Author: Winston

The one word to describe Tesla’s Q4 earnings report released this morning is stable.

Tesla’s team has consistently delivered stable performance, as reflected in the steady increase of their automotive gross margin (excluding carbon credit revenue) to 29.1% (as compared to 28.8% last quarter), achieved during a period of continuous supply chain bottlenecks and rising raw material costs.

When carbon credit revenue is considered separately, its share of revenue has dropped to 1.96% (compared to 2.31% last quarter).

The overall pre-tax profit margin has increased to 14.7% (as compared to 14.6% last quarter).

Gross revenue reached 48.8 billion CNY (as compared to 36.7 billion CNY last quarter), and net profit reached 26.1 billion CNY (as compared to 20 billion CNY last quarter).

Free cash flow was 2.77 billion CNY (as compared to 1.32 billion CNY last quarter).

These are the results of their operating performance. Once again, we give a thumbs-up to Tesla’s team, whose adherence to the correct direction and diligent management led to these impressive numbers.

Next, following the same format as our last earnings report read, let’s delve deep into the data contained in this report.

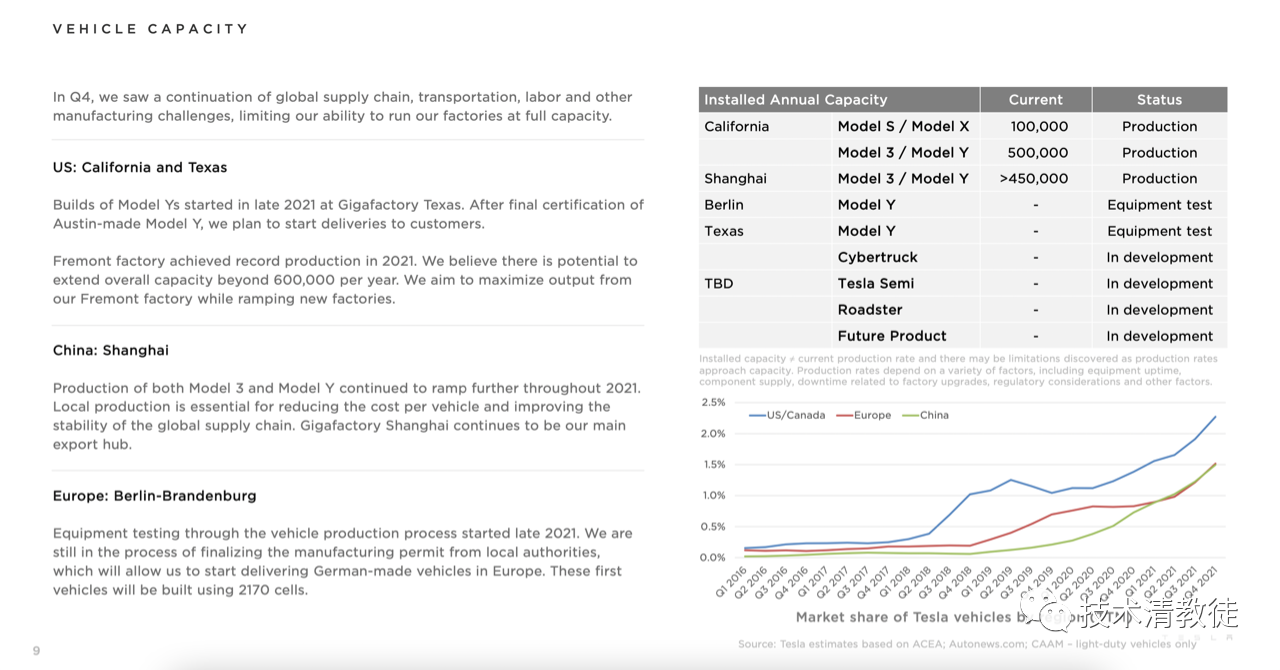

Production Capacity

It is worth mentioning that the production capacity of Tesla’s Shanghai Gigafactory has increased rapidly, unexpectedly reaching an annual output of 840,000 by the end of December. It is still expanding, and I personally forecast that after completion in April 2022, it will reach a level close to 1 million / year.

The production capacity of Tesla’s Fremont factory remains at 600,000 / year. I believe that most of Tesla’s North American team’s efforts have shifted to ramping up production capacity at the Texas Gigafactory.

The Texas Gigafactory began producing vehicles in January, and I predict that production capacity in 2022 will be comparable to that of the Shanghai Gigafactory’s first year, which is 130,000-150,000 / year, and will reach 400,000-500,000 / year in 2023.

The main challenge facing the Berlin Gigafactory is complying with the complex environmental regulations in the area. I anticipate that it will officially open for production in March, but due to difficulties in recruiting and supporting mature teams in the area, its production capacity ramp-up will be more challenging than that of its North American counterparts. I estimate that its production capacity in 2022 will be 50,000-100,000 / year, and 200,000-300,000 / year by 2023.

Price and Gross Margin

The following data only covers Tesla’s automotive sector, as its solar and energy storage divisions currently account for a smaller share of revenue.

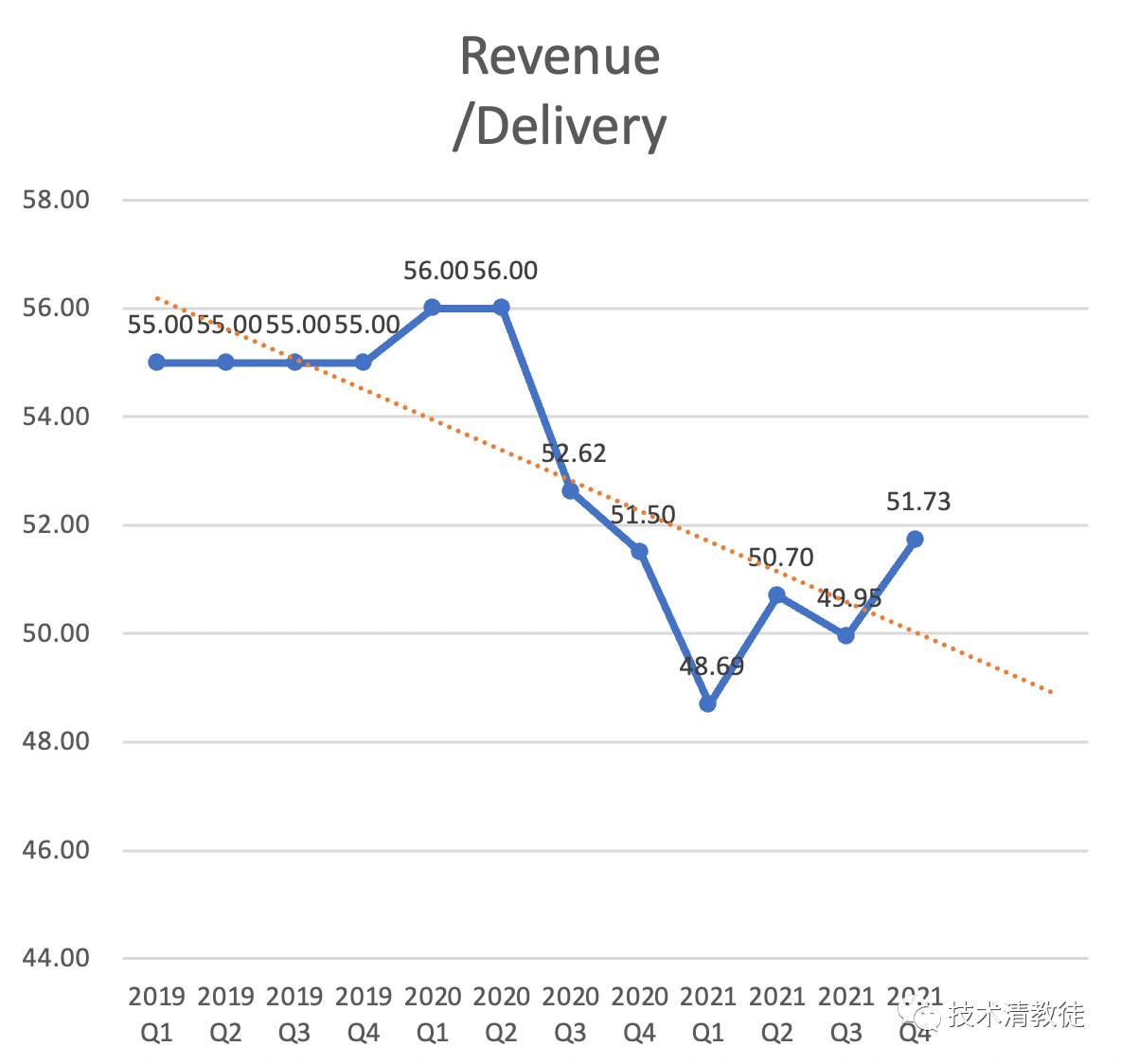

Q4 average selling price per vehicle increased by $17,000 compared to Q3, mainly due to multiple price increases of Model 3/Y and increasing deliveries of new Model S/X.

Q4 average selling price per vehicle increased by $17,000 compared to Q3, mainly due to multiple price increases of Model 3/Y and increasing deliveries of new Model S/X.

The gross profit also continues to increase.

Operating Expenses

The average operating expenses per vehicle sold by Tesla increased from $6,860 in Q3 to $7,240 in Q4 mainly due to heavy stock-based compensation to Elon Musk. Excluding this factor, the number for Q4 would be $6,500.

Profit

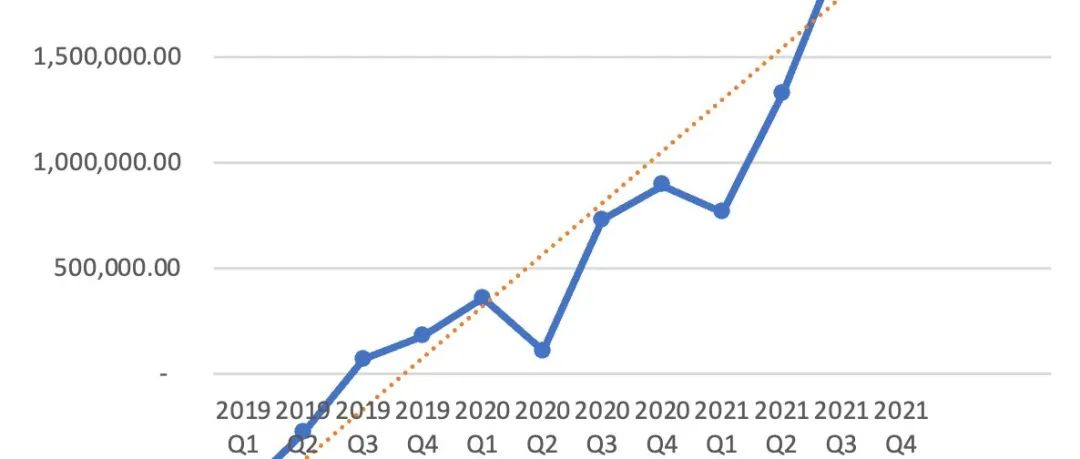

I expect the EBIT curve to continue to be steep in the future.

Production Asset Efficiency

The per-vehicle depreciation and amortization decreased to $2,750 in Q4 from $3,150 in Q3.

Overall, Tesla’s current financials are strong, with free cash flow rapidly increasing and projected to potentially exceed $10 billion this year. The company has also reserved many means of lowering costs in the future with already disclosed technical projects such as the 4680 battery plan, integrated casting, and the Dojo supercomputer project.

Furthermore, I noticed during this Q4 Earnings Call that Elon and Zach (Tesla CFO) emphasized the future increase in the software proportion, which may indicate Tesla’s revenue growth entering the second curve and the opening of the FSD deployment.

Facts: The FSD Beta, a fully automated driving testing version, has expanded from thousands of people in North America in Q3 to about 60,000 in Q4.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.