Jia Haonan from Co-driver Temple

Reference for Intelligent Cars | WeChat official account AI4Auto

The so-called “car company” BYD is only the shallowest image it presents to the public.

On January 20, the announcement of the startup committee of the Shenzhen Stock Exchange showed that BYD Semiconductor, one of BYD’s most critical businesses, has started listing.

Referred to as the domestic “leader in power semiconductor” and “the first share of car core”, who is BYD Semiconductor?

What is the role of the semiconductor business within the BYD Group?

Can this car core leader solve bottleneck problem?

Listing Information

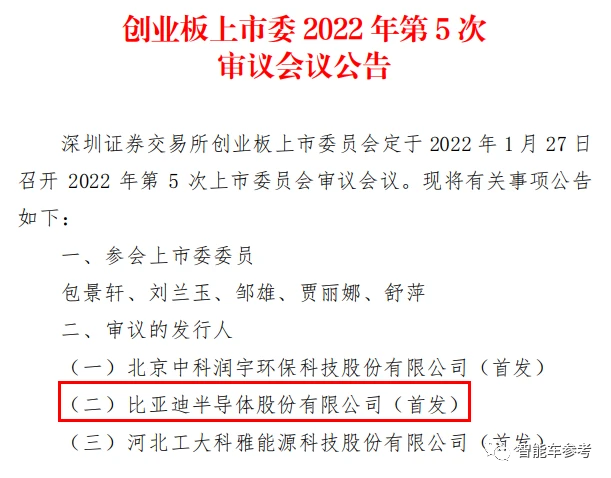

According to the announcement of the fifth deliberation meeting of the Shenzhen Stock Exchange’s startup listing committee in 2022, BYD Semiconductor Co., Ltd. (hereinafter referred to as “BYD Semiconductor”) will be listed on the GEM for the first time on January 27.

“First review” refers to the Securities Issuance Review Committee Discussion that the listed company must go through before new share issuance.

According to the latest prospectus information, the planned fundraising for this IPO is RMB 2.686 billion, including investment in the industrialization and upgrading of new power semiconductor chip projects, and the research and industrialization of power semiconductors and intelligent controller components, as well as supplementing working capital.

In fact, this is a restart of BYD Semiconductor’s listing.

In June 2021, BYD Semiconductor submitted a prospectus to the Shenzhen Stock Exchange. However, the IPO review was suspended because the law firm hired for the issuance was investigated by the China Securities Regulatory Commission.

From the publicly disclosed information, the suspension was most likely due to the law firm’s involvement. Prior to the law firm investigation, BYD Semiconductor’s GEM issuance and listing application had been accepted, and it had received the first round of inquiries within a month, which could be described as speedy.

So, why is BYD Semiconductor valued? What makes this company known as the “leader in power semiconductor” in China?

Where did “leader in power semiconductor” and “the first share of car core” come from?

The prospectus provides an answer.

BYD Semiconductor mainly engages in the research and development, production, and sales of power semiconductors, intelligent control ICs, intelligent sensors, and photoelectric semiconductors.

From the perspective of the industrial chain, BYD Semiconductor has established a full-industry chain IDM model in the field of automotive-grade semiconductor with chip design, wafer manufacturing, module packaging and testing, system and application testing, with automotive-grade semiconductor as the core.

From the perspective of the industrial chain, BYD Semiconductor has established a full-industry chain IDM model in the field of automotive-grade semiconductor with chip design, wafer manufacturing, module packaging and testing, system and application testing, with automotive-grade semiconductor as the core.

In terms of product categories, BYD automotive-grade semiconductors are mainly divided into three categories: SiC (silicon carbide) modules, IGBT modules (insulated gate bipolar transistor), and self-developed hybrid DM control modules with relatively high integration.

In the IGBT field, BYD Semiconductor ranks second worldwide and first among domestic manufacturers in the new energy passenger vehicle motor driver vendor for two consecutive years in 2019 and 2020, with a market share of 19%, second only to Infineon.

This is the source of the so-called “China’s No.1 auto chip.”

In addition, BYD Semiconductor has many self-developed technologies in the design, wafer manufacturing, and wafer testing of automotive-grade IGBT chips.

In the SiC device field, BYD Semiconductor is in a leading position, not only in terms of technological breakthroughs but also in the large-scale application of SiC modules in high-end new energy vehicles.

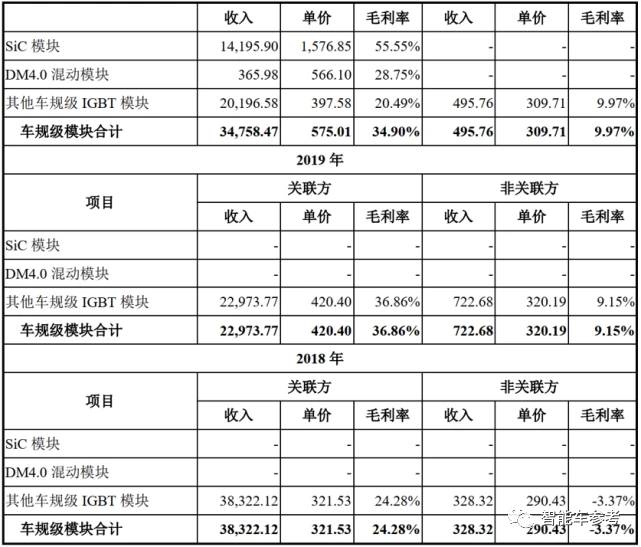

Judging by the financial data disclosed by BYD Semiconductor in recent years, their half-year revenue in 2021 has already exceeded or is close to the annual revenue of previous years.

Considering the revenue details chart above, it is easy to see the reason: the production of SiC modules and DM modules contributed a lot in 2021.

Among them, DM modules have undoubtedly increased with the popularity of BYD hybrid cars, while SiC, the representative of new semiconductor technology, is currently the most explosive business and is highly likely to maintain rapid growth in the future.

After all, at present, only one car model, the Han EV, is equipped with relevant SiC products.

Of course, BYD Semiconductor’s business scope is not limited to automotive-grade semiconductors.

According to the prospectus information, BYD Semiconductor has achieved mass production in the fields of industry, home appliances, new energy, and consumer electronics besides automotive-grade semiconductors.

The above roughly outlines the basic situation and overall view of BYD Semiconductor’s business. From the objective data, it can indeed be regarded as the leader in China’s automotive-grade semiconductors.

Naturally, we also need to ask a crucial question: Can BYD Semiconductor solve the “neck tightening” problem?

Because the shortage of chips costing less than one yuan has led to the suspension of production of cars worth hundreds of thousands of yuan, this is the dilemma of all automakers this year.

Therefore, the core of solving the bottleneck problem lies in having technology and production capacity.

Does BYD Semiconductor meet these requirements?# Technical Aspects

IGBT

According to IHS research report, the domestic market share leader in IGBT is StarPower Semiconductor. Their self-developed FS chip is ahead of BYD’s by 1-2 generations. However, StarPower’s business is mainly focused on the industrial control field, while the vehicle-grade market is still dominated by BYD. Reliability and durability are key factors for vehicle-grade products, so the leading level of the product itself is not a decisive factor.

SiC

On the other hand, SiC is the advantageous field of BYD Semiconductor, with an early start and a relatively complete layout. Due to the semiconductor properties of silicon carbide, the industry barriers are high and the technological challenges are great. BYD Semiconductor started early and had a relatively complete layout. Currently, BYD’s vehicle-grade SiC module voltage covers 400A-950A, and both the technology and commercialization are in a leading position globally.

Production Capacity

From the prospectus, it can be seen that BYD Semiconductor’s main business still relies on its parent company, with BYD Auto being its largest customer. Judging from the delay in the delivery of the popular DM hybrid model this year, BYD Semiconductor is only barely meeting its own needs. Therefore, it is too early to talk about solving bottleneck problems.

Moreover, from the information publicly available, BYD Semiconductor’s chip production business is currently focused on wafer production, and its dependence on external foundries has increased in the past two years.

However, BYD Semiconductor has announced the construction of a new wafer fab, and its self-owned SiC production line (Ningbo Semiconductor) is under construction. It is expected to achieve a monthly output of 10,000 SiC wafers in 3 years, and 20,000 SiC wafers in 5 years.

The incremental space for vehicle-grade chips in the future is very broad, with over 20 million new cars sold in China every year. For BYD Semiconductor, accelerating the construction of wafer fabs is the company’s strategy focus, after all, only by first meeting the needs of the company can we talk about competing for the autonomy of the industry chain.

As for valuation, BYD Semiconductor’s A-round financing in the primary market has already reached nearly 10 billion yuan. Let’s see what kind of actions it can take.

— The End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.