“This is my last participation in Tesla’s earnings call, unless there is something very important to announce in the future.” This was the summary given by Tesla CEO Elon Musk during the 2021 Q2 earnings call at the end of July last year.

Thus, when Musk confirmed that he would participate in the 2021 Q4 and full year earnings call, people around the world began to look forward to this Tesla year-end summary conference.

After all, Musk had previously hinted on social media that the Road Map for Tesla’s new products would be revealed during the meeting.

“Will there be a clear delivery schedule or even a pre-launch of the Cybertruck, Semi-truck and Roadster supercar? Will the rumored $25,000 entry-level new car be officially put on the agenda? These are all exciting mysteries.”

However, even if you, like me, overcome jet lag and got up at 5:30 in the morning on the 27th to listen to this earnings call, the impression left in our sleep-deprived brains is likely to be “the higher the expectations, the greater the disappointment.”

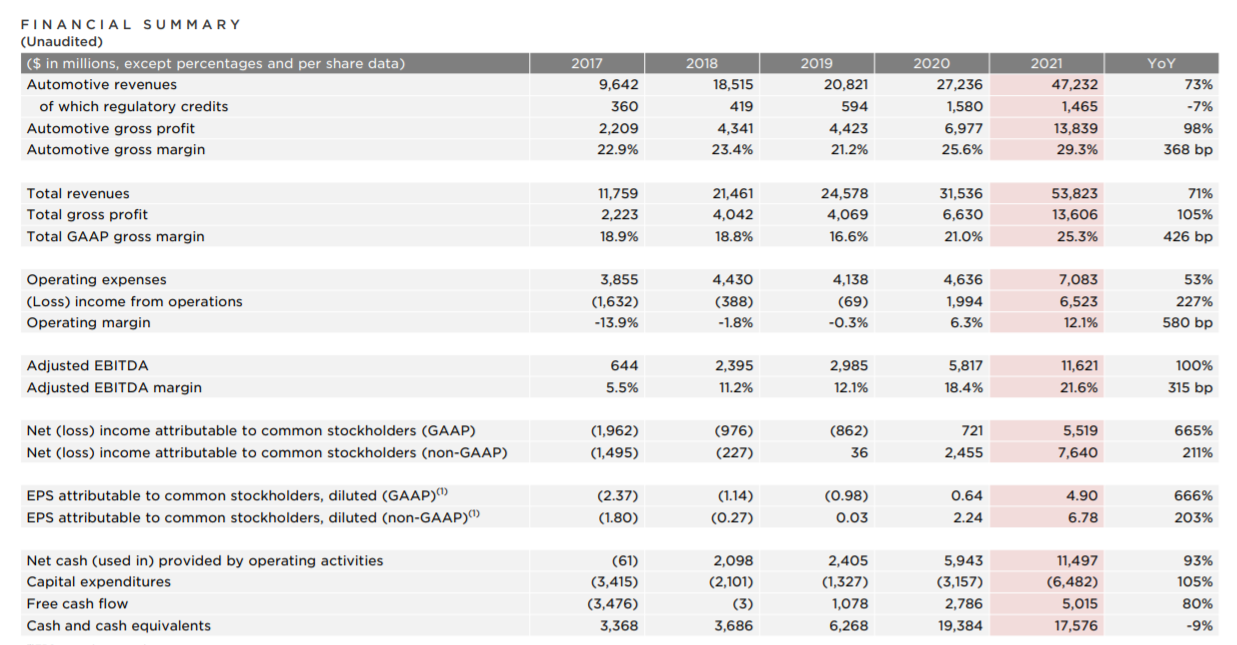

Setting aside the specific numbers and information, let us compare Tesla’s Q4 earnings reports for 2020 and 2021.

In the 2020 document, the first image after various financial statements is this one:

In the first image of the 2021 report, the main focus shifted from the fierce and reticent Livyatan to a production line worker screwing bolts at Tesla’s California factory.

The stark contrast between these two images also sets the tone for Tesla’s Q4 2021 earnings report: no flashy product information, only practical discussions of current revenue and future production plans.

Musk’s participation in the event was more like a celebration of the excellent results achieved by Tesla in 2021. After repeatedly denying new vehicle plans and delivery schedules, he continued to arouse people’s excitement with futuristic technologies such as self-driving and humanoid robots that still seem distant.

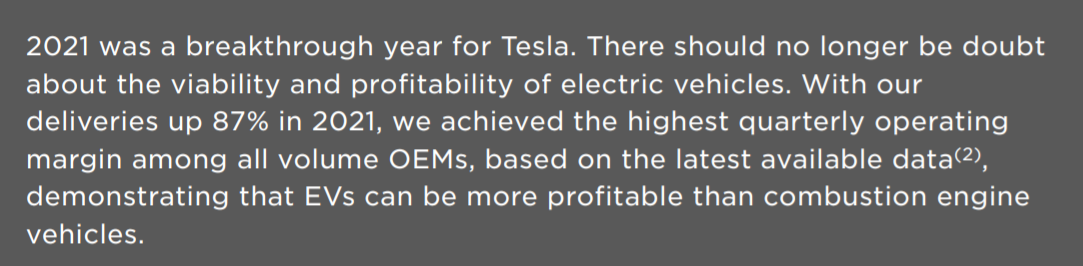

The most profitable car company in the world: $100 million net income per day.”2021 was a breakthrough year for Tesla. There should no longer be any doubt about the market viability and profitability of electric vehicles. Tesla’s deliveries increased by 87%, and we achieved the highest quarterly operating profit margin among all mass-produced car manufacturers. This has demonstrated that electric vehicles have more market prospects than gasoline vehicles.“

This is the final word in the first sentence of the financial report. The central idea is still to tell everyone that Tesla is currently the most profitable carmaker in the world.

To make money, on the one hand, it is to sell more cars, and on the other hand, it is to make a hefty margin on every car sold.

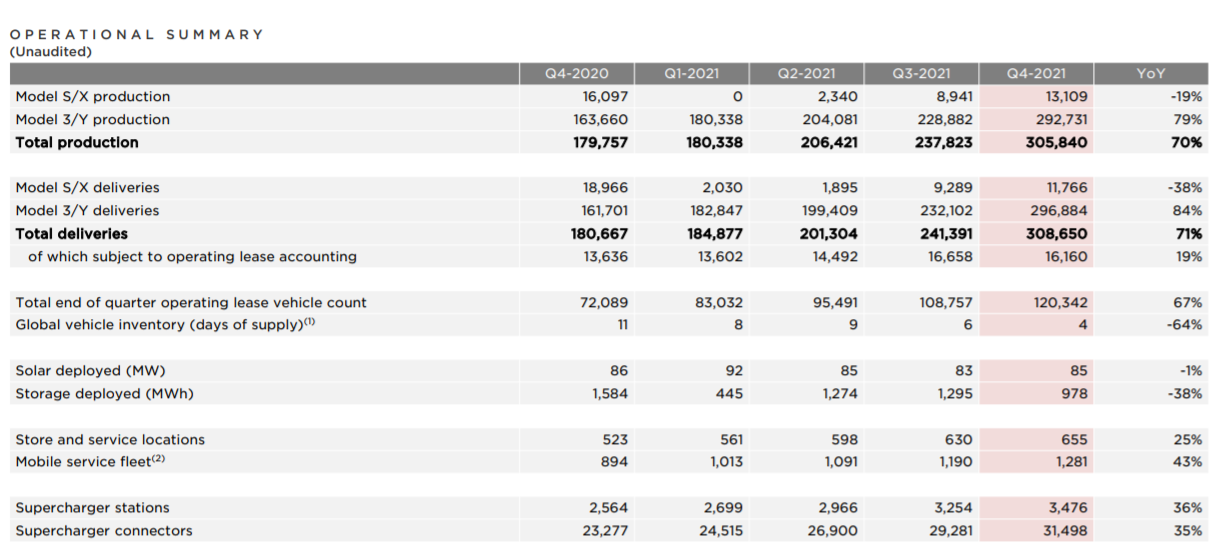

Let’s start with the fourth quarter. Tesla delivered a total of 308,650 vehicles worldwide in that quarter, an increase of 71% compared to 180,667 in the same period last year.

It’s not particularly surprising to sell more than 300,000 new cars in one quarter globally, but what’s worth paying attention to is how much revenue and profit these new cars can generate.

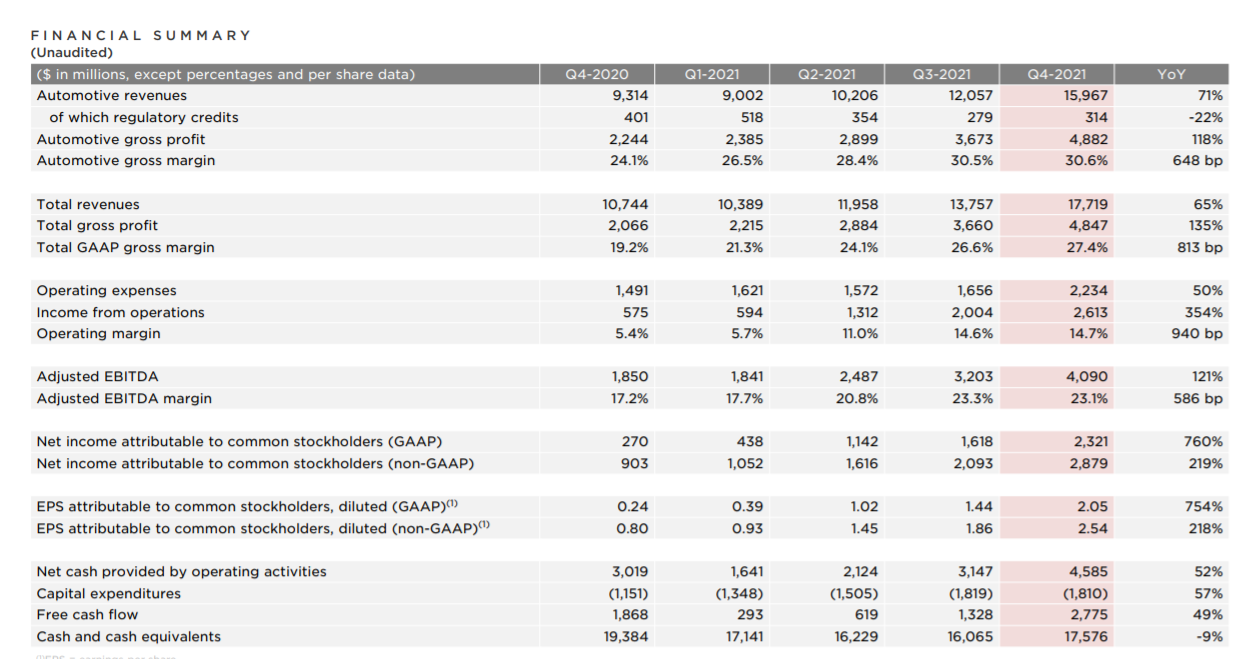

In the fourth quarter, Tesla’s total gross profit from the automotive business was $4.882 billion, an increase of 118% over the same period last year’s $2.244 billion.

Converted to the gross margin on new Tesla cars, it reached a staggering 30.6% in the fourth quarter – remember this number, this is why Tesla claims to be the most profitable carmaker. Previously, it was generally believed in the industry that the highest gross margin per vehicle for traditional gasoline car makers was around 10%.

As for the whole year of 2021, Tesla delivered a total of 936,222 vehicles globally, an increase of about 87% compared to the previous year.

While new Chinese manufacturers are still striving to deliver 100,000 vehicles per year, Tesla has begun to make a breakthrough towards millions of vehicles.

In terms of revenue for the whole year, Tesla had a total revenue of $53.823 billion in 2021. Among them, the total revenue from the automotive business was $47.232 billion. The total gross profit from all businesses reached $13.606 billion, with a gross profit margin of 25.3%.

In terms of net profit, Tesla achieved $5.519 billion in net profit for the full year of 2021, which is about RMB 34.76 billion and approaching RMB 1 billion net profit per day. This is a new high since its listing, and Tesla has achieved profitability for the second consecutive year.

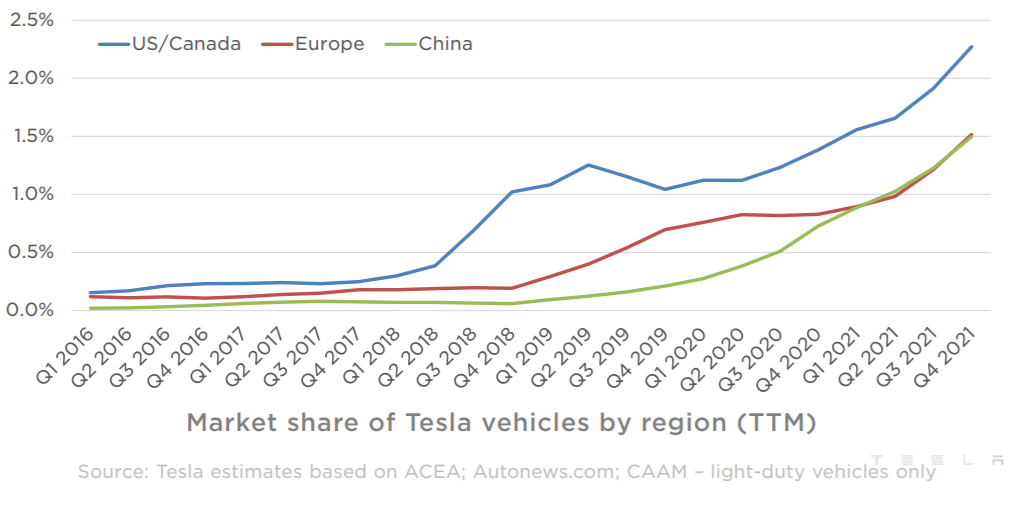

Looking back at Tesla’s revenue structure in 2021, we can clearly see that the share of its automotive business is increasing.

Tesla is becoming more and more like a “serious car seller” — in the fourth quarter, Tesla’s carbon emission credit revenue was only $314 million, which basically removes the label of being a “coal seller.”

In addition, Tesla’s global sales are currently in a state of “production and sales balance”: total production in 2021 was 930,422 cars, and total deliveries were 936,172 cars. Essentially, they can sell as many cars as they can produce, with the global market’s average inventory cycle being only 4 days.

For 2022, Tesla estimates that its delivery volume will continue to grow by over 50%. Compared to the data above, the method to achieve this goal is also very clear: increase production capacity and produce more new cars.

Can “Chinese speed” be replicated?

Based on the estimated annual delivery growth rate of over 50%, Tesla factories will need to expand their annual production capacity by nearly 500,000 cars next year. To achieve this goal, it’s easy to say but hard to do.

It’s easy to say, because from the number of factories on paper, it shouldn’t be too difficult for Tesla to achieve this goal in 2022.

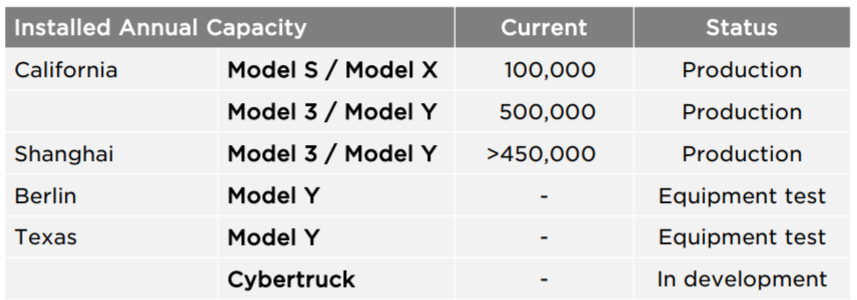

Currently, Tesla has 4 factories worldwide, two in their hometown of California and Texas, and two others, one in Berlin, Germany, and the other in our familiar Shanghai.

In the financial report, Tesla describes these factories as follows:

The Fremont factory in California reached peak production capacity in 2021. At the same time, the factory’s annual production potential is expected to eventually exceed 600,000 cars.

The Shanghai factory currently has an annual production capacity of over 450,000 cars. Local production in China has played an important role in ensuring Tesla’s global supply chain stability and reducing per-car cost, and it will continue to serve as Tesla’s major export hub.

The Berlin factory in Germany started equipment debugging and product production verification at the end of 2021. However, it still needs to wait for the final production permit from the local government before delivering the new cars to the European market. At the same time, the first batch of vehicles produced by the German factory will continue to use 2170 batteries.

The Berlin factory in Germany started equipment debugging and product production verification at the end of 2021. However, it still needs to wait for the final production permit from the local government before delivering the new cars to the European market. At the same time, the first batch of vehicles produced by the German factory will continue to use 2170 batteries.

Meanwhile, the production capacity plan of the Texas Austin factory is still not clear and is still in the equipment debugging phase. We can also see from the table that the focus of the factory’s subsequent production will be on the Model Y and the electric pickup truck Cybertruck.

However, during the conference call, Musk revealed some new information about the production of the Texas factory: the first batch of Model Y equipped with the latest 4680 battery is expected to be offline and delivered in the first quarter of 2022.

Although Tesla held a grand opening ceremony for the Berlin factory at the end of last year, when the factory can start working, the difficulty of obtaining government approval is still much greater than technical problems.

In contrast, the Texas factory in the later plan may even achieve an “overtake on a curve” and start production before the Berlin factory.

This actually reflects the difficulties that Tesla’s production capacity climbing is facing: factory construction is just the first step. The subsequent various processes, equipment debugging, supply chain guarantee, and even the impact of the new crown epidemic will bring uncertainty.

Thinking back, do you find it thought-provoking that the Shanghai factory once achieved the “Chinese speed” leap?

Therefore, during the earnings call, Musk also made it clear that there will be plans for a new factory: will begin to select sites globally and may announce relevant news this year.

In fact, the news of Tesla’s new factory has been around for a long time. From seemingly unreliable Indian factories to the Qingdao factory refuted by Tesla China, various speculations have long been flooding the market.

Thinking from another perspective, if you were Musk, where would you want to build a new factory?

Musk’s “Seasoning”

Although he previously claimed to disclose future new car plans during the earnings call, Musk ultimately left a tone of “Tesla will not launch new cars this year.”The explanation he gave was: “If we are going to launch a new car this year, the total production will decrease.” In the current global market where the demand for Model 3 and Model Y is soaring, ensuring the existing car production capacity, and focusing on the supply chain and production optimization are Tesla’s most important tasks.

Immediately after, Musk disappointingly denied the N-connection:

The Cybertruck, Semi and Roadster will not be released ahead of schedule, and will continue to be delayed. Among them, the Cybertruck, which has recently been exposed on the Internet with production cars, can only be delivered in the most ideal situation by 2023.

When asked about the reason for the Cybertruck’s difficulty in production, Musk surprisingly stated that it was not due to insufficient 4680 battery capacity, but the “pricing and the cost that consumers are willing to pay for new technology” are the main issues.

He said: “The biggest problem is actually how to make the Cybertruck affordable for people?”

Compared with the current situation where there are endless competitors in the US electric pickup truck market, Tesla seems to have returned from the dimension of technology R&D to the dimension of market marketing, and more pragmatically considers the design issues of the Cybertruck.

However, Musk still gave a clear production capacity expectation for this cool pure electric pickup truck: the annual production volume will reach 250,000 units. It seems that Tesla is not too concerned about competitors such as the F-150 Lightning and Rivian R1T.Regarding the entry-level model rumored to be even cheaper, close to $25,000, Musk said “No, currently we have too much work to do, rather than developing a cheaper new car, we should put more energy into the development of the fully autonomous driving system FSD.”

When hearing this statement, I don’t know if Chinese electric vehicle manufacturers secretly breathed a sigh of relief?

Of course, even without a new car, Musk will not give up a good opportunity to outline a blueprint for Tesla’s various leading intelligent technologies.

Regarding the FSD Beta system currently being tested, he said that nearly 60,000 Tesla models have participated in the test in the United States. When the time is right in 2022, it will be pushed to all models worldwide equipped with the system.

But we also know that the new FSD system, which Musk has already said is “almost approaching human driving,” has also been constantly delayed in the past. Whether it can really be officially pushed this year, as the saying goes, just listen and forget about it.

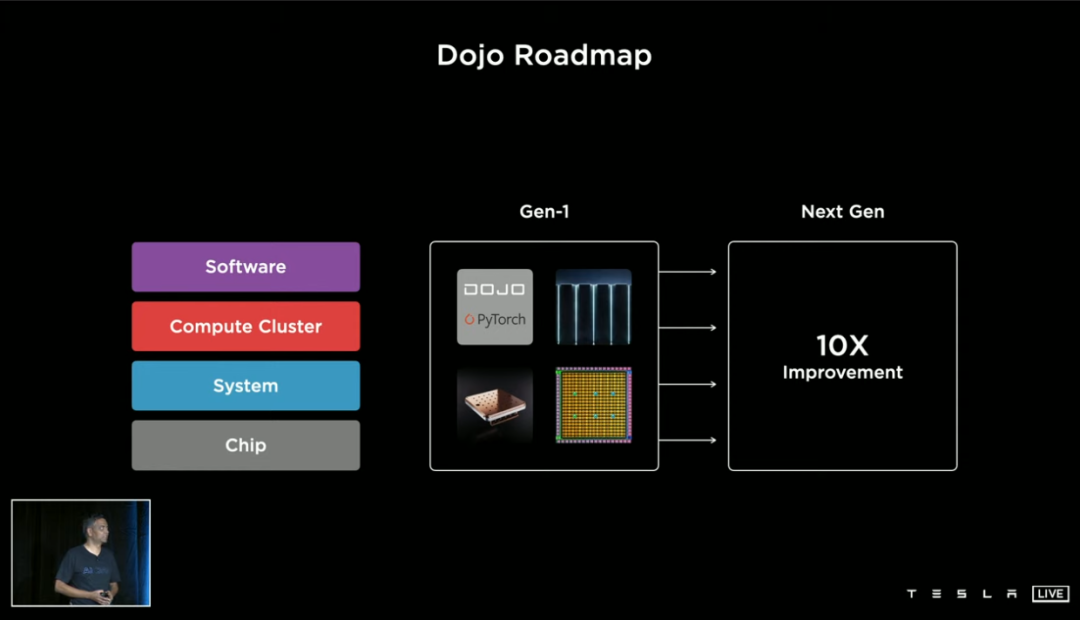

Finally, about the Dojo supercomputer and humanoid robot Tesla Bot, which were unveiled at AI Day last year, Musk’s few words also brought new news:

Dojo will be officially put into use in the summer of 2022. However, this amazingly powerful supercomputer is not a necessity to achieve autonomous driving. Its biggest significance is to reduce the cost of autonomous driving technology development and improve development efficiency.

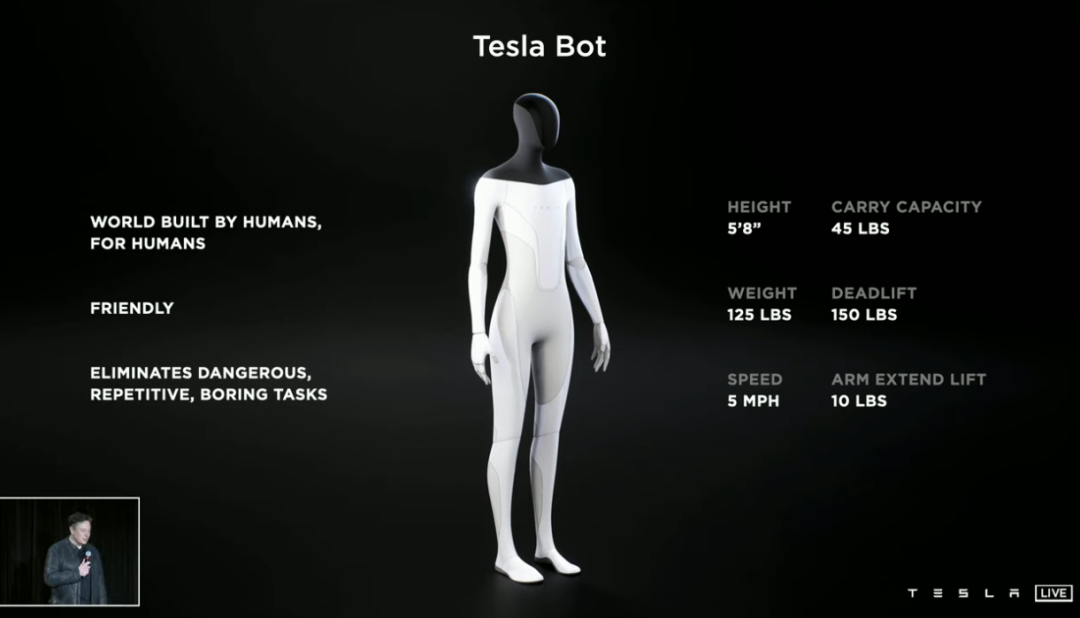

In addition, remember the humanoid robot Tesla Bot that was incomprehensible at AI Day? Musk said that this is the “most important product currently under development, which may be more important than the automobile business”.

At some point in 2022, Tesla will launch the code-named Tesla Bot prototype named Optimus, and its first use case may be “handling parts or other items around the factory.”

Will the scene of human workers and robot workers screwing screws together really appear in the future Tesla factory? Let’s wait and see whether this is another “satellite” launched by Musk or it will really become a reality.

Will the scene of human workers and robot workers screwing screws together really appear in the future Tesla factory? Let’s wait and see whether this is another “satellite” launched by Musk or it will really become a reality.

Final Thoughts

Above are the main contents of Tesla’s 2021 financial report. The core message can be summarized as “delay the launch of new vehicles and technologies, focus on expanding production capacity, sell more cars and make more money in 2022.”

However, in the Chinese market this year, we can see a dazzling array of new car models with our own eyes. Can Tesla continue its sales success in 2021 by relying on the two “old cars” – Model 3 and Model Y? And what measures will it take to maintain its competitive advantage?

Let’s wait for the actual market feedback to give us the answer to this question.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.