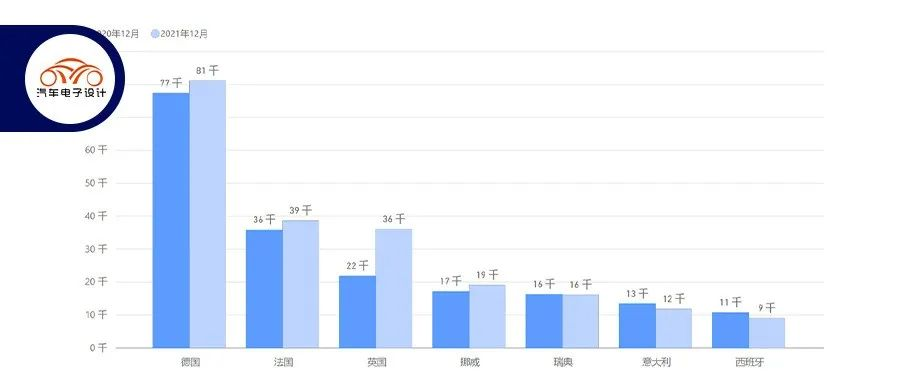

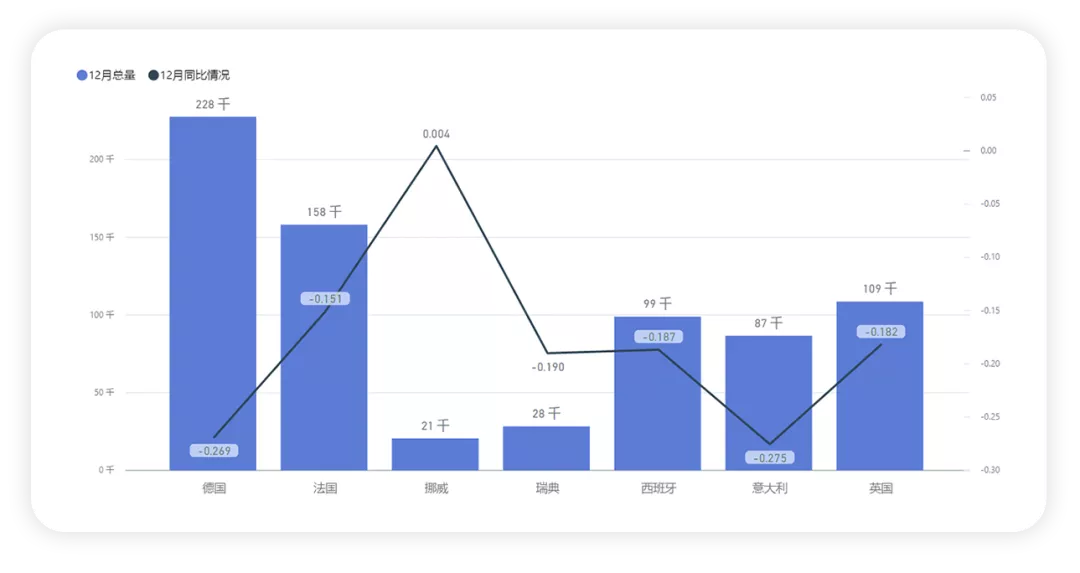

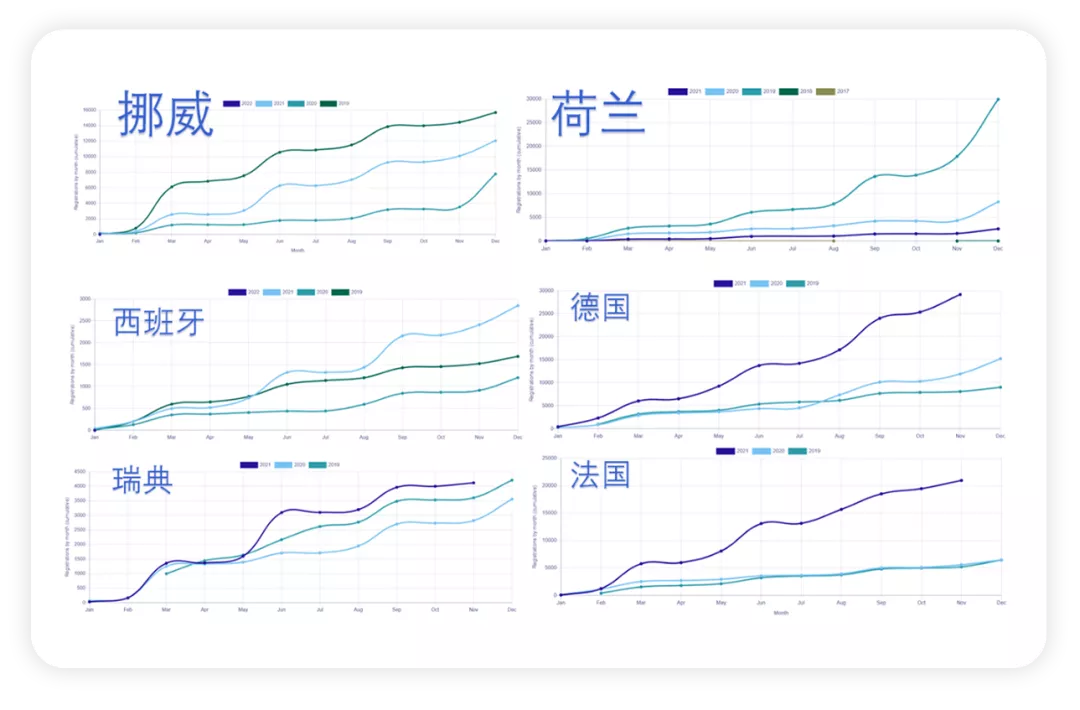

The sales data for new energy vehicles in major European countries in December is now available. Overall, in 2021, most countries performed well. The sales numbers from Germany, Norway, Sweden, France, Italy, UK, and Spain in December were 81,188, 19,151, 16,224, 38,669, 11,862, 36,041, and 9,035 respectively. The year-on-year growth of new energy vehicles in December was 4.89%, 11.41%, -0.42%, 7.82%, -12.12%, 64.47%, and -16.48%, except for the UK’s data. Overall, the market has entered a plateau phase.

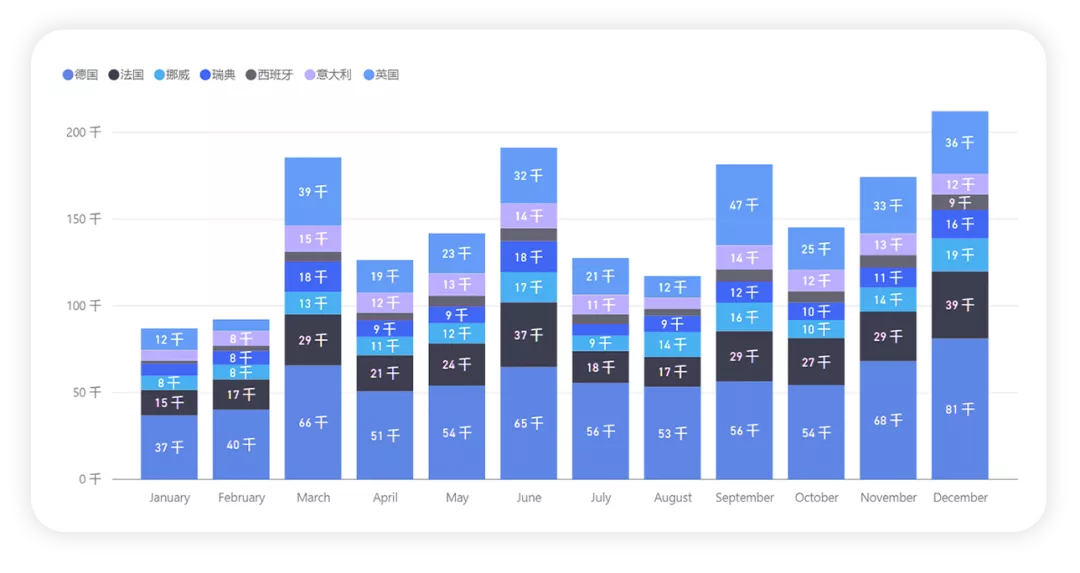

Looking at the situation for the whole year, the seven major countries sold more than 212,000 vehicles in December, and the growth trend has also entered a plateau phase.

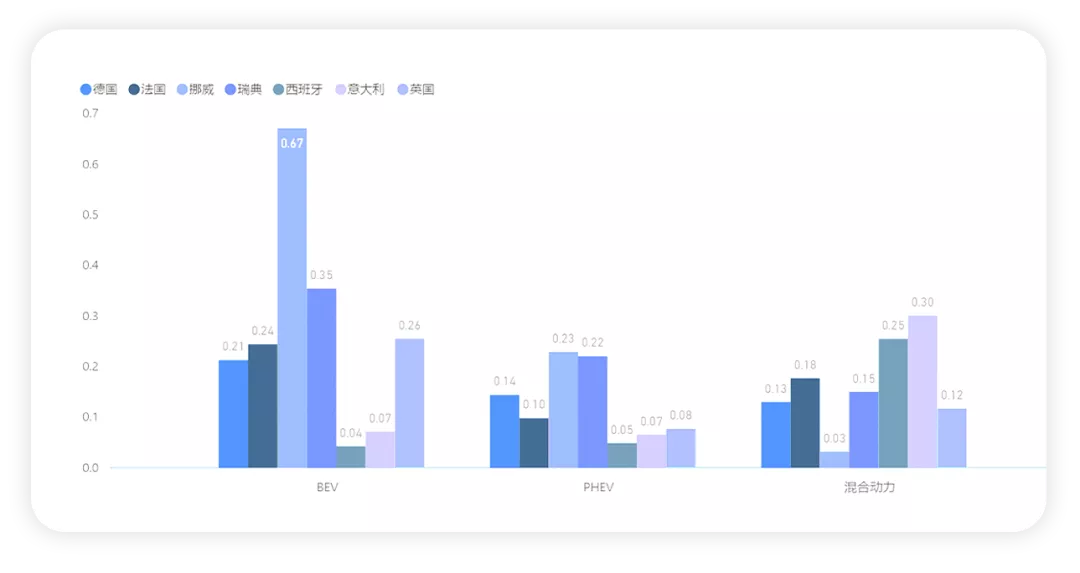

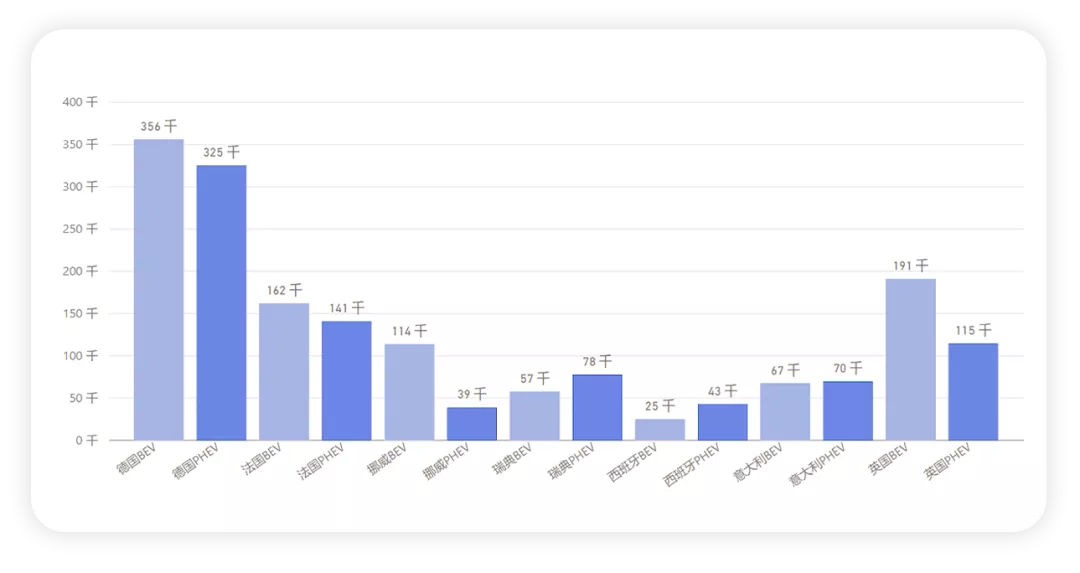

Penetration rate in major European countries

This year’s shortage of chips has been affecting the sales of vehicles in Europe. Regions with relatively large sales volumes have experienced declines of nearly 20% or even more, making the overall market look depressing.

The data shows that in December, the penetration rate in these countries increased to alarming levels. The major countries all had BEV rates exceeding 20%, and PHEVs were slightly lower but still around 10-20%. This round of production cuts caused by the chip shortage dealt a heavy blow to conventional vehicles. Even HEVs reached new heights without subsidies.

Looking at the absolute numbers, the rise of BEVs is particularly impressive.

● Germany

BEV: 355,961, PHEV: 325,449, a total of 681,000.

● NorwayBEV: 113,745 units, PHEV: 38,781 units, for a total of 152,000 units.

● Sweden

BEV: 57,422 units, PHEV: 77,719 units, for a total of 135,000 units.

● France

BEV: 162,099 units, PHEV: 141,019 units, for a total of 303,000 units.

● Italy

BEV: 67,437 units, PHEV: 69,717 units, for a total of 137,000 units.

● United Kingdom

BEV: 190,727 units, PHEV: 114,526 units, for a total of 305,000 units.

● Spain

BEV: 24,731 units, PHEV: 42,917 units, for a total of 67,600 units.

The total for the seven countries is 1.782 million units, and the estimated total for new energy vehicles in Europe is around 2.15 million units.

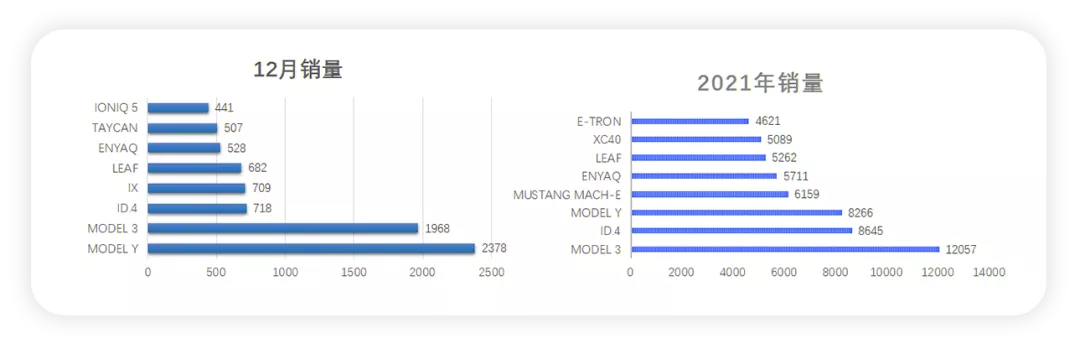

Specific Model Sales

From the current information, the situation in Norway is relatively normal, with major models competing including Model 3, ID4, and Model Y – all of which are relatively large vehicles.

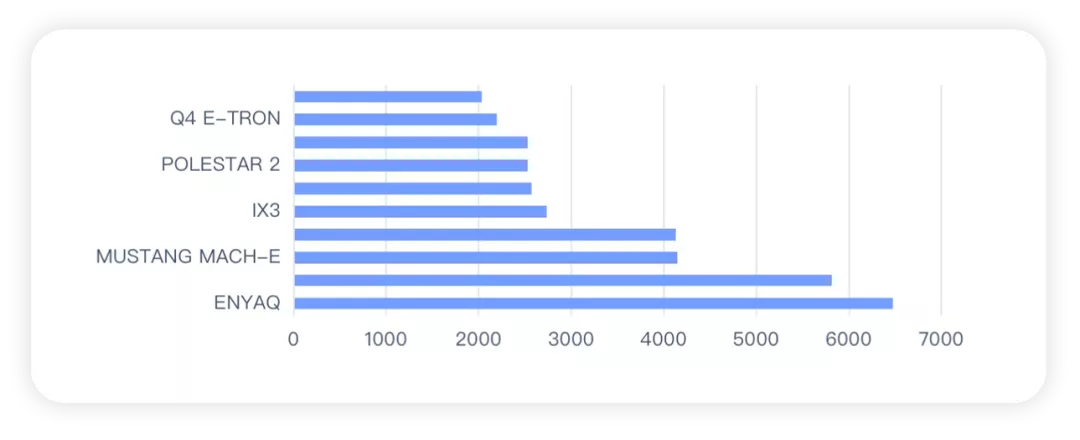

After the recovery of tax collection in the Netherlands, most electric cars have declined, with mainly low-cost models being used by companies.

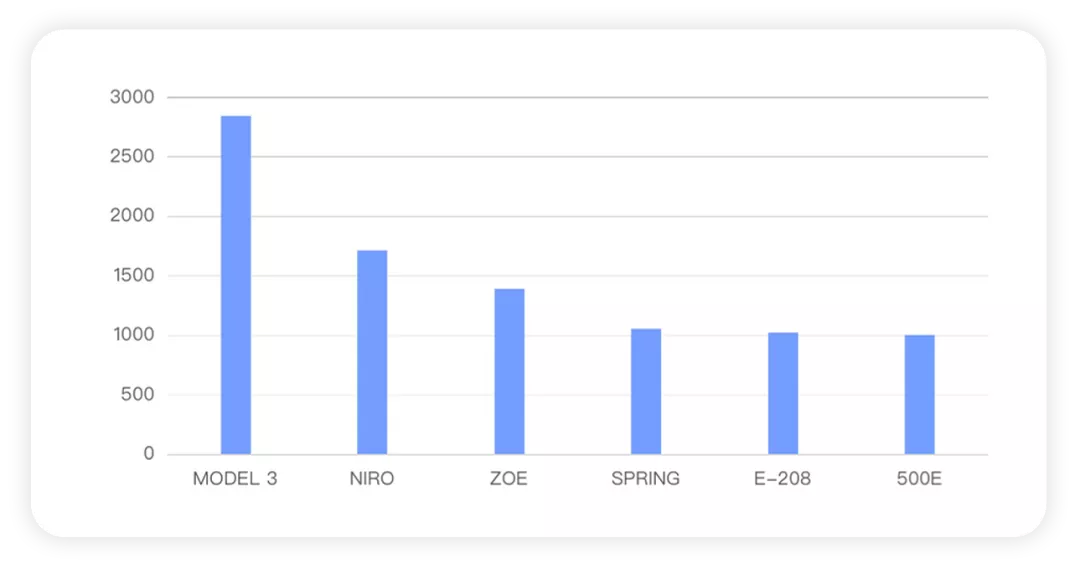

Heading to Southern Europe, the situation looks quite different:

In Spain, the total sales volume is not large, and there are still many small cars. In Italy for December, the top two models are the FIAT 500 and Dacia Spring. In France, the Dacia Spring was the best selling model.

For reference, I have also compared the sales volume of the Tesla Model 3 in various countries in 2021 and previous years.This year, Tesla’s focus has primarily been on major sales regions, such as Germany, France, and the United Kingdom, whereas the growth has been relatively slow in markets such as the Netherlands and Sweden.

In summary, from my personal perspective, the high penetration of new energy vehicles in Europe may enter a plateau period, and with chip production gradually recovering, the overall sales will become more balanced.

In addition, next year, Tesla’s Berlin factory will gradually increase its supply, which will be of great help to the market share of electric vehicles in Europe. This is also something that needs to be followed up on.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.