At CES 2022, Sony unveiled its second concept car, the VISION-S 0 SUV, and Sony Chairman, President, and CEO Kenichiro Yoshida announced the establishment of a new department, Sony Mobility Inc., which is expected to focus on the commercialization of electric cars and launch in spring of this year.

The Vision-S 02 was developed by Sony’s AI and robot teams. Could this lead to the birth of a new electric car company?

Note: Dyson embarked on the same venture but did not succeed.

The Highlights of the Vision S Series

This concept car is led by Sony’s AI and robot teams (and their robotic dog, Aibo), and several other companies are involved, including NVIDIA, Qualcomm, ZF, Bosch (many components), BlackBerry, QNX, Conti (a lot of ECU development), Benteler (chassis and battery), Magna (the entire EE design), and others. The biggest feature of this series is the complete set of high-level autonomous driving sensors deployed inside and outside the Vision-S vehicle body, which aims to provide panoramic imaging, 360 sound, all-time connectivity and other characteristics.

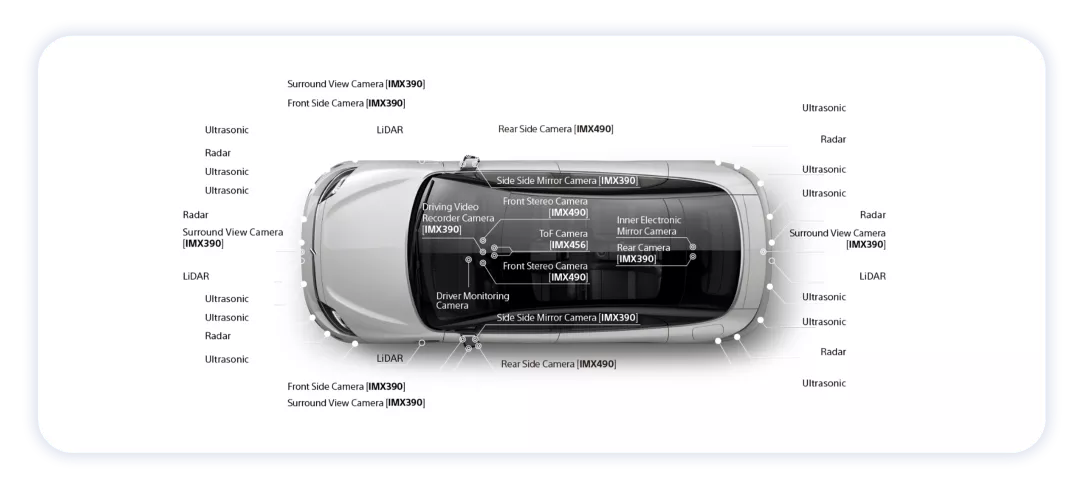

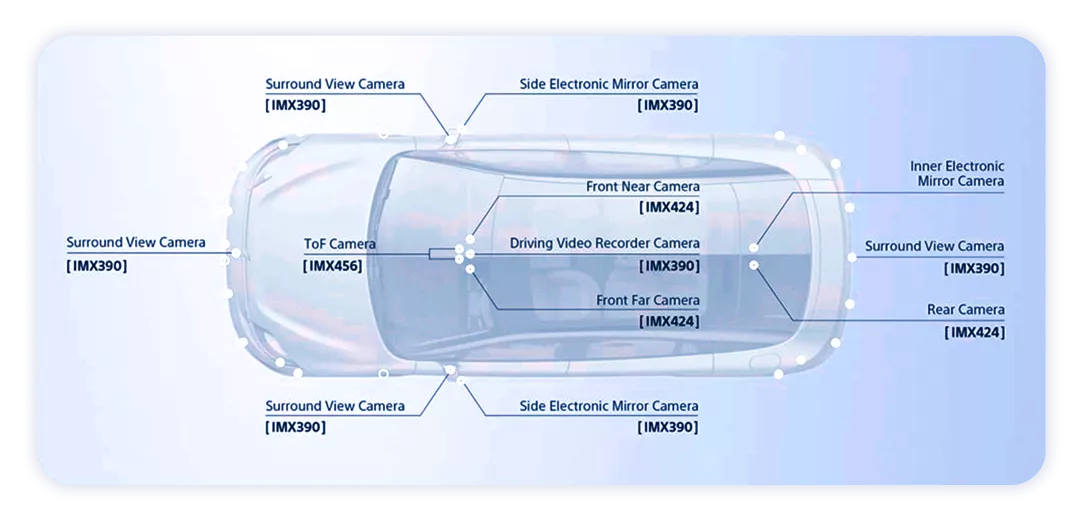

The 40 sensors on the Sony Vision include:

- 16 cameras: 8 external cameras, including 4 surround-view cameras (IMX390), 2 side and back cameras (IMX3902), and 2 side-view cameras (IMX4902), as well as 8 internal cameras, consisting of two front stereo cameras (IMX4902), two ToF cameras (IMX4562), one driver monitoring, one driving recorder, one rear camera, and one internal electronics camera.

- 18 ultrasonic/radar sensors and 4 LiDAR sensors.

The Sony Vision-S prototype has already participated in public road testing in Austria.From a logical perspective, this is a technology demo for building the entire system, centered around the 5G technology, that enables high-speed, high-capacity, and low-latency connections between the car system and the cloud, integrating various perceptual electronic technologies. In other words, Sony and its partners have transformed the Vision-S into a mobile entertainment space.

For Sony, the most important thing is to have a showcase to demonstrate its strength in content, gaming experience and audio. Through the exploration of the Vision-S and the support of its partners, there is more room for development in the “mobile entertainment space” direction.

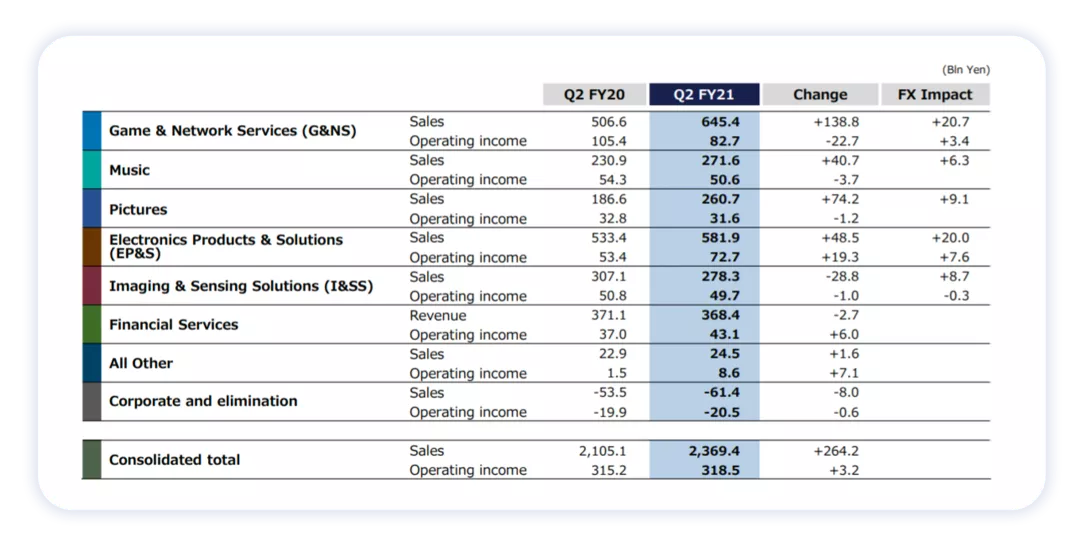

If we carefully study Sony’s business structure, we can see that Sony has become a company that revolves around game consoles and content (music + movies). Traditionally, our understanding of Sony is that electronic products account for less than 1/4 of its business, and image sensor CIS is an important part of its business.

In other words, the Electronics Products & Solutions department, to which the concept car belongs, is now an independent business unit.

In this sense, Sony’s company structure is different from that of Apple. Apple can keep spending money around Apple Car (it is said that Apple has recently pulled a lot of resources to focus on AR and Metaverse), while Sony and Dyson are burning money. What is the purpose of establishing this business unit?

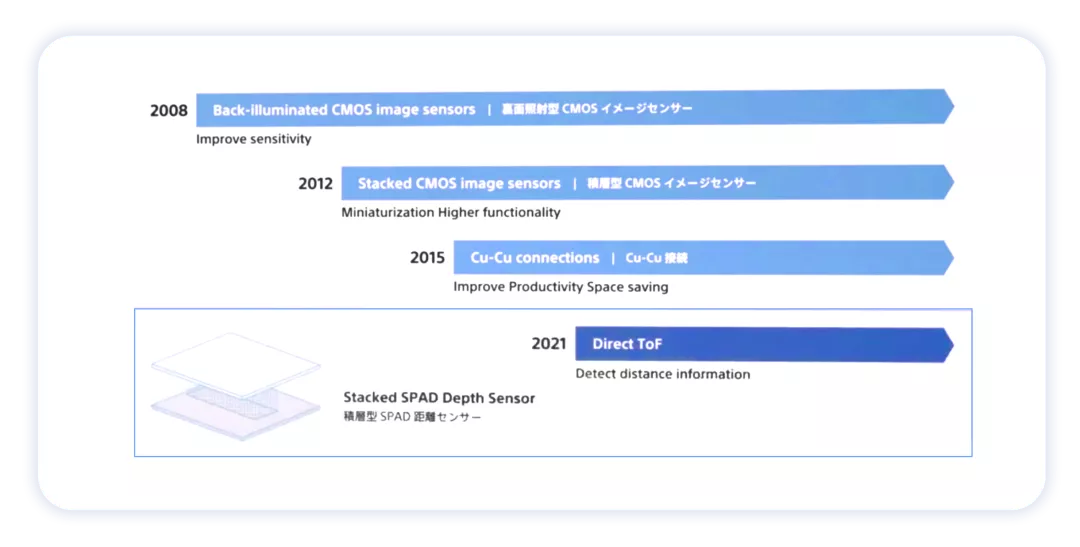

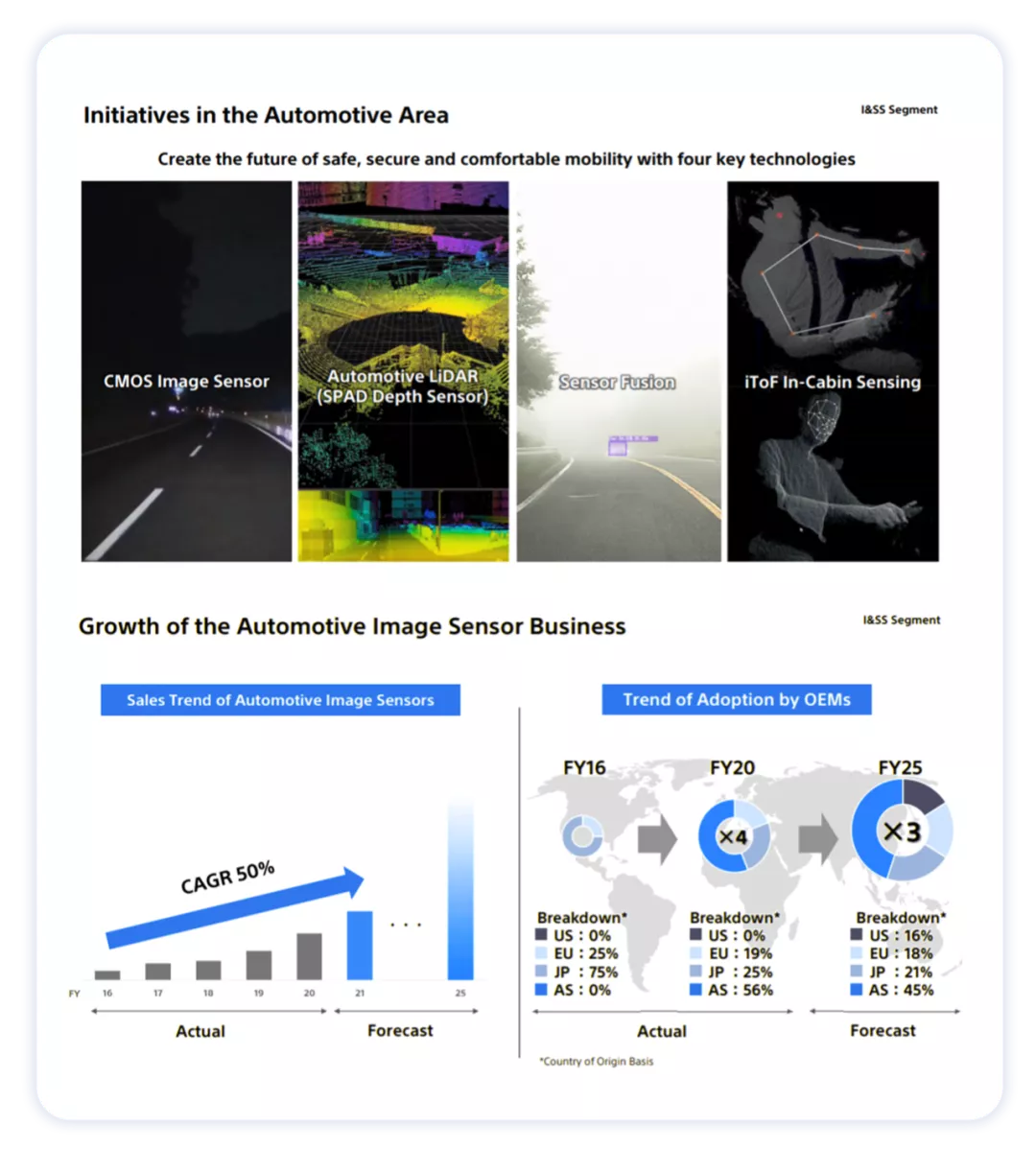

At Sony’s Technology Day exhibition, a very important part of the demonstration was the LIDAR:

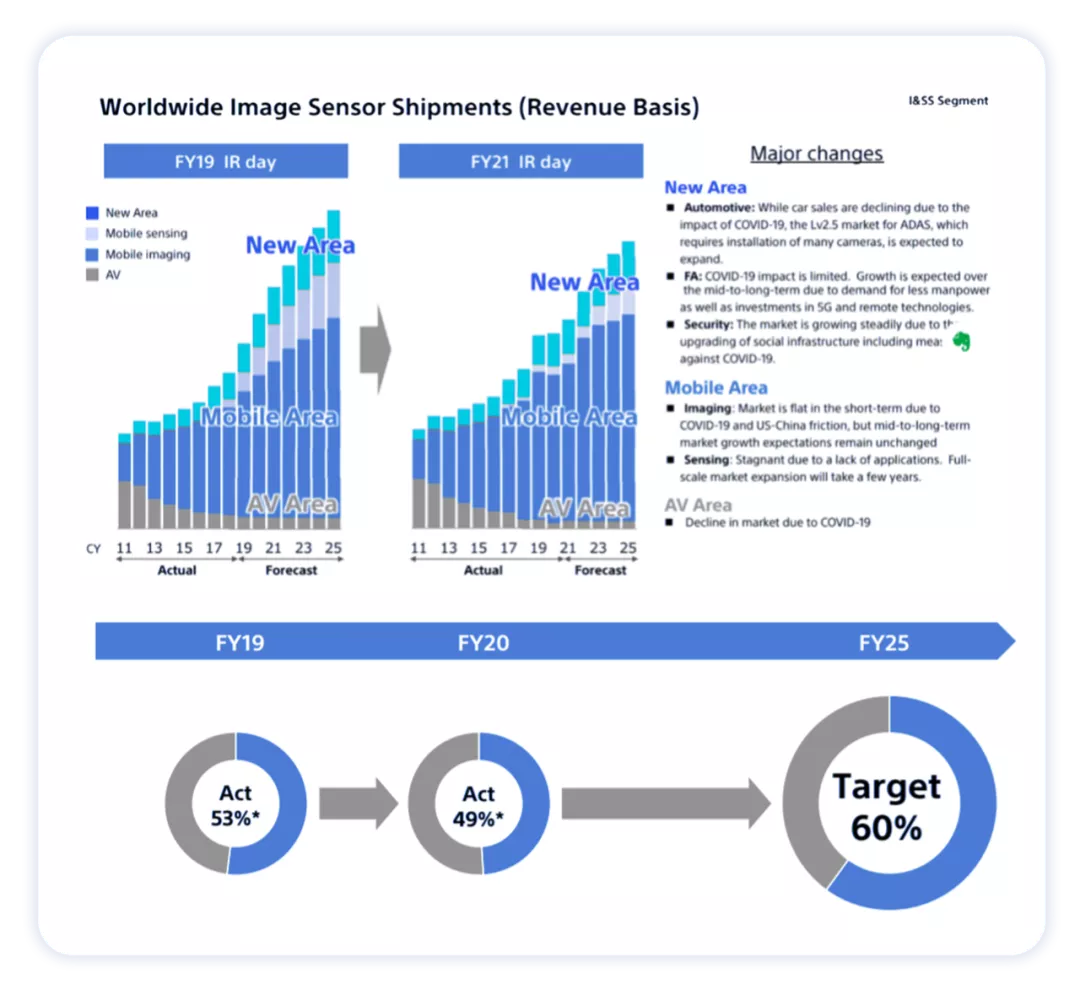

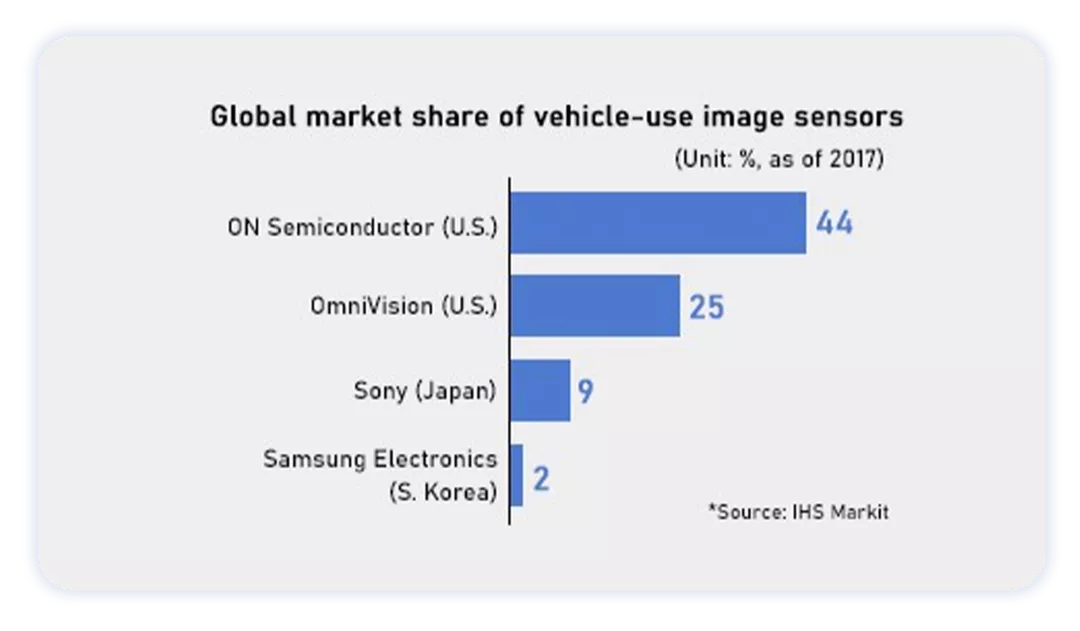

An important context is that Sony’s CIS business has a very low market share in the automotive market. Sony intends to leverage its advantages in the mobile field through the demand for ADAS to expand its new business development in image sensors CIS, which is currently limited to some Japanese automakers.

In the Vision S series, most of them are cameras, which can be used as a solution displayed to global automotive companies and surpassing ON Semiconductor in this segmented market.

Once this platform is established, it will be easier to find partners in various businesses and contents, especially for the direct demands of OEMs that Sony has less contact with. In my personal opinion, this is the key point. Starting a car company now is not worth the effort.

Summary: In my personal opinion, besides China and the United States, it is difficult for traditional Europe and Japan to have start-up car companies, and there are no so-called software giants in these two places. Companies like Dyson and Sony that make products entering the automotive industry are also unlikely to win.

Next, I plan to analyze the market for ADAS cameras and automotive CIS, which may yield better results.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.