Jia Haonan Posted from the Vice-riding Temple

Intelligent Car Reference | WeChat Official Account AI4Auto

The South Korean women’s football team has not yet overcome the “Great Wall” of the East, and the fate of South Korean power batteries remains unchanged.

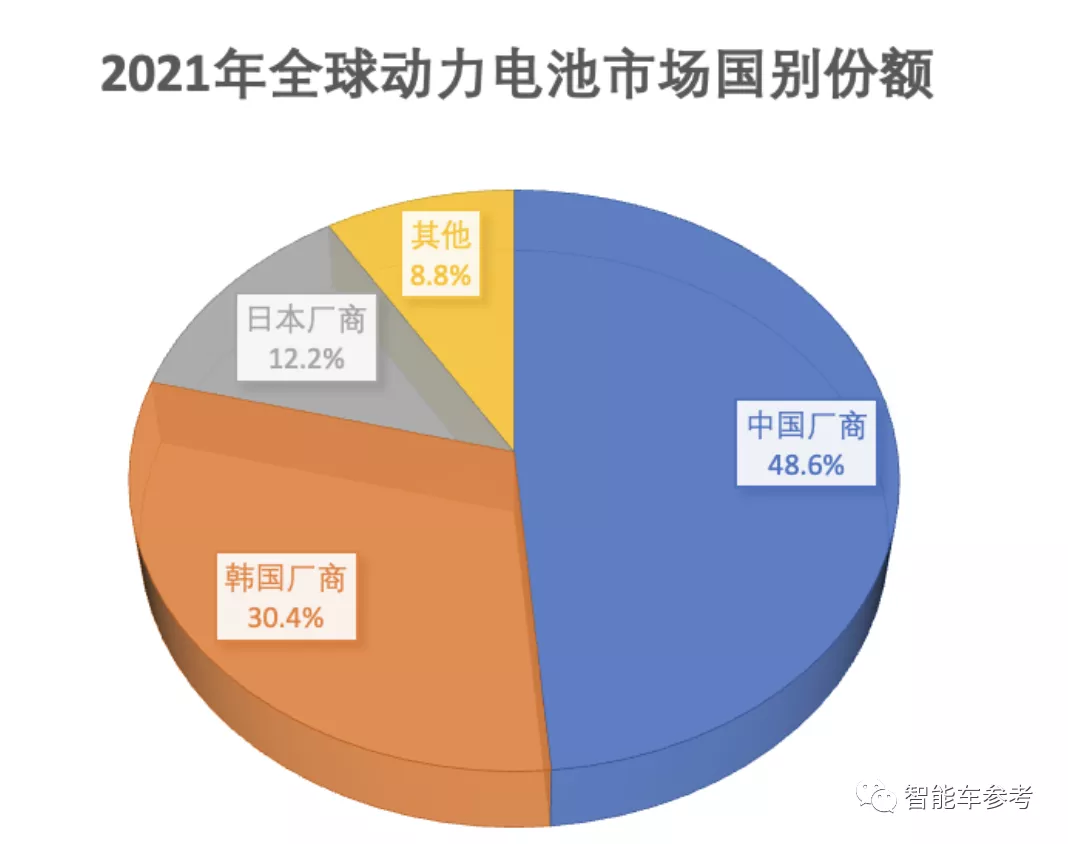

According to the latest report from SNE Research, in 2021, China provided nearly half of the global demand for new energy vehicle power batteries.

The market share of South Korean manufacturers is declining.

To be precise, Chinese power battery manufacturers accounted for 48.6% of the global installation volume.

The “Trillion King” of Ningde Era, still won the championship for the fifth time with overwhelming advantage.

The top ten are all occupied by Chinese companies, and the fastest growing one has grown more than 430%, surprisingly from a traditional car company.

The power battery race of this year is quite interesting.

China Advances, South Korea Retreats: More than Half of the World’s Power Batteries Come from China

First, let’s quickly popularize why SNE Research report is taken as a reference.

It is a South Korean research institution established in 1999, which has long been focusing on the development of new energy, and is currently the most cited research institution in the field of electric vehicles and batteries worldwide.

SNE’s latest power battery report shows that the total amount of electric vehicle battery capacity registered globally in 2021 was 296.8GWh, an increase of more than twice (102.18%) compared to the previous year.

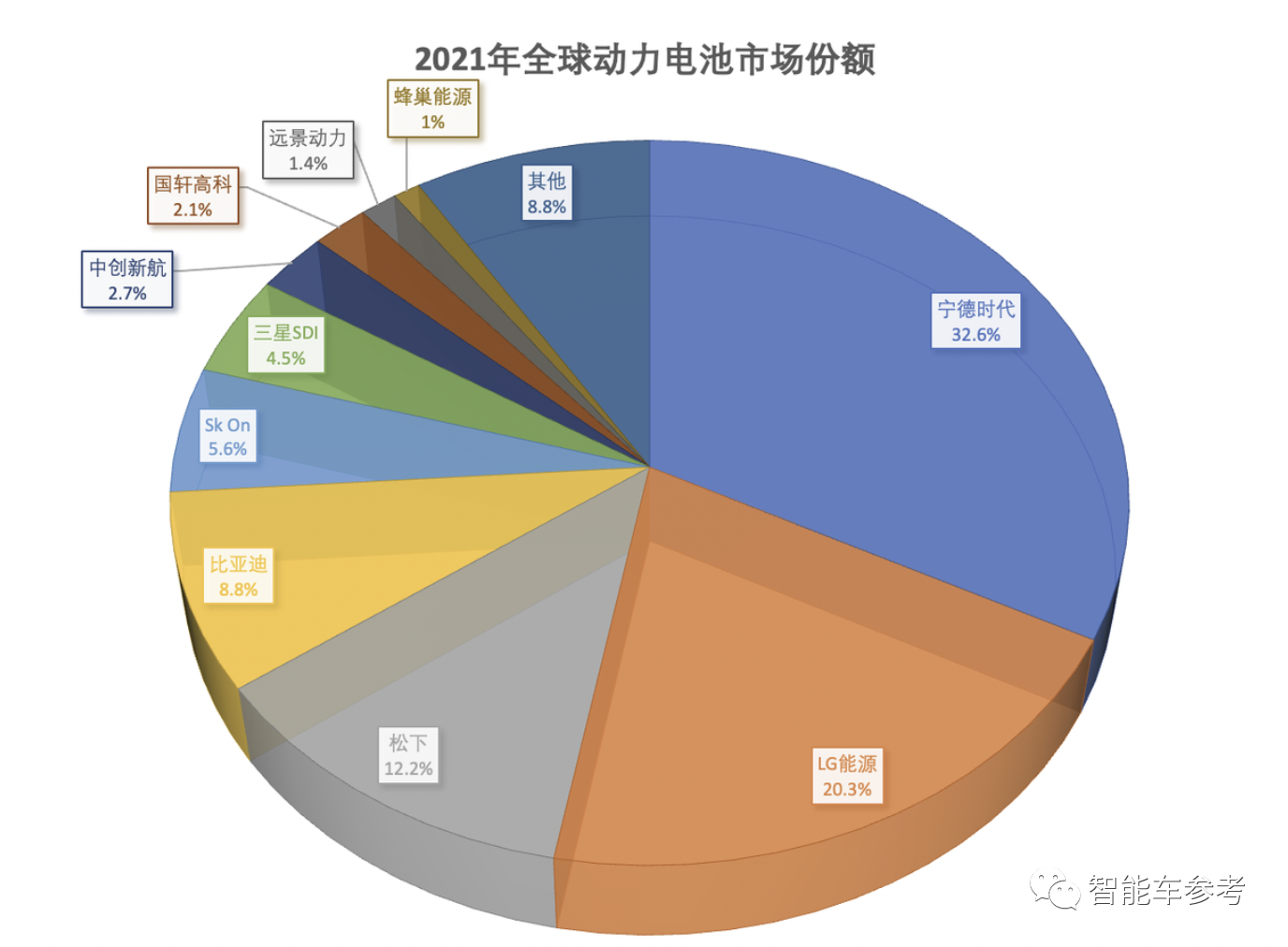

Among these, more than 90 percent of the market share was divided among the top ten manufacturers:

China’s performance is particularly outstanding, with nearly half of the global market share of power batteries coming from Chinese manufacturers.

First of all, Ningde Times continued to win the championship for five consecutive years with a market share of 32.6%, an increase of 8% year-on-year.

In addition to the overwhelming “Trillion King”, another five domestic manufacturers entered the top ten, which means that China occupies six of the top ten positions in the world of power batteries.

These five companies are ranked by share:

BYD, CATL, Guoxuan High-tech, Farasis Energy, and SVOLT.

Although the overall market share of the South Korean team is declining, they are still a player with considerable discourse power in the industry.

LG Energy is the second in the world with a market share of 20.3%, which has dropped by about 3%, and it is also the biggest competitor of Ningde Times.

SK Innovation ranks fifth in the world with a market share of 5.6%.

Samsung SDI closely follows with a share of 4.5%, ranking sixth.

Now, friends who are familiar with the development of the battery industry will ask: Where is the Japanese team?

After more than a decade of successive impacts by Chinese and Korean manufacturers, only Panasonic remains in the top 10 Japanese companies with a market share of 12.2% in 2021, ranking third.

However, Panasonic’s strength should not be underestimated.

Its battery business is deeply tied to Tesla, with the highest energy density per cell. In addition, starting this year, Panasonic will gradually begin production of the 4680 battery with greatly improved energy efficiency, which will be given priority to supply to Tesla.

What about other players besides CATL?

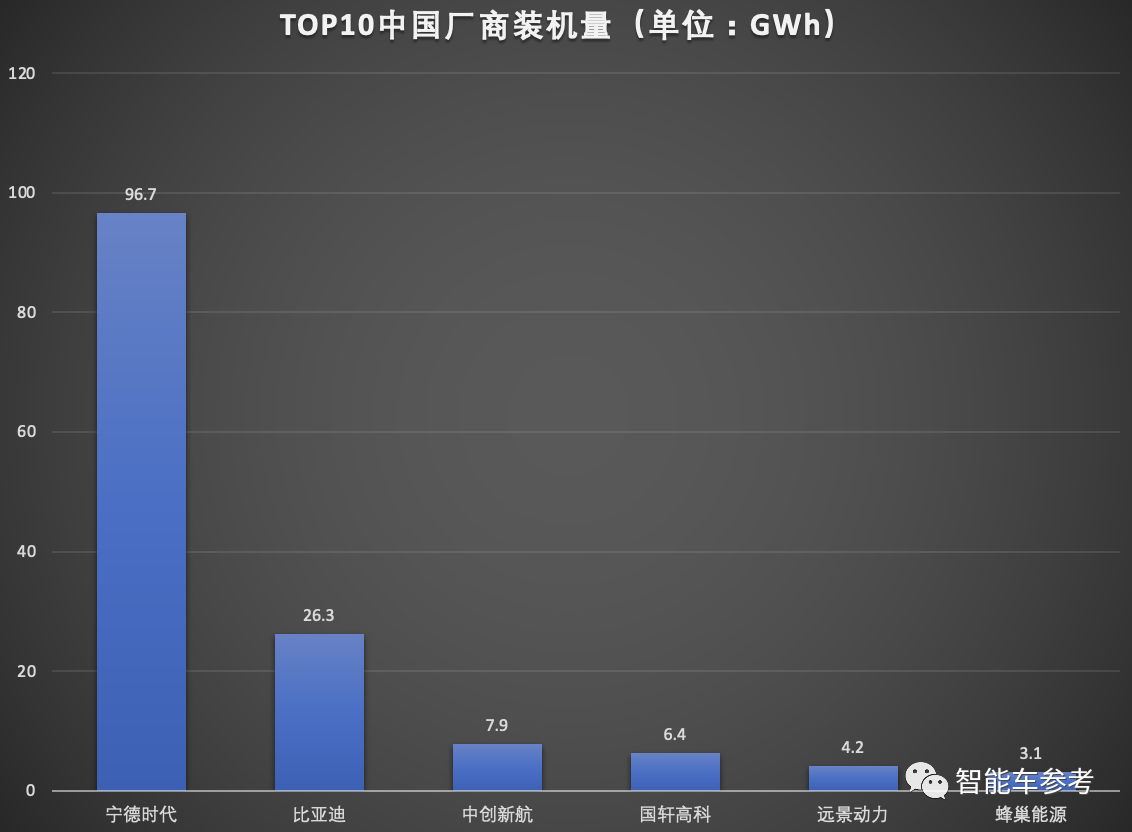

BYD ranks fourth in the world with a power battery installed capacity of 26.3 GWh, a year-on-year growth of 167.70%.

In terms of production capacity, BYD has established or planned to build 17 production bases including the Xiangyang base, with a total production capacity far exceeding 400 GWh.

In 2021, BYD also expanded its production bases in Shandong Jinan, Anhui Wuhu, Jiangsu Yancheng, Hubei Wuhan, Shaoxing Shengzhou, Zhejiang Ningbo, Anhui Chuzhou, and Jiangxi Fuzhou, with a total new production capacity of 205 GWh.

As for power battery outsourcing, the Hongqi E-QM5 series by FAW is equipped with blade batteries, and Changan’s pure electric vehicle model, as well as the Jinlong and BAIC models, are also equipped with BYD’s blade batteries. In addition, it is said that BYD is also in contact with multiple international automakers such as Tesla, Ford, Volkswagen, Daimler, and Hyundai.

CATL ranks seventh, with a year-on-year growth rate of 130.50% in 2021.

Currently, CATL has established nine industrial bases in Changzhou, Luoyang, Xiamen, Chengdu, Wuhan, Hefei, Heilongjiang, Guangzhou, and Jiangmen, forming clustered industrial bases in the Pearl River Delta, Yangtze River Delta, southwestern region, central region, and northeastern region.

In terms of production capacity, CATL plans to reach 500 GWh by 2025.

As for customers, from the point of view of supporting the new forces of car production, CATL has won the bid for all XPeng Motors models, and has provided power batteries for the mass production models of XPeng P5/P7. In addition, in Leapmotor, the power battery of Leapmotor C11 model is exclusively supplied by CATL.In addition, Zhongchuangxinhang is currently working with traditional main engine plants such as GAC, Changan, Guangfeng, Guangben, SAIC-GM-Wuling, and Geely.

Guoxuan High-Tech ranks eighth with a 2.1% market share. It has built ten production bases in Hefei Fèidōng, Hefei Economic Development Zone, Hefei New Station, Lujiang, Nanjing, Qingdao, Tangshan, Nantong, Liuzhou, and Yichun, with a total capacity of 10 GWh.

According to Guoxuan High-Tech’s latest production capacity plan, it will continue to build new production bases or expand on the basis of its existing ten production bases, and plans to reach a capacity of 100 GWh by the end of 2022, with planned new production capacity exceeding 50 GWh.

Farasis Energy is ranked ninth with the lowest year-on-year growth rate, but its potential is still enormous. On February 7, 2022, the groundbreaking ceremony for Farasis Energy’s second-phase battery manufacturing base project was held in Wuxi. The base will produce the latest generation of high-quality power battery products, with a planned capacity of over 15 GWh, to be built and put into operation by 2023.

In addition to Wuxi, Farasis is also constructing 20 GWh of energy storage and power battery production capacity and an industry chain ecological project in the world’s first zero-carbon industrial park, the “Farasis Erdos Zero-Carbon Industrial Park,” which will provide power batteries for more than 30,000 electric heavy-duty trucks annually and provide over 10 GWh of energy storage battery products.

Earlier, Farasis AESC invested over 1.8 billion U.S. dollars with Nissan to build two new battery factories and provide batteries for the entire Renault-Nissan-Mitsubishi alliance.

It was reported earlier that Farasis is discussing going public in the United States by 2025.

Under China’s Great Wall Motor Company, Honeycomb Energy is the company with the highest year-on-year growth rate, reaching 430.80%, due to the small base in 2020 and rapid development in 2021.

In terms of production capacity, so far, the in-construction production capacity of Honeycomb Energy has reached 287 GWh, of which 257 GWh is in China, distributed in cities such as Chengdu, Suining, Changzhou, Huzhou, Ma’anshan, Yancheng, Nanjing, Shangrao, and Shanghai. In addition, 30 GWh of production capacity is being built in Germany. Honeycomb Energy plans to build production capacity of 600 GWh by 2025.

It is understood that Honeycomb Energy Technology Co., Ltd. recently filed for listing guidance with the Jiangsu Securities Regulatory Bureau. Earlier reports stated that Honeycomb Energy plans to complete the application for China’s Growth Enterprise Market (GEM) in the first half of 2022, with China Citic Securities as the lead underwriter.

Apart from the rankings, what else do we need to know about power batteries?In the first decade of the 21st century, the global power battery pattern saw South Korean companies continually eating away at the market share of Japanese companies, while the second decade saw Chinese battery companies continuously eroding the market share of Japanese and Korean companies.

Chinese manufacturers have launched a massive offensive, and CATL’s position is unshakable. Can we say that China has stabilized in the race of power batteries?

Looking beyond these superficial figures of market share, we can see the real situation of the global power battery market.

Let’s study CATL and LG Energy.

According to the latest data from the China Automotive Power Battery Industry Innovation Alliance, CATL has an annual production capacity of 65.45 GWh and is currently building 92.5 GWh. The installed capacity in 2021 was 80.51 GWh.

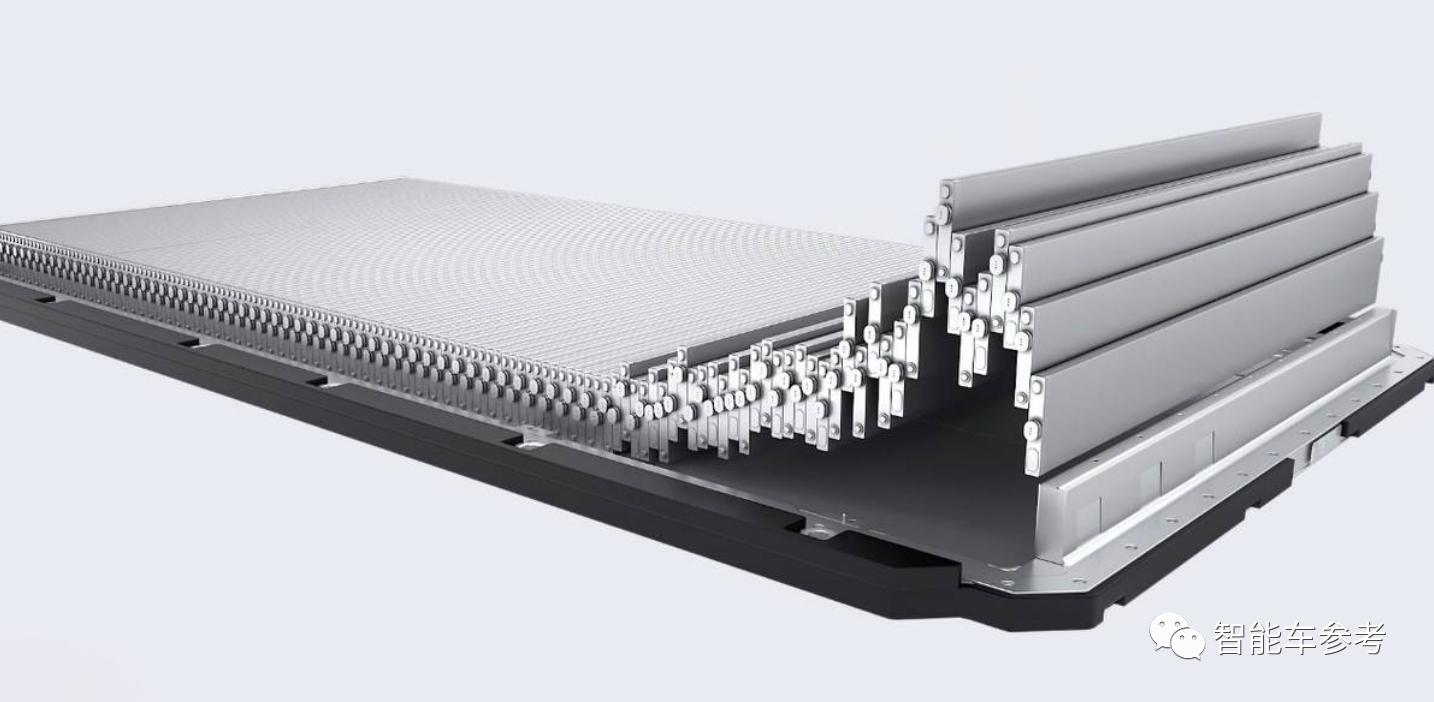

“More cost-effective lithium iron phosphate batteries” occupy a larger market share in CATL’s battery products.

Meanwhile, “LG’s products are all higher-priced ternary lithium batteries,” and the installation of high-end 811 ternary cells accounts for a higher proportion.

If we only look at the output volume of ternary lithium power batteries, LG New Energy has surpassed CATL.

This directly causes fundamental differences between the two companies.

CATL, like all other Chinese battery manufacturers, will focus mainly on lithium iron phosphate batteries in the future.

This trend matches the strong momentum of domestic lithium iron phosphate batteries.

Therefore, CATL, as a representative of Chinese battery manufacturers, serves the vast majority of domestic automakers, with the overseas plant construction process just beginning, and the international competitiveness is still insufficient.

In 2020, the overseas installation rate of CATL (excluding the Chinese market) was 6.5%, ranking fifth in market share. Overseas installation power only accounted for 5.3 GWh.

In contrast, LG Energy and Panasonic primarily engage in higher-priced ternary lithium batteries, with obvious advantages worldwide.

Major automakers in the United States, Europe, and Japan, including Tesla, General Motors, Daimler, PSA Peugeot Citroen, Volkswagen, Honda, Toyota, and Ford, have all signed LG orders to some degree.

Overall, while Chinese battery manufacturers are conquering a larger market share globally, they mainly rely on China’s enormous and rapidly growing new energy vehicle market. Overseas business is still striving to expand.

For Japanese and South Korean companies represented by LG Energy, they may not pose any threat to CATL in the Chinese market but they have obvious advantages in overseas markets, particularly in North America, where they focus on more profitable ternary lithium batteries.

As the new energy vehicle markets in Europe and the United States advance, the battle between China, Japan, and South Korea’s power batteries will undoubtedly take place in overseas markets.

–End–

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.