Tesla’s Strategy in Short, Medium, and Long Terms

Author: Kaikai Qiu

Editor: Kaikai Qiu

In 2021, Tesla sold nearly one million electric cars, leading the global market. The more Tesla leads the market, the more important it is to study its strategy.

Tesla’s strategy can be broken down into short, medium, and long terms:

-

In the short term, Tesla aims to expand its market share as quickly as possible despite facing supply chain issues, slowing down new car launch plans to ensure supply. “Tesla’s fundamental focus this year is to expand production,” said Elon Musk.

-

In the medium term, Tesla insists on its product performance strategy: “Our goal is to improve vehicle performance, reduce production costs, and increase affordability,” according to Tesla’s 10-K filing.

-

In the long term, Tesla is developing many killer features and exploring new business models in research and development, being a leader in disrupting itself and the industry.

Short-Term Production Expansion

Tesla delivered 936,200 electric cars in 2021, an increase of 87% from 2020. In 2022, Tesla aims to deliver around 1.5 million cars, an increase of roughly 50%.

Although the production capacity of Tesla’s plants in Shanghai and Fremont will meet this goal according to Tesla’s CFO, Zachary Kirkhorn, the supply chain and logistics issues that plague the entire industry remain a problem.

Therefore, Tesla’s primary task for 2022 is to expand production and ensure that the existing factory’s production capacity reaches its design ability while addressing core supply chain issues.## Tesla is coping with the chip shortage very well in 2021

Tesla has achieved nearly 90% growth when other automakers’ sales are shrinking. According to Elon Musk, “Last year, we spent a lot of engineering and management resources to solve the supply chain problem, rewriting the code, replacing chips, and reducing the number of chips we need.” Of course, this is thanks to Tesla’s strong software capabilities. However, Tesla also pays a price for this, which is to postpone the launch of new cars. Musk said, “If we really introduce an additional product, it requires a lot of attention and resources on the complexity of the additional product, which will result in a reduced number of vehicles delivered in reality. This year is the same. Therefore, we will not launch any new models this year.” He revealed that the Cybertruck, Semi, Roadster, and Optimus (humanoid robot) are expected to be put into production next year. He also mentioned that Tesla is not developing a $25,000 cheap car.

In terms of logistics, Tesla now has more car factories, which makes it convenient for Tesla to deliver them to consumers nearby. The Texas Gigafactory and the Berlin Gigafactory have begun equipment testing at the end of 2021.

For Tesla, a capacity of approximately 1.5 million vehicles cannot satisfy its appetite. It’s just that it assumes that the industry will still be limited by chips in the next year or two, and may be limited by batteries in the following years. Therefore, simply building complete vehicle factories cannot increase true production capacity.

Tesla expects the next stage of production capacity growth to be dependent on volume production at the Berlin Gigafactory and the Texas Gigafactory, as well as its self-produced batteries.

On the conference call for the fourth-quarter report, Elon Musk, Tesla’s Senior Vice President of Powertrain and Energy Engineering, Andrew Baglino, and analysts mentioned the 4680 battery. Andrew Baglino revealed that models with 4680 batteries will be launched in the first quarter. The 4680 battery will ensure that Tesla’s production capacity continues to increase.

Musk also emphasized that after the automobile industry gets rid of the chip shortage, the battery will become a bottleneck, and this is where the 4680 battery comes into play.

In addition, Tesla is also considering building factories in other parts of the world, but the location has not been decided yet. Tesla may announce new factory locations at the end of this year.

Continuously improving product competitiveness

Tesla has been established for nearly 20 years. It has grown from a small attacking force into today’s object that all automakers want to defeat.

How does Tesla cope with this?# Google vs Microsoft: A Business Strategy for Facing Challenges

In 2003, Google was facing a vigorous retaliation from Microsoft after Google’s rapid growth and success in the search engine market. The Google management was demanded to write a business plan to counter Microsoft’s challenge.

The plan submitted by Google’s CEO Eric Schmidt and the management team focused entirely on how Google could better serve users, enhance its platform, and deliver exceptional products. They emphasized outstanding products as the best way to counter Microsoft.

Similar to Google’s philosophy, Tesla aims to increase its brand recognition and create demand by improving its car’s performance and functionality while decreasing its costs.

Tesla has no competitors, only itself. There are four main pathways to improve performance, functionality, and reduce costs, which include utilizing new battery technology, employing advanced production techniques, offering artificial intelligence and software products, as well as purchasing locally.

4680+CTC

The new battery technology primarily consists of 4680 batteries and structured batteries, also known as CTC (Cell-to-Pack) technology.

Tesla’s Texas factory has already begun producing and installing 4680 batteries in cars. The Berlin factory is also planning to produce 4680 batteries while using structured battery technology that places the 4680 batteries directly on the chassis, avoiding modular technology.

Tesla previously announced on Battery Day that the use of 4680 and CTC technologies can reduce battery costs by 56%, increase range by 54%, and decrease investment and production costs by 69%. These advancements can significantly enhance the range of Tesla cars while reducing costs.

Advanced Manufacturing Techniques

Tesla is also an innovator in the automotive manufacturing process. Its advanced production techniques have significantly improved production speeds and led the trend in the industry.

At the Shanghai and Fremont factories, Tesla uses 6,000-ton casting machines to integrate the rear body frame into a single casting piece. This technique allows Tesla to reduce chassis casting costs by 40% and save 79 components.

In the Berlin and Texas factories, Tesla has adopted this technology to manufacture both the front and rear parts of the car, which further increases integration efficiency.

In addition, according to the media, Tesla is planning to use 8,000-ton casting machines to manufacture the Cybertruck’s rear body. Moreover, Tesla is also considering using 12,000-ton casting machines to manufacture the front and rear car bodies in one piece.

Autonomous Driving and Software

As a leader in electrification, Tesla is also at the forefront of smart driving technology.Tesla is always optimistic about its autonomous driving ability and progress. This time, Musk stated that “we will achieve fully autonomous driving this year.”

Based on historical experience, Musk’s boasts are usually delayed in implementation. Therefore, Tesla’s L4 autonomous driving is expected to arrive soon. This will be a huge advantage for Tesla models.

In addition, foreign media recently reported that Tesla is developing an app store, allowing its users to download and use programs through their own app store.

A rich software and content ecosystem will also bring unique advantages to Tesla.

In terms of localized procurement, Tesla’s China factory can be said to be a benchmark. In its annual report, Tesla stated that “due to localized procurement and manufacturing in China, the average unit cost of Model 3 and Model Y has significantly decreased. In addition, the gross profit margin of our Model Y benefited from the shared manufacturing of Model 3 and past production experience.”

Thanks to the contribution from the Shanghai factory, Tesla’s automotive business gross profit margin increased from 25.6% in 2020 to 29.3% in 2021. With this gross profit level, Tesla has become one of the most profitable brands in the world.

This multi-pronged approach can indeed keep Tesla competitive. As a leader, it doesn’t need to worry about catching up with its competitors when it runs fast enough.

In addition to batteries and autonomous driving, Tesla is also developing many disruptive technologies and products. In addition to Optimus humanoid robots, there is also the DOJO machine learning training system. If you add the research and development of other fields personally invested by Musk, its future is even more unpredictable.

As an engineer at heart, Musk naturally attaches great importance to research and development. In 2021, Tesla’s R&D expenses increased by $1.1 billion, or 74%, compared to 2020. R&D expenses as a percentage of revenue remained at 5%, the same as in 2020. Research and development expenses increase proportionally with the increase in total sales revenue.

In addition to being willing to spend money on R&D, Tesla also attaches special importance to the combination of research and development and production.

During the earnings call, Musk dissed so-called incubators and research centers. He believes that research and development cannot be separated from production. “You have to link it to production, like the Giga Texas production line we’re sitting in now.”CFO Zachary Kirkhorn also said, “The closer you get to applying blood, sweat, and tears to actual production, the faster you can bring new things into actual production.”

Tesla also focuses on building new business models after new technology emerges. In addition to the innovations that Tesla has already implemented, such as direct sales, lease-to-own, and insurance sales, Tesla will also innovate business models in the following areas.

Software sales

Currently, Tesla’s sales revenue already includes software. In addition to purchasing hardware, consumers can also purchase AutoPilot or FSD software services.

Zachary Kirkhorn has high expectations for this. He said, “In terms of hardware, we are actively promoting manufacturing innovation and operating efficiency to reduce costs. As FSD develops rapidly, software-based profits will eventually become a strong complement to hardware sales profits.”

In Zachary Kirkhorn’s view, nearly 30% of Tesla’s current gross profit margin has not reached its peak, but the driving force is software. “As we work towards the Robotaxi space, from a software point of view, there is actually considerable room for profit margins to increase.”

In addition, as mentioned earlier, Tesla will also develop more software, or establish a software store, and open the platform to other developers to obtain a share of software or content purchases, similar to Apple.

Autonomous vehicle operations

“We plan to establish a self-driving Tesla ride-hailing network in the future, and we hope that this will allow us to gain new customer base while the transportation industry continues to develop,” Tesla said in its annual report.

Musk said that after autonomous driving is achieved, cars “may eventually be the asset class with the greatest increase in asset value in history.” He gave an example that originally, a car had 12 hours of utility per week, but after autonomous driving, it would have 60 hours of utility per week, increasing its asset utility by five times.

Robotics production operations

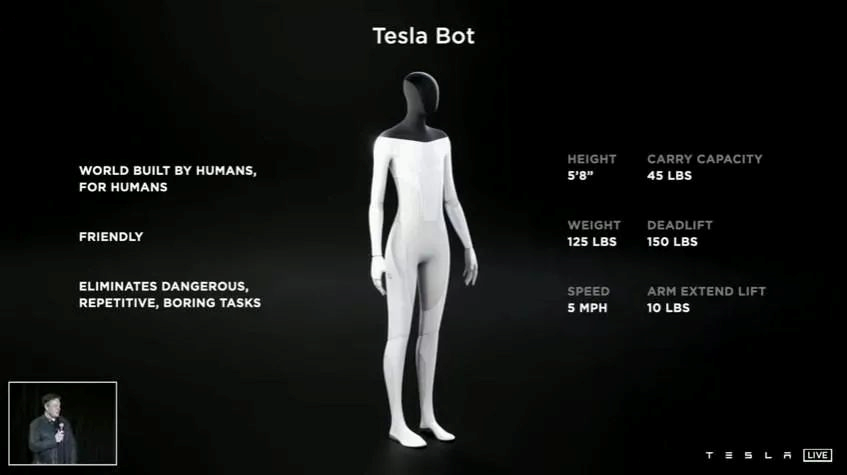

Optimus humanoid robot, which is already beyond the scope of the automotive industry, is considered by Musk to be the most important product this year.

Musk also said, “Over time, this may be more important than the automotive business.” He believes that labor will be in short supply in the future, and the economy will suffer as a result. At that point, the purpose and value of Optimus humanoid robots will emerge.

In answering analytical questions, Musk also confirmed that Tesla’s Optimus robots will first be used by Tesla itself, such as moving parts around the factory.

Conclusion# Review of Tesla’s Early Success

The strategy set by Musk in 2006, which was to raise production and lower costs, to gradually explore and improve technology, has proven to be very effective in Tesla’s early success.

With the release of the affordable Model 3, Tesla has fully demonstrated its capability not only in manufacturing high-quality cars, but also in generating profits.

However, this is only the first stage, and Tesla cannot escape the extension paradigm of new technological products.

What’s next?

Tesla is heading towards the road of cross-boundary fusion innovation, combining the fields of transportation, energy, artificial intelligence, the internet, and more. It will not only be a smart hardware company, but also a software company that may take over your transportation, home automation, or become your smart space.

Tesla cannot be viewed as a simple car company or an internet company. It has not only elevated its thinking, but also has the ability to elevate its capabilities.

Its products will be a multi-dimensional species with overwhelming advantages over other single-dimensional species. Tesla is pushing forward at its own pace.

Can any global automaker catch up with such a powerful Tesla?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.