Introduction

With technology giants entering the field one after another, bringing capital, traffic, and technology, the commercialization and scaling of autonomous driving are accelerating, and the market for LiDAR is booming. At the Guangzhou Auto Show last year, we saw that new-generation automakers such as Autowise Avita 011, Salon Mecha Dragon, E-An LX Plus, and XPeng G9, WM M7, and IM L7 have already taken LiDAR as the core component of autonomous driving, and they have also shown an increasingly in-depth understanding of this technology path. It can be said that autonomous driving has become a necessary step for intelligent vehicles to achieve advanced autonomous driving. However, will LiDAR, which has always been expensive, really become the standard for autonomous driving in the future? Can intelligent driving really not work without LiDAR?

Core Components of Autonomous Driving

The past year of 2021 was undoubtedly the year of commercial landing for the domestic autonomous driving industry. In the Robotaxi field, Baidu Apollo and Xiaoju Smartek implemented charging operations in Beijing; in the Robotruck field, top players such as Mainline Technology successively landed in national ports and started L4 level autonomous driving tests on highways. Whether it is the Robotaxi or Robotruck autonomous driving system, LiDAR is a necessary perception component. This is because LiDAR has more accurate perception distance and can withstand harsh weather conditions. In the entire autonomous driving system, LiDAR can form a favorable supplement with millimeter-wave radar and cameras.

It can be said that LiDAR is the core sensor in the autonomous driving system. This statement has been verified by the market. Currently, except for Tesla, all companies involved in the autonomous driving industry equip their own car models with LiDAR. However, as the laws and regulations of autonomous driving are continuously improving, the development of the autonomous driving industry is constrained by costs. The high cost of a single vehicle makes it impossible to produce autonomous driving vehicles on a large scale. The reason for this is the high cost of autonomous driving components, especially LiDAR.

LiDAR products that can meet high performance and car-grade requirements have extremely high costs; if low-cost products are used, their performance and stability are not outstanding. In fact, stability, performance, and cost have formed an “impossible triangle” within the LiDAR industry.

At the same time, the technical routes of the LiDAR industry are diverse and complex, and various manufacturers have created and continuously iterated multiple technical routes of mechanical, MEMS, OPA, Flash, and single-axis micro-mirrors. These LiDAR technical routes have their own advantages and limitations, and the LiDAR industry has not formed a technology standard that is more suitable for onboard use.

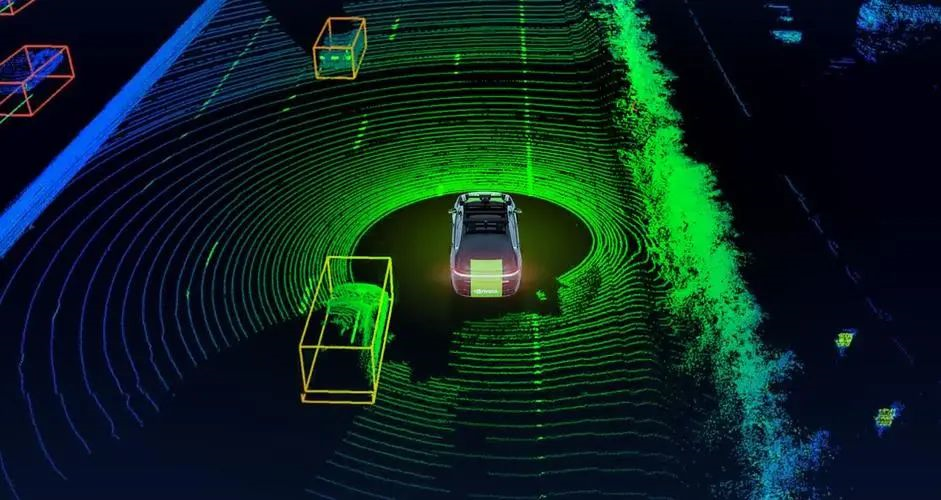

Essential Sensors for Perception AlgorithmAs one of the most important and hottest modules in the field of autonomous driving, the stability of perception algorithm directly affects the ability and safety of autonomous driving algorithms. Currently, point cloud-based perception algorithms dominate the industry. This is partly because compared to images, autonomous driving point cloud data can provide more accurate, stable, and detailed information, and on the other hand, the range perceived by point clouds is wider than images, and is better at preserving details. This is also why even though the cost of lidar is so expensive, various autonomous driving companies are still so persistent in it.

In addition, the perception fusion algorithm is not mature enough. Currently, most autonomous driving systems use post-fusion algorithms, which require spatial registration and time synchronization of multiple sensors such as cameras, lidars, and millimeter wave radars to achieve point-to-point correspondence, and this process is difficult. The main reasons behind this are: first, there is a certain level of error in cross-sensor platform time synchronization, which can reach up to the second level at most; second, the sensor views are different, and there are differences in perception of the environment. In the end, post-fusion perception algorithms are prone to false positives and misses, which can affect the decision-making of the entire autonomous driving system.

Carmakers are adding lidars one after another

China’s new forces in car making have directly accelerated the speed of entrepreneurship in the field of intelligent driving, and the most outstanding of them is the deployment of lidars. With the help of the largest market in China, lidars have surpassed foreign brands and have shown multiple improvements in technology. The number of lidars installed in autonomous vehicles has become a competition, and although it may seem a bit overhyped, its most direct impact is the activation of the lidar industry.

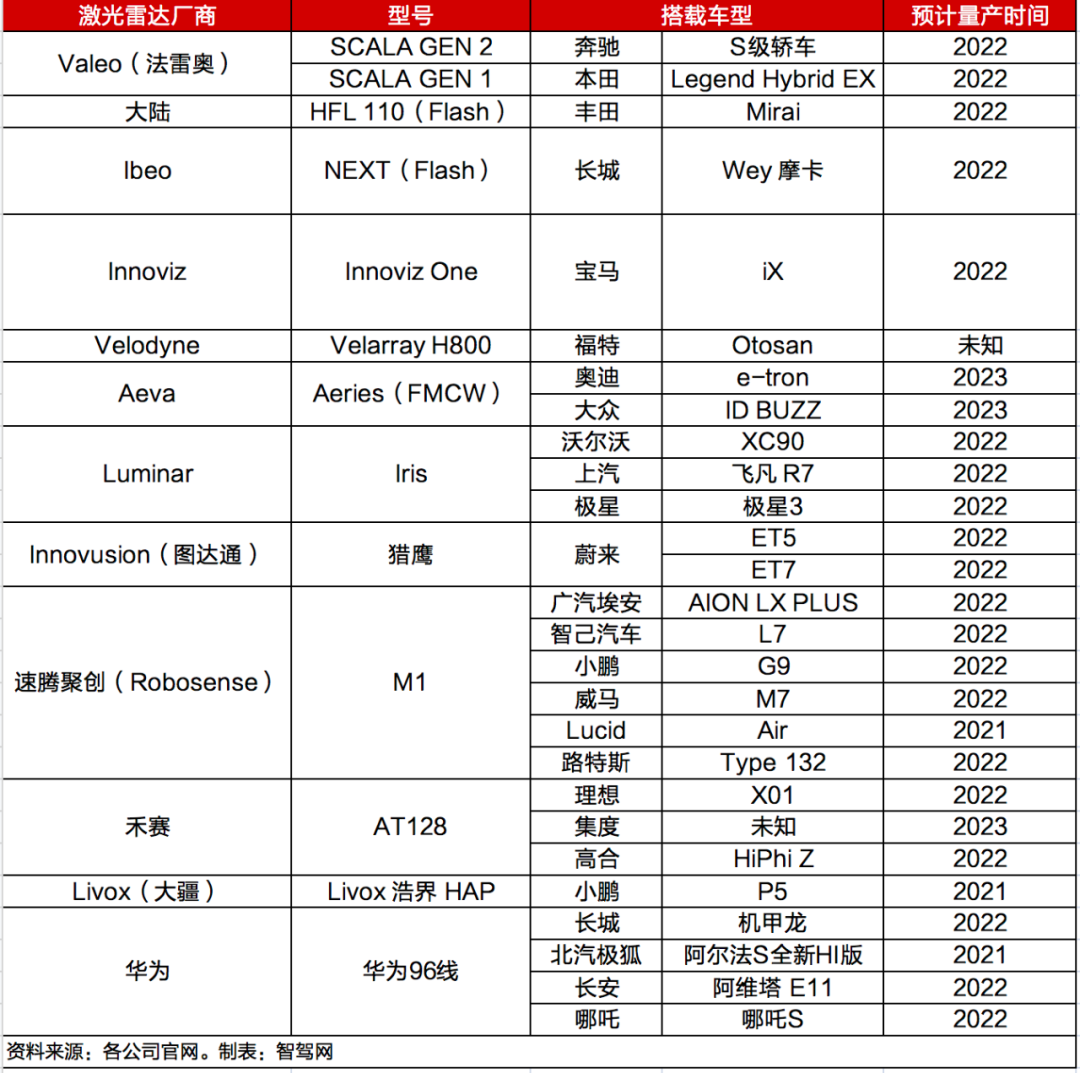

From XPeng to Qiming Drive, from IM Auto to Great Wall, many carmakers have announced plans to launch models with lidars, all of which are expected to be mass-produced between 2021-2022. 2021 has become the legitimate first year of adding lidars to cars.

The above is our analysis of the models using lidar and their chosen lidar suppliers. A clear phenomenon is that Chinese automakers mostly opt for domestic lidar, while foreign brands tend to use traditional suppliers. According to Sullivan, a US consulting company, the market for advanced driver assistance lidar is predicted to reach $4.61 billion, or RMB 30 billion yuan, by 2025, with a compound annual growth rate of 83.7% from 2019 to 2025. There will obviously be a showdown between Chinese and foreign brand lidar suppliers, but the outcome of this competition depends on the market share of domestic and foreign car brands. The long-term bullish view of Chinese car brands by society seems to have been confirmed in the capital market regarding the future competition.

The above is our analysis of the models using lidar and their chosen lidar suppliers. A clear phenomenon is that Chinese automakers mostly opt for domestic lidar, while foreign brands tend to use traditional suppliers. According to Sullivan, a US consulting company, the market for advanced driver assistance lidar is predicted to reach $4.61 billion, or RMB 30 billion yuan, by 2025, with a compound annual growth rate of 83.7% from 2019 to 2025. There will obviously be a showdown between Chinese and foreign brand lidar suppliers, but the outcome of this competition depends on the market share of domestic and foreign car brands. The long-term bullish view of Chinese car brands by society seems to have been confirmed in the capital market regarding the future competition.

Rising lidar start-ups

Robosense (Suteng Innovation), a domestic company, is probably the biggest winner in the lidar industry in 2021. They have exclusive partnerships with six models that are expected to go into mass production between 2021 and 2022, and they also won more than 40 pre-installation orders for entire vehicles during 2021. According to Yole Développement’s industry research data, Robosense had the highest market share of lidar for pre-installation in China and second highest globally in Q3 of 2021, thanks to their MEMS-based solid-state M1 lidar. Robosense has been developing MEMS lidar since 2016, and in 2018, they showcased the initial version of M1 at CES.

Another shining star in the domestic lidar industry is Hesai Technology. They had an eventful year in 2021, even though their IPO was interrupted due to patent issues at the beginning of the year. Their solid-state AT128 lidar is still popular. In a 10% reflectance scenario, the detection distance of the AT128 can reach 200 meters. Hesai has secured pre-installation orders for millions of cars from several automakers including Ideal, Jidu, and GAICOM, and will begin mass production and delivery in 2022.

Huawei has also successfully launched its own 96-beam lidar and produced it in a variety of models.

The DJI Livox, which is mounted on the XPeng P5, became China’s first on-board lidar sensor in mass production.Just as a reminder, although the P5 has started delivery, the LIDAR function still needs to wait for this year’s OTA upgrade.

In addition, many Chinese LIDAR companies, including RoboSense, Hesai Technology, Innovusion, SureStar, Beixing Photonics, Whirly Vision Technology, SiLC Technologies, Beike Tianhui, Dahua Laser, and HoloMatic have rushed into the in-vehicle market.

Conclusion

As for the future of autonomous driving, whether it will become standard remains to be seen. In principle, since humans can drive with only their eyes, autonomous driving should not require any other sensors. However, the biggest problem with pure visual perception is the inability to measure distance, speed, and acceleration. But since the human brain can approximate these values, a neural network trained by calculation should be able to possess this capability as well. Since Tesla’s fully camera-based FSD can be launched, it means that the practical effect of this system is reliable. However, this solution is only suitable for Tesla, based on the strong software ability of the company. As each step towards autonomous driving is taken, the dependence on redundant computing capability and redundant recognition capability will increase exponentially. Once LIDAR is mass-produced and placed on vehicles, it will be an indispensable core component of autonomous driving cars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.