The content of this article is sourced from 42how and has been translated by ChatGPT

The development of the new energy market in recent years has been evident to all. In 2021, the production and sales of new energy vehicles in China both exceeded 3.5 million, with the new energy retail penetration rate surpassing 20\% in December.

The excellent sales performance and growth potential have greatly accelerated the mainstreaming process of new energy vehicles in the automotive industry, highlighting the commercial value of the new energy market. It is not difficult to see that in recent years, traditional automakers have been gradually “correcting their attitudes,” increasing investment in new energy product lines and launching independent new energy vehicle models. Standing on solid ground, new automakers are also seizing the opportunity to prepare for the next stage of arms race, striving to maintain their leading advantages in the intelligent and electric fields.

For those who are still waiting and watching, 2022 is undoubtedly a year worth paying attention to. With the progress and maturity of the industry, a new round of technological iteration has already begun. Regardless of old or new players, 2022 is a symbolic node for product replacement. In this article, we will also summarize the upcoming heavyweight new energy vehicles in 2022.

Three New Forces: Hottest, Latest and Smartest

All three new forces will launch new models this year, which are basically fearless contenders according to the current information. After Tesla officially announced that no new cars will be released in 2022, the attention on these new cars has been further consolidated.

NIO: Three models with all-wheel drive

In 2022, NIO will launch three new cars, with the already unveiled ET7 and ET5, and the ES7 that is still partially concealed.

The released ET5 and ET7 adopt the same new generation of assisted driving hardware and cabin hardware, mainly including:

- 1 Luminar Falcon lidar sensor

- 7 8-megapixel cameras forming a surround-view visual system

- An assisted driving calculation platform consisting of 4 NVIDIA Orin X chips

- An intelligent cabin system powered by Qualcomm Snapdragon SA8155 chips

In addition, both of these cars are equipped with an OLED infotainment screen with a resolution of 1,728 × 1,888 pixels, UWB keys, and a 23-speaker Dolby audio system.

After equipping both models with the above-mentioned configuration, which has a difference in positioning, it is not difficult to see that NIO has considered reducing the number of underlying system branches and increasing the scale effect in the planning of new cars on this platform. Therefore, the upcoming NIO ES7, which is also on the NT2.0 platform, will likely use the same assisted driving and cabin hardware. The two cars will also adopt similar configurations in terms of the three-electric system.On February 15th, it was announced at an official event by NIO that the ES7 would be launched in April, with a positioning as a 5-seater medium-to-large SUV, primarily focused on comfort.

Simply put, the ES7 is likely the SUV version of the ET7, with the relationship between the two being similar to that of the Model Y and Model 3, with the main differences being in exterior design and space. In terms of pricing, considering that the ES7 is positioned between the ES6 and ES8, the price will be similar to that of the ET7, with a starting price perhaps above 400,000 yuan.

According to official information from NIO, deliveries of the ET7 will start at the end of March, with the second model, the ET5, set for delivery in the third quarter. The yet-to-be-launched ES7 is expected to debut at the Beijing Auto Show, following the launch of the ET5.

Ideal: Full-size flagship

The highlight of 2022 for Ideal is the new X01 model.

The X01 is positioned as a full-size SUV larger than the Ideal ONE, with the same extended-range power system, still targeting families as its main consumers as the brand’s flagship model.

Compared to the Ideal ONE, the higher-positioned X01 has comprehensive upgrades in terms of configurations. In terms of advanced driving assistance, the IPO prospectus of Ideal mentioned:

Starting from 2022, all of our new models will be equipped with hardware that is compatible with L4 automated driving as standard.

The X01, scheduled for release in 2022, will naturally meet these specifications. According to rumors circulating on the internet, the X01 will be equipped with Livox LiDAR and the NVIDIA Orin X chip.

Additionally, according to information disclosed by Ideal in the Q3 2021 financial report conference, the X01 will be officially launched in the second quarter of this year, with deliveries in the third quarter, and advanced driving assistance will continue to be standard. Another aspect related to intelligence- the X01’s intelligent cabin will also be upgraded iteratively, with enhancements beyond simply being equipped with a high-performance processor.

Upgrades for the X01 include double wishbone suspension, air suspension, and range extenders, among other undisclosed features.When positioned higher and configured higher, the price of the X01 new car will also be higher than that of the Ideal ONE. According to the speculation based on existing information, the price of the X01 will probably be in the range of 400,000 to 500,000 yuan.

Xpeng: G9 & P7

Xpeng’s new cars for 2021, the P5 and G3i, are both based on the David platform and mainly target the market of 200,000 yuan and below. Under this positioning, the upgrade of the vehicle is still somewhat limited, so many people who plan to buy Xpeng’s new cars are waiting. Xpeng’s new cars in 2022 will be based on the Edward platform of medium and large-sized cars, so the new car’s abilities will also make greater progress after the platform ban is lifted.

The G9 that debuted at the Guangzhou Auto Show last year is Xpeng’s flagship product this year. The new car will be equipped with Xpeng’s XPILOT 4.0 assisted driving system, with two Sensonor ST’s LiDAR sensors installed in front of the vehicle. The visual system also uses higher resolution cameras and the NVIDIA Orin X computing chip. The upgraded full-scale hardware-assisted driving capability is worth looking forward to.

According to previous spy photos, the G9 is likely to introduce a three-screen design, including an entertainment screen added for the co-pilot. G9’s intelligent cockpit experience, supported by high-performance infotainment chips, will also be a highlight of this launch.

In addition to intelligence, the G9 has also made some significant upgrades in battery, electric and ‘car’ aspects. The new 800V electrical platform brings faster charging speeds and the SiC Mosfet-based electronic control system delivers better energy control. We believe that the new car’s endurance performance will be excellent compared to models of the same class. As Xpeng’s flagship product in the SUV market, it also offers air suspension.

As for the pricing of the G9, according to Xpeng’s information given to investors, Xpeng’s product pricing for this year will rise to around 400,000 yuan, which basically indicates the price position of the G9 top models. The official price information may be released at the Beijing Auto Show and the G9 is expected to be delivered in the third quarter of this year.

After the G9, it is highly likely that Xpeng will also launch a modified version of the P7 this year. Considering that the P7 has not been on the market for a long time, the degree of modification may be similar to that of the Ideal 2021 modified edition, with no significant upgrades in large body and electric and other aspects but mainly improving some pain points and details of the existing vehicles.

The pain points that P7 car owners complain about, such as the lack of a trunk opening button and the difficult to use steering wheel design, are expected to be improved in this modification. After these pain points are optimized and improved, the modified P7’s experience will also be further improved.

ConclusionThe top three new forces have started to show some homogenization upgrades on key new products this year, such as the ES7, X01, and G9, all equipped with lidars, all using SA8155 cockpit chips, all using NVIDIA’s Orin X intelligent driving chip, and all using higher-spec visual perception systems, aiming to achieve city street-level navigation-assisted driving.

From this, we can see that the high requirements of intelligence for the top three new forces have entered a new stage since 2022. The new vehicles basically choose the latest and highest-performance version of mass-produced components for intelligent hardware such as chips. This has also laid a good foundation for the popularity and expected capabilities of these new vehicles.

However, the almost identical chip selection of the three companies also indicates that there are not many options for the top suppliers of intelligent hardware at present, which is very similar to the current mobile electronic industry. Under these circumstances, the differences in the capabilities of several new vehicles in terms of hardware will be reduced compared to before, and the final intelligent performance will further test the company’s overall R&D.

In addition, NIO, XPeng, and Ideal have all planned high-end models for their new products this year, and XPeng and Ideal have even opened up the market in the higher price range of their brands, which is closely related to the barbell structure of the domestic new energy market. In the past period of time, relatively high-priced new energy vehicle models in China have been favored by financially affluent early adopters due to their more comprehensive user experience. In 2022, where is the turning point of the leveraged market? This may be explored through the market performance of ET7, X01, and G9.

Top luxury brands: 1.0 models in the era of market 2.0

The electrification transformation has been talked about for some time in the traditional car makers’ camps, but everyone has only recently started to take real action. Several leaders, such as Volkswagen, Hyundai, Kia, and Ford, have already put the first batch of native pure electric platform models on the market. However, in the current context of Tesla’s expansion and the new forces’ incremental advancement, luxury brands are actually the most threatened.

After the market performance of the first few models that were compatible with the platform or modified from gasoline cars fell short of expectations, BBA realized that its original brand value could not be seamlessly inherited in the electrification era, and it must comply with the new rules and values in the new field.

So, BBA has painfully come up with native pure electric models one after another, and 2022 happens to be the time when these models will land in China.

Mercedes-Benz: EQE with High Expectations

Mercedes-Benz’s seed player this year is EQE. In the official description of Mercedes-Benz, this new car is called “a shorter EQS.” This mid-to-large-sized pure electric sedan was released at last year’s Munich auto show and is based on the Mercedes-Benz EVA 2.0 platform. It has a similar appearance and interior design to the flagship EQS, with even the same 1,512mm height and wider 1,961mm width. The wheelbase also reaches 3,120mm.

Under the pure electric platform, the “four wheels and four corners” of EQE has widened the shoulder space by 27 mm, extended the cabin space by 80 mm, raised the seat height by 65 mm compared to the current Mercedes-Benz E-Class. Equipped with large angle rear wheel steering and a width of 141 cm, as well as 24 G of operating memory from the flagship EQS, the Hyperscreen with three screens can also be optional on the EQE.

With the support of an 811 ternary lithium battery with a usable capacity of 90 degrees and a low wind resistance design, the WLTP range of EQE long-range models can reach 660 km. For comparison, the WLTP range of the CLTC range of the Tesla Model 3 Performance version is 547 km, with a range of 675 km.

However, the most important information about EQE is that the domestic market version of this car will be locally produced by Beijing Mercedes-Benz, with a timing of mid-2022. “Made in China” also means that the EQE has a certain room for imagination in terms of price. The domestic EQE’s high-low matching strategy with the imported EQS is similar to the sales of Tesla Model S and Model 3 in China, but the market performance ultimately depends on the pricing courage of Mercedes-Benz on EQE.

After the EQE, Mercedes-Benz also prepared a backhand, the larger EQE SUV will also be released later this year, and the domestic market version will also be produced locally.

BMW: Two imports and one domestic

BMW’s new energy surprise for 2022 is not as high, and three new cars including the i4, i7, and pure electric 3 Series will be introduced domestically this year.

Regrettably, none of these three cars are native to the pure electric platform, but fortunately, BMW’s product strength in platform-compatible models is still at a good level, and there is still a certain market under the premise of appropriate prices.

The pure electric 3 Series is highly likely to use the same three-electric configuration as the iX3, and the problem is not that big with an 80-degree battery and a small 300-horsepower rear-drive motor as the main-selling model. As for the price, there is hope that it will continue to fall below the iX3, with an entry-level model between 250,000 and 300,000 yuan.

The phrase “price is right” obviously does not apply to the imported i4 and i7. The i4 is mainly promoted with the high-performance M50 model, which is BMW’s first pure electric M model. The zero-to-100 km/h acceleration time is less than 4 seconds, and the rear axle is equipped with air suspension, an upgraded high-performance braking system, and an anti-roll bar. It should have outstanding performance in driving experience.

The phrase “price is right” obviously does not apply to the imported i4 and i7. The i4 is mainly promoted with the high-performance M50 model, which is BMW’s first pure electric M model. The zero-to-100 km/h acceleration time is less than 4 seconds, and the rear axle is equipped with air suspension, an upgraded high-performance braking system, and an anti-roll bar. It should have outstanding performance in driving experience.

As BMW’s flagship pure electric sedan this year, there is not much information revealed about the i7, but it can be expected that the i7 will also be equipped with a high-performance electric drive system similar to iX and a large battery of over 100 kWh. The highlight inside the car is a floating large screen with a resolution of 7,680 x 2,160 in the rear row.

In addition, the iX model released last year has already started delivering in China. The brand new interior and exterior design and frameless doors make this flagship SUV highly recognizable. The high-level configurations such as four-wheel steering, air suspension, electric suction doors, carbon fiber body, and a battery capacity of over 110 kWh also make the iX highly competitive with its peers.

During the period when the Model X is difficult to obtain, the iX will be the largest, most expensive, and longest-range luxury electric SUV available in China.

Audi: Bring in existing models first, wait for new products

Audi’s new energy vehicle product line is divided into two routes, high-end products have a later schedule, and the main task in China is to introduce existing models.

The highest-level positioned e-tron GT in the e-tron series will be launched in China this year. This coupe model, which shares the J1 platform with Taycan, has slightly lower performance compared to Taycan, the battery capacity is consistent with the latter, and the price is lower than Taycan.

In addition to high-performance coupes, Q6 e-tron and Q4 e-tron will also be produced and launched respectively in North and South China. Both models are based on the MEB platform of Volkswagen Group, and can be regarded as upgradable versions of Audi Q7 and Touareg, Q5 and Tiguan, respectively.

In terms of overseas three-electricity configurations, the Audi Q4 e-tron is consistent with the Volkswagen ID.4 model, with the top-of-the-line model equipped with a battery of over 80 degrees and a front asynchronous and rear permanent magnet dual-motor power system with a maximum power of 220 kW, zero to sixty miles per hour acceleration in just over 6 seconds, and CDC electronic control damping.

Like the ID.6 series, the Q5 e-tron is currently a special three-row seat model for the Chinese market. Apart from having a larger interior space, its other configurations are almost the same as the Q4 e-tron.

The pre-sale price of the Q5 e-tron is currently between 400,000 and 500,000 RMB, and the smaller Q4 e-tron is expected to be priced lower, with an expected price range of around 330,000 to 430,000 RMB. Considering the current market situation of pure electric SUVs in China, the pricing of the Q4 e-tron and Q5 e-tron is somewhat embarrassing, and they may not be very competitive in the price range of 300,000 RMB and above in 2022.

Audi’s ace in the hole this year is the A6 e-tron and Q6 e-tron, which come from a higher-level PPE pure electric platform. The former’s concept car was unveiled last year. The domestic project E6L corresponding to the new car was also exposed online, with an entry-level model featuring a single motor rear-wheel drive, a battery capacity of 83 kWh, an estimated range of 550 km, and the four-wheel drive version equipped with a 100 kWh battery with a zero to sixty miles per hour acceleration of 5.7 seconds.

These two new cars are also like the dual-car plan of the Mercedes-Benz EQE and EQE SUV, but the Volkswagen PPE platform will adopt an 800 V electrical architecture and has a better advantage in technology.

Summary

In 2022, BBA’s actions in the domestic new energy market began to accelerate, with Mercedes-Benz and Audi having domestic plans for C-class pure electric platforms that are almost synchronized with overseas markets, and BMW introducing multiple pure electric new cars this year and producing the pure electric 3 Series domestically.

From a product perspective, the main difference between the new Mercedes-Benz EQE, Audi A6 e-tron, and BMW iX and previous models lies in their departure from the development of fuel models and their design that avoids the appearance of “oil-to-electricity” conversion.After developing on a pure electric platform, BBA has achieved relatively good results in the electrification and spatial design of vehicles. In fact, they are not falling behind new automakers, such as NIO’s ET7 and XPeng’s P7 extended-range versions, with the Mercedes EQE achieving a WLTP range of 660 km with a large battery and low wind resistance designs.

However, BBA’s improvements in intelligentization are currently not significant. These new vehicles generally lag behind the new forces of 2022 in terms of assisted driving hardware, as none are equipped with lidars or surround view systems. Even the intelligent cockpit, which is a traditional weakness for automakers, only presents improvements in hardware.

Therefore, although first-tier luxury brands in the domestic market have entered a new stage in 2022, the products they have brought belong to the 1.0 era of the 2.0 market. If the brand value cannot be sustained and intelligence is not a priority, they will not have enough appeal for new users, and the high-level mechanical quality and vehicle quality premiums will also be limited. That is why pricing will still be the core factor determining market performance.

Domestic Brands: Each has its own strengths

2022 was another year where domestic brands stood out in terms of new energy. After experiencing accelerated market penetration in 2021, each has become bolder and more decisive in their various attempts to take different paths, including joint ventures, exploring the high end market, personalizing labels, differentiation, and dislocation competition, and they have begun benchmarking the new forces in terms of the main technical skiils, the three electrics and intelligentization.

Huawei Lineup

Huawei, whose objective is to “help companies build good cars,” made many moves last year. After the ARCFOX Alpha S Huawei HI version was released and let the public see the outstanding level of Huawei’s intelligent driving, Huawei’s joint ventures had become a label that comes with stream views in the automotive industry.

The Alpha S Huawei HI version is the first player in the Huawei series. Its product boasts a range of dazzling parameters, such as the three lidars, high-resolution surround view system, and a 400 TOPS computing power. It has already shown the capabilities of the system through assisted driving during city navigation and advanced self-parking. The customized version, equipped with the 990 chip, also shows excellence in speech and ecosystem.

The HI version also uses Huawei’s three-electric system and has a maximum power of 473 kW with a combination of front asynchronous and rear induction motors, and a zero-to-hundred acceleration of 3.5 seconds. The 750 V fast charging also provides an excellent energy supplement speed.

According to previous information, the Alpha S Huawei HI version has already achieved small-scale internal deliveries at the end of last year, and delivery to consumers is expected to begin in the first quarter of this year.Another model with Huawei’s scheme is the Avita 11. This pure electric SUV, jointly built by Changan, Huawei and CATL, will have a CLTC pure electric range of over 700km and a zero-to-sixty acceleration of under 4 seconds. The officially announced charging speed greater than 200 kW is also implying that the vehicle will have a high-voltage electrical platform.

Huawei’s ADS assisted driving is also set to appear in the Avita 11, with the configuration of three laser radars and an omni-view vision system confirmed.

Currently, overall, the Avita 11 is also a highly competitive model in terms of the three electrics and intelligence, and the vehicle’s car design is quite outstanding. The time of delivery in the third quarter of 2022 is the same as that of popular models such as the X01 and G9, and among traditional brands, the Avita 11 is considered the most powerful dark horse.

Another popular Huawei product is the AITO WJ M5, which differs from other Huawei models in that it is a range-extending product. The 40-degree battery provides a WLTC range of 150 km, and the four-wheel-drive model uses a rare combination of front asynchronous and rear permanent magnet double motors in range-extending products. The top-of-the-line model has a zero-to-sixty acceleration of 4.4 seconds.

As a replacement product for the SF5 of Seres, Huawei has made almost every possible renovation to the internal and external design of the WJ M5, and has replaced it with the Hongmeng car system and Huawei’s audio system, giving it significantly improved appearance and cabin experience.

The price of the rear-wheel-drive model of the WJ M5 is 250,000 RMB, and that of the four-wheel-drive model is 286,000 RMB, which is relatively reasonable. The biggest regret of the vehicle is that, due to the relatively old electronic and electrical architecture of the SF5, it cannot be equipped with Huawei’s high-end assisted driving.

Even so, with the distance anxiety-free characteristics of the range-extending car and the relatively affordable price, the WJ M5 is likely to become the most popular vehicle among the Huawei legion.

Established Independent Brands

In 2022, leading independent brands such as Geely, Great Wall, Changan, Chery, Dongfeng, BYD, SAIC, GAC and others have released numerous new energy products.

Another highlight of Geely this year is the introduction of products with its new “Thunderbolt Power” hybrid system. The hybrid system includes HEV, PHEV and REEV (range extender) types, with a highly efficient internal combustion engine and 3 speeds direct drive being the main highlights. Such power systems are naturally seamless with the hot-selling models, adding even more value to them.When it comes to hybrid vehicles, in 2021, several Chinese car manufacturers unveiled their dual-motor parallel hybrid systems with direct drive (known as extended range technology) – not only Geely Lei Shi Power but also BYD DM-i, Great Wall Lemon DHT, and Chery Kunpeng DHT have adopted this hybrid system.

In terms of comprehensive technical features, this type of hybrid system has better low-speed energy consumption, and the driving quality under low electric status has been effectively improved. It relies less on the battery and can be used for both HEV and PHEV.

After the technology was released, products will be launched in the market in 2022, including popular models such as Geely’s Starbound L Lei Shi HiX, Han DM-i, H6 PHEV, Ruihu 8 PLUS Kunpeng e+, and so on.

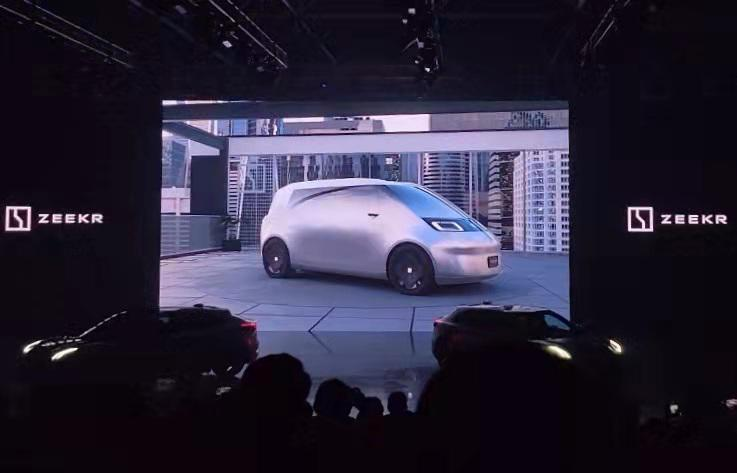

After having announced their Geely’s ultra-futuristic electric vehicle brand “JiKe” and releasing JiKe 001 last year, the company will launch a second car model, which will be an MPV with advanced auxiliary driving, according to the official announcement.

Previously, Geely’s JiKe 001 had an internal code of DC1E, and this second car model has an internal code of EF1E, and it is rumored to be named JiKe 002 in the future. The new car is from the SEA platform, of medium-to-large size and will be produced in the Hangzhou Bay factory.

Therefore, the large battery, double-wishbone suspension, and air suspension seen in JiKe 001 are likely to appear again on this MPV. According to further news leaks, the new car will have an electric sliding door and may release an extended range version.# Introduction

The MPV model of Landto Dream Maker will be delivered this year as well. The strategy of Landto FREE pure electric extended range dual models continues on this car. The power configuration of the extended range version is similar to that of Landto FREE. The maximum power of the dual-motor model, 390 kW, is very rare in the MPV industry. It can be said that it is very powerful for a 5.3m long and 3.2m wheelbase vehicle. The price of the car has not been officially announced yet, but it is expected to be announced at the Beijing Auto Show, and the delivery time of the new car is expected to be in the middle of this year.

In 2022, Great Wall and Changan will also make big moves. The two companies will respectively produce and deliver the Salon Mechadragon and the pure electric vehicle with the code name C385.

As the pyramid product of Great Wall’s pure electric product line, Mechadragon is very exaggerated in overall configuration. It is equipped with a 115 kWh battery, an 800V electrical architecture, a dual-motor electric drive system with a total power of 400 kW, 4 LiDAR, and a 400 TOPS Huawei MDC computing platform. As for the auxiliary driving software, Momenta’s solution is reportedly adopted.

Changan C385, as Changan’s first pure electric platform model, has not yet released a lot of data, but the official information reveals that it will be a B-class sedan equipped with Changan’s latest three-electric technology, and there will be certain highlights in the cockpit and auxiliary driving aspects.

BYD has both upgraded hot-selling models and new series appearing in the pure electric field this year. The upgraded Han EV and Tang EV have already appeared on the MIIT website. The new models have a new front face. Among them, the range of the Tang EV version has been significantly improved, with a range of 700 km in the single-motor version and 615 km in the dual-motor version under working conditions.

As for the new products, BYD’s model with the code name “Sea Lion” may appear at the Guangzhou Auto Show this year. This car is the mass-produced version of last year’s Ocean-X concept car and will use BYD’s new generation of pure electric platforms. It is expected to achieve entry-level rear-wheel drive and be equipped with a double-wishbone front suspension.

Summary

Compared to traditional overseas car companies, Chinese domestic brands are taking a faster step in the development of new energy vehicles. It’s easy to see that various product lines are exploring new energy products during this era, with many new cars falling into the price range of over 200,000 or even 300,000 yuan. The high configuration of independent brands has not fallen behind in the electrification era, with high-specification three-electric and chassis configurations as the main focus. Smart features are relatively weak, but the importance of smart features for top independent brands is increasing day by day. Laser radar and advanced assisted driving have begun to appear in the new cars of independent brands in 2022, no longer exclusive to new car companies.

The influx of new cars from independent brands in 2022 will bring more choices to the market. Dual-motor hybrid products are very attractive to displaced users of original gasoline vehicles who do not have charging conditions or are subject to license plate restrictions. These affordable models will greatly accelerate the penetration of new energy vehicles priced under 200,000 yuan.

And these

Although Tesla did not release any new cars in 2022, Tesla has not stopped improving its existing models. This year’s Model 3/Y will continue with this process.

According to current circumstances, it will take some time for domestically produced 4680 batteries. This year’s improvements to the Model 3/Y may include front casting bodies and some engineering details, which will not have a significant impact on consumer perception.

In addition, the redesigned Model S/X was originally planned to be delivered in the first quarter of this year, and the two new cars delivered at that time will be further minor changes that were previously shown in Taiwan. With the addition of these two cars, the new energy flagship cars of luxury brands such as iX, EQS, e-tron GT and Taycan will compete for the million-level market in China in 2022.

As a domestically produced car model, the Cadillac Lyriq is currently priced at 439,700 yuan for pre-sales. The CLTC 650 km range and rear-wheel drive 255 kW models will start delivery in the middle of the year, and its main competitor will be the NIO ES8.

Volkswagen’s new car for the domestic market this year is expected to be the ID.5, which is a coupe version of the ID.4, with little change except for the styling. It is worth noting that on March 9th, Volkswagen will officially release the long-awaited pure electric MPV model ID.BUZZ.

Compared with other pure electric MPVs, the Volkswagen ID.BUZZ has more prominent individualized and fashionable attributes. As the most special car product under the MEB platform, its parameters are not much different from other MEB models. The real focus is on whether the ID.BUZZ production version’s appearance and interior can reach the level of the concept car and whether it will be introduced in the domestic market and priced.

Japanese automakers’ performance in 2022 is still mediocre. The Nissan Ariya will be introduced to the domestic market in the second half of the year. This 160 kW front-wheel-drive pure electric SUV still upholds Nissan’s current philosophy of comfort and economy in terms of product features. The range is expected to reach 600 km, and the expected sales price, though not disclosed, can be guessed to be between the Lole and the Qashqai based on the size.

As a brand-new compact pure electric SUV, the Honda e:NS1 and e:NP1 will be on the market in the first quarter of this year. The new car has a range of 510 km, and overall, the feeling it gives is that except for the unique exterior design, its other product features are quite traditional.

Toyota will also launch the bz4X this year. The maximum WLTC range of this pure electric mid-size SUV can reach over 500 km. Toyota said that the new car is based on the e-TNGA platform and will provide a 4WD version.

ConclusionBy now, you should have some impression of the new energy vehicles in the 2022 automotive market, which has been flooded with a large number of new cars this year. However, players on the track have already shown a clear order. The top three new car manufacturers are already the benchmark players in the industry this year, and while their new products are well known for their high quality, they are also launching new attacks towards cutting-edge intelligence.

Several traditional car companies have made rapid transitions this year and produced new cars with electric levels that have undergone generational improvements. Pure electric platforms are also appearing in plans from more and more manufacturers. This year will also be a year to prove consumers’ value orientation towards high-priced electric cars in the high-end market. We also wait to see whether technology and intelligence can win, or whether brands and luxury can take a comeback.

Since the rise of domestic brands and new forces, high-end brands and high-end models have become increasingly popular in 2022. However, as the first batch of companies have encountered setbacks, people have come to realize that the success of new forces is not so easy to replicate, the gap in software power is visible, and there is still much to learn and improve beyond the product. Therefore, 2022 may also be a year for domestic brands to find themselves in the market.

In 2022, the fighting capacity of joint venture brands has been improved, but the impact on the overall pattern is not significant, such as Japanese basic pre-order members.

Finally, for consumers, 2022 is a year where the overall product strength of the new energy market has significantly improved. Regardless of the type of new energy vehicle you like, this year’s options and quality will reach new heights. At this level, our new energy market will undergo a period of reshuffling and precipitation, and with the maturity of the overall environment, the market in 2022 has stepped into a convergence stage, which is often a signal for a developing industry to move towards mainstream.