Author: Duo Duo

In 2021, China’s new energy vehicle market has developed rapidly, with annual sales exceeding 3.5 million vehicles and market penetration rate increasing to 13.4%, demonstrating the trend from policy-driven to market-driven transformation.

Among the independent Chinese automotive companies, which one has a faster transformation toward new energy? On January 23, Great Wall Motors released its 2021 annual performance report, which impressed everyone.

In terms of revenue, Great Wall Motors generated a total operating income of 136.317 billion yuan in 2021, an increase of 31.95% year-on-year. Net profit was 6.781 billion yuan, up 26.45% year-on-year.

Excellent revenue data is naturally inseparable from the rising product sales. In 2021, Great Wall Motors sold a total of 1.28 million new cars, a year-on-year increase of 15.2%, and exceeded one million in sales for six consecutive years.

Of greater note is that Great Wall Motors has sold a cumulative total of 137,000 new energy vehicles in 2021, accounting for 10.7% of overall sales and approaching the overall market penetration rate of new energy vehicles.

In 2021, Great Wall Motors has produced an excellent report card.

To achieve this performance is certainly not a coincidence. Great Wall Motors has adopted a strategy of early layout for hybrid, pure electric, and hydrogen energy routes and carried out precise research and development.

Lemon Hybrid Technology: Building a cornerstone

According to data released by the China Association of Automotive Manufacturers, plug-in hybrid and pure electric vehicles have both shown rapid growth, with year-on-year cumulative growth rates exceeding 100%.

Previously, it was widely doubted that the hybrid technology route was only a “transitional route” for fuel vehicles to transition to electric vehicles. From the good sales data, hybrid vehicles are the most realistic and feasible technology solution for consumers in the short term.

Since 2018, Great Wall Motors has initiated the research and development of lemon hybrid DHT technology and is one of China’s earliest automotive companies to begin relevant hybrid technology research.

In December 2020, Great Wall Motors officially announced its lemon hybrid DHT, which is a core technology route in Great Wall’s hybrid technology line. It has been put into production on models such as the WEY Mocha, ORA Mecado, ORA Latte, Haval H6s, and Tank 800 since 2021.

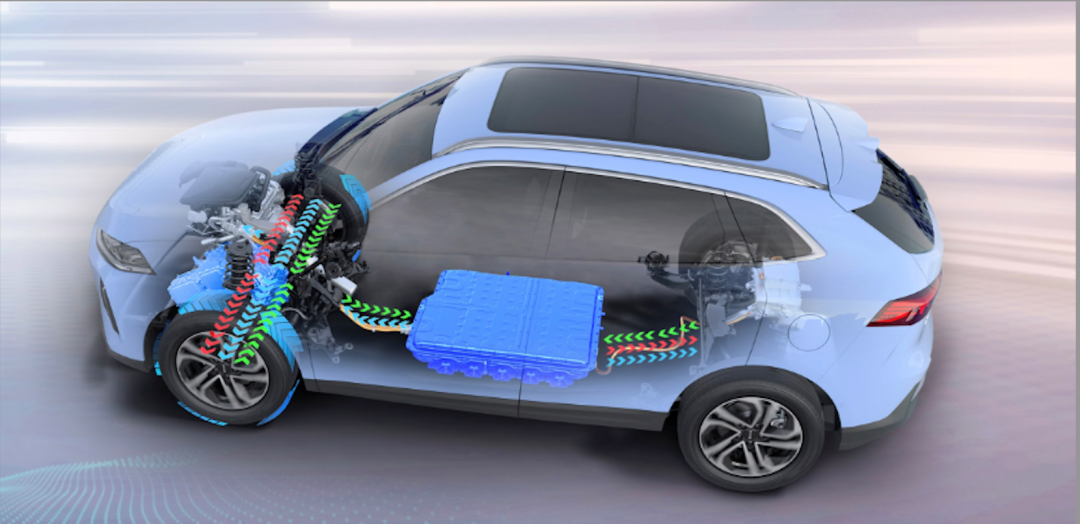

The core value of this hybrid system lies in its coverage of almost all driving scenarios in urban roads, including low-speed driving, long-time parking, and high-speed/city ring road driving. It can bring users lower fuel consumption, stronger power, and more comfortable travel experience.

Its technological foresight and advancement are also reflected in “1-2-3”, namely one hybrid system, two powertrain architectures, and three powertrain assemblies. Among them, the one hybrid system refers to “Lemon Hybrid DHT” adopting a dual motor hybrid topology, which has multiple working modes such as pure electric, hybrid, series, and energy recovery. Through intelligent control system switching, it can achieve a perfect balance of high efficiency and high performance in full-speed domain and all scenarios. The two powertrain architectures are HEV/PHEV which are derived from this basis to meet different consumer demands.

For a long time, Toyota’s THS and Honda’s i-MMD have been the two representative technologies in the hybrid field, but they have different characteristics. However, “Lemon Hybrid DHT” of Great Wall Motors can be said to have drawn on the strengths of all and achieved further optimization in technological content.

At the end of 2021, Great Wall Motors released an upgraded Lemon Hybrid DHT long-endurance PHEV architecture. The 45 kWh high-capacity battery that has been applied allows the maximum pure electric endurance to reach 204 kilometers, creating a record for PHEV models in the industry.

Thus, even PHEV models only need to be charged once a week to meet daily commuting needs. In the future, the 58.96 kWh ultra-large-capacity battery pack will also be put into production and application successively, and the models equipped with it will continue to grow based on the current 204 km electric endurance. They will be able to handle 99.5% of daily use scenarios, helping consumers easily get rid of the anxiety of electric driving.

# Domestic Hybrid Car Market

# Domestic Hybrid Car Market

Hybrid cars in the domestic market have been dominated by joint venture brands, while independent car companies have sporadically introduced hybrid models. However, most so-called independent hybrid technologies are simply upgrades and modifications of their existing engines, which are seen as supplementary measures to fully embrace electrification.

The Great Wall Motors’ Lemon Hybrid DHT is different. It is completely independently designed and developed by Great Wall Motors, with full intellectual property rights, and has accumulated 199 patents, including 80 core patents.

Electrification: Steady Efforts

In the field of pure electric vehicles, Great Wall Motors’ layout has covered the entire industry chain, not only in the production of electric vehicles, but also in deep engagement in the upstream and downstream of the entire electrification process.

In the upstream raw materials sector of the new energy vehicle power battery, as early as 2017, Great Wall Motors invested RMB 146 million to participate in Australian lithium mines to ensure the supply chain stability of its own electrification transformation.

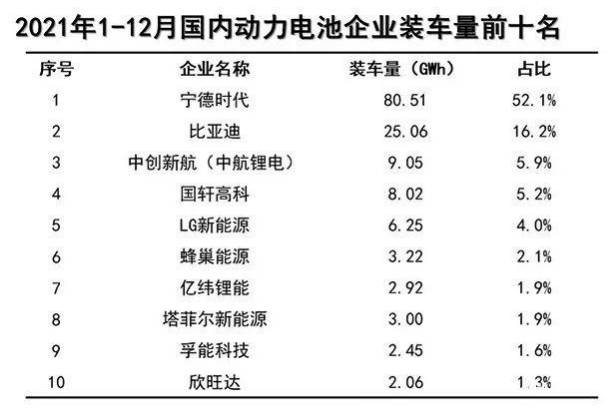

In the middle of the industry chain, Great Wall Motors’ subsidiary, Honeycomb Energy, has become an important domestic battery supplier. In 2021, Honeycomb Energy ranked among the top ten domestic power battery companies in terms of installed capacity.

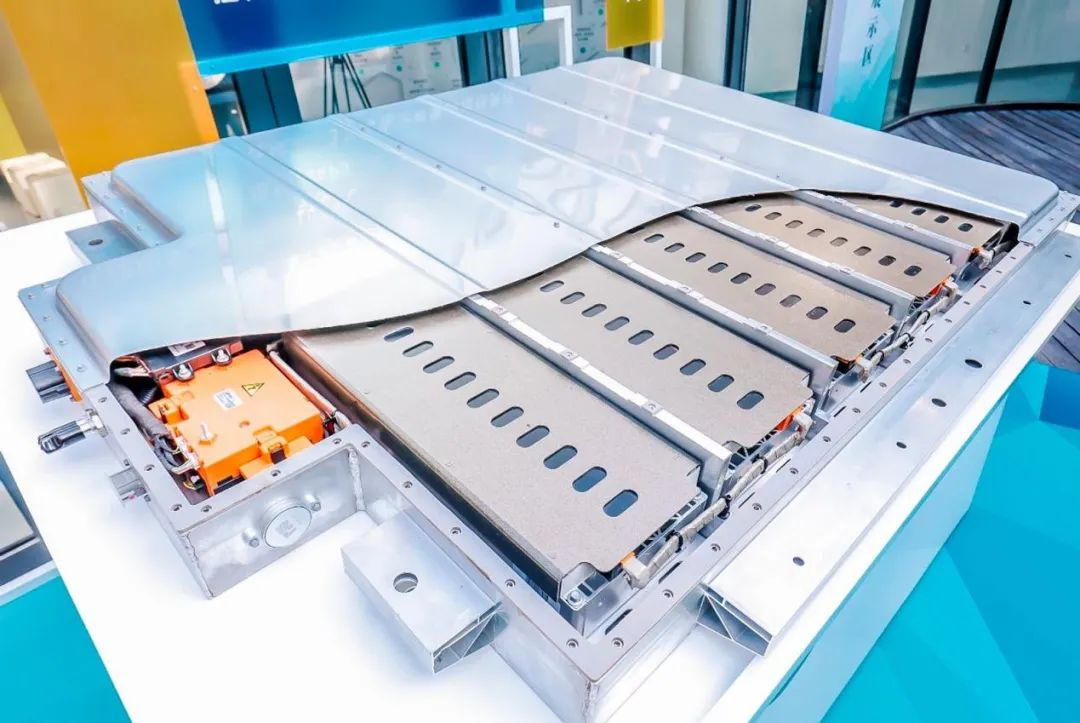

While battery installation continues to grow, Honeycomb Energy has also independently developed advanced technologies such as cobalt-free stacked cell batteries, L-shaped long cell batteries, and LCTP non-module technology.

“Participating in lithium mines and laying out battery production from the perspective of supply chain control provides a guarantee for Great Wall Motors’ electrification transformation,” said a company representative.

“Facing consumers, Great Wall Motors is still centered on users and adopts technological research and innovation to address the most concerning issues for electric vehicle users.” In the field of battery safety, Great Wall Motors has come up with a novel solution – the Dayu Battery Technology.

Dayu Battery Technology employs eight new technologies, such as thermal barrier and directional explosive exclusion, to “reduce congestion” during the research and development process. In the case of thermal runaway triggered by one or more cells at any position in the battery pack, it can achieve non-fire and non-explosion solutions, solving the safety problem of NCM811 high-nickel cells that has troubled the industry.

“This technology was first used in Great Wall Motors’ Saloon brand under the Mech-Dragon, marking the leap from technology to practical application of Dayu Battery Technology,” the company representative added. In 2022, Dayu Battery Technology will be fully applied to Great Wall Motors’ new energy vehicle series, and will look to the next generation of all-new electric vehicle platforms.

Aside from battery technology, Great Wall Motors has also been continuously innovating in the field of electric drive. Currently, it has a series of products ranging from 35kW to 220kW, covering A00-D level vehicles. Its latest 220kW high-power T-shaped electric axle boasts a peak efficiency of 95% and a power density of 2.4 kW/kg, reaching an outstanding level in the industry.

Seizing the Hydrogen Energy Opportunity: Layout for the Future

For a long time, people have envisioned hydrogen as the ultimate environmentally friendly energy source for automobiles – generating electricity through hydrogen-oxygen chemical reactions, and emitting only pure water, achieving absolute zero emissions. However, due to the difficulty and high cost of hydrogen energy technology development, only a few multinational automobile giants such as Toyota have engaged in research and development in this field.

In 2021, Great Wall Motors held a global hydrogen energy strategy conference to showcase its years of technical achievements and strategic direction in the hydrogen energy field. It turns out that Great Wall Motors has long been focused on the future, and has already made significant strides in the hydrogen energy arena.

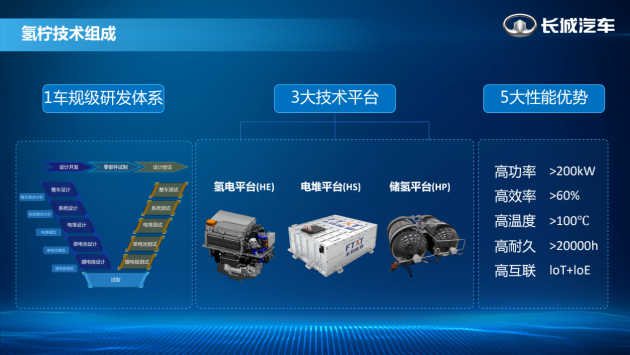

As early as 2016, Great Wall Motors established the XEV project team to focus on hydrogen energy development. Today, Great Wall Motors has built an internationally advanced integrated supply chain ecosystem for “hydrogen production, storage, transportation, refueling, and application,” and launched the first vehicle regulation-level “hydrogen power system” comprehensive solution – Hydrogen Nemo technology.

This technology has achieved completely independent self-sufficiency in six core technologies and products with intellectual property rights, including “fuel cell stack and core components, fuel cell engine and components, four types of hydrogen storage cylinders, high-pressure hydrogen valves, hydrogen safety evaluations, and liquid hydrogen processes,” with a 100% localization rate for core components.

In the second half of 2021, Great Wall’s hydrogen energy products have landed and intensified:

The first batch of 100 49-ton hydrogen fuel heavy trucks developed in-house by Great Wall Motors have already been put into operation. The brand new high-performance membrane electrode has entered mass production, while the latest technologies such as the “Transcend—Shenzhou 200” high-power fuel cell engine, hydrogen fuel cell detection technology “NODS Cloud Doctor,” “Yanzhu” 70MPa multifunctional integrated pressure reducing valve, and other cutting-edge technologies have been launched one after another.

As the world’s largest hydrogen producer, China has a solid foundation for the development of the hydrogen energy industry thanks to its abundant resources. At the policy level, the government has provided clear support for hydrogen-powered vehicles.

As the world’s largest hydrogen producer, China has a solid foundation for the development of the hydrogen energy industry thanks to its abundant resources. At the policy level, the government has provided clear support for hydrogen-powered vehicles.

Against this background, it is predicted that hydrogen fuel cell costs will rapidly decrease. In the new era of hydrogen energy, Great Wall Motors has taken the lead.

Closing Remarks

Cobalt-free battery, Dayu battery technology, Lemon hybrid DHT, Hydrogen Lemon technology…

In 2021, Great Wall Motors has made significant breakthroughs in electric, hybrid, and hydrogen power, including the Dayu battery technology that has been installed in the first model of the Salon, the Lemon hybrid DHT technology that has been applied to the Wei brand Mocha, Macchiato, and Latte and other series of vehicles. Hydrogen products have also begun trial operations.

In 2021, supported by category innovation and technological breakthroughs, Great Wall Motors achieved sales of 1.28 million units, reaping rich rewards. With more core technologies breaking through and new products landing, this may just be the beginning.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.