NIO and XPeng

●XPeng

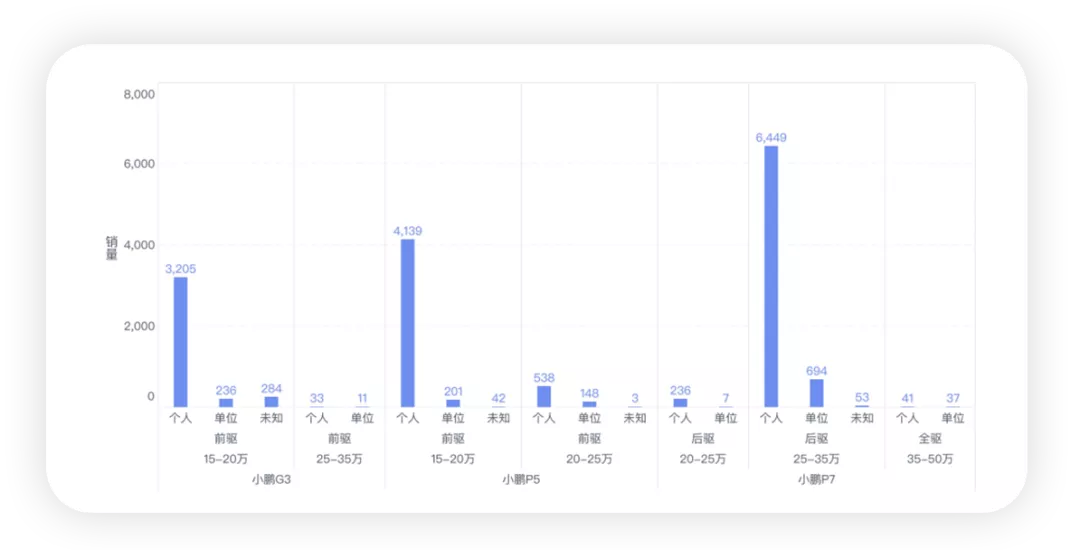

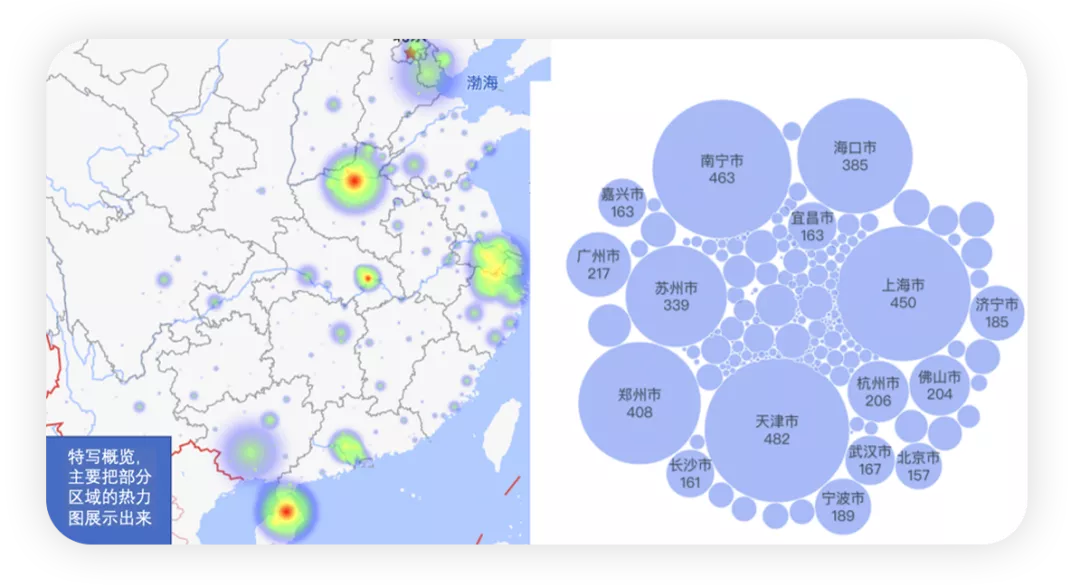

From the perspective of usage and driving configuration attributes of XPeng, combined with the price segment, it can be seen very clearly:

To make a four-wheel drive vehicle in China is a pseudo-proposition – among the 16,000 XPeng vehicles, only 78 four-wheel drive models are available (and they even occupy half the unit); P5’s choice of intelligent laser radars indicates that only about 1/9 of people choose to try intelligence.

Therefore, I doubt whether the long-term combat effectiveness of P5 and G3, which are priced between 150,000 and 200,000, is sufficient.

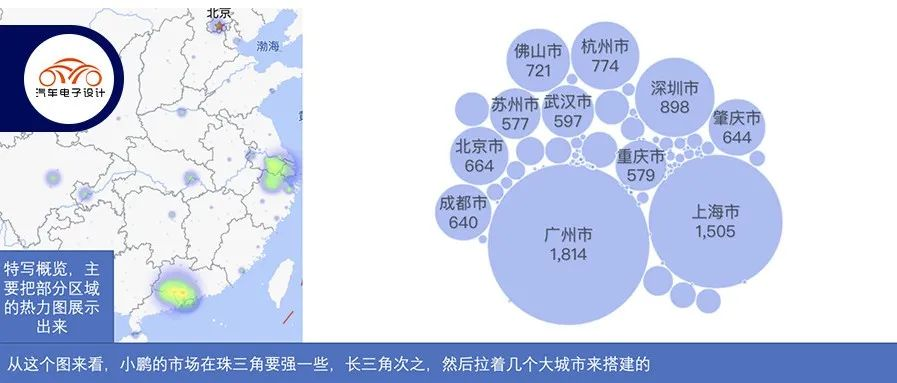

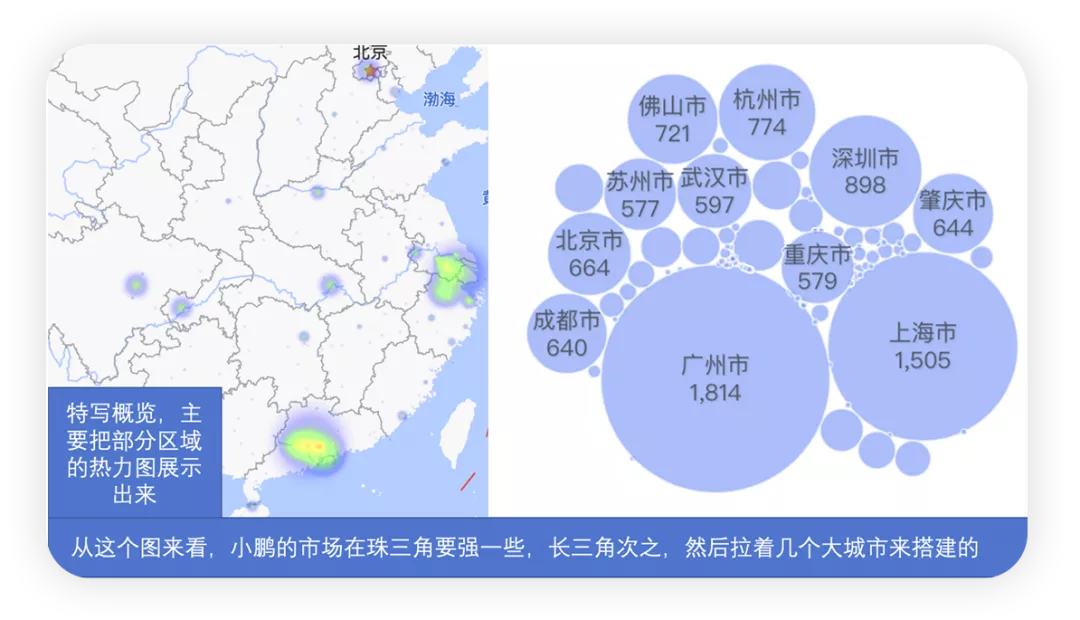

From the heat map, XPeng’s gameplay mainly revolves around the Pearl River Delta region, the Yangtze River Delta region, plus provincial capital cities. The following Figure 2 is a clear reflection of XPeng’s strategy. XPeng has established penetration in second-tier cities through several models and the effect is quite solid.

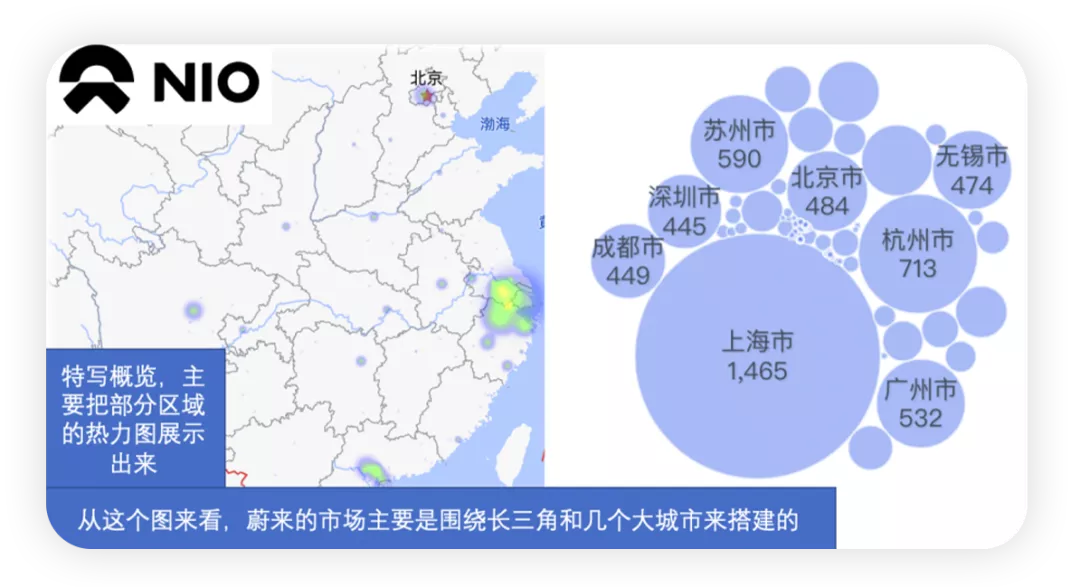

●NIO

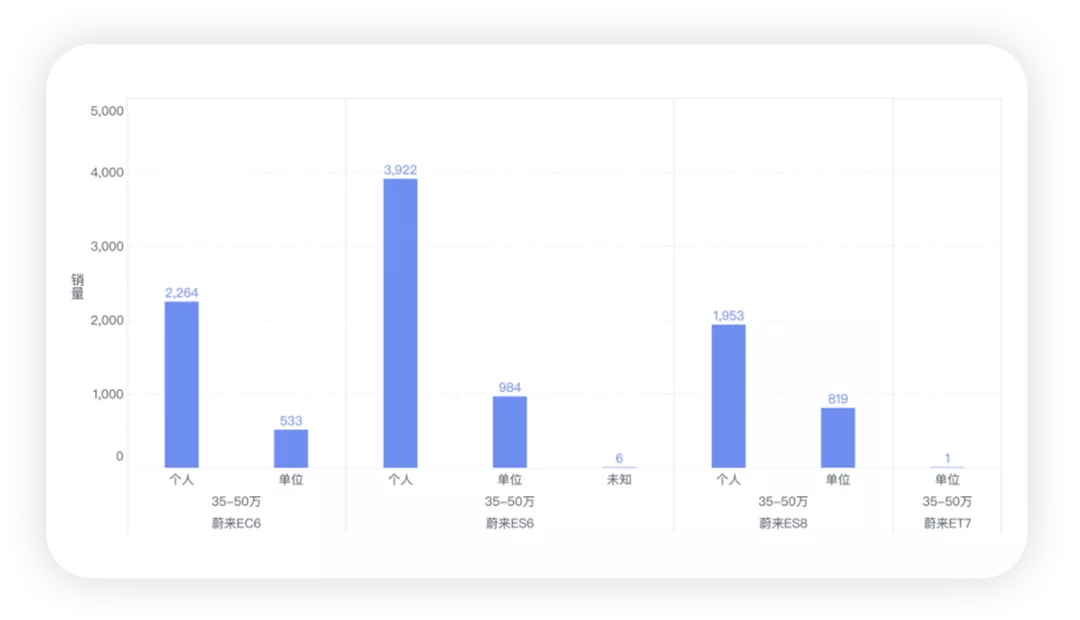

The issue with NIO is that the car is too expensive and can only be used in big cities. Interestingly, about 20% of recent NIO purchases were made by companies.

Therefore, if NIO does not launch a second brand and does not separate the car and the power, the overall sales audience will still be too limited. In order to evolve to the next stage from the service level, some changes must be made. Starting with the ET5, the situation of exploration may improve significantly.

NIO, XPeng, and Li Auto are currently performing particularly interestingly in competition.

NIO’s strategy is to differentiate itself greatly above Tesla; XPeng mainly competes in the 150,000-200,000 range, where the competition is intense. P7’s performance has exceeded expectations, and the specific performance of G9 will be observed next. Li Auto will compete with a group of DHT next year, and it will not be possible to compare with BEV in the short term.## WM, Hezhong, and Leapmotor

Due to time constraints, I will focus on Hezhong and Leapmotor, and won’t comment much on WM.

● Hezhong

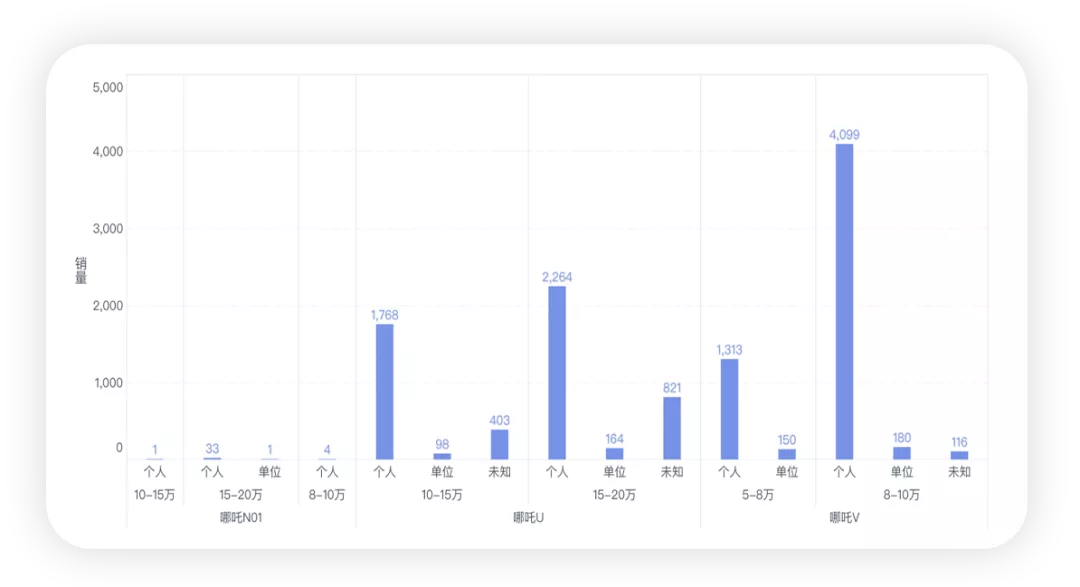

I took a NETA U ride-hailing SUV for 400 kilometers in Shanghai some time ago, and the driver told me that the NETA U compact SUV was selling for 100,000 RMB. This marketing strategy relies on extreme cost-effectiveness to expand sales volume. The number of operational vehicles is actually not that high, and they seem to be mainly operating in the 100,000 RMB price range, as shown in Figure 5.

As long as the cost-effectiveness is good for individual consumers, everyone is willing to buy it, as shown in Figure 6. Hezhong’s styling is actually quite similar to that of five-star, and is like an upgraded version of this series. I estimate that after the next step of battery cost reduction, Hezhong’s strategy may be more focused on NETA U and V without any alternatives.

Next, they will further enter the market of 150,000-200,000 RMB by focusing on the sedan version of NETA.

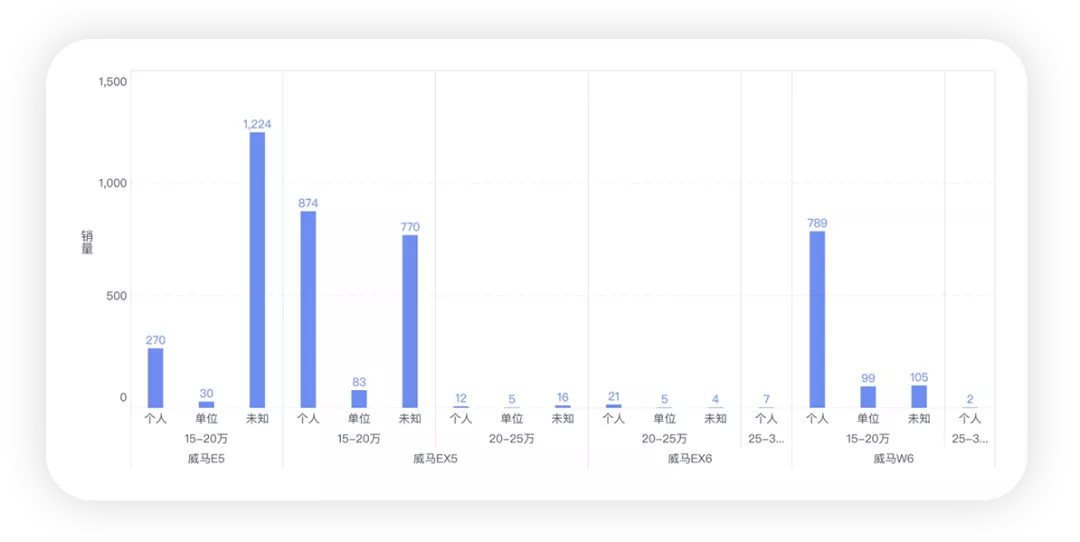

● WM

The problem with WM is that E5 has become an operational model, and half of EX5 is also an operational model. Only the current W6 is better for individual users, but only 789 individuals have purchased it, and a total of only 2,000 are for individuals.

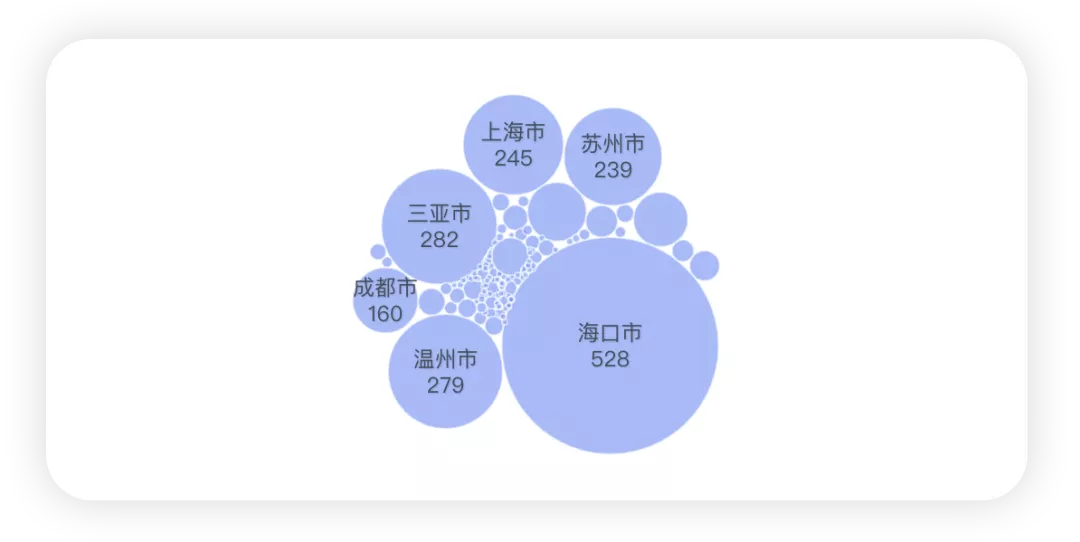

It is precisely because of this situation that WM has not held up in larger cities and has mainly focused on Hainan.

● Leapmotor

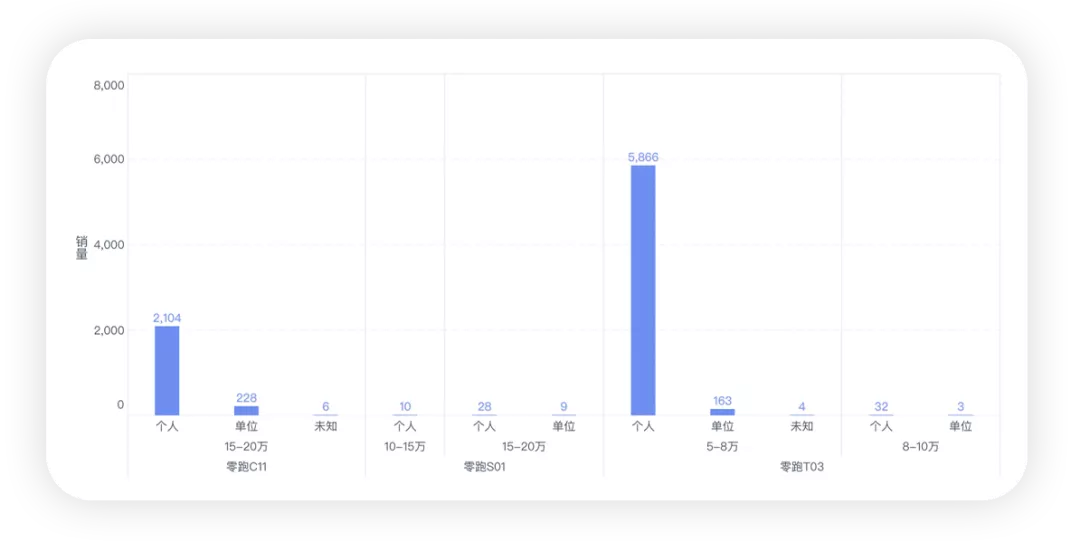

I think Leapmotor is still undergoing a major transformation, starting with the transition from T03 to C11 for mass production, which is also an inevitable choice after the cost of batteries rises in 2022.

Summary: I’ve just provided a brief overview here. I’ll do some more detailed visualization analysis work when I have time, which will be helpful for all readers.

Summary: I’ve just provided a brief overview here. I’ll do some more detailed visualization analysis work when I have time, which will be helpful for all readers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.