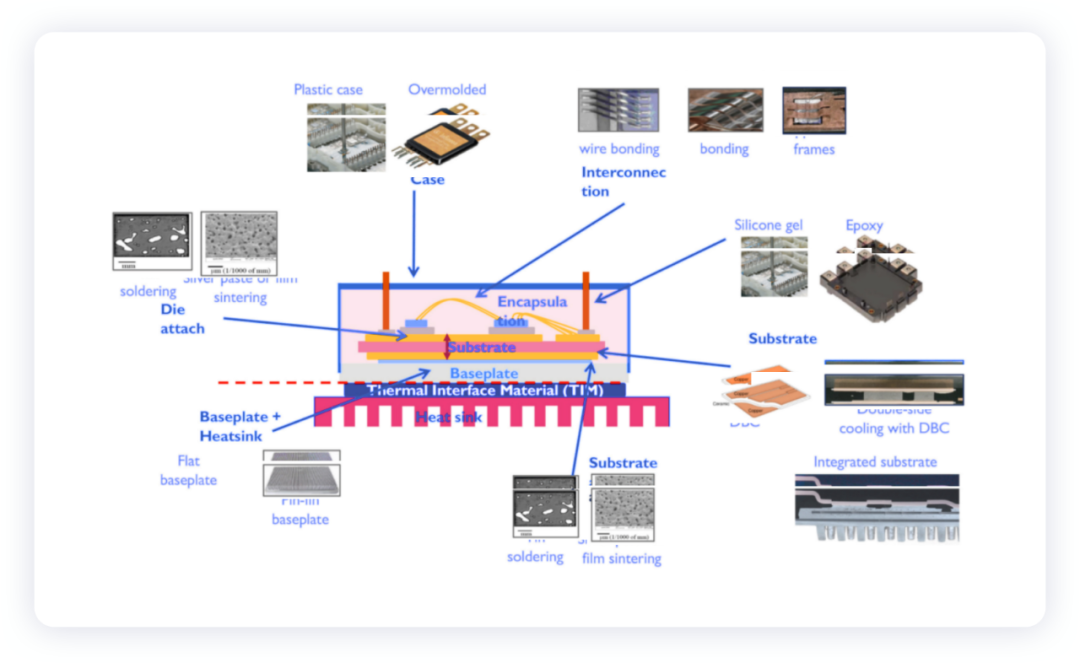

From a value perspective, the largest segmented market for power packaging materials is substrates, followed by substrate packaging and chip packaging materials. Due to the increasing demand for power devices, the shortage in the power device market has led to changes in the business model and reshaping of the supply chain.

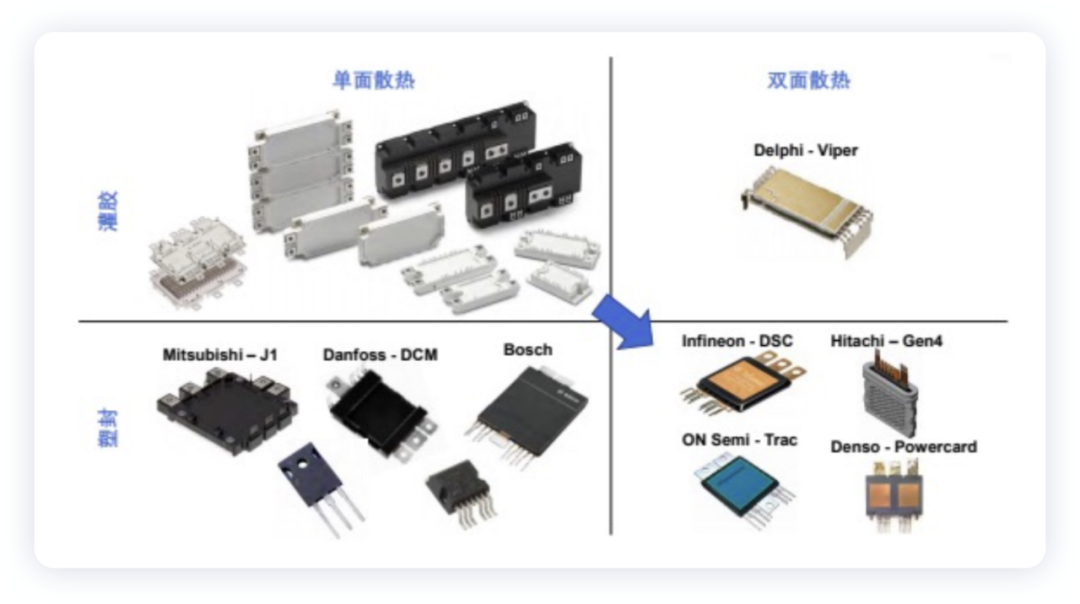

Currently, Tier-1 automotive parts suppliers and car OEMs have started to participate deeply in the design and manufacturing of power modules. Power module packaging for semiconductor devices is an opportunity for system manufacturers and automakers to control the upstream supply chain. Since the packaging technology for IGBT is more mature, Tier-1 suppliers and OEMs are more willing to invest in silicon carbide (SiC) MOSFET technology.

Chip shortages in 2021 have made Chinese car companies hope to localize the core power electronic components in the supply chain as much as possible. Chinese companies are developing power module packaging solutions and starting to use some domestic power chips, while European, Japanese, and American companies still account for a large proportion.

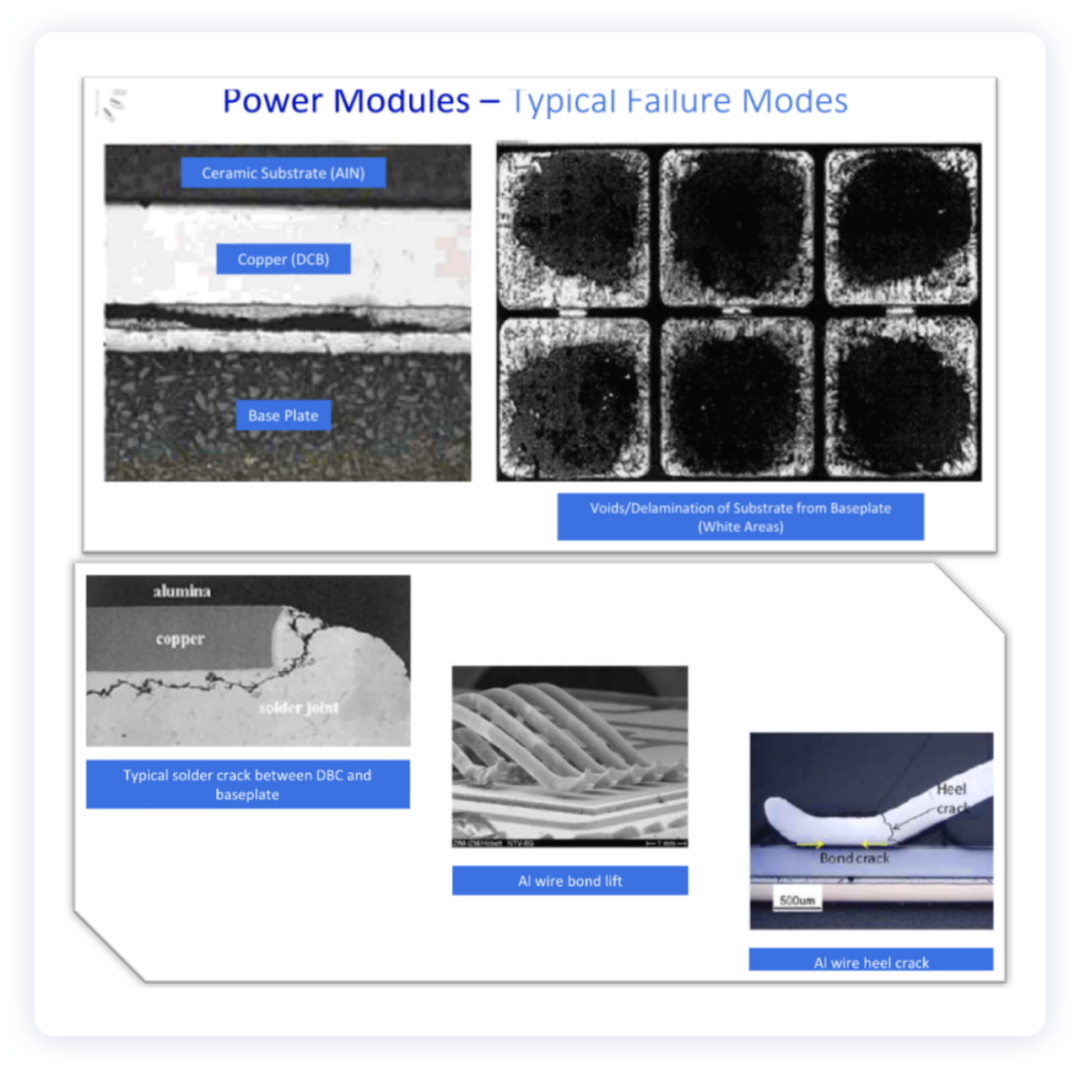

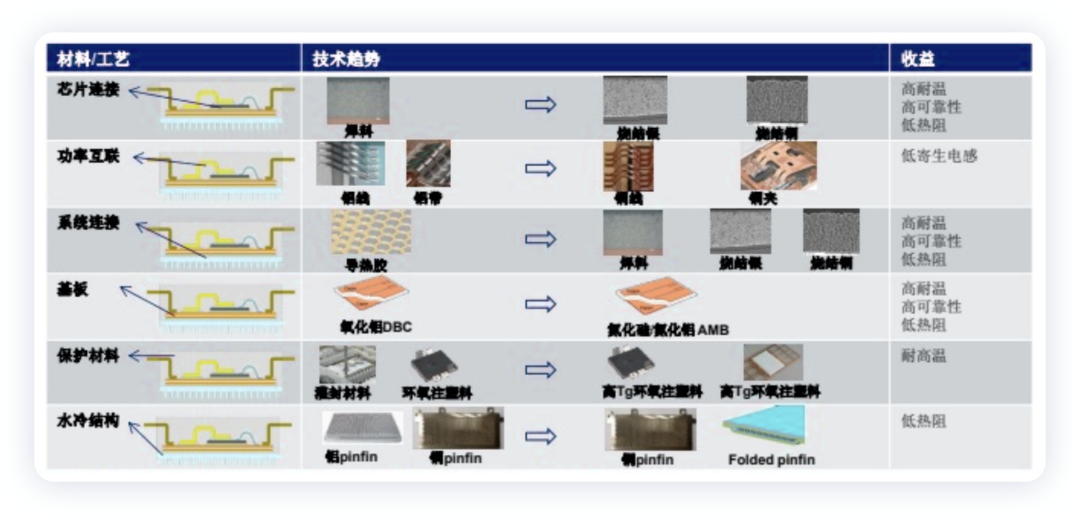

From a technical point of view, power module packaging technology is not only about wire bonding, welding, and encapsulation; packaging technology in the automotive field is more complex and requires specific proprietary technologies in power density, performance, and reliability.

Development Trend of Power Modules

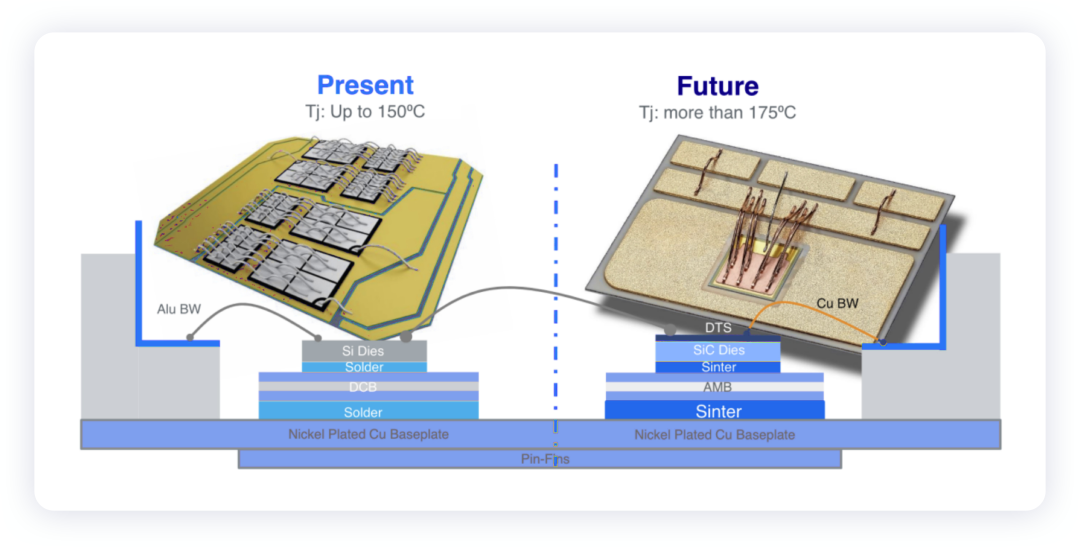

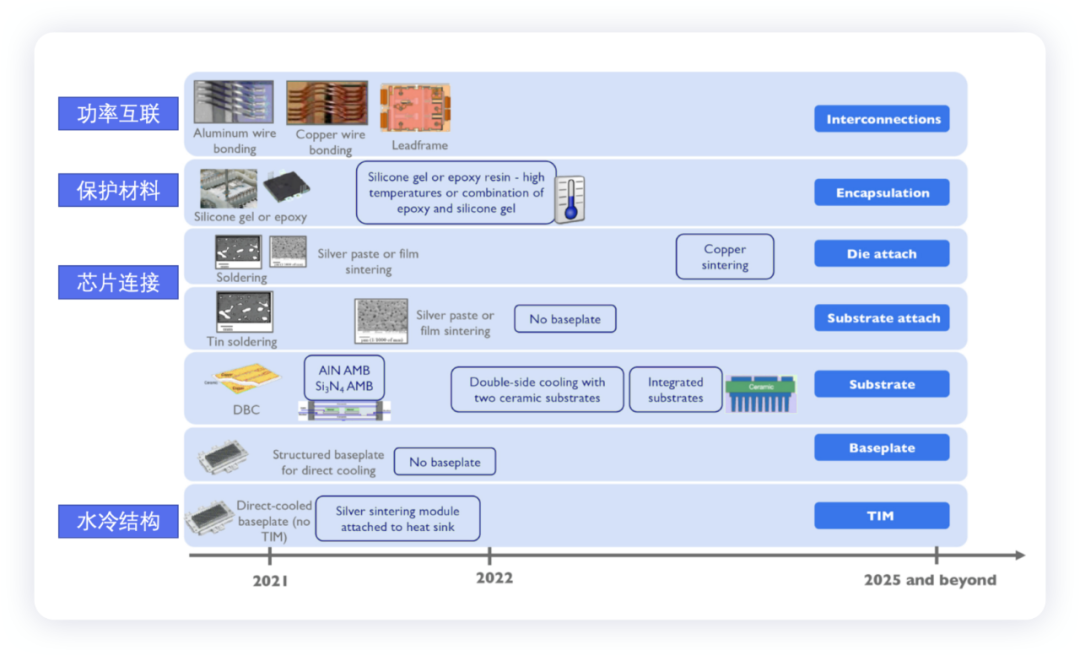

From the perspective of technology development, Yole and Unimicron engineers have respectively given a trend of technology development. My understanding is that it is necessary to sort out according to the choices of each car company. Currently, it seems a bit early to bet on a single company. Around the factors of temperature resistance, reliability, parasitic inductance, thermal resistance, and cost, many system solutions can be combined.

With the development of SiC modules, it is possible to explore the respective routes of Tier1 and chip manufacturers. I did not pay special attention to this before, but now I need to spend time collecting and organizing this information.

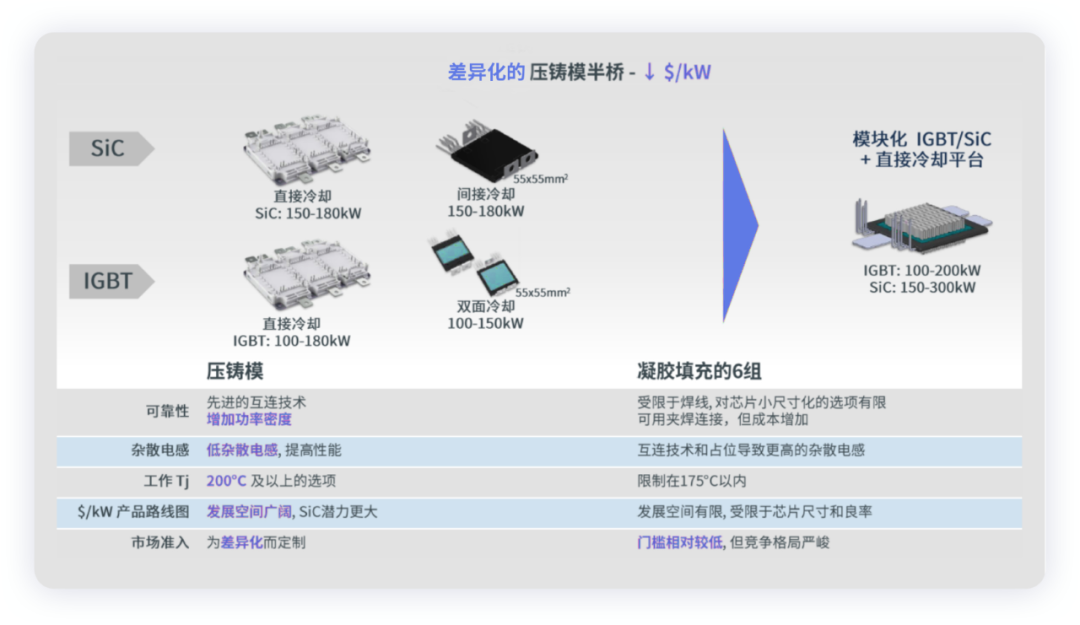

Each company’s technology route and considerations are different. Take ON Semiconductor as an example, its development focus will also be on plastic-encapsulated die-cast modules, which can also be directly water-cooled. The difference between die-cast modules and gel modules is that the power density of the module can be higher, and the stray inductance can be lower, especially for silicon carbide, the acceptable operating temperature can be higher, up to 200℃ or even higher. The operating temperature of silicon carbide can be very high.

For the same system price, using die-cast modules should be able to achieve greater potential and differentiation—ON Semiconductor is now discussing with many car manufacturers to make some special manufacturing of the main drive modules for them. In addition to the relatively low stray inductance and high power density, the characteristics of cooling plastic-encapsulated modules are also relatively good in terms of scalability. ON Semiconductor can use three half-bridge modules to make a power of 150 kW or combine them into two for a power of 300 kW, and the space occupied is basically the same. Compared with gel modules, the life cycle of die-cast modules is relatively long. In the ON Semiconductor double-sided cooling module, the IGBT is an intelligent chip with two built-in sensors. One is a temperature sensor (accurate temperature detection), and the other is also built-in an current sensor (total reaction time will be faster, can better protect the system).

Summary: In the competition of power semiconductors, domestic companies have a large space for indigenous substitution. From the perspective of future market demand, the requirement for supply chain security is placed at a high position.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.