China’s New Energy Vehicles Thriving in the Year of the Ox

By LYNX

On the first day of the Chinese New Year in 2021, I completed my first article titled “The Year of the Ox has Arrived for China’s New Energy Vehicles!”

Looking back at 2021, this title can be considered a “New Year’s prediction” —

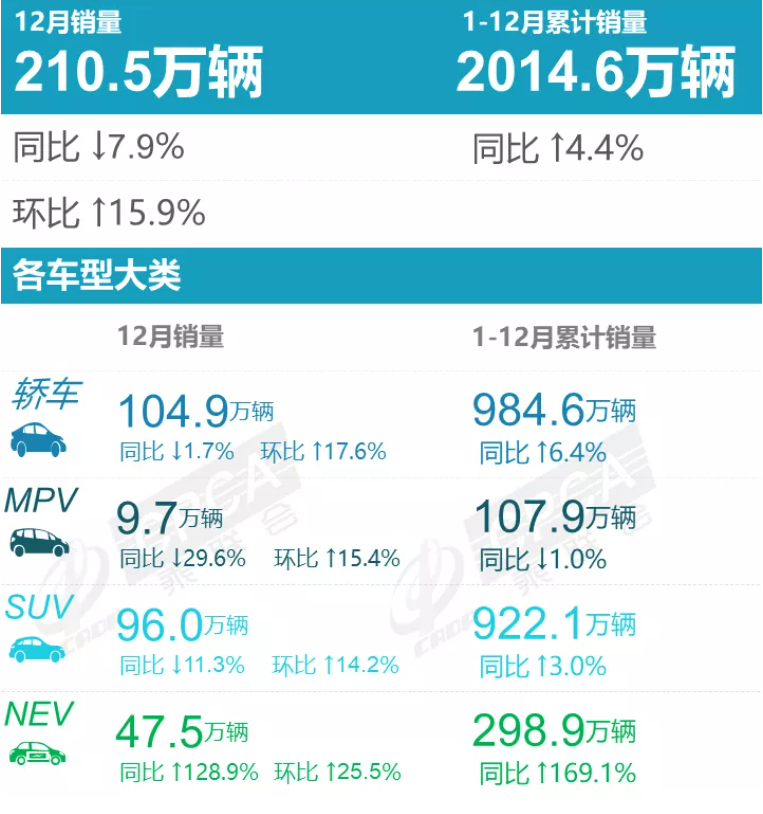

The total retail sales of new energy passenger vehicles reached a new high of 2.989 million, a year-on-year increase of 169.1%, and the market penetration rate reached 14.8%. In other words, for every 100 new cars sold in China last year, 15 were new energy vehicles.

In terms of manufacturers, the top three sales leaders are BYD, SAIC-GM-Wuling, and Tesla China, with total retail sales exceeding 300,000 units. New force manufacturers also achieved monthly sales of over 10,000 units by the end of last year. “Wei Xiaoli,” the three small giants, have all begun to strive for an annual sales target of 100,000 units.

Looking at the models, there are more and more options available to buyers. A range of plug-in hybrid models, such as BYD DM-i, are available for those still concerned about the inconvenience of charging. Basic features such as a range of over 500 kilometers have become the standard for mainstream electric vehicles.

In addition, popular models such as the Tesla Model Y and the Zeekr 001, advanced technologies like lidar and 800V high-voltage fast charging, and new players like Xiaomi and Huawei, have all contributed to the rich and exciting discussions in this industry. Even if you have no plan to buy a car, you can still get excited as a spectator.

The year of the Ox deserves its name. From the industry to manufacturers, and from models to technologies, the performance in the past year has been “ox” enough.

Now, we bid farewell to the year of the Ox and welcome the year of the Tiger. Will China’s new energy vehicles continue to thrive in the new year?

The Tiger in the Supply Chain

The Chinese language is vast and profound. Compared to the straightforward meaning of “Ox,” the meaning of “Tiger” is much more complex.

In November last year, during a 2000+ kilometers drive from Beijing to Guangzhou with my colleagues, the Canadian car god and super charging station expert, the big-eared TuTu teacher, he explained to me the wonderful meaning of this word in Northeastern dialect.“`markdown

On the Chinese internet, people seem to hope for a different “big-cat” year during the rule-abiding year of the Tiger.

Speaking of cats, the most famous one nowadays is Schrödinger’s cat, being unable to be observed in actuality because of quantum entanglement.

Compared to the optimistic 2021 when people believed that “bullish” was the way to go, the uncertainty of the new energy vehicle market in the upcoming Tiger year is like the Schrödinger’s cat with many variables still unknown.

The biggest uncertainty is still the shortage of chips and the turbulence of the supply chain.

The “chip shortage” issue officially appeared on people’s radar at the end of 2020. In the past year, we have witnessed the car executives’ anxiety about chip shortage, the delay of car delivery and reduction of discounts caused by the problem, and even heard about some manufacturers’ helpless policy of “delivering cars first and retrofitting radar chips later.”

When will the chip shortage be alleviated? Optimists think it will be around mid-2022, while pessimists think it will last for another year or two. However, what is certain is that in the Tiger year, it will still be as mysterious as Schrödinger’s cat.

And this is merely the most prominent problem in the entire turbulence of the supply chain. The rise of raw materials for power batteries, the shortage of other parts, and other issues continue to affect the healthy development of new energy vehicles, and even the entire automotive industry.

Setting aside the specific magnitude of price increases, the two recent hot news can illustrate the problem very well:

“`The first one is Toyota’s announcement at the end of last year that “it will start using defective parts supplied by suppliers for production.” The background reason is to alleviate the cost increase caused by chip shortages and raw materials and achieve the planned production speed.

The second is Tesla’s statement on the focus of work in the Year of the Tiger when announcing the Q4 and full-year 2021 financial report: “Will not launch new car models, focus on ensuring supply chain stability, capacity expansion, and spare no effort to solve delivery problems.”

Market orientation is “fierce”

Even though there is a lot of uncertainty in the supply chain, it is certain that consumers’ demand for new energy vehicles is increasing.

During the festive Chinese New Year holiday, startups did not forget to release sales figures for January:

-

XPeng sold 12,922 vehicles, an increase of 115% year-on-year.

-

Li Auto sold 12,268 vehicles, an increase of 128.1% year-on-year.

-

NIO sold 11,009 vehicles, an increase of 402% year-on-year.

-

Zero Running sold 8,085 vehicles, an increase of 434% year-on-year.

Tesla’s sales figures have yet to be reported by the China Passenger Car Association, and the most eye-catching traditional automaker is still BYD.

In January, BYD’s new energy vehicle sales reached 92,926 vehicles, a year-on-year increase of 367.7%. At the same time, new energy vehicles accounted for more than 90% of BYD’s total sales of 95,000 passenger vehicles.

It is worth noting that the beginning of the year near the Chinese New Year holiday has always been a slow season for the auto market. Regardless of whether it is a startup that sells 10,000 vehicles per month or BYD selling nearly 100,000 vehicles per month, they have actually told us through actual data that consumers’ purchase of new energy vehicles is no longer driven by policies such as subsidies and license plates, but is actually placed on an equal footing with traditional fuel vehicles on the decision-making scale.From the sales data in January, we may be able to predict in advance that the first new car maker with an annual sales volume of 100,000 and the first Chinese own-brand with an annual sales volume of 1 million new energy vehicles will be born in 2022.

All of these confirm the summary of the new energy vehicle market in China from policy orientation to market orientation since 2020 till today.

Under the trend of expanding market, we can split it into three small problems to glimpse the impact of “consumer demand” on the market in 2022:

Firstly, will the A00-level pure electric micro-car continue to grow and sell better?

Represented by the Wuling Hongguang MINI EV, A00-level micro-cars have been controversial since their birth.

What is astonishing, however, is the sales surge. Only in 2021, the total sales volume of SAIC GM Wuling’s GSEV (Global Small Electric Vehicle architecture) models reached 450,000 units and the MINI EV tops the monthly sales charts.

The controversy arises from negative public opinion, such as “for old people or flat people”, “only a few thousand yuan profit for one car, solely for points”, “industrial waste”, etc.

Putting aside the controversy and examining the current hot sales of pure electric micro-cars in China, it is hard not to think of the best-selling electric car in the European market in recent years – Renault ZOE.

Although it is also unattractive and has a short range, at first glance it seems to have no competitive advantage. But on the eve of Tesla, Volkswagen ID. entering the European market, Renault ZOE has won the sales champion for many years.

The mainstream view used to explain this phenomenon with “Europeans prefer small cars”, yet in fact, the most critical reason is much more straightforward: cheap price.

The low price and maintenance cost, together with enough range for urban commuting, are the biggest reasons why European consumers buy Renault ZOE. This reason is equally valid for the popular MINI EVs in China.

Recently, in a program on NHK TV in Japan, this point was proven by actually dismantling a Wuling Hongguang MINI EV. Japanese experts found that this electric micro-car “uses cheap, not very durable parts, and is assembled in a way that is easy to replace, making it susceptible to damage, but easy to repair.”

This goes against the idea of creating cars that can last for 20 or 30 years without breaking down, a concept that Japanese automakers have been pursuing for a long time. However, it perfectly caters to the needs of Chinese consumers today: they usually change cars every 5-10 years and constantly pursue fresh driving experiences as products are upgraded and iterated.

Therefore, if you say that Hongguang MINI EV, Ora Black Cat, and Leapmotor T03 are merely “elderly electric cars,” it may be too narrow a view. Their greater significance may lie in the “demonization” of the Chinese people’s attitude towards cars –

It is no longer just a symbol of wealth and social status, but more of a common and practical city commuting tool.

Their rapid iteration and eye-catching design also rid these small cars of their previous durable product attributes and make them more like fast-moving consumer goods such as Uniqlo, ZARA, and Coca-Cola.

Therefore, if A00-class cars can still maintain high-speed growth in 2022 and various manufacturers continue to launch similar products, it may not be a bad thing. It can even be said to be a powerful annotation of a more mature Chinese automobile market and a more enriched car culture.

The second issue worth paying attention to is whether plug-in hybrid models can catch up in sales.

Similarly, what do people care most about when buying new energy vehicles today?

Unfortunately, although the stories of new technologies such as autonomous driving and intelligent cockpits have been told for so many years, when people actually buy a car, the first question they ask the sales staff is probably still “What is the range of this car?”

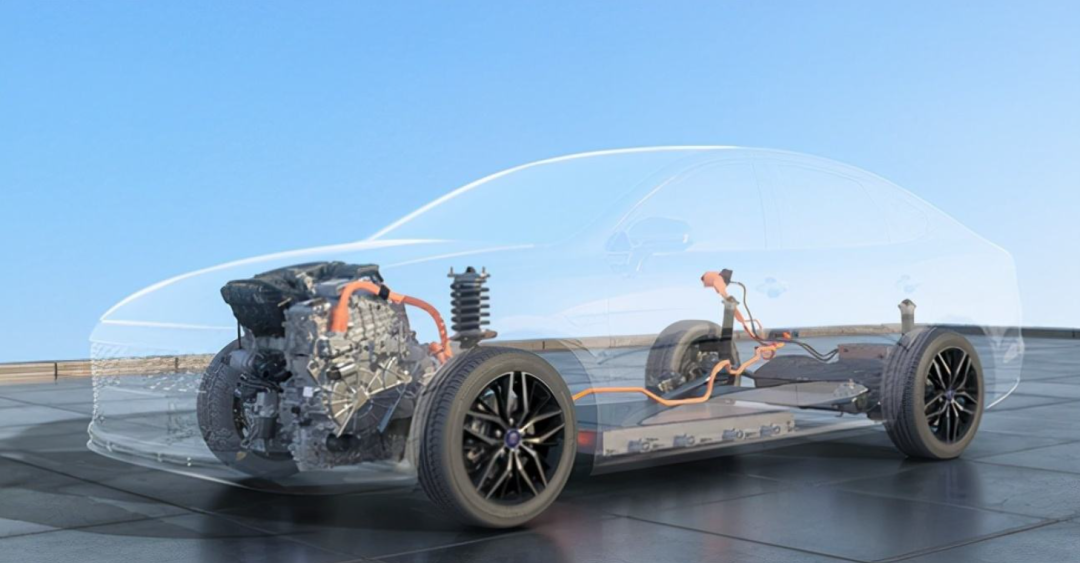

From the perspective of pure electric vehicles, the bottleneck of battery energy density cannot be quickly overcome, 800V high-voltage fast charging cannot be immediately popularized, and battery swapping technology is only implemented by a few manufacturers due to the high cost.## Electric and Plug-In Hybrid Vehicles Will Continue to Rise in the Chinese Market in 2022

Although plug-in hybrid vehicles were once considered only a “transitional solution,” their competitiveness may continue to improve and become a powerful driving force in the further expansion of the new energy vehicle market in 2022, despite the short-term disadvantage of insufficient supplementary energy to fully charge the battery.

In terms of overall growth rate, the sales volume of pure electric vehicles in China increased by 168% year-on-year in 2021, while the growth rate of plug-in hybrid vehicles also reached 171%.

Take BYD as an example. Throughout the past year, BYD has gradually replaced its traditional fuel vehicles with its DM-i plug-in hybrid technology. In January of this year, BYD’s hybrid vehicle sales reached 46,540, almost equal to their pure electric vehicle sales of 46,386, creating an even distribution of their product portfolio.

After BYD, independent automakers such as Great Wall Motors’ Lemon DHT, Geely’s Lie Shi Min hybrid DHT, and Chery’s Kunpeng hybrid DHT are poised to unleash their plug-in hybrid vehicles into the market.

The latest plug-in hybrid technologies released by these companies show a great deal of difference compared to the original, hastily-designed technologies that were created only to ease the pressure of dual credit implementation.

The biggest change is that the technology philosophy has turned from reducing fuel consumption by electric drive assistance to electrification with the internal combustion engine as a supplement.

According to the manufacturers’ propaganda, their plug-in hybrid vehicles are designed to provide both the driving experience of a pure electric vehicle and the range of a fuel vehicle, while greatly reducing the energy consumption of both.

Of course, it is worth noting that, while the government clearly encourages the use of pure electric vehicles, there are clear plans and schedules for the implementation of subsidies for plug-in hybrid vehicles in some cities.

Nonetheless, when purchasing a car, consumers do not consider the technical path, but rather focus more on the actual driving experience. Will these new plug-in hybrids from Chinese automakers be favoured by the market? The sales rankings in 2022 will give us the answer.

Finally, with regards to policies, the last issue is whether the growth of new energy vehicles can continue at the pace set in the previous Tiger year, despite shifts in the market, especially regarding subsidy policies.

In 2022, national subsidies will be reduced by 30%. Meanwhile, the impact of factors such as rising raw material costs and increased insurance premiums means that buying a new energy vehicle this year will, inevitably, cost a little more than last year.Against this backdrop, will users still “vote with their feet” and buy new energy vehicles?

Judging from the sales in the first month of 2022, the answer should be affirmative. However, all manufacturers should not be overly optimistic. Looking back at the news from last year, we can see that every small issue in vehicle production, channel construction, and after-sales service can turn into a big problem that affects the overall development pace.

In the Year of the Tiger, the prospects seem bright but the challenges are heavy.

Expectations for the Year of the Tiger: Less routine, more sincerity

The traditional auto market has long boasted of “product cycles,” but for new energy vehicles, the past two years have been big years.

Looking ahead to the Year of the Tiger, there are still many exciting things to watch: Can the goal of 20% penetration rate for new energy vehicles by 2025 be achieved earlier? With no new cars to be launched, how much will Tesla’s Model 3/Model Y “old cars” increase in sales? What kind of waves will tech companies like Xiaomi, Baidu, and Huawei stir up this year?

But compared to these grand topics, as an ordinary consumer, we may still be more concerned about what new car models and technologies we will see this year.

After all, recalling 2021, new cars like NIO ET7, Xpeng P5, and Mustang Mach-E earned a lot of attention.

In practical markets, the number of new models actually delivered may be negligible. What people still see on the streets are familiar faces like Xpeng P7 and Ideal ONE.

Therefore, less marketing gimmicks and futures-style marketing, delivering eye-catching new cars to the market and allowing more people to experience the convenience of new energy vehicles may be the most practical New Year’s wishes for every consumer.

Fortunately, after a year of brewing, NIO ET7 will be actually delivered at the end of March. Let’s look forward to seeing more cutting-edge, fresh, and innovative new energy vehicle products in the Year of the Tiger.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.