About the Controversial Topic

Everyone has their own understanding of the controversial topic. In the short, medium, and long term, this event may cause continuous changes in the automotive market. Let’s explore some possible predictions.

I am thinking about the revolutionary progress of electrification and intelligence in the traditional European automotive industry and auto parts industry. The scope of this economic impact is considerable, and when an industry develops large enough, it is related to the national economy and people’s livelihood. The previous wave of new energy vehicle subsidies in Europe actually promoted the awareness of buying new energy vehicles in their own country and supported the transformation of traditional cars to new energy.

The Russian Market and Automobile Materials

The Status of the Russian Market

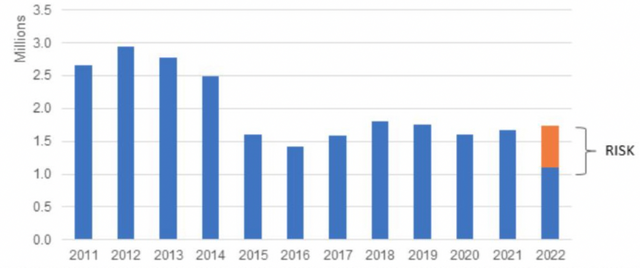

With a population of 146 million, the Russian automotive market reached a peak of 2.94 million vehicles in 2012. Many auto companies expected the Russian market to become the largest light vehicle market in Europe. Affected by the Crimean incident in 2014, it hit a low point of 1.43 million vehicles in 2016. Since then, government incentives have supported the market to some extent; Due to component shortages and supply constraints, the recovery was much weaker than expected in 2021—total vehicle sales for the year totaled 1.67 million units, a 4% increase from 2020.

This part is not very important in terms of global volume but it still has an impact on some individual companies (JD Power and LMC Automotive analysts have reduced their 2020 global light vehicle production expectations to 85.8 million units).

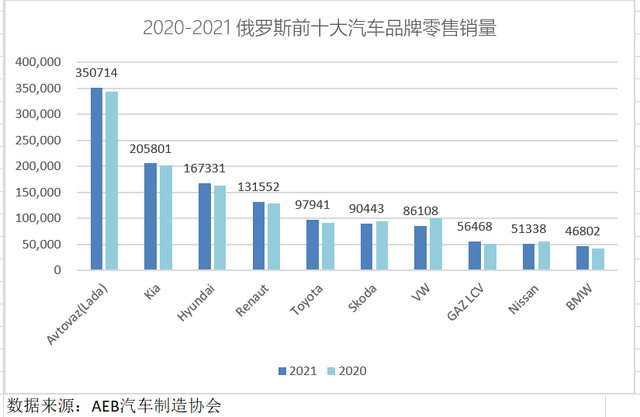

From the perspective of a single brand, Russian domestic giant AvtoVAZ occupies the majority, which has a joint venture with Renault, and a considerable amount of parts comes from abroad. Although China exports quite a lot, overall sales in Russia are not particularly large.

Hyundai-Kia Motor (There Will Be Some Influence)

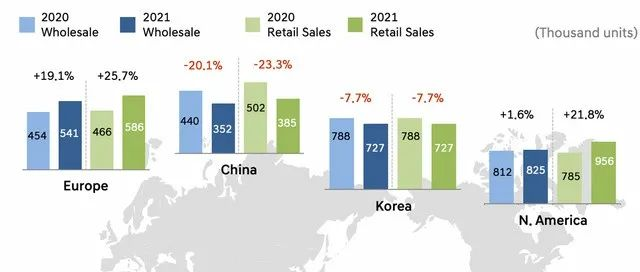

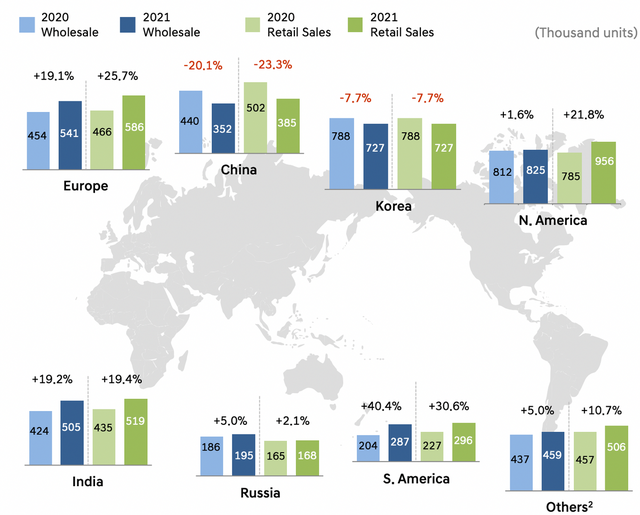

Hyundai Group sold 373,132 vehicles in the Russian market in 2021, accounting for the largest market share, including 10.3% for Hyundai and 12.3% for Kia. Hyundai established a plant in St. Petersburg in 2010, purchased a former General Motors factory, renovated production of the Hyundai Tucson, Palisade, and Kia Sorento, and exported to North America and other parts of Europe this year. Currently, over 230,000 vehicles are produced in Russia every year.# 2021 Export of Cars and Auto Parts to Russia from South Korea

In 2021, South Korea sold USD 2.5 billion worth of cars and USD 1.45 billion worth of auto parts to Russia, which accounted for 44% of South Korea’s annual exports to Russia.

Auto Parts

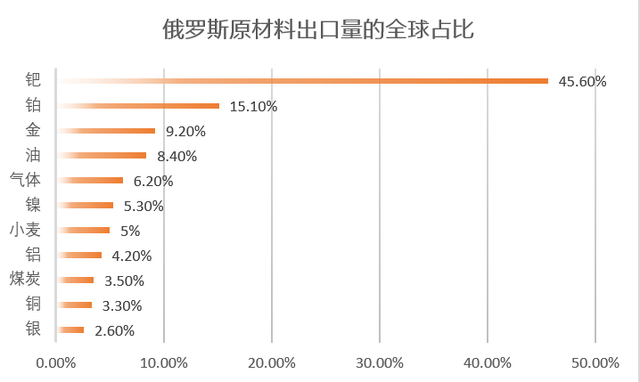

Russia is one of the largest suppliers of several key metals used in automobiles worldwide. In terms of the proportion, Russia exports 40% of palladium for catalytic converters, which are mainly used in internal combustion engines. Platinum accounts for 15.1%, and nickel accounts for 5.3% of auto metal components. In addition to Russia, South Africa and Zimbabwe also produce a large amount of palladium, and the current price has risen slightly above USD 2,400. Such a price increase will increase the average cost of a new car by USD 150, and the average cost of an SUV or pickup will increase by over USD 200.

Therefore, in the short term, the automotive industry that is most affected is Renault and Hyundai in terms of the impact on internal combustion engines, where the rising prices of metal supplies for catalytic converters are a concern. The price of nickel in the battery sector will also increase, but these are all short-term fluctuations.

Mid- and Long-term Fluctuations in the Market

European Energy Crisis and Green Transformation

Developing green energy in Europe is the right path in many ways, but balancing ideals and realities is important.

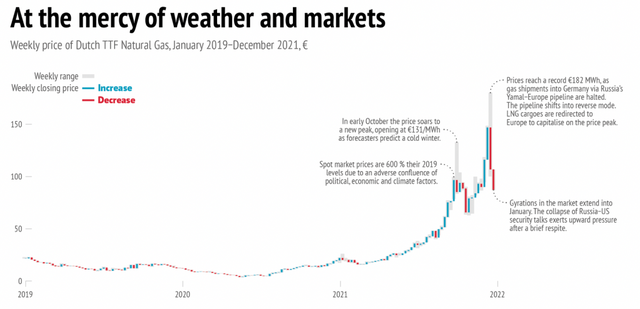

Logically, the soaring energy prices in Europe have magnified inflationary pressures. In the summer of 2021, the inflation rate of the energy sector rose sharply by 17.4%, causing the inflation rate of European economies to reach a 13-year peak of 3.4% in September 2021 and increase to over 5% in December. Natural gas accounts for 22% of Europe’s electricity production, and the soaring price is passed on to consumers’ bills. In 2021, the EU electricity benchmark contract doubled, and the wholesale electricity price rose to about 7.5 times the average value from 2010 to 2020.

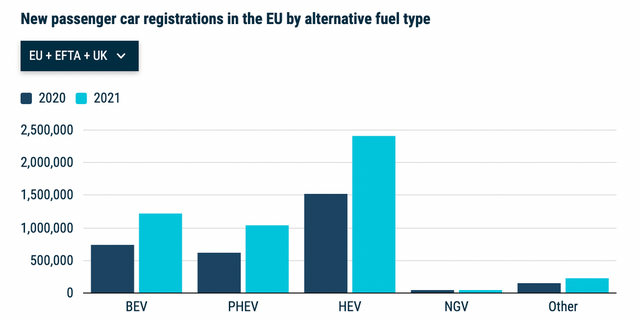

If the electricity price is high, developing electric vehicles is actually a very difficult thing. When the entire transportation sector switches to electric drive, new problems arise in terms of power source and price. From a holistic perspective, the high growth of electric vehicles in Europe in 2021 mainly revolves around several core Western European countries. It’s unclear where the money will come from to subsidize the transition to electric vehicles in countries such as Eastern and Southern Europe. I believe that it is difficult for both Europe and China to make a one-step transition to pure electric vehicles. The transformation brought about by Volkswagen’s electric vehicle “All in” campaign can raise awareness among enterprises. In various games, the importance of hybrid vehicles has truly taken a step up.

If the electricity price is high, developing electric vehicles is actually a very difficult thing. When the entire transportation sector switches to electric drive, new problems arise in terms of power source and price. From a holistic perspective, the high growth of electric vehicles in Europe in 2021 mainly revolves around several core Western European countries. It’s unclear where the money will come from to subsidize the transition to electric vehicles in countries such as Eastern and Southern Europe. I believe that it is difficult for both Europe and China to make a one-step transition to pure electric vehicles. The transformation brought about by Volkswagen’s electric vehicle “All in” campaign can raise awareness among enterprises. In various games, the importance of hybrid vehicles has truly taken a step up.

Batteries and Raw Materials

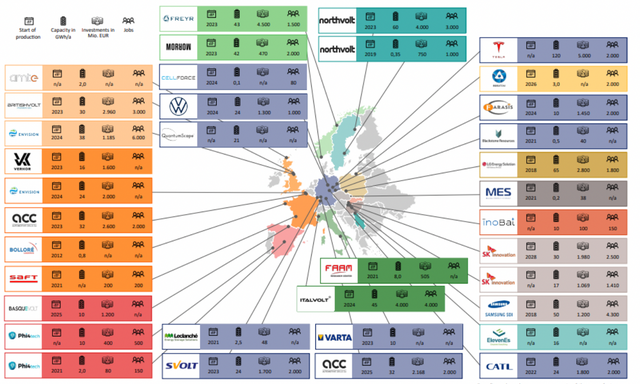

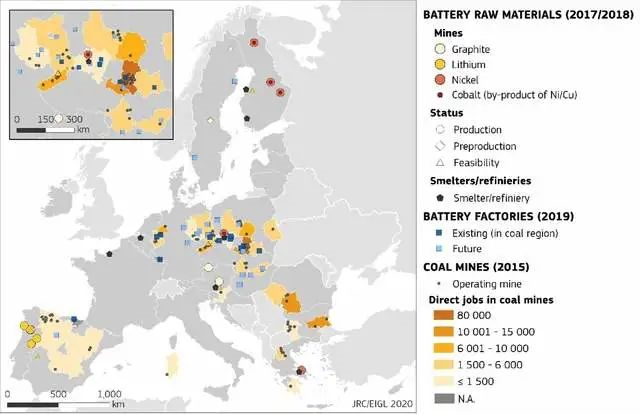

In the development of electric vehicles, Europe has been focusing on two issues: whether it can independently manufacture battery cells and how to supply raw materials. These two issues determine whether batteries can be developed in the next generation supply chain. Considering the geopolitical constraints, such large investment in Europe makes the reduction of battery prices a difficult goal, as there is a continuous demand for battery raw materials.

This means that we need to take a longer-term view of this development path. However, the endgame is difficult to determine, especially when it comes to social problems brought about by the development of a large number of industries. If short-term changes bring about a large number of job losses, this is difficult to become a reality. The possible path is to continue to invest heavily in building a large number of battery industry chains (as well as the previously discussed European chip issue), and then transition from smart cars.

In summary, I personally think that many things need to be viewed from a longer-term perspective. Supply chains and upstream resources are now in a very important position, and the replacement and substitution within the industry is more market-oriented.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.