After reviewing the materials from Stellantis Software Day, I have the feeling that the global automotive industry has confirmed that software capabilities will be the key to competition and brand differentiation in the automotive industry for the next ten years. Therefore, Stellantis announced an ambitious plan to increase its software platform and professional capabilities to follow in the footsteps of Tesla’s successful software platform, the Gold Box. See Figure 1 for Stellantis Software Day introduction material.

I think it is necessary to break down and discuss the details together with everyone.

Note: Starting from 2022, automotive companies that only talk about EE architecture without mentioning software will be considered low. See Figure 2 for an overview of Stellantis’ software progress.

Stellantis Software Strategy

Stellantis realized at the end of last year that the development of electric vehicles is essentially a strategic transformation, and consumers need all brands and models of Stellantis that can keep up with the development of the times and move towards a software-defined platform.

Stellantis has 14 automotive brands, including Chrysler, Dodge, JEEP, and Ram in the United States and Citroen, Fiat, Opel, and Peugeot in Europe.

For a complete vehicle enterprise, the core issue of software is how to sell cars in the next era, which is a core issue directly related to revenue. Stellantis’ strategic goal is to manage the software needs of 14 different brands, cross different price ranges and segmented markets, and meet the needs of different consumers from passenger cars to commercial vehicles.

Once the software platform transformation is completed, it can reduce many costs and increase more revenue (the competitiveness of selling cars and potential subscription services). Of course, the biggest risk for automotive companies to develop software is the huge development costs in the next five years and whether they can do it. See Table 1 for Stellantis’ software strategy.From the perspective of multi-brand enterprises, 80% of software platforms can be shared in the future, while 20% need to be individually developed for segmented brands (and are related to the UI of consumer groups), so the core issue is to decouple software and hardware platforms. The biggest advantage of doing this in the new era is that different chips can be replaced at any time when problems arise in the chip supply chain.

In terms of revenue estimation, Stellantis has made a decomposition, which is currently the boldest estimate of the automotive software market we can see: it will exceed 20 billion euros by 2030.

In 2021, the actual revenue was 400 million euros – the software business has 400,000 subscription users, and the base that can currently generate revenue is 12 million vehicles (with an average income of only 33 euros). At least the current connected cars cannot make money.

However, by 2030, the number of profitable vehicles will increase to 34 million, and the expected incremental software revenue in 2030 will reach about 20 billion euros (with an average income of 588 euros per vehicle), or nearly 17 times higher than the current total.

The growth is expected to come from the increase in services, the expansion of OTA, and other factors. From a business perspective, it mainly includes:

- Software services and subscriptions: traditional remote information services, and many other connected services are emerging.

- Feature On-Demand: software functions generated based on user needs, such as audio, Wi-Fi, and streaming music, Amazon’s Fire TV. Revenue-sharing agreements between car companies and entertainment companies will also become more and more popular.

- DaaS (Data as a Service) and Fleet Services: UBI (Usage-Based Insurance) deployed in 2022 can create revenue from data services using Otonomo. There is considerable potential in the European commercial vehicle fleet, including a large business in the North American commercial vehicle fleet field.

- Vehicle pricing and resale value.This is an indirect effect that car owners will find updated features such as OTA, ADAS, infotainment and connectivity will increase the resale value of their used cars, which is also a factor in generating software revenue.

●Usage, retention rate and cross-selling:

This is another indirect factor, with convenience and cost savings being basic elements, and there is a growth of more than 10% in terms of service retention rate.

Software Technology Platform

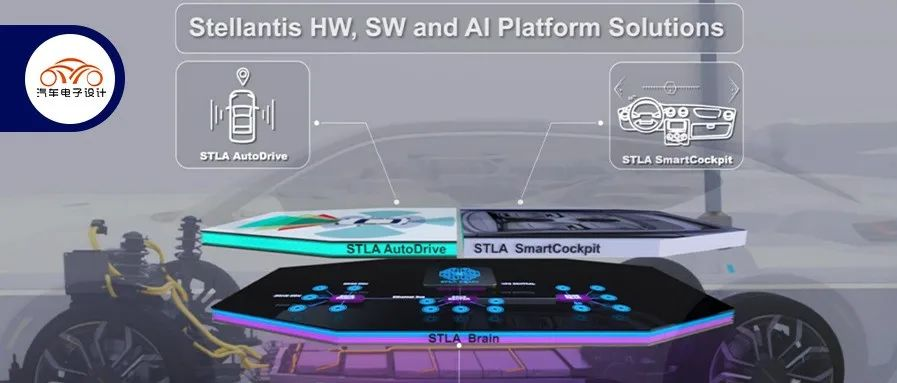

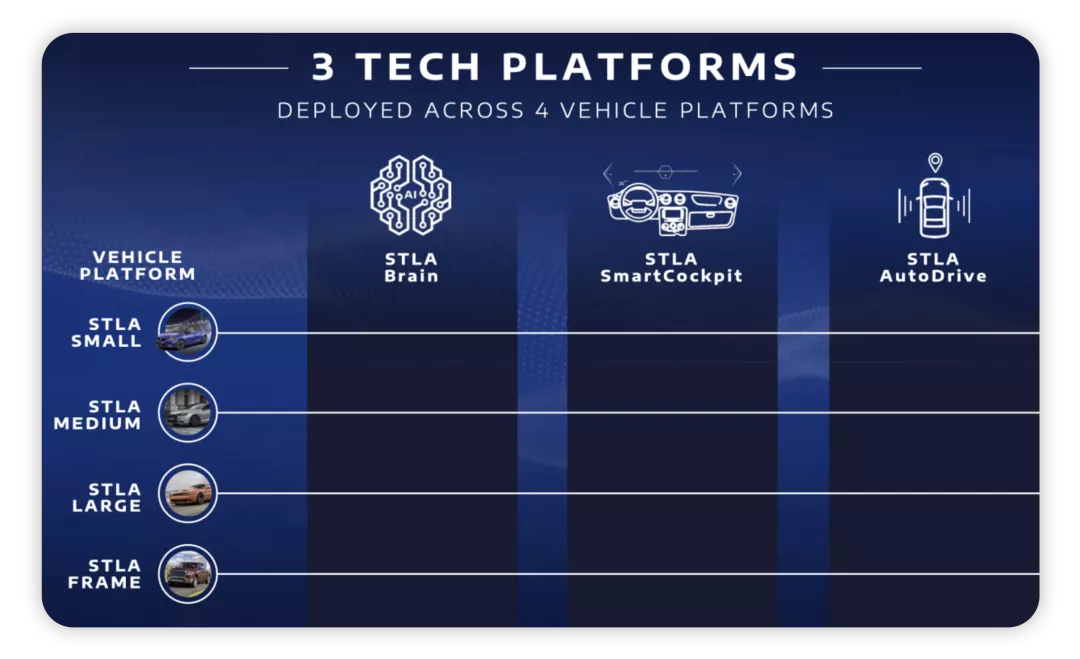

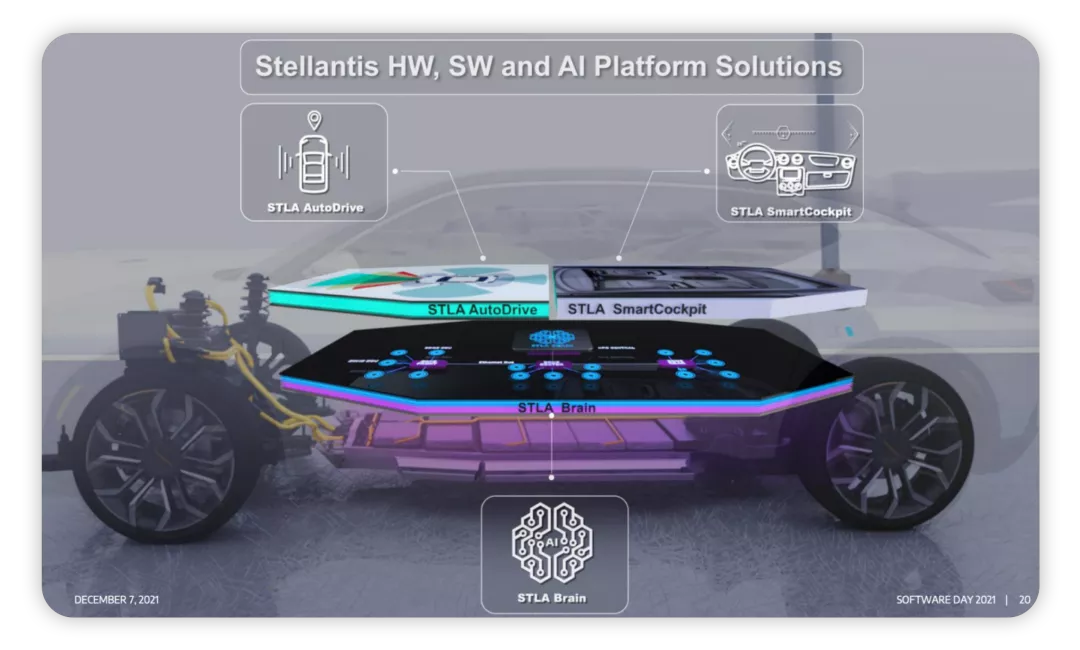

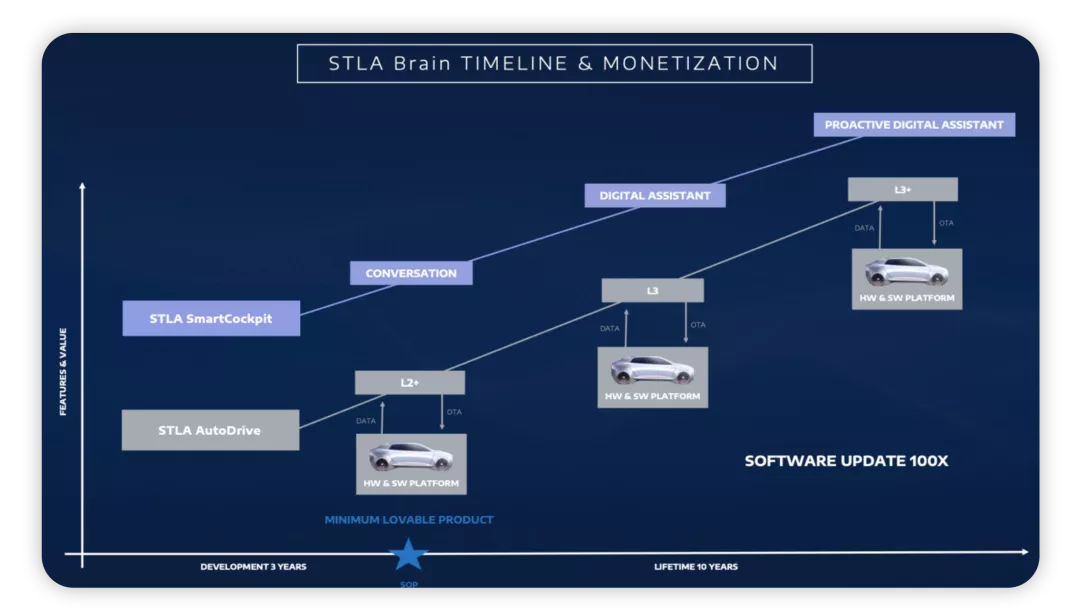

As of now, Stellantis is developing three technology platforms, which is somewhat similar to the three-domain architecture that has been mentioned, but it is not just about domain-related issues, but instead about the soul problem surrounding the STLA Brain. With so many vehicles under planning on the four electric platforms of Stellantis, it is just a pipe dream without software and iteration as support.

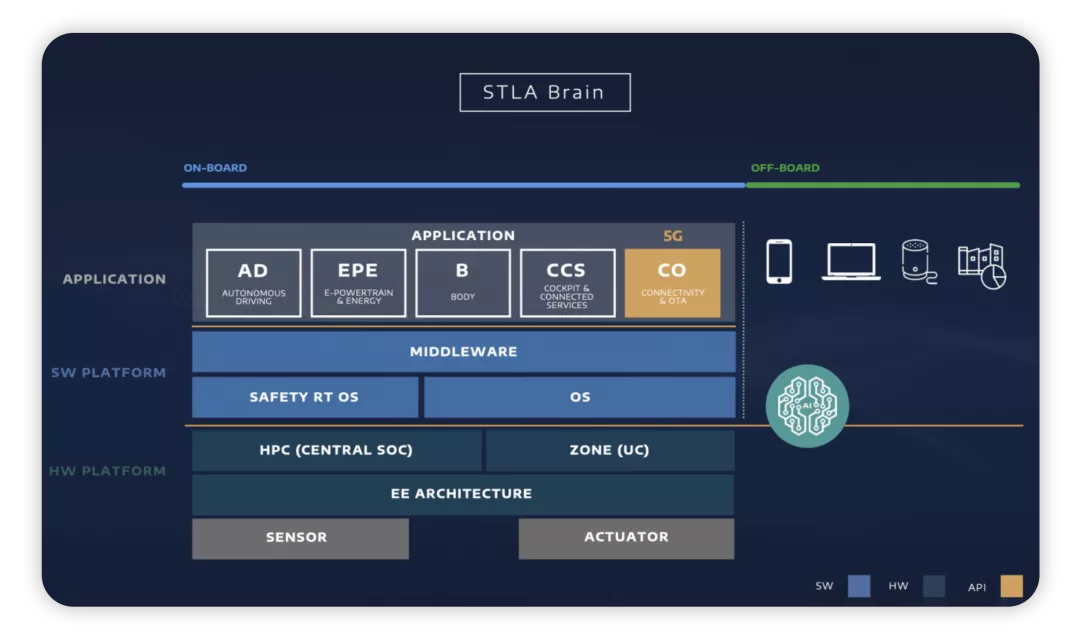

Stellantis mainly develops the on-board computing platform, which is a layered software and hardware framework, including cloud and mobile device-based connections, and the overall core covers the on-board computer HPC and zonal controllers.

The STLA Brain platform uses the SOA architecture to combine the entire network architecture into the core of what they are doing. From a logical standpoint, this time point is probably around 2024-2025, which is actually very soon!

# STLA SmartCockpit

# STLA SmartCockpit

STLA SmartCockpit provides entertainment and navigation, as well as voice assistant, e-commerce, and payment services. In May 2021, a joint venture named Mobile Drive was established with Foxconn to develop platforms (a non-binding memorandum of understanding was signed to establish a partnership). SmartCockpit aims to transform cars into personalized living spaces by interacting with the vehicle using a combination of sensors such as touch, voice, sight, and gesture. Additionally, the two companies will design a series of semiconductor products covering 80% of Stellantis’ semiconductor needs, and upgrade its current design and production technology. The new chips will reduce complexity, simplify the supply chain, and increase the flexibility and innovation speed of the hardware platform.

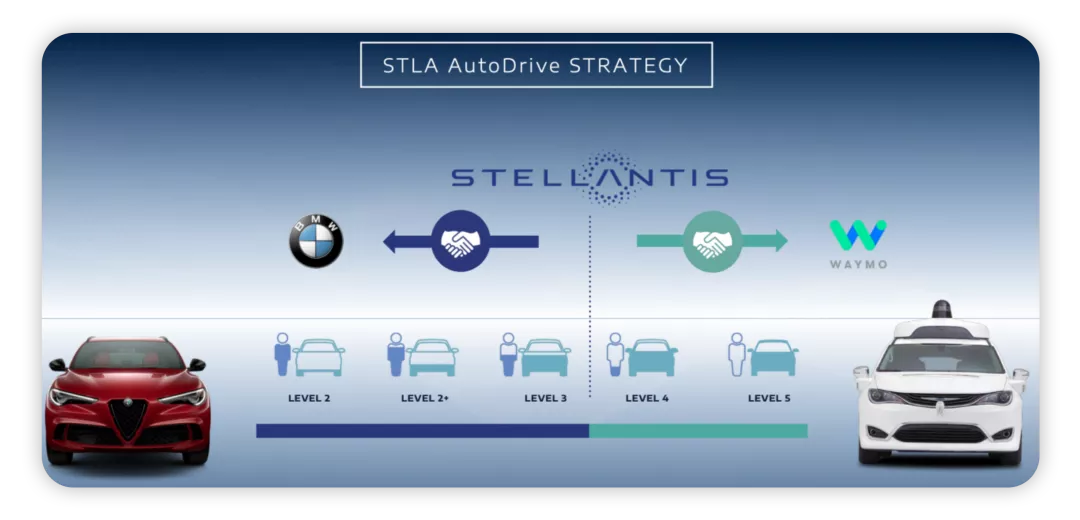

STLA Auto Drive

STLA Auto Drive is implemented in two stages: ADAS and AV. Currently, with the support of suppliers, L1 and some L2 ADAS capabilities have been developed and ADAS capability will be upgraded regularly through OTA. L2+ and L3 capabilities are being jointly developed with BMW (since 2018, through cooperation between FCA and BMW), and L3 capabilities will be launched in the near future.

Above L4, Waymo has already conducted Robotaxi testing with a Chrysler Pacifica in Phoenix and transported cargo in multiple locations. The Chrysler brand of Stellantis has been working with Waymo for over five years, and the Pacifica has always been and still is one of Waymo’s main models. In 2022, Stellantis and Waymo will use Stellantis commercial vehicles for AV development.

Conclusion

This strategy requires a team of 4,500 people to plan and implement, and 1,000 people to be deployed in new positions. I believe that in 2022, we will see the demand for software talent from all vehicle manufacturers, and this investment is significant worldwide.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.