New Energy Vehicle Market in China: Highlights of 2021 and What to Expect in 2022

Authored by: ZeLin Leng

Edited by: Xianzhi Wu

The year 2021 has been the most significant year for new energy vehicle (NEV) penetration in China, with the growth rate skyrocketing from the single-digit percentage at the beginning of the year to around 20% at the end, since the introduction of the first plan for the development of energy-saving and NEV industry in 2012. This has come as a surprise to many automotive trailblazers.

The changing market demands timely adjustments in the strategies of automotive manufacturers. To meet the increasing demand for delivery, the pace of product updates and differentiation of NEV products must be accelerated.

In the past year, various brands rapidly iterated multiple products, such as the XPeng P5, Hongguang MINI EV Macaron, BYD Qin PLUS DM-i, Seres SF5, which include pure electric, hybrid, and extended-range models, as well as micro-cars, sedans, and SUVs, broadening the range of products and prices, covering more consumers.

Furthermore, the functionality of vehicles has been evolving. Many car models have started to incorporate advanced driver assistance features, such as the high-speed navigation function introduced by Xpeng and Li Xiang last year, and the competition for the use of LiDAR technology among auto companies, such as the Mech Dragon, which is equipped with four LiDARs. Voice recognition has also become more sophisticated, with multi-area speech recognition and an increased controllable range.

However, PHEVs and micro EVs have contributed significantly to last year’s NEV scorecard, while some consumers still have some doubts about pure electric cars. A recent CCTV report on the difficulty in charging in Beijing seems to suggest that NEVs are not yet ready for an explosion. Meanwhile, the decline in subsidies has continued to push NEVs towards weaning.

In the past decade, the NEV market in China has undergone the transition from policy-oriented to industry-oriented stages. The question remains, has it now entered the user-oriented marketization stage? As we enter 2022, what changes, visible or invisible, will happen?

Penetration and Intersection, High, Middle, and Low All Gaining Momentum

When it comes to the new energy vehicle landscape, new forces always receive the most attention, not because of their sales volume (BYD’s sales volume is much higher), but because they always bring something unexpected and different from traditional car companies.

Years ago, you thought NIO was going down, but its delivery data slowly recovered. When you thought XPeng’s breaking 10,000 deliveries was already impressive, it unexpectedly increased its delivery volume by several thousand. When you thought Li Xiang’s single-vehicle ceiling was too low, it repeatedly surpassed your imagination and outperformed most models.Overall, the top three new forces in the automobile industry have similar delivery volumes in 2021, with XPeng leading mainly due to the advantages of product quantity and time to market. However, NIO’s ET7 and ET5 are coming to market in 2022, and Ideal’s next extended range vehicle X01 is on its way.

However, even if the relationship between the founders of the three companies is good, business is business. We can see that, unlike the initial few companies that intentionally or unintentionally avoided each other’s market choices, there is now gradually overlapping in price ranges and vehicle positioning.

XPeng’s G9, revealed at the Guangzhou Auto Show, overlaps with the consumer groups of Ideal ONE and NIO ES6 in terms of appearance and naming rules, although there are no specific parameters announced yet. At the end of the year, NIO also released a new car, ET5, with a starting price of 258,000 yuan, targeting the market of P7 and Model3.

According to earlier media reports, some owners who had previously ordered Ji Ke 001 turned to NIO after the release of the ET5, and competition at the same price point has quietly begun.

On the other hand, earlier Ideal executives revealed that X01 will be launched in the second quarter and delivered in the third quarter. X01 is positioned as a 6-seater SUV, with a larger size and higher level than Ideal ONE, but the user group should still be relatively similar. If the pricing is too high, consumers won’t buy it, but if it is too close, it is easy to have a left and right hand monopoly scenario.

After all, when X01 is launched, Ideal will only have two models to sell. However, Ideal’s ability to create explosive models was evident last year, and Photon Planet also expressed optimism about this car when communicating privately with many Ideal owners.

As the three companies begin to compete on the same stage, this is also a microcosm of the entire new energy market, where the models of various brands are becoming more and more diverse and covering a wider range of users. It is difficult to define the user of a car company with a few words. Since the new forces are still continuing to lose money and more powerful brands are entering the competition, if the next increment slows down, the competition will become extremely fierce.

Another surprise from last year was the rise of the mid-tier forces. NETA Auto achieved delivery of over 10,000 vehicles for two consecutive months, and Lingang’s December delivery was also close to 8,000 vehicles. Both of these companies have good sales of low-priced mini or compact electric cars.

The previous B-side market approach has been abandoned by most automakers, with a shift to the C-side market. According to NETA’s November results, its individual users accounted for 91%. This also means that electric cars are moving from “toys for the rich” to the mass market.Therefore, the low-end and mid-range markets are likely to continue to grow in 2022, while the increase in the high-end market is already small, and the competition will become increasingly fierce due to the delayed adjustment of the market. Compared to the traditional fuel vehicle market, only BBA’s luxury brand positioning has remained stable over the years, while new energy markets target high-end brands one by one. In the last year of subsidies, it may not be easy to stand out.

To quote Li Bin, “We can never say that the most dangerous time has passed.”

Plug-in Hybrids Welcome a New Era as Pure Electric Vehicles Fail to Meet Demand

Although surviving host factories in the initial melee of new energy have now started to feast, they are still dwarfed by BYD.

BYD’s full-year sales of new energy vehicles last year were close to 600,000, more than all the new forces in the automaking industry combined. Of course, this is thanks to BYD’s background and earlier layout.

And from the sales distribution point of view, BYD’s hybrid technology is indispensable.

Since BYD released its new generation hybrid technology DM-i early last year, sales have grown rapidly. The three DM-i models released less than 3 months ago accumulated more than 100,000 pre-orders, but the production capacity was seriously inadequate, leaving many car owners waiting for 4 to 5 months to get their cars.

Most families today need a car to assume multiple roles, in addition to daily city travel, they also need to consider short-distance self-driving, pick-up and drop-off and other scenarios. Compared with the uncertainty of pure electric power supply, plug-in hybrids are clearly a better choice.

Although the general trend is towards pure electric vehicles, the transition process always takes time. And to seize this opportunity, many traditional automakers launched their own hybrid systems last year. For example, Great Wall Lemon DHT, Changan Blue Whale iDD, Chery Kunpeng DHT, Geely, etc. The plug-in hybrid market, which is no longer monopolized by the “two fields,” will once again usher in a new era.

Overall, the plug-in hybrid systems currently launched by automakers are different from the earlier hybrid systems that were pushed into production hastily without sufficient preparation. They have changed the past thinking of being oil-based and electricity-assisted, and shifted the focus to electric drive with engine drive as the auxiliary, paying attention to energy feedback and fuel consumption. Plug-in hybrid models seem to have undergone marketization transformation earlier than pure electric models.

On the other hand, as the new energy subsidies continue to decline, the subsidy gap between plug-in hybrids and pure electric vehicles is gradually narrowing. For example, this year’s pure electric vehicles with a range of over 400 km and plug-in hybrids with a range of 50 km (in pure electric mode) only have a subsidy gap of 7800 yuan.

In addition, except for Beijing and Shanghai, which will soon stop issuing green license plates for plug-in hybrids, other cities have the same policies for both.

The popularity of IDEAL ONE also proves that consumers don’t care about your technological route, but are more concerned about actual experience. With the improvement of the plug-in hybrid models of domestic brands, there is still a lot of room for growth in the new energy market for plug-in hybrids in 2022.

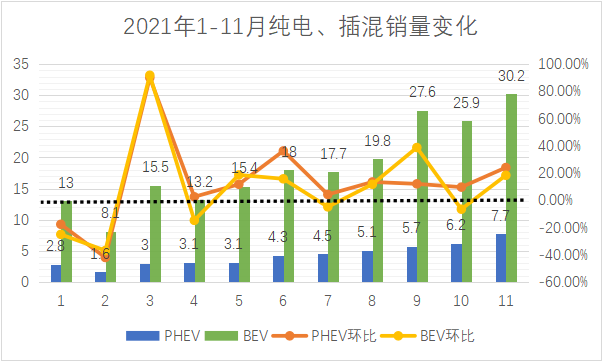

Looking at the sales of pure electric and plug-in hybrid from January to November last year, pure electric vehicles have an absolute advantage in terms of sales volume, but in terms of growth rate, especially in the second half of the year, the growth rate of plug-in hybrid vehicles exceeded that of pure electric vehicles. At the same time, a large part of the growth in pure electric vehicle sales is contributed by micro electric vehicles.

In 2021, SAIC-GM-Wuling’s GSEV (Global Small Electric Vehicle Architecture) sales reached 450,000 units, averaging approximately 37,500 units per month.

Excluding the sales of micro cars, the growth rate of pure electric vehicles was not as good as that of plug-in hybrids for most of the year. The data shows that in 2021, BEV sales increased by 168.6% year-on-year, slightly lower than the 171.2% increase of PHEV.

It is almost certain that small cars will be replaced by pure electric vehicles, as evidenced by the popularity of the MINI EV and T03. However, plug-in hybrids are still a topic for medium and large cars and family cars.

The disadvantage of charging infrastructure cannot be overcome in the short term, and the competitiveness of plug-in hybrid models may continue to improve.

In the year of 800V mass production, fast charging still cannot compete with battery swapping

One of the reasons that restricts the further penetration of pure electric vehicles is the imperfect charging infrastructure. In addition to home slow charging, fast charging infrastructure is also essential. There are three main solutions for fast charging: NIO’s battery swapping mode, Tesla’s high-current fast charging mode, and Porsche’s high-voltage fast charging mode.

Because the early investment in the battery swapping model was large and the business model was not obvious enough, fast charging is the means for most car companies to achieve fast charging.

To achieve high power charging, either voltage or current needs to be increased, but increasing the current will cause heating of the electrical system and higher requirements for heat dissipation. Therefore, the high-voltage fast charging mode has become the choice of many car companies.

In 2021, major manufacturers have successively launched 800V platforms, such as Geely Haohan SEA, BYD e3.0, and Audi PPE platform. Vehicles developed based on the 800V platform, such as XPeng G9, BYD Ocean-X, and Great Wall Saloon Armor Dragon, will also be unveiled or delivered in 2022.

High-voltage fast charging places higher demands on both the vehicle and the charging station. On the vehicle side, the high-voltage platform needs to develop a series of components such as the vehicle’s three-power system and air conditioning compressors according to the high-voltage platform, which involves the willingness of upstream component suppliers and is therefore slower to transform. Secondly, the safety requirements for the battery system are also higher. Finally, the on-board semiconductor devices need to be replaced from Si-based IGBT to SiC MOSFET, which is more expensive.Currently, major suppliers such as Bosch, Rohm Semiconductor, and Sanan Optoelectronics plan to expand SiC capacity to meet growing demand, which will help further reduce costs.

As for charging stations, without the adaptation of supercharging stations, the 800V high-voltage platform cannot achieve high-power charging, making it difficult to find matching high-voltage charging stations for models using a high-voltage platform. Currently, the major automakers are also building their own high-voltage supercharging stations. Last year, XPeng Motors released the first 480 kW supercharging station.

However, it appears that the utilization rate of ordinary charging stations is still low and the popularization of high-voltage supercharging stations will take time. Furthermore, cost limitations mean that high-voltage platforms are mostly used in mid- to high-end models and cannot continue to expand into more mid- to low-end models.

Therefore, high-voltage platforms cannot impact the battery swapping mode.

When asked about the conflict between supercharging and battery swapping modes, William Li, Founder and CEO of NIO, gave the following explanation last year: First, if supercharging becomes mainstream, battery swapping stations can also be retrofitted into supercharging stations at any time, but it is difficult to rebuild supercharging stations as battery swapping stations. Second, in urban scenarios, parking spots are a scarce resource, and currently, the efficiency of a battery swapping station is more than twice that of a supercharging station on a single parking spot, and with the popularization of high-power charging, battery swapping stations can also improve efficiency. Finally, and most importantly, a swapping station can solve the problem of battery decay in electric vehicles.

From a policy perspective, China has gradually developed from a charging-dominated and swapping-auxiliary mode to a parallel mode of charging and swapping.

According to Founder Securities, the battery swapping mode will achieve rapid penetration, and the total sales of battery swapping models could exceed 3 million, with more than 28,000 supporting battery swapping stations by 2025. Companies such as Geely and SAIC are also following up on battery swapping technology and models. There is still significant room for growth, especially in the commercial vehicles and operation vehicles fields that prioritize price and battery decay issues.

Conclusion

Although the situation for new energy vehicles is promising, we should not be overly optimistic. A large portion of the growth in new energy vehicles comes from hybrid and micro electric vehicles, while pure electric vehicles cannot fully meet the needs of most people in terms of usage scenarios.

However, there are still many automakers relying solely on pure electric cars, and most are not profitable.

As we enter 2022, the effect of subsidy reduction is showing the most rapid impact. Many companies such as NIO, XPeng, Tesla, Volkswagen, Aiways, NIO EVE, Leapmotor, and Geometry have increased prices or reduced discounts to offset the impact. The price increases range from around 2000 to 20,000 RMB. Some carmakers like NIO and XPeng have offered a buffer period and chosen to subsidize themselves, but they are no longer eligible for the 2021 subsidy policy.

In addition, in the face of increasingly fierce competition, upstream raw materials are also rapidly increasing in price. Materials such as battery diaphragms, negative electrode materials, electrolytes, and lithium salts had price increases ranging from 10% to 170% last year. The chip shortage is also continuing to affect car manufacturers.If car makers bear the cost themselves, the gross margin rate will inevitably be under pressure. The competition among car makers is becoming increasingly fierce. It seems that raising prices is the only way to spend money, but it may also affect some sales.

On the other hand, ideally, no subsidy is enjoyed, and there is not much action on subsidy decline, but this is a plug-in hybrid car.

If new energy wants to continue to gallop, it needs to meet several basic conditions. Firstly, the supply of the upstream industry chain should be stable, and the main engine factory and suppliers should develop together; secondly, infrastructure construction should be improved to solve the problem of power supplement. In addition, we should be vigilant against overcapacity and guard against chaos after blindly galloping.

New energy needs to be handed over to the market, but before fully accepting the market validation, it can’t be said that new energy has entered the mature stage. For example, the laser radar and computing power arms race that started last year may not have bet on the current competition direction.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.