In my new direction of work, I am not only exploring new technological areas, but also looking at new entrepreneurial teams to explore possibilities.

Ivan Koshurinov from Invisens has written a series of articles, “Automotive radar startups review,” including four articles covering 2017, 2018, 2019, and 2021, mainly observing seven radar companies from 2017.

• 2017 (7 companies):

Seven radar companies emerged, namely Vayyar, Oculii, Arbe Robotics, Art Sys 360, Echodyne, Oryx, and Omniradar.

• 2018 (12 companies):

Five new companies were added, namely Lunewave, Metawave, Ghostwave, Uhnder, and Zendar.

• 2019 (15 companies):

Three new companies were added, namely Ainstein, Neteera, and Steradian Semi.

• 2021 (21 companies):

Six new companies were added, namely Bitsensing, Gapwaves, Radsee, Wavesense, Xandar Kardian, and Zadar Labs.

I have carefully read this series of articles and did some sorting. My core questions are:

• Why are there so many radar entrepreneurial ventures abroad? (Implied question: Why are there so many in China?)

• What are these entrepreneurial ventures going to do? How is this market doing? What is the competition in the automotive radar industry like? How to compete with existing players?

• Among these entrepreneurial ventures, what is the relationship between cooperation and competition? What can be done in terms of new technological high grounds?

With these questions (there are quite a few), this article is also the starting point for me to explore the field of autonomous driving (perception devices and logic processing) and I will continue to look more into these areas, and write down some of my thoughts.

What are the ideas behind foreign radar start-ups

Millimeter-wave radar is based on the Doppler principle, which measures the distance, velocity, and direction of a target object based on the time and frequency difference between the echo and the transmitted wave. There are mainly two types of millimeter wave radar based on the different electromagnetic wave radiation methods: pulse and continuous wave. Among them, continuous wave can be divided into FSK (frequency shift keying), PSK (phase shift keying), CW (continuous wave), FMCW (frequency-modulated continuous wave), and other modes.The development of millimeter-wave radar is relatively expensive and requires a lot of scientific research talents to create a prototype. In 2016, the millimeter-wave radar market was approximately 3 billion US dollars. According to Yole’s report, the millimeter-wave radar market reached 20.5 billion US dollars in 2019, of which automotive radar was approximately 5.5 billion US dollars, which is between 3 billion to 5.5 billion US dollars. It is mainly dominated by old players (which I will elaborate on in the second part).

In 2017, the four Israeli companies, Vayyar, Arbe Robotics, Art Sys 360, and Oryx, all had a technology background that was transferred from the military field.

In addition, there are two American companies, Oculii and Echodyne, and Omniradar started with a single-chip solution. As financing gradually progressed, we found that many American companies entered this field, with the most being Vayyar’s 188 million US dollars and Uhnder’s 145 million US dollars.

Note: I will find information about the operating models and product characteristics of these top companies.

So from an intuitive impression, this track is very popular, and so many companies. The main entrepreneurial roads can be divided into three categories:

● Proprietary hardware:

Design SoC or separate analog and processing components for radar. The RF part of the imaging radar provides a large amount of data flow to the processor. Several startups have made separate efforts in the processing and analog aspects.

● Focused on software and processing:

Transform through a post-processing algorithm. The radar sends certain frames per second, each of which contains a point cloud (the points will differ from frame to frame), and their range and angular coordinates will also differ. By analyzing a series of frames, the processor can approximate points or objects to improve measurement accuracy. Processing itself takes time and extends the overall data processing time, requiring more processing power, and resulting in higher unit costs.

● Supporting design of radar:

New antenna varieties and materials. These companies have the ability to develop the entire radar, but they focus on parts of it and cooperate with the original old companies.

## Market Capacity and Technological Change

## Market Capacity and Technological Change

From the perspective of the market, the market for automotive millimeter-wave radar in 2019 was 5.338 billion US dollars, with mainland China accounting for 24.7%, Denso 16.5%, Bosch 15.6%, Hella 14.6%, and the rest of the market being relatively scattered. Based on an average price of 100 US dollars per unit, there were approximately 53.38 million units, and the overall penetration rate was around 80 million, which is less than one per vehicle.

Note: Currently, the normal configuration for L3 vehicles is based on five (1+4). There is still a lot of room for expansion.

The entire market will further expand, mainly because previously, only one LLR long-range radar was installed for AEB. Subsequently, the four-corner radars and 4D imaging radars will have a very positive impact on the entire market’s growth rate.

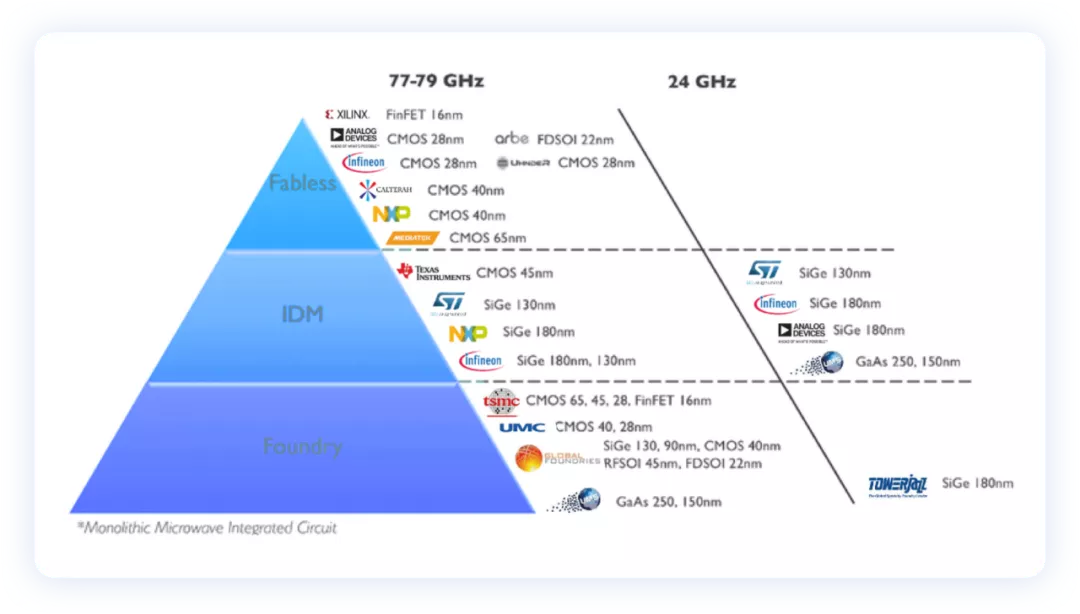

I believe that the most important thing is that technological change has occurred during this process of technological iteration. The core RF part of millimeter-wave radar is responsible for modulation, transmission, reception, and demodulation of millimeter-wave signals. The integrated methods mainly include hybrid microwave integrated circuits (HMIC) and monolithic microwave integrated circuits (MMIC). MMIC uses planar technology to manufacture all microwave functional circuits on semiconductor chips such as gallium arsenide (GaAs), germanium silicon (SiGe), or silicon (Si). The functional circuits mainly include low noise amplifiers (LNA), power amplifiers, mixers, up-converters, detectors, modulators, voltage-controlled oscillators (VCO), phase shifters, switches, MMIC transceivers, and even the entire transmit/receive (T/R) component (transceiver system).

From the perspective of technological development, with low cost and high integration, silicon-based (CMOS, SiGe BiCMOS, etc.) MMIC development in various races has changed.

In the context of process innovation, low-cost integrated single-chip systems present one possible path, while high-performance radar products incorporating powerful computing capabilities may break the traditional Tier 1 radar evolution.

Note: It is challenging to determine whether ECU processing can be transferred to the system level.

In summary, from a broader perspective, the underlying process changes of technological evolution, along with the low-cost and high-performance of application terminals (achieved via high computing power software), have produced multifaceted characteristics of millimeter-wave radar. Thus, it is challenging to solely restrict the development of start-up companies by cost, and this track is somewhat interesting.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.