From Industry to Capital level

On the night of the 18th, rumors surfaced that ByteDance was laying off or transferring employees in its strategic investment department, and dissolving its financial investment department. Some believe this is related to some departments needing to pre-approve the investment and financing of some large-scale internet companies. However, the official denied the news the next day.

Nevertheless, it is indisputable that the Internet industry is facing contraction, and the tycoons no longer wildly expand horizontally. Just as BAT is descending from its throne, the acceleration of the manufacturing industry’s return is just beginning.

On January 21st, according to news reported by 36Kr, Geely’s mobile phone company, Star Era, was in contact with Meizu for acquisition. Geely did not comment on the market rumors and said that the high-end mobile phone R&D business of Star Era is being developed orderly, and hopes to build an open and integrated ecological partnership. In comparison, Meizu’s response seems to be difficult to hide its excitement: thank you for your concern about Meizu.

Seven years ago, Meizu completed its first strategic financing. At that time, Alibaba was the investor, with a total financing scale of USD 650 million, of which USD 590 million came from Alibaba. Because of this investment, Alibaba was punished by the State Administration for Market Regulation on November 20th last year. Who would have thought that there is now a wild card like Geely preparing to buy everything.

Geely’s acquisition of Meizu is just one concrete example of many manufacturing giants’ investment. At the same time as the new energy is taking off, we see that both upstream and downstream, whether it is Ningde Times, car companies, old forces or new forces in manufacturing, are accelerating growth through investment layout.

Investment not only considers consolidating market position but also considers opening up the upper and lower reaches.

The Prince of Ningde strikes

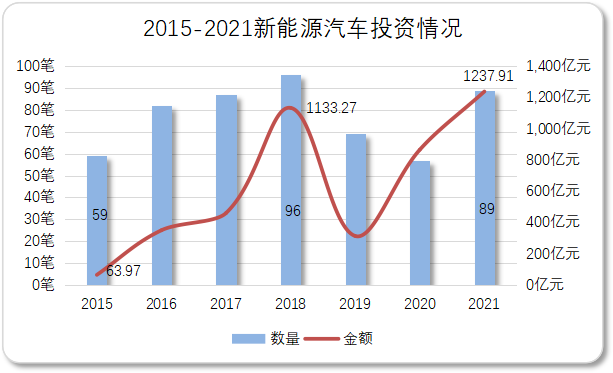

The recently passed 2021 is very likely to be the most active year for investment in the new energy vehicle industry chain.

Data shows that there were a total of 89 financing events for new energy vehicles throughout last year, which is the second-highest since 2018. In terms of the scale of investment, from the situations where the specific amount has been disclosed, the scale of investment and financing has reached a record high in recent years, with a total of at least 123.7 billion yuan or more in 2021.

Among them, there are billion, or even tens of billions of financing events, covering electric power, energy storage, and entire vehicle manufacturing.

For example, Fueled by HEC, a power battery R&D and production manufacturer that is the predecessor of the battery department of Great Wall Motor, completed a B-round financing of RMB 10.28 billion in July. Listed company Sungrow Power Supply completed a 4 billion yuan scale placement in June, planning to invest 2.418 billion yuan of the raised funds into a year of production of 100GW of new energy power generation equipment manufacturing base projects.### In terms of the whole car, with the maturation of We Xiaoli, it has successively landed on the capital market, and the capital has begun to spread to the mid-waist area, such as NETA, LingPao, Byton, AiChi, and even Zeekr, which will be put into production next year.

Among many financings, we have seen the situation of “enterprises are better if they are invested”, which is more typical in the industry, such as Ningde Times.

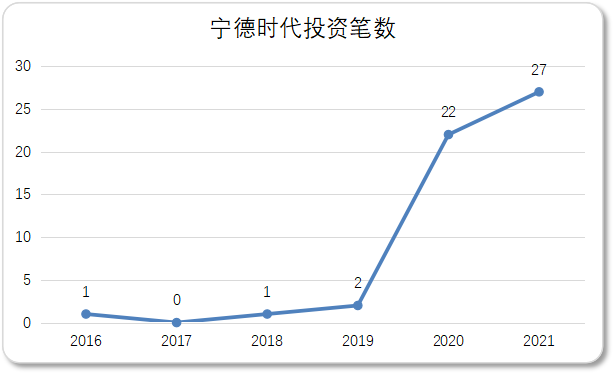

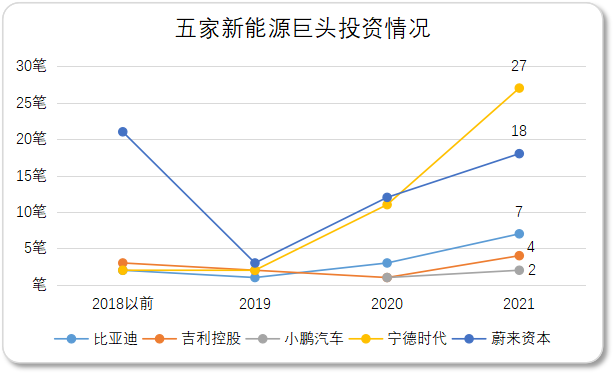

As early as 2016, Ningde Times participated in the investment of Praydel, a lithium iron phosphate battery material developer. Since then, it has made few moves in the past three years. In 2020, with We Xiaoli out of the life and death line, traditional car companies turn to the defensive, competition in the new energy industry has intensified, which has greatly stimulated the demand for lithium batteries. As a result, the investment frequency of Ningde Times suddenly accelerated in the past two years, with a total of 27 transactions last year, reaching a peak.

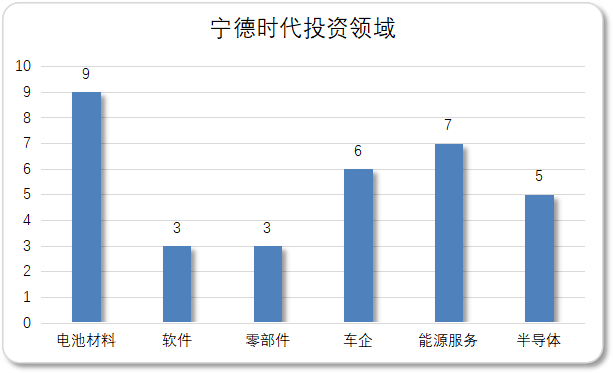

Unlike the “race track” investment of Internet giants, most of the projects invested by Ningde Times are closely related to its own business. It can be summarized as: focusing on batteries, expanding upstream and downstream, and complementing with software, chips, and finance.

In the past six years, Ningde Times has invested in at least 9 companies related to battery materials, including raw material suppliers such as lithium batteries and iron phosphate mines, as well as manufacturers of positive electrode materials, electrolytes, lithium iron phosphate batteries, and so on. It is worth mentioning that among the 9 targets, except for the early-stage Praydel and Yuben New Energy, the other 7 are exclusively invested by Ningde Times.

Upstream layout is obviously to ensure the supply chain. In recent years, Ningde Times has also extended downstream along the industrial chain, with one of the focuses being energy services, especially battery swapping operation and service providers.

On January 18th, Shidai Electric Service, a wholly-owned subsidiary of Ningde Times, announced the battery swapping service brand EVOGO and the overall solution of combination swapping. Perhaps the outside world did not notice that it had already completed investment coverage in the first half of last year. On the one hand, it has formed multiple providers of battery swapping service by investing in Upplus New Material, Blue Valley Zhihui New Energy, and Yun Quick Charging, and on the other hand, it acquired the power system planning enterprise Shidai Yongfu.

In the current domestic battery swapping market, NIO (some battery main bodies belong to Wuhan Lishen) occupies an absolute advantage in private cars, Bartun Technology and BAIC Blue Valley are mainly oriented towards operating vehicles, and Aodong New Energy has both. Among the above-mentioned companies, the figure of Ningde Times can be seen in Wuhan Lishen and Blue Valley Wisdom New Energy (the main body of BAIC Blue Valley’s battery swapping operation).

In addition to energy services, Ningde Times is also constantly adding chips to car companies, trying to open up a second front.We can see that the new carmakers are increasingly unwilling to see a behemoth emerging in the upstream – CATL. In order to ensure the security of the supply chain and not to be restricted by others, some top car companies are trying to introduce new suppliers. For example, XPeng has included CATL in its supplier system, which clearly means to balance against CATL.

CATL naturally will not sit idly by. Two essential factors for new car production are “electricity” and “money”. Therefore, when many medium-to-large car companies raise funds, we can also see the waving of checks by CATL.

In addition to participating in the $500 million B round financing of Byton Motors with FAW in 2018, from May to November last year, Ai Chi, Ji Ke, AVETA, NETA, and two-wheel vehicle manufacturers Su Ke Zhineng have successively completed a new round of financing, and CATL participated in all of them, especially the D+ round of financing for NETA Automobile, in which CATL was the only investor with an undisclosed amount.

Not just CATL, BYD has also made frequent moves in recent years, such as strategic investments in Ruicheng Core Micro and Suteng Juchuang in December. The former is a semiconductor foundry and packaging enterprise, while the latter is a provider of laser radar environmental perception and solution.

CATL and BYD’s entry into the capital market is just one concrete manifestation of the entire new energy trend. Some car companies have also come to the investment market with their own goals.

Photon Planet has sorted out energy storage giant CATL, two domestic brand car companies (BYD and Geely), and two new forces (NIO and XPeng). In terms of quantity, they all show the same trend.

Due to the industry’s decline, investment and financing activities were sluggish in 2019. In the past two years, due to the growth of electric vehicle penetration, the activity of relevant companies in investment and financing has been flourishing. Energy storage demand has spawned CATL and BYD. Next, the “four modernizations” competition may trigger a capital war among car companies.

Capital Wars Between New and Old Forces

In fact, the investment and financing game does not only exist in the supply chain. In the process of the two-strong competition in batteries, the old and new forces of car manufacturing are also competing behind the scenes.

Firstly, let’s look at the new forces. As the darling on the cusp, the actions of new car-makers are all being watched by countless media, so whenever there is news about investment and financing, related reports and analyses will flood in.

Taking NIO Capital, which has made frequent moves in recent years, as an example, although one can clearly see that its investment direction focuses on the smart electric vehicle industry, there are occasionally external companies mixed in.

In February 2020, NIO Capital participated in the B+ round financing of MokaDocs, and there were rumors in the industry that NIO intended to build a vehicle-mounted office scene. However, NIO Capital is not equal to NIO Automobile, and the relationship between the two may be more akin to that between Xiaomi and Shunwei Capital.## Translation

NIO founder Li Bin once told Photon Planet: “The investment logic of NIO Capital mostly focuses on the business model and prospects of the enterprise, regarding the enterprise’s products as extra points rather than necessary options.”

Despite NIO Capital’s frequent investments, its investment logic is not completely coupled with NIO’s car-making business, and there is still some room for both to operate independently. However, it is undeniable that NIO Capital has cast a wide net in recent years and has caught several big fish.

From 2018 to 2021, NIO Capital has invested in Innovusion Tudatong, a laser radar manufacturer, several times. The latter has lived up to expectations and delivered the world’s first mass-produced high-performance laser radar for cars – the Falcon laser radar, becoming a standard configuration for NIO’s ET7 in the first quarter of this year.

Unlike NIO, another member of China’s new automakers, XPeng Motors (XPeng), has not invested in many projects, but every investment has its significance.

Looking at XPeng’s recent investment and financing targets: Foday Automotive is a vehicle manufacturer; Xpeng Huitian specializes in low-altitude, manned-flight solutions; Aijian Technology provides laser radar solutions; Qianhang Technology focuses on unmanned, cargo-hauling scenarios.

Obviously, XPeng’s precise industrial chain layout behind its investment logic is very clear: the acquisition of vehicle manufacturers helps solve the shackles of hardware manufacturing; entering the field of autonomous driving simultaneously with technology and scene layout; dabbling in the field of low-altitude, manned-flight with high-tech endorsement and early layout of the next future.

Therefore, whether it is NIO or XPeng, their investment and financing layouts seem to imply the current technological anxiety of China’s new automakers.

In the past, the competition in the new energy race was far less intense than it is today, and new entrants with little experience in car-making were more inclined to seek partners to solve technical problems.

However, with the vigorous development of the new energy market, car-making has become a desirable business, and a large number of internet and technology companies have come in, even former partners have gradually revealed their own plans.

Taking the power battery sector with an unbalanced supply and demand as an example, Ningde Times relies on its production capacity advantage to have an absolute voice in cooperation. Car companies had to let Ningde Times bind the demand to share the risks for the sake of supply.

For core components, the same is true for core technologies. WM Motor once lost the possibility of developing autonomous driving on its own in exchange for Baidu’s Apollo autonomous driving technology, but Baidu quickly turned around and cooperated with Geely to establish Jidu, leaving WM Motor in an awkward situation.

Based on this, when new players are no longer short of funds, they will naturally invest more in technology, as no one wants to keep knocking on doors for batteries or drinking and talking about chips.

In fact, not only the new automakers are caught up in a technological race. Long-standing car companies eyeing the new energy market are also accelerating their investments.

Although veteran car companies have a solid supply chain, new energy vehicles are not oil cars, and past technologies and resources may not be reusable. On the contrary, once the technology path is lost, they may miss the last opportunity to get on board.Therefore, whether it’s BYD or Geely, the investment logic has gradually shifted in recent years: BYD’s appetite has extended from the vertical industry chain of lithium batteries to the automotive sector, while Geely has consolidated its focus on new energy vehicles from various automotive scenes. Satellites, mobile phones, and other fields are also covered.

Especially in the past two years, the pace of investment and financing of traditional car companies has significantly accelerated, and the investment direction is focusing on their weakest areas in chips and autonomous driving.

Faced with the challenges of the new forces in the automobile industry, traditional car companies also have to participate in the investment competition, which has become an important way for them to make up for their shortcomings.

Conclusion

Against this background, looking back at Geely’s acquisition of Meizu, it seems no surprise that it happened in the current investment and financing frenzy. After all, the news that Geely entered the smartphone market had already spread in September last year.

At that time, few people understood why Geely would invest in the smartphone business. After all, the market demand is already saturated, and the cake has been divided by major brands. What’s more, Geely’s background in manufacturing industry is not a valid reason for entering such a field.

However, if we change our thinking, it is very likely that cross-border manufacturing of smartphones is to prepare for the intelligent networked automobile battlefield. Both are intelligent scenes. If they are ecologically integrated, the process of turning to intelligence will also be accelerated.

In the early years, a group of Internet giants were deeply involved in the ecological war, investing heavily and forging alliances, but eventually ended up with bubble burst and even disintegration.

Nowadays, whether it’s NIO or traditional automakers, frantic investment seems more like a “real battle”. Aiming to frequently strike and move towards reality is not a long dream, but rather thirst for it. After all, the new energy track is under assault from all sides, and for those who sit idly, it may likely become a backdrop in the sunshine.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.