Translation

In 2019, Tesla released the HW3.0 chip with 144TOPS computational power, which caused a sensation in the industry. Therefore, “computational power” became an important indicator for evaluating a car after “horsepower”. For a while, high computational power chips were highly sought after.

“If we compare autonomous driving to a play that we all sing together, the chip is actually the stage, and the boundaries of the chip determine the size of the stage. Why do we compete for high computational power? It’s because when we don’t know how the play will turn out, we need to do everything we can to build a bigger stage.” Yang Yuxin, CMO of Black Sesame Intelligence, revealed industry secrets.

He believes that “the development of all electronic industries starts with hardware because the chip determines the boundary of the entire autonomous driving performance and function. If something is not supported by hardware, the software cannot achieve it. This is a technological law.”

“The computational power of the chip is the boundary of the functional performance of the entire system. Therefore, in the early stages of the development of the industry, the hardware must stack up functional performance. This is commonly referred to as stacking materials. Only after stacking up functional performance can the software better play its advantages.”

So, in the current era where smart cars are emerging, how is the technical development and industrial competition of high computational power chips in the automotive industry? Follow us to explore in this article.

“Multitasking” Chip

There are many types of chips, some control audio power amplifiers, some do power management, some drive motors, and some do analog-to-digital conversion… In short, as many electronic functions as there are subdivisions, there will be as many chips.

In the mid-1990s, people were inspired by the use of application-specific integrated circuits to implement chipsets, and they came up with the idea of integrating all different functional blocks of a complete computer directly onto a silicon chip.

So, we have seen the concept of SoC (System-On-Chip) that has recently emerged in the automotive industry. SoC, which means system-level chip, can be simply understood as making the system on a chip.

This integrated thinking principle is common, especially after the architecture of cars has shifted from distribution to centralized, and has become an industry consensus, and companies in the industrial chain are developing towards domain control and centralized control. The so-called domain controller seeks to integrate many different functional basic modules ECU. This directly stimulates the demand for SoC chips.

The SoC chip is like a multitasking performer that can do everything. It has to handle images, graphics, audio, and also deep learning. Now, looking at a complete SoC, it usually includes the following modules:* Central Processing Unit (CPU): It is the “brain” of SoC, and performs overall coordination work, running most of the code for Android or Linux and most applications.

-

Graphics Processing Unit (GPU), which handles tasks related to graphics, such as visualizing the user interface of visual applications and 2D/3D games.

-

Image Signal Processor (ISP) pre-processes camera data, such as noise reduction and HDR processing.

-

Neural Processing Unit (NPU) accelerates machine learning tasks, including image, video, and speech processing.

-

Digital Signal Processor (DSP), which handles more complex mathematical functions than the CPU, including decompressing music files and analyzing gyro sensor data.

-

Memory (ROM/RAM) is used to store program and various data information. Memory can be divided into two categories, main memory and auxiliary memory, and the main memory exchanges information directly with the CPU.

-

Building Baseband Unit (BBU) is used for network coverage. In addition to the above main units, there are also modules such as Bluetooth, 5G, and Wi-Fi.

Taking the core advantages of Hezhima Intelligence’s products as an example, its two self-developed core IPs, the NeuralIQ ISP image signal processor and the DyanmAI NN deep neural network algorithm platform, belong to the ISP and NPU blocks respectively. The former allows intelligent driving vehicles to see the world more clearly, while the latter enables cars to “understand” what they see.

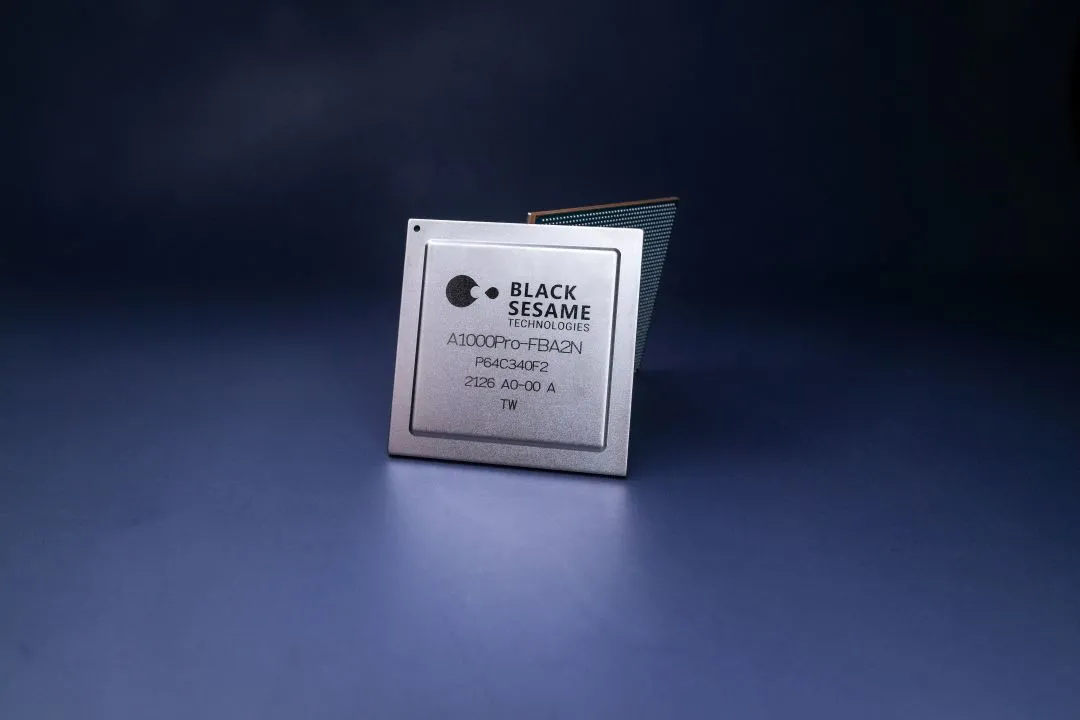

According to Dr. Deng Kun, Vice President of Application Engineering at Hezhima Intelligence, in the past, image processing or graphic computing that required car chips could only be achieved through the procurement of third-party IPs; however, Hezhima Intelligence’s self-developed A1000 single chip already has this function, and the NPU part can handle data from more than 10 cameras with a single chip.

“Core IPs are very important, and most chip design companies still rely on purchasing third-party IPs to make chips. In China, apart from us, only Huawei may be able to develop core IPs, which gives us a significant competitive advantage,” added Yang Yuxin, CMO of Hezhima Intelligence.

This multi-core heterogeneous high-integration chip is different from the stacking of small-caliber chips, which brings new architecture thinking to the industry. However, this has led to a more complicated issue: there are multiple computing devices in the heterogeneous mixed-computing system, requiring different sets of code. Therefore, single-direction programming in the past has turned into multi-direction programming, significantly increasing the difficulty of application development.Different processor vendors have introduced vastly different accelerator solutions, which not only adopt their own specialized processor architecture, but also their own execution instructions and compilers. In this non-uniform architecture, porting parallel programs to heterogeneous processors requires not only recompilation, but also rewriting of the code.

This demands the use of excellent software stacks to fully utilize computing resources, without the need for developers to consider complex hardware details during programming. The toolchain provides a set of basic system software for chip programming, including development environments, compilers, assemblers, linkers, library functions, debugging, and more. It can be said that the quality of the toolchain directly impacts the market for programmable chips.

Black Sesame Intelligence’s open software and toolchain not only provides convenience for OEM applications, but also encourages more people to develop with it and contribute to its improvement.

It is worth mentioning that heterogeneity not only brings different levels of computing architecture, but also different levels of storage architecture. Data needs to move between multiple types of storage, and program execution needs to simultaneously access multiple types of storage, which directly affects the performance of the chip. Moreover, high computational power can also lead to high power consumption. However, according to data from Black Sesame Intelligence, this aspect of the problem has been well overcome.

No wonder high-computational-power chips are called “pearls on the crown,” as their complexity alone deserves this “honor.”

“3 to 4-year Time Window”

The pearl on the crown is dazzling, and it is also beyond the reach of ordinary people.

In the past two years, due to the events in the smartphone industry competition involving Huawei, the general public has learned that chips are a bottleneck for China. In the China-US trade war, merely playing the card of semiconductor had a heavy impact on multiple industries, and under the influence of multiple factors, it dealt a blow to the automotive industry for a whole year.

Unfortunately, “China’s information industry is short of chips and souls,” as pointed out by then Minister of Science and Technology of China, Xu Guanhua, in 1999, still hangs like a sharp sword over us today.

As we all know, chip technology follows Moore’s Law, which means that on the premise of the same price, the number of components will double every 18 to 24 months, in other words, performance doubles.

This terrifying rate of evolution means that the chip industry chain can turn a cutting-edge technology into outdated technology every two years, and to put it another way, if you are too slow, all your prior investments will be wasted.

At the same time, the development cost of chip design is very high. “In the past, chip design companies in China were out of bounds because of the long cycle. We calculated that it takes five years from the definition to the final release of a chip, which means that this chip will not generate any revenue within five years.”It can be seen that the situation for competitors in this field is extremely challenging. This is largely due to the fact that for a considerable period of time, the main reason for the competition in this field has been international players; objectively speaking, this is also due to the historical weakness of our country’s chip industry.

Fortunately, under the new trend, China has already had many players who have bravely entered the SoC chip development track and are competing with traditional giants such as Nvidia and Qualcomm.

For example, Huawei empowers car companies with core components and solutions for autonomous driving systems, and currently has the Ascend 310 and Ascend 910 chips for vehicle-mounted SoC. Meanwhile, start-ups, such as Hei Zhima Intelligent, have launched chips like the A1000 that can meet mainstream computing needs.

Yang Yuxin believes that the current competition situation is very opportune for domestic players.

Firstly, under the context of the Sino-US technology game, everyone is increasingly concerned that the entire supply chain system is overseas; this is one of the reasons why people hope to have a local supply chain.

“In the past, car companies may not have considered the chip industry because chips are separated by several layers in the supplier list. However, in the past six months, every car factory has established its Shanghai office and goes to see the leaders of chip companies every day for one task – ensuring supply. Almost every car factory has a vice president level person sitting at the door of a chip company demanding goods.”

As the saying goes, it is better to take precautions than to repair after the damage. After the chip shortage crisis, car companies have realized the importance of developing local production capabilities. It should be noted that in history, Chinese manufacturers have always been the lowest priority on the list of global supplier giants. Under the pressure of various realistic environments, developing a local supply chain has become an important way to break free from the shackles, and this is also an important development opportunity for local suppliers.

Secondly, China’s development of smart new energy vehicles is faster than the global pace, and requires suppliers that are more in line with its technological iteration speed and can provide comprehensive and close services. This is also an important opportunity for local chip companies.

“I think that in the future, a number of Chinese vehicle-grade chip manufacturers should be developed, although this is difficult to achieve. However, there is a chance to enable a group of vehicle-grade chip manufacturers to survive.”

“From the perspective of the pattern of various industries in the past, it is impossible for only one company to eat up this market, at least two or three are needed. I think that these domestic chip design companies are all very outstanding and everyone has a chance, but we hope to have an opportunity to lead this market.”

In Yang Yuxin’s opinion, China’s automotive industry chain can be considered as opening a door for local vehicle-grade chip manufacturers. “But this door will not be too long. Once the new supply chain system matures in 3-4 years, the window will close.”He did the math and estimated that it would take about two years to develop chips starting from now, along with the certification process from automotive companies, which could take three to four years. “We need to seize this opportunity within the next three to five years,” said Yang Yuxin.

“We are currently working with car manufacturers on the next generation of electronic architecture for mainstream models that will be launched in 2022 and 2023,” revealed Yang Yuxin.

Regarding how to benchmark the development speed of the market, Yang Yuxin stated that “we conduct preliminary research on each generation of chips, collaborate with OEMs and first-tier suppliers to understand the industry trend and anticipate the required CPU, GPU, and NPU power for the next three years. Based on the situation, we choose the current generation of chips as the focus of research and development.”

At the same time, planning for the next generation of products is equally important due to the rapid development of chip technology. Existing partnership experiences can only serve as references for future prediction, and chip companies need to conduct comprehensive global research.

“We will benchmark the highest computing power platform internationally and make certain extensions that exceed their level as our selection criteria for the iteration of two generations of chips,” Yang Yuxin added.

In Yang Yuxin’s view, the Chinese automotive-grade chip industry is still in its early stages of development. The challenges Black Sesame Intelligence will face are continuous breakthroughs in technological bottlenecks and improving the safety and reliability of their products.

He firmly believes that the road to the domestication of automotive-grade chips for autonomous driving is bright and full of hope.

The Shackles of “Automotive-grade”

The difficulty of the chip industry not only lies in the short time window and high initial investment but also in the different requirements of different industries for chips.

According to typical application scenarios, chips can usually be divided into three levels: consumer-grade, industrial-grade, and automotive-grade, with their difficulties ranking in that order. Automotive chips are more challenging than industrial and consumer chips.

Although the iteration speed of automotive SoCs is not that fast, automotive chips have much stricter certification requirements for all dimensions due to different application scenarios and design focuses. Last year in June, Black Sesame Intelligence released the Huawei Mountain No. 2 A1000 with a computing power of up to 116TOPS, supporting L3-level autonomous driving systems. The following month, A1000 obtained ISO 26262 functional safety product ASIL B certification, making it the first domestic self-driving computing chip to pass safety certification.In the industry standard, ASIL levels define safety requirements for systems, ranging from level A to D in increasing order of severity. The higher the ASIL level, the higher the safety requirements for the system, which also implies that higher levels entail higher system design complexity, longer development cycles, and greater cost.

This year, Black Sesame Intelligence introduced Huashan No. 2 A1000 Pro, which has a maximum computing power of 196 TOPS. Currently, A1000 Pro has announced the achievement of mass production, with a projected market release for the end of 2022. A1000 Pro satisfies the ISO 26262 functional safety product certification, directly reaching ASILD level.

“We have also obtained the ASILD certification process this year, which is genuine credentials for employment. There are three certifications required to develop car-grade chips: one for the team, one for the product, and one for the process, and we have obtained them all,” said Yang Yuxin, referring to the new certification.

In addition to car-grade certification, there is another challenge for chip companies from the automakers. In the past, automakers used small chips, and a tiny microcontroller did not require repeated testing and verification of technical and performance indicators. But in the era of intelligent vehicles, facing such complex chips, automakers also need time to learn, understand, and adapt.

“This cycle takes at least a year or so. Our chips are very complex, and they are the most critical chips in the entire domain controller architecture of the auto industry,” he said.

Still, chip companies raise the torch and forge ahead, trying to blaze a bloody trail in the SoC chip competition. One industry insider vividly described the chip race as a matter of who can build and fasten more reliably than the others.

There is no doubt that the in-vehicle AI chip (SoC chip) will play a critical role in the rapidly growing scale of intelligent cars. According to Global Market Insights, the in-vehicle AI chip market is expected to grow to $12 billion by 2026.

Chinese chip companies, who are fortunate enough to have forged ahead in this competition, are bound to get a piece of this pie.

“NVIDIA is not the rulemaker; it is surrounded by the habit of using CUDA by everyone,” said Zhao Lidong, CEO of Sure-Fi Technology. His call is undoubtedly heartening, “Shoot for the pinnacle of entrepreneurship, and do the most high-end chip!””Our goal is to truly promote the rapid commercialization of autonomous driving in the current wave of development of intelligent automobiles in China, and to grow together with Chinese automakers during the period of their significantly faster development rate than the rest of the world.” said Yang Yuxin firmly.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.