Does the implementation of RCEP have an impact on the development of China’s new energy vehicle industry?

Ms. Lithium Extraction gave me this topic and I also want to explore it.

The Regional Comprehensive Economic Partnership (RCEP) officially came into effect on January 1, 2022. Its 15 member countries span the two continents of the northern and southern hemispheres, covering resource-endowed countries and technology-endowed countries, with their economic size, total population, and total trade all accounting for one-third of the world’s total.

Among the member countries of RCEP are not only developed countries with a relatively developed automobile manufacturing industry such as Japan and South Korea, but also emerging countries with an automotive industry such as ASEAN. Overall, the implementation of RCEP has a very positive impact on the development of China’s new energy vehicle industry and market.

Review of China’s new energy vehicle imports and exports in 2021

First, let’s take a look at the production, sales, and import-export situation of China’s new energy vehicles in 2021.

In terms of production and sales, facing the complex and volatile economic situation and pressure from the supply chain, the sales of China’s new energy vehicles in 2021 reached 3.521 million vehicles, ranking first in the world for seven consecutive years, and setting a new historical record. The new energy vehicle industry is in a stage of vigorous development, with broad prospects in the future.

A reversal trend has appeared in the export scale of China’s new energy vehicles. In 2019, China exported 254,000 new energy vehicles, an increase of 72.8% year-on-year. Although the export of new energy vehicles in 2020 dropped compared to the previous year due to the COVID-19 pandemic, China’s total export of new energy vehicles suddenly exceeded 550,000 in 2021. Whole new energy vehicles are exported to Asia, Europe, North America, and Africa, among which the Asian market is the largest market for new energy vehicles and the largest target market for China’s new energy vehicle exports.

In terms of the import and export of whole vehicles, among the member countries of RCEP, Japan exports some hybrid vehicles to China, South Korea has basically withdrawn from the Chinese imported car market, and Australia, New Zealand, and Southeast Asian countries are not the main importing countries of China’s new energy vehicles. As China becomes a production base for new energy vehicles, the potential for China to export to these countries is becoming very large.

The Impact of RCEP on the Development of the New Energy Vehicle IndustryThe goal of RCEP is to gradually eliminate tariffs and non-tariff barriers on all goods traded between contracting parties, achieving regional trade liberalization. The tariff reduction model of RCEP includes “immediate reduction to zero upon the agreement’s effectiveness”, “partial reduction”, and “exceptional products”. Specific measures are mainly based on “immediate reduction to zero upon the agreement’s effectiveness” and “reduction to zero within 10 years”.

Industry of Components for New Energy Vehicles

RCEP’s overall impact on the Chinese new energy vehicle component industry is not significant. This is mainly because before the formal signing of RCEP, the import tariffs on most auto parts in China were already at a relatively low level. Since July 2018, the most favored nation tariff rates on many automotive parts in China have been reduced to 6%, and the import tariffs on relevant parts between China-Singapore, China-Australia, and China-ASEAN have been reduced to zero. The tariff level between China-South Korea is also relatively low. Looking at the overall components of new energy vehicles, large numbers of battery, motor, and electronic control devices have been domestically produced, and the impact on the supply of certain chips is not significant.

Due to the reduction of tariffs, the cost of importing automobiles and auto parts from China for countries within the region such as Japan and South Korea will decrease. Some of the orders that previously belonged to North American and European countries may be transferred to China. The signing of RCEP has provided further development opportunities for Chinese auto parts suppliers to expand globally. In particular, the effectiveness of RCEP will help improve the international competitiveness of battery companies that utilize nickel resources in Southeast Asia, particularly in the upstream precursor and positive electrode materials areas.

We need to see that this round of changes in the global auto industry will accelerate the aggregation of the Asian region’s auto parts industry chain. The Chinese and Southeast Asian auto parts industries are competitive in the low-end sector. The Yangtze River Delta auto parts and Southeast Asia may both become the center of aggregation in the Asian auto parts industry chain.

Whole Industry of New Energy Vehicles

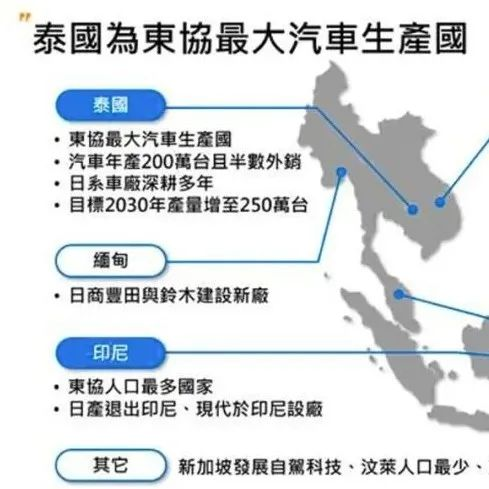

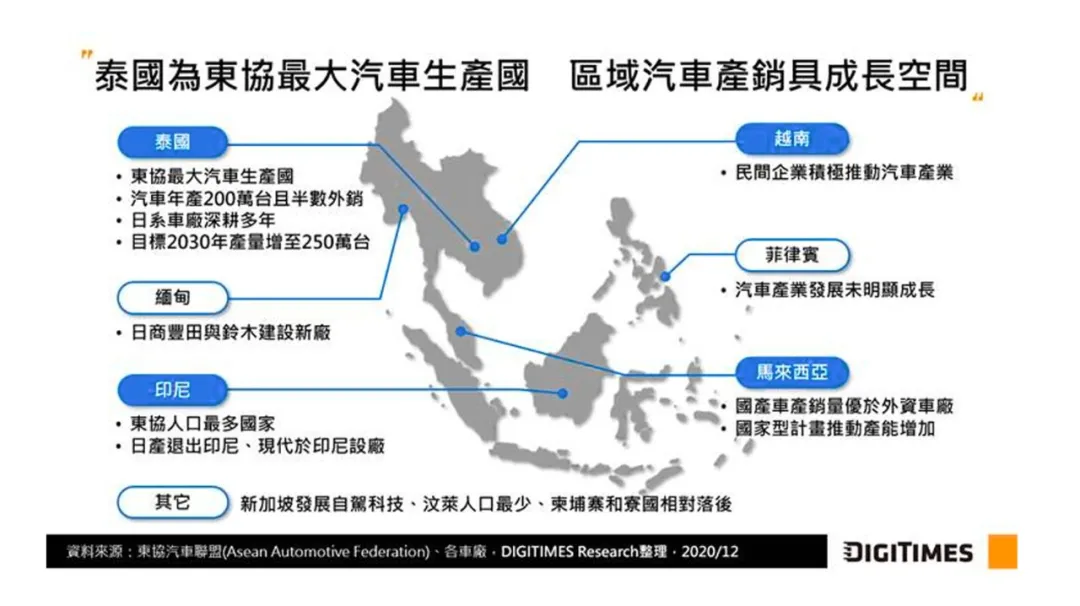

The impact of RCEP on the whole vehicle sector of new energy vehicles in China is relatively small in the short term. According to the existing arrangement of RCEP, most of China’s entire vehicle products are not subject to tariff reductions or are subject to rates higher than the most favored nation tariffs and tariffs under relevant free trade agreements. RCEP’s impact on China’s export of new energy vehicles as a whole is not significant. However, RCEP countries, particularly member states in Southeast Asia, are export countries of our low-end, high-cost-effective electric vehicles. At present, the Southeast Asian whole vehicle industry has not formed a complete industry chain, and there are no strong domestic new energy vehicle whole vehicle enterprises and brands. This market is relatively large and is also the main target for domestic penetration into overseas markets.The complementary power system of new energy vehicles mainly includes two parts: battery swapping and charging services. After the entire vehicle is sold, the demand for after-sales maintenance will also increase. Thailand, Indonesia, Vietnam, Malaysia and other countries maintain an open and welcoming attitude towards foreign investment in the field of new energy vehicles. Thailand hopes to absorb more foreign investment in the electric vehicle industry and make Thailand the center of electric vehicles in ASEAN. ASEAN has a large population, and from the perspective of overall consumption, the sales volume of cars maintains a certain growth rate. It is one of the fastest growing economies in the world in terms of global car sales growth, and there is great potential for future development in the automotive industry. In the medium and long term, the Southeast Asian market will be an important market for China’s future overseas exports of new energy vehicles.

Summary: RECP has a limited short-term impact on China’s new energy vehicles, but the export of China’s new energy vehicles is inevitable and represents a highlight of China’s technology and product development.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.