Introduction

In the short term, the role of hybrid vehicles in transitioning from fuel vehicles to pure electric vehicles will not change. Hybrid and fuel vehicles will eventually exit the stage of history when solid-state or other high-capacity batteries eliminate range anxiety.

On January 11, 2021, BYD released its own super hybrid technology. During the unveiling, Wang Chuanfu made the bold statement that “the DM-i is a disruptor of fuel vehicles.” After a year of market testing, did BYD’s DM-i disrupt the market for fuel vehicles?

With the release of BYD’s December 2021 sales report, the total sales of BYD new energy passenger cars in 2021 have been determined. The data shows that BYD’s pure electric vehicle models have sold more than 320,000 vehicles, and plug-in hybrid models have sold more than 272,000 vehicles.

This shows that the sales of BYD’s plug-in hybrid and pure electric vehicle models are now similar. Furthermore, star vehicle models such as the BYD Han DM, Tang DM-i, Qin PLUS DM-i, Song PLUS DM-i, Song Pro DM-i, and Dolphin have continued to see an increase in sales, long-term leading the new energy monthly sales charts.

At the same time, Ideal ONE, which started with range-extended technology and has a single model and configuration, sold more than 90,000 vehicles in 2021, strongly entering the top 10 of new energy vehicle sales.

In the past two years, major domestic automakers have released their own hybrid technologies in the hope of grabbing a slice of the hybrid vehicle market. With the trend towards pure electric vehicles in new energy, how much time is left for hybrid vehicles to transition?

Domestic Hybrid Technology is Booming

Since BYD launched its super hybrid DM-i technology in 2021, domestic carmakers have all come up with their own hybrid technologies, which have emerged like bamboo shoots after a spring rain.

For example, Changan’s Blue Whale iDD Hybrid, Great Wall Motor’s Lemon Hybrid DHT, Chery’s Kunpeng Hybrid DHT, Geely’s Devotion Hybrid Hi・X, and GAC directly lay flat and, relying on their good cooperation with Toyota, pursue utilitarianism, launching “Green Engine Technology,” which is China’s first powertrain to perfectly integrate Toyota’s fourth-generation THS system with its own independently developed 2.0TM engine. In short, they directly borrowed Toyota’s latest fourth-generation THS hybrid technology.

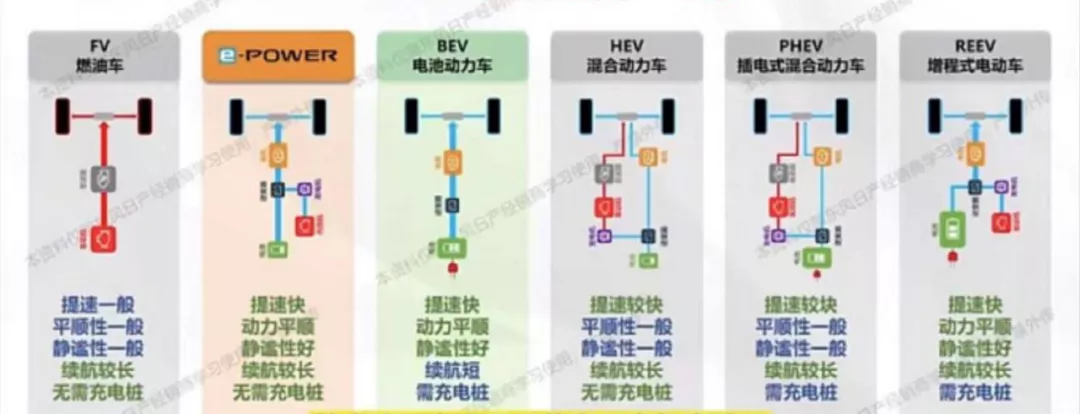

SAIC seems to prefer the 48V light hybrid PHEV technology of European and American automakers, while BAIC is more fond of pure electric on the road.Add to that the Toyota Hybrid System (THS) which has long been available in China, Honda’s Intelligent Multi-Mode Drive (i-MMD), and the Nissan e-Power which arrived late to the game in the end of 2021. It can be said that 2021 was a year of great development and competition for hybrid technology in China, with the popular extended range hybrid of Li Xiang ONE and the newly rising star, Lynk & Co ZERO, among the contenders.

What exactly led to the breakthroughs and progress in domestic hybrid technology over the past two years, and why has there been such a surge of new hybrid technology releases from various manufacturers? This relates to the opening of hybrid technology patents.

Toyota is undoubtedly one of the strongest global manufacturers of hybrid technology, but a solitary tree does not make a forest, and market growth cannot be achieved through a dominant player alone. The Japanese brands – Toyota, Honda, and Nissan – still promote hybrid and electric hybrid drives today, while other manufacturers such as German, American, and Korean brands have not taken much interest in developing hybrid technology. These manufacturers have not been able to circumvent the patent barriers of Japanese automakers in hybrid technology, and have instead developed their own fuel-efficient plans, such as the 48V mild hybrid system.

In September 2020 during a media communication meeting held by Volkswagen China, Dr. Stephan Wöllenstein, CEO of Volkswagen Group China, said: “From a single vehicle perspective, plug-in hybrids have a certain value, but from the perspective of the whole country and the planet, they are the worst solution.”

Although he did not name-drop, it was clear that Volkswagen’s statement had offended Li Xiang, the founder of Li Xiang ONE. Li Xiang subsequently fired back on Weibo, saying that he was willing to battle the Audi Q7 e-tron with Li Xiang ONE to see who was genuinely more energy-efficient and eco-friendly. Later on, Li Xiang responded strongly with sales performance of Li Xiang ONE, which helped to restore the face of extended range electrics.

The major Japanese automakers have been slow to get into the pure electric vehicle market, partly because they have not seen breakthroughs in battery technology, and even consider pure electric vehicles to be inconsistent with the more environmentally-friendly ideal. On the other hand, Toyota and other automakers had hoped that hybrid would become a global automotive trend, and other manufacturers would pay to use Toyota’s hybrid patent technology. However, they have been disappointed to find that other automakers have no interest in Toyota’s hybrid technology, and even Japanese brands like Honda and Nissan have opened up their own patent routes, such as Honda’s iMMD and Nissan’s e-power.On April 3, 2019, Toyota Motor Corporation announced during a press conference at its headquarters in Nagoya that, as part of its measures to promote electric vehicles, it will provide free-of-charge licenses for Toyota’s electric vehicle technology patents, including those related to motors, power control units (PCUs), and system control (including pending applications). In addition, Toyota will also provide technical assistance to companies using Toyota’s power transmission system to advance the development and manufacture of electric vehicles.

This free-of-charge license offer covers about 23,740 patents related to electric vehicle technology, including Toyota’s renowned THS hybrid system. Toyota intends to attract other companies to join the hybrid vehicle industry using this initiative.

This may be one reason why China’s mainstream automakers have made significant progress in hybrid technology in recent years. However, it is also said that the sudden rise of hybrid technology in China is due to the “bootlegged” Honda IMMD two-motor hybrid technology. Of course, they will not admit to self-made fake products. Nevertheless, whether it is a two-motor hybrid or an extended-range electric vehicle led by Ideal, the market has been “mixed” up.

How much longer will hybrid technology dominate?

In 2021, hybrids are the rage.

In addition to the BYD DM-i, whose orders need to be booked 3-4 months in advance, sales of more than 90,000 units of the Ideal ONE have also skyrocketed. The LanTu free model has also made gains in the extended-range electric vehicle market with a strong launch in the second half of the year, with sales surging to 3,138 units in December and 6,444 units sold throughout the year. The recently released Huawei WM Motors’ M5 and Leapmotor’s Leapmotor T03 both plan to enter the extended-range electric vehicle market, achieving pure electric and extended-range electric dual strategies.

The entry of more automakers indicates that they still believe that the potential for this market segment exists in the short term. Whether it is a plug-in hybrid or an extended-range electric vehicle, it can allay many consumers’ anxiety about traveling long distances in a shift from fossil fuel-powered vehicles to electric vehicles. The emergence of hybrid technology is not only to meet global and national environmental requirements, but also to satisfy consumer’s desire for fuel efficiency. At the same time, China has introduced a series of support measures to promote hybrid technology development.

For example, in Guangzhou, where license plates are limited, nearly a thousand energy-saving license plates are issued separately for non-plug-in hybrids each month, which is good news for local Japanese and local joint venture brands such as Toyota and Honda to put the blue plates on their vehicles. The latest national regulations require all hybrid vehicles sold after October 1, 2021, to meet the basic requirement of a pure electric range of no less than 43km in order to be eligible for new energy license plates. The original standard was 50km. The new lower standard is beneficial to citizens in major limited plate cities, putting green plates on their vehicles.### Plan for Energy-saving and New Energy Vehicle Technology Roadmap 2.0 Released at the End of 2020

According to the plan for Energy-saving and New Energy Vehicle Technology Roadmap 2.0 released at the end of 2020, by 2025, the proportion of new energy vehicle sales will reach 20% (BEV 18% + PHEV 2%), and the proportion of hybrid vehicle sales to traditional vehicle sales will reach 50% (HEV + MHEV total 50%).

Based on the sales data of 20.35 million vehicles in 2020, the expected sales volume of automobiles in 2025 will be 25 million, of which the sales volume of hybrid vehicles (HEV + MHEV + PHEV) will be 10.5 million. Under this vision, the market share of hybrid vehicles becomes more obvious, and the pace of replacing fuel vehicles with hybrid models will accelerate. Therefore, before 2025, the policy support will still drive the sales increase of hybrid models. Due to the uncertain development of battery technology in the future 5-10 years, the hybrid technology still has a place in the market.

In the short term, the role of hybrid vehicles as a transitional solution from fuel vehicles to pure electric vehicles will not change. With the advent of solid-state batteries or other high-capacity batteries, the day when there is no longer range anxiety will come, which leads to the exit of hybrid and fuel cars from the historical stage.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.